Lawrence Glass

In a surprise move, President Biden made announcements supporting the pardon of federal marijuana possession and the de-scheduling of cannabis as a drug. The moves could have a drastic impact on cannabis legislation, possibly opening up the potential for SAFE Plus approval with great benefits to U.S. multi-state operators (MSOs) like Curaleaf Holdings (OTCPK:CURLF). My investment thesis is ultra Bullish with this big rally on the pronouncement of the President only pushing the stock back above $6 after once trading far higher in 2020 despite strong growth during this period.

Legal Shakeup

In a surprise move considering the market focus on the OPEC+ production cut yesterday, President Biden made an aggressive move on marijuana. The main move is the pardoning of all prior federal offenses of simple marijuana possession. The second move is to request a review by the Attorney General to declassify marijuana under the Controlled Substances Act (CSA) from the current Schedule I classification as similar to heroin and fentanyl.

The key here is that a large part of the cannabis legislation held up in the Senate are the debates over how to handle prior criminal offenses and the classification of cannabis as a drug by the Federal government. The pardon of prisoners and reclassification could set up the possible approval of the SAFE Plus legislation more focused on cannabis businesses accessing the U.S. banking system.

The SAFE Plus bill including the original SAFE Banking Act that already passed the House and includes measures for SBA loans, increased medical cannabis access for veterans, and marijuana conviction expungements. The biggest issue with the bill amongst Republicans was the expungement of prior crimes, but the pardon of federal possession crimes by Biden could help solve this problem.

Any move to de-schedule cannabis would eliminate the 280E tax and open up the uplisting of the stocks setting up a major boost for MSOs. Cory Booker (D-N.J.) has been seen as positive on the SAFE Plus option while Senate Majority Leader Chuck Schumer (D-N.Y.) may not be as positive on throwing away the Cannabis Administration and Opportunity Act.

The bulk of marijuana convictions are in the state or local prisons with only 6,500 estimated in Federal prison, so Governors would need to follow the lead of President Biden to make such pardons. Congressman Dave Joyce (R-OH) estimates some 14 million cannabis-related records hold Americans back as follows:

I also commend the President’s recognition of the need for state and local level expungement efforts. The bulk of petty, non-violent cannabis convictions take place at the state and local level, so to truly remedy the unjust war on cannabis, we must start there and vacate antiquated offenses that are no longer even considered a crime. More than 14 million cannabis-related records at the state and local level continue to preclude Americans from stable housing and gainful employment – two cornerstones of safe and prosperous communities

Either way, Biden has made a move to solve the issues holding back the SAFE Plus legislation, which as well could possibly include expungement of cannabis offenses at the state/local level in such a bill.

Only The Start

The cannabis sector has faced a tough year due to weakness in the retail sector limiting cannabis sales and the lack of progression of federal legalization. The AdvisorShares Pure US Cannabis ETF (MSOS) was down 70% over the last year prior to the rally on Thursday.

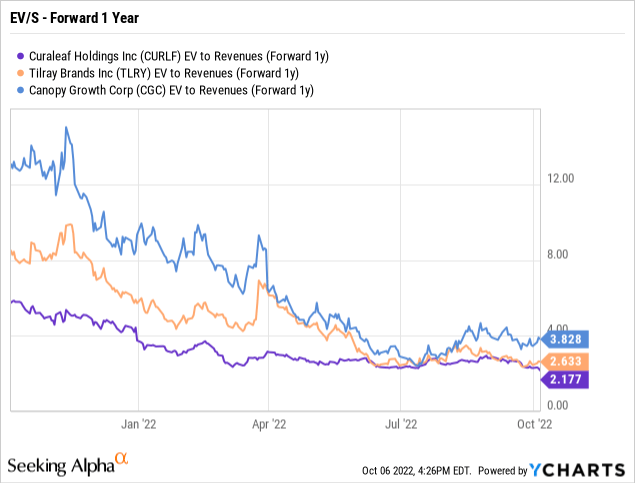

Curaleaf traded at a forward EV/S multiple of just 2.2x sales prior to the big rally. The stock remains a discount to the Canadian cannabis stocks with both Tilray Brands (TLRY) and Canopy Growth (CGC) trading at higher multiples without the revenue growth or strong EBITDA profits.

Curaleaf remains the global cannabis leader with 2023 sales targets at $1.7 billion. Once uplisted, the MSO is likely to obtain a premium multiple in comparison to the Canadian stocks with the market leader in the U.S. the preferred investment going forward. Both Tilray and Canopy Growth will need to buy U.S. assets after a rally to really participate in the opportunity.

Curaleaf has far higher adjusted EBITDA targets at what could amount to over $500 million next year on 30% EBITDA margins in a better retail environment once the recessionary and inflationary pressures end in the retail sector. Curaleaf is one of the best ways to play the cannabis space with the leading current position and access to New Jersey, New York, Connecticut and Europe markets making the company the only way to directly play all of the prime growth markets opening up in the near term.

Takeaway

The key investor takeaway is that federal legislation can’t be guaranteed. The announcements from President Biden are very positive signs a path to legalization is actually possible now. With the midterms coming up, cannabis legalization or de-scheduling might not make any progress.

At the current stock price below $6, Curaleaf is just too cheap to get caught on the sidelines.

Be the first to comment