Lee Hyuck/iStock Editorial via Getty Images

Elevator Pitch

I downgrade my investment rating for POSCO’s (NYSE:PKX) [005490:KS] shares from a Buy to a Hold. I previously reviewed PKX’s Q3 2021 financial performance in an earlier article published on November 2, 2021.

It is necessary to focus on both the steel and non-steel businesses for POSCO in analyzing the stock. On the negative side of things, the short-term and long-term financial performance of POSCO’s core steel business might be negatively affected by weak steel prices and tighter environmental regulations, respectively. On the positive side of things, PKX’s new holding company structure should help to ensure that its non-steel businesses receive sufficient attention and resources necessary for their future growth. I also like POSCO’s changes to its shareholder capital return policies. Taking into account both the positives and negatives associated with the company, I deem POSCO’s stock to be a Hold.

Weak Steel Prices Could Hurt Steel Business’ Near-Term Performance

A recent June 18, 2022 Nikkei Asia article highlighted that “the price for hot-rolled coil steel has hit a 14-month low in East Asia” due to unfavorable demand-supply dynamics in China, and it was noted that “many market watchers expect low (steel) prices to persist for some time.”

According to the company’s fiscal 2021 20-F filing, POSCO’s core steel business segment accounted for 84%, of the company’s gross profit last year. As such, it is reasonable to conclude that the weakness in steel prices will have an adverse impact on the company’s earnings for FY 2022.

South Korean stockbroker NH Investment & Securities issued a research report (not publicly available) for POSCO on June 10, 2022, and NH’s analyst covering the stock chose to cut his FY 2022 operating profit forecast for PKX by -5% to KRW7.4 trillion which translates into a -20% YoY contraction. This supports my view that weak steel prices will be a drag on the financial performance of POSCO and its core steel business.

Steel Business Might Be Impacted By Regulatory Issues In The Long Run

On top of weak steel prices in the short term, POSCO’s steel business also faces challenges in the long term due to regulatory and policy issues.

According to an April 4, 2022 article published in The Korea Economic Daily, the “price of carbon permits (in South Korea) has risen more than 20% in one year”, following the introduction of “stricter emission standards.” Based on information sourced from Reuters, South Korea’s 2030 “greenhouse gas reduction goal” was changed from 26.3% to a more demanding 40.0%.

In an interview with The Financial Times which was published on June 5, 2022, “Cho Ju-ik, head of POSCO’s hydrogen business” was quoted as saying that “our competitors in China and India face looser domestic (environmental) regulations” and noted that “this can put us at a disadvantage” in terms of costs. POSCO’s export sales contributed approximately 57% of the company’s steel business segment revenue for FY 2021 as per its 20-F filing. In other words, POSCO could potentially lose market share in foreign and international markets, due to higher costs relative to its rivals in other Asian countries.

In the same Financial Times article, it was also noted that “decarbonizing its (POSCO’s) steelmaking operations will cost about Won40tn ($32bn)” as part of plans to “use hydrogen to replace coal in steelmaking processes by 2050.” As an indication of how significant this KRW40 trillion investment will be, PKX’s FY 2021 net profit attributable to shareholders was KRW6.6 trillion. FY 2021 was an exceptional year for POSCO, as the company delivered earnings of KRW1.9 trillion and KRW1.6 trillion for FY 2019 and FY 2020, respectively. This suggests that POSCO has to spend multiple years of profits to be in compliance with the environmental regulations in South Korea.

Commitment To Diversification Validated By Establishment Of Holding Company

It is vital for POSCO to diversify more aggressively into non-steel businesses, considering the challenges faced by its core steel business as discussed in the earlier sections of this article.

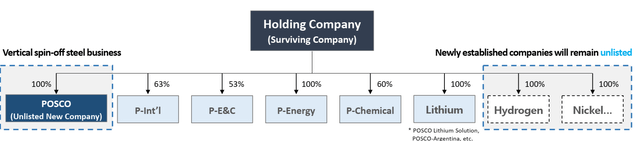

On March 2, 2022, The Korea Economic Daily reported that PKX “launched a holding company” to support its goal to “ramp up operating profits from the non-steel business to 50% (from 20% now) of the entire group’s profit.”

POSCO’s New Holding Company Structure

POSCO’s Corporate Presentation Slides

In the company’s meeting with investors, POSCO explained why the new holding company structure will help to drive the growth of its non-steel businesses. PKX noted at the investor meeting that both its steel and non-steel businesses have never “enjoyed the level or intensity of support and interest” they deserve in the past. This is because “the steel business (the ‘old’ POSCO which played the dual role of being an operating company and a holding company) had to spend time “to engage in the management of the Group” and “a steel-centered management system” inhibited the growth of the company’s non-steel divisions.

Among the non-steel businesses, it is worth paying attention to POSCO’s lithium and hydrogen subsidiaries. As per its investor presentation slides, PKX has set ambitious targets of becoming one of the three biggest lithium producers globally and among the 10 largest hydrogen producers by 2030 and 2050, respectively.

Positive Shareholder Capital Return Catalysts In 2022

At the start of the year, POSCO announced a few changes to the company’s shareholder capital return policies, which should provide support for its share price to some extent.

Although POSCO’s current policy of paying out 30% of its earnings is decent, dividends in absolute terms might vary from year to year depending on the company’s bottom line. A key change to the company’s shareholder return policy is that PKX committed to “a minimum dividend in excess of KRW10,000 per share onwards in tandem with corporate value” as per its January 2022 announcement. This is roughly equivalent to a dividend yield of 3.8% for POSCO based on my calculations.

The other key change is that POSCO guided for a cancellation of 11.6 million treasury shares (or 13.3% of its total treasury shares) to be taking effect by the end of this year. It is noteworthy that while the company has been buying back its own shares, the last time it cancelled its treasury shares was in 2004.

Bottom Line

POSCO is rated as a Hold now. The prospects of the company’s core steel business aren’t great, considering steel price weakness in the near-term and the substantial investments needed to comply with South Korea’s environmental rules in the long run. On the other hand, I am positive on changes to POSCO’s capital return policies and the company’s diversification efforts. This explains my mixed view of PKX, which in turn supports a Hold rating for the company’s shares.

Be the first to comment