retouchman/iStock via Getty Images

Introduction

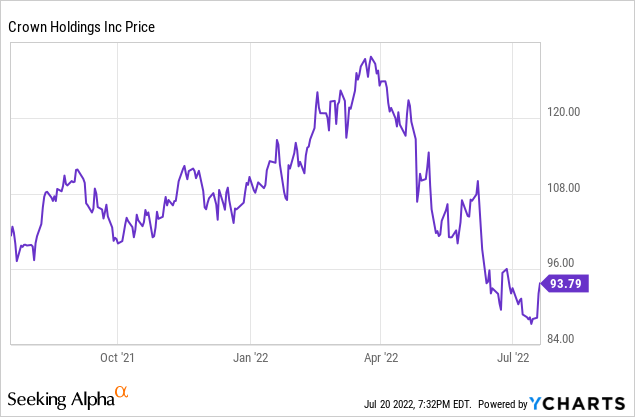

I like the packaging industry and I’m quite fond of aluminum beverage can producers. All three main players including Ball (BALL) and Ardagh Metal Packaging (AMBP) are trading at attractive levels again. Crown Holdings (NYSE:CCK) completes the top-3 as it’s the second largest producer of beverage cans in the world and I have been keeping an eye on Crown for a while now as the balance sheet was strengthened by the sale of its non-beverage can business for total sales proceeds of $2.2B at a $2.7B valuation.

Crown Holdings released its quarterly results as the first one of the three main can producers and I was very interested in seeing how the cash flows evolved during the quarter as the higher energy prices for sure would have had an impact. In my June article, I already mentioned I expected the full-year EPS to come in below Crown’s guidance so it wasn’t a big surprise for me to see Crown now indeed reducing its full-year expectations.

A decent result in the second quarter, but Crown had to reduce its full-year guidance

As a reminder, the contracts with the customers generally contain built-in clauses related to the aluminum price: The sales price per can will generally immediately be adjusted for aluminum price changes due to this pass-through mechanism. That’s great, but when it comes to other potential COGS increases (labor, energy,…) companies are still dealing with a lag.

That also was the case at Crown Holdings as its contracts have an April 1 date to adjust prices for inflation so Crown was absorbing a bunch of the higher operating expenses over the past few quarters and was now able to start charging its customers for those higher expenses. And according to a statement in the quarterly update, Crown will be looking to include “more comprehensive raw material and other inflationary pass-through provisions.” This means that Crown’s next series of contracts will likely include energy prices as a pass-through factor.

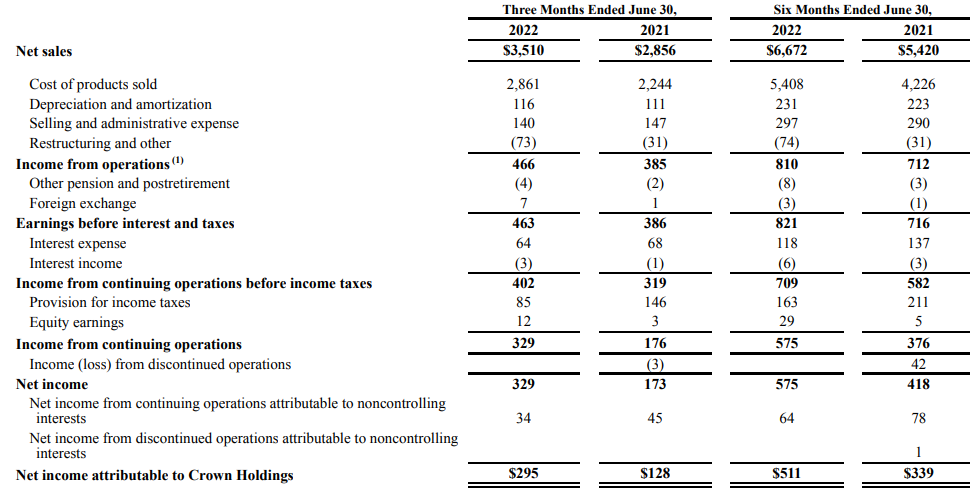

In the second quarter of this year, Crown reported a total revenue of $3.51B. An increase of almost 25% compared to the same quarter last year, but also a QoQ revenue increase of more than 10% which really shows the impact of the inflation-related price hikes. To put things into perspective; the revenue increased by $348M on a QoQ basis.

Crown Holdings Investor Relations

This doesn’t necessarily mean the company is now fully making up for the inflation-related cost increases, but at least it’s a start. We see the operating income was $466M but there was a $73M restructuring benefit (a $29M restructuring cost offset by the $102M after-tax gain on the sale of Kiwiplan division) boosting this operating income result. Excluding this non-recurring item, the operating income would have been less than $400M for an operating margin of 11%. Not bad, but that number is lower than the 12% in Q2 of last year.

With a net income attributable to the Crown Holdings shareholders of$295M, which represents an EPS of $2.44/share.

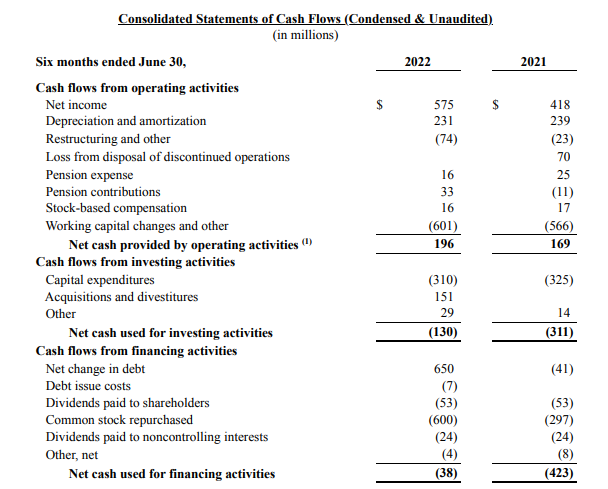

Crown continues to invest in expansion. In the first semester, its capital expenditures totaled $310M which is almost a third higher than the $231M in depreciation and amortization expenses. With an adjusted operating cash flow of $773M ($196M in operating cash flow was reported, but there was a $601M investment in the working capital position while $24M in dividends were paid out to non-controlling interests).

Crown Holdings Investor Relations

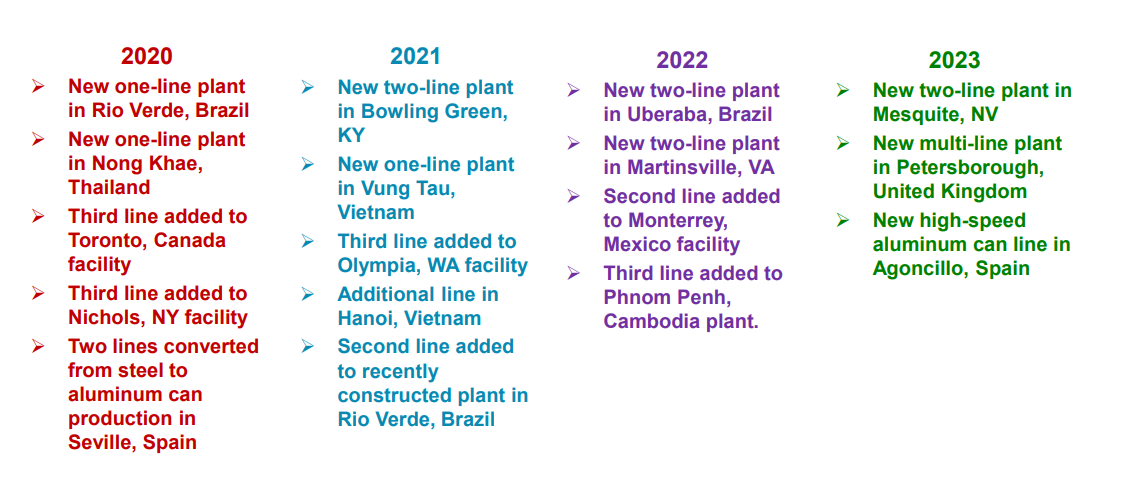

Keep in mind the first semester appeared to be capex-light: Crown expects to spend $1B on capex this year, which means it will have to ramp up its investments in the current semester. On top of that, it also wants to complete a $1B share buyback plan which means it will likely repurchase an additional $400M worth of shares.

This means it’s very unlikely the second semester will result in any positive free cash flow after taking the shareholder rewards into consideration. But it’s important to make a distinction between sustaining capex and growth capex as Crown is in full growth mode and is planning to open several new plants and lines over the next two years.

Crown Holdings Investor Relations

The balance sheet definitely can handle this kind of “temporary” overspending. The EBITDA will now likely exceed the $2B I was expecting and with a net debt of $6.1B, the debt ratio is still very decent. And keep in mind that once the expansion plans have been completed and Crown will only have to deal with sustaining capex, the free cash flow result will likely bump to in excess of $1.1-1.2B. Assuming the share count will have decreased to 110M shares by the end of 2023 (there are currently about 121M shares outstanding), I’m sticking with my 2024 sustaining free cash flow guidance of at least $10/share.

Despite robust results in the second quarter, Crown Holdings has reduced its full-year guidance by about $0.50 per share to reflect the negative impact of inflation and the higher energy prices in Europe. Crown now expects the full-year EPS to come in at $7.65-7.85/share so my hunch Crown would be unable to meet its full-year guidance was right.

Investment thesis

While it’s never fun to see a share price go down, I took advantage of the opportunity to buy a few more shares of Crown Holdings while I also still have written put options that are currently in the money.

The recent increase in interest rates also creates opportunities for bond investors. The 2026 bonds (maturing on Feb. 1, 2026) are trading at about 98.5 cents on the dollar. Combined with the 4.75% coupon, the yield to maturity increases to approximately 5.2%. That doesn’t beat the current inflation but with a total return of approximately 18.5% over 3.5 years. Not shocking, but decent for a “sleep well at night” income investment.

That being said, at this point I only own the shares (and the written puts). At less than $95/share, I still think Crown is attractive in the longer run as the expansion capex will likely decrease from 2023 on which will boost the reported free cash flow.

Be the first to comment