DarioGaona/E+ via Getty Images

It’s been a brutal start to Q3 for the Silver Miners Index (SIL), which has found itself down 8% quarter-to-date and 35% for the year. This is a massive underperformance relative to silver’s 19% decline, and it’s explained by leverage being quite painful on the downside. One name that’s been hit especially hard is First Majestic (NYSE:AG), which is down 36% year-to-date and 68% from its all-time highs reached in Q1 2021. After this violent decline and with sentiment in the dumps, some investors might be circling the stock looking for an opportunity. However, with AG still trading at a sizeable premium to net asset value, I still don’t see enough margin of safety just yet.

Jerritt Canyon Mine Operations (Company Presentation)

Just over two months ago, I wrote on First Majestic Silver (“First Majestic”), noting that while the stock still didn’t offer any margin of safety, a swing-trading setup would present itself on any dips below $7.85. While the stock did enjoy a 20% bounce in less than a month, it’s now found itself at lower lows, sliding back to May 2020 levels. While this decline might be a head-scratcher for some investors, the company has a much higher share count, and inflationary pressures have impacted operating costs, putting some strain on margins. Fortunately, the company did together a decent Q2 report, which might be able to help the stock find a temporary bottom. Let’s take a closer look below:

Q1 Production

First Majestic released its preliminary Q2 results this week, reporting quarterly production of ~2.78 million ounces of silver and ~59,400 ounces of gold. This translated to the production of ~7.7 million silver-equivalent ounces [SEOs], helped by another strong quarter at Santa Elena. In fact, Santa Elena’s production came in at record levels (~2.24 million SEOs), helped by the shift to mining at Ermitano, and the company has increased its full-year guidance based on what should be a strong second half at the mine. Unfortunately, this was offset by a weaker quarter at Jerritt Canyon, where a significant failure in the oxygen plant reduced roasting capacity temporarily (two weeks in May).

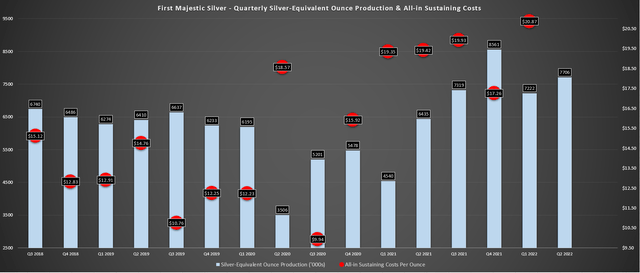

First Majestic Silver – Quarterly SEO Production (Company Filings, Author’s Chart)

Looking at the chart above, we can see that Q2 production was up 20% year-over-year, with the strong quarter at Santa Elena more than making up for the weaker than anticipated quarter at Jerritt Canyon. While this is disappointing, even if production was up sharply, First Majestic has increased its full-year guidance to incorporate higher production from Ermitano, improved milling efficiencies at Santa Elena, and higher tonnage/grades at Jerritt Canyon. This new outlook calls for the total production of ~18.5 million SEOs in H2, pushing total production to 33+ million SEOs for the year if the company can deliver on guidance.

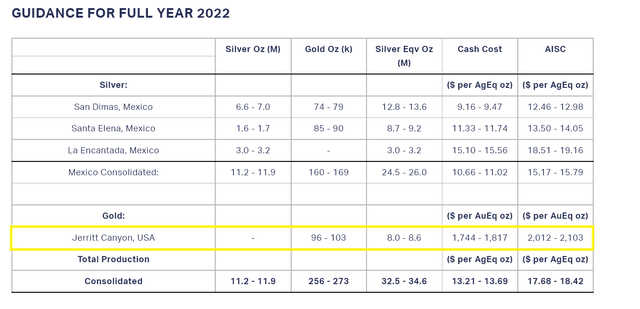

Unfortunately, this is a slight downgrade from initial guidance from a cost and production standpoint, related to lower silver production at San Dimas and lower gold production at Jerritt Canyon. The lower production at Jerritt Canyon is also expected to translate to higher costs at the asset, with all-in sustaining costs for FY2022 revised up to $2,012/oz to $2,103/oz, or all-in costs closer to $2,200/oz. These cost estimates are up from previous guidance of $1,503/oz to $1,607/oz, reflecting the tough H1 for the company. While it’s easy to be disgusted by this cost profile, the full-year costs do not accurately depict the potential of the asset, which we’ll discuss later.

Margins & Costs

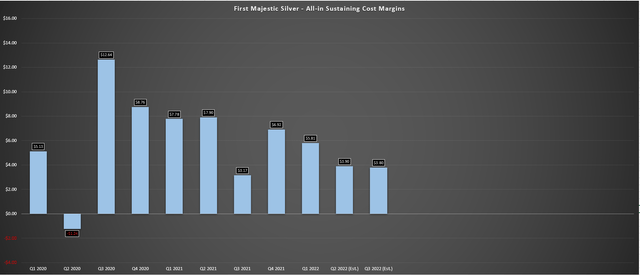

Unfortunately, while production was solid in Q2 and will improve in H2 given the outperformance at Santa Elena, the company has gotten no help from metals prices, and this will weigh on margins in Q2 and Q3 unless we see an immediate recovery in metals prices. This is because even if First Majestic’s all-in sustaining costs [AISC] improve to $19.80/oz in Q2 and $17.20 in Q3, its AISC margins are expected to dip to $3.90/oz and $3.80/oz, respectively. These figures assume an average silver-equivalent price of $23.70/oz in Q2 and $21.00/oz in Q3, which could end up being below the company’s average realized price. Still, I have chosen to be on the conservative side due to cost pressures, and under these assumptions, First Majestic will see considerable margin compression.

First Majestic – AISC Margins & Forward Estimates (Company Filings, Author’s Chart & Estimates)

Even assuming my estimates are too conservative, the best case I see for Q2 AISC margins is $5.00/oz, representing a 30% decline from year-ago levels ($7.90/oz). Meanwhile, the best case for Q3 2022 AISC margins looks to be $4.10/oz, translating to an improvement from Q3 2021 levels when sustaining capital was elevated but down ~65% from Q3 2020 levels ($12.64/oz). I don’t see a lot of value in judging a company by a quarter or two of results, and there appears to be a path towards lower costs long-term at Jerritt Canyon. However, the market is less forgiving in the short-term, and with margin compression on the horizon in the Q2 results, the stock could certainly come under more pressure if sentiment has not improved sector-wide.

Recent Developments

In addition to solid operating results in Q2, First Majestic continues to remain optimistic about Jerritt Canyon, an asset with a capacity of 4,000 tonnes per day (~1.45 million tonnes per annum), of which only 60% of capacity is being utilized. In fact, the company is targeting a quarterly average run rate near 30,000 ounces in H2, a considerable increase in production from its H1 quarterly average. This is expected to be accomplished by increasing mill feed from the Saval II and West Generator underground mines, as well as operational improvements at the SSX Mine. Historically, West Generator produced 600,000+ ounces at an average grade of ~4.80 grams per tonne of gold.

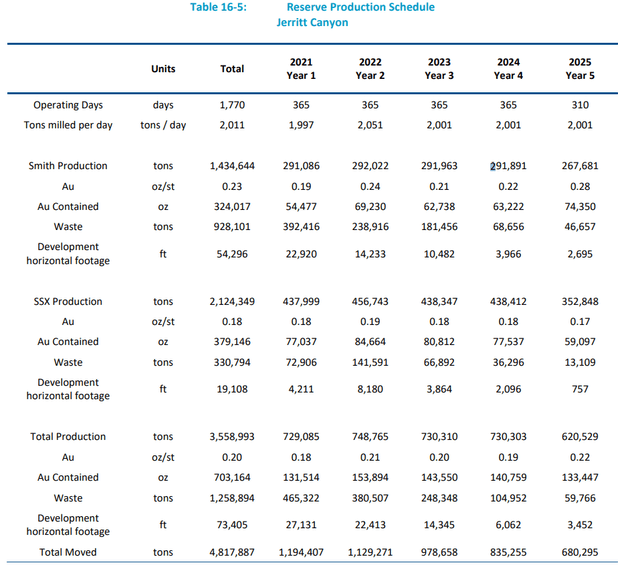

Jerritt Canyon – Mine Schedule (Excludes West Gen/Saval II) (Technical Report 2020)

Assuming the company can increase throughput to 3,800 tonnes per day by 2024 and process an average head grade of ~4.6 grams per tonne of gold (below 2023 mine plan assumptions), this would translate to an annual production of 170,000 ounces of gold, assuming slight improvements in recovery rates (82% vs. 80%). This would represent a nearly 100% increase from current production levels and should help to drive down costs considerably. So, while the company receives tons of criticism for this asset’s costs ($2,000/oz plus), I struggle to see the value in judging an asset during its ramp-up phase when it’s running at 60% of full capacity and also struggle to see the value in judging an asset by 2-3 quarters of results.

A good example of this is the Detour Lake Mine, which entered Kirkland Lake’s portfolio with costs well above $1,100/oz and averaged costs of $1,259/oz in Q3 2020, with considerable criticism. However, the asset is expected to produce gold at an average cost of $775/oz long-term, which does not include benefits from the following:

- reduced hardness of mineralization from Detour West

- improved fragmentation

- improved primary crusher choke feeding

- an increase in operating time to 93%

- the addition of secondary crusher screens

- a potential increase to 32 million tonnes per annum

- spiking head grades with the addition of ore from 58 North (higher-grade underground deposit).

These initiatives could ultimately pull costs below $750/oz at this asset even after adjusting for inflationary pressures and move it from a ~700,000-ounce producer to a 950,000-ounce per annum producer. Obviously, Jerritt Canyon is no Detour Lake, and this is a very different case. Still, this example points to why judging an asset by a couple of quarters of production has little value, especially if clear optimization work is underway and there’s considerable excess processing capacity to help drive down unit costs. So, while First Majestic might be guiding for all-in sustaining costs of ~$2,000/oz this year, it wouldn’t shock me to see AISC improve to $1,400/oz or lower in 2024.

Jerritt Canyon 2022 Guidance (Company News Release)

Obviously, the key will be successful execution here. If we continue to see a deterioration in the gold price to below $1,550/oz, it may be more difficult to implement a successful turnaround at this asset. However, in a $1,700/oz to $2,000/oz gold price environment, Jerritt Canyon should enjoy solid margins post-2023 if the team can deliver on its goals here and push production above 170,000 ounces per year. That said, First Majestic is somewhat of a turnaround story since acquiring the JC Mine, having to prove to the market that this acquisition will pay off, similar to what Kirkland Lake went through post-Detour acquisition but with higher risk (weaker margins). When it comes to turnaround stories, investors should be looking for dirt-cheap valuations, and I don’t see this as the case for First Majestic. Let’s take a look below:

Valuation

Based on ~270 million fully diluted shares and a share price of US$7.00, First Majestic trades at a market cap of ~$1.89 billion. However, this figure is still well above my estimated net asset value of ~$1.0 billion. So, while this updated valuation of 1.90x P/NAV is certainly an improvement from more than 3.5x P/NAV when I noted to sell the stock above $18.00 per share in Q1 2021, I still don’t see any margin of safety here to justify owning the stock from an investment standpoint.

To put this figure in perspective, Agnico Eagle Mines (AEM) also offers growth, operates in more attractive jurisdictions, and has much higher margins. However, it trades at less than 0.90x P/NAV, a 50% discount to First Majestic’s estimated P/NAV multiple. This doesn’t mean that First Majestic can’t go higher or that it must drop further before finding a bottom. However, for investors looking to buy with a large margin of safety to protect themselves against a further dip in metals prices, I do not see First Majestic as meeting this criterion.

Some investors will argue that First Majestic should trade at a premium due to its considerable silver exposure and its ability to sell silver at above market prices through its bullion store, which certainly helps in periods of commodity price weakness. While these are differentiators and its silver sales through its store help to pad margins, sales represent less than 10% of quarterly production. Meanwhile, although a premium is justified for silver producers, I see the current premium as excessive, and I am only interested in precious metals stocks that trade at a discount to their net asset value. Therefore, even after a 68% decline, I don’t see AG as investable.

Technical Picture

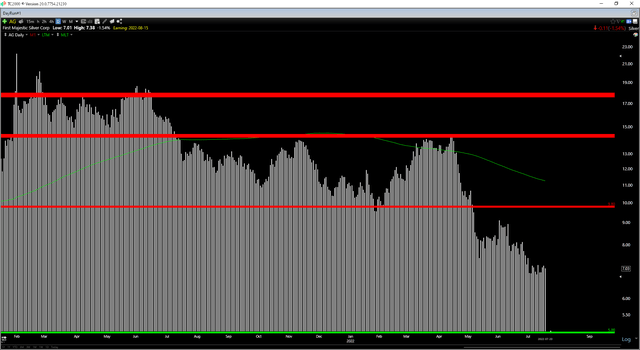

If we look at the technical picture, there’s not a lot to like here either, given that First Majestic broke key support near US$8.00, and its next major support level doesn’t come in until US$5.00. The good news is that it doesn’t have any meaningful resistance until US$9.80, suggesting there could be some upside in the stock if sentiment improves in the back half of this year. Still, with $2.00 in potential downside to support and $2.80 in potential upside to resistance, the reward/risk ratio doesn’t meet my buying criteria just yet (1.40 to 1.0). So, with a low-risk buy zone for First Majestic of $5.70 or lower (6.0 to 1.0 reward risk ratio), I think there are more attractive buy-the-dip candidates elsewhere.

Summary

While First Majestic has been the target of considerable criticism for its Jerritt Canyon purchase due to the high all-in sustaining costs at the asset, I am cautiously optimistic that they can turn this asset around. This should help the company to deliver growth. Still, investors will have to be patient to reap the benefits of its Nevada operations, and success here is contingent on the gold price not weakening much further. In addition, the company will need some exploration success over the coming years to increase the mine lives at its assets. It won’t be able to rely on higher metals price assumptions, given that it’s already using prices of $22.50/oz silver and $1,750/oz gold, respectively.

Unfortunately, the biggest issue with First Majestic has been valuation, and while one can be optimistic about its future in Nevada, there’s simply no margin of safety in the stock. When betting on a turnaround in a weakening commodity price environment, the first thing investors should be looking for is safety, and AG doesn’t offer this yet. So, while sentiment is bad and an oversold rally is possible given the waterfall decline we’ve seen, I would not get interested in the stock unless it dipped below $5.70 per share.

Be the first to comment