PonyWang/E+ via Getty Images

If we could only invest in ten companies for the next ten years, we would still choose Taiwan Semiconductor (NYSE:TSM) as one of them. We believe this is one of the most attractive businesses in the planet, and it is currently on sale for a variety of reasons including fear that growth might cool down if the economy enters a recession. We are not overly concerned, as we believe the share price is already more than pricing slower growth.

Historically there has been significant cyclicality due to the fact that foundries tended to add excessive capacity during good times that resulted in under-utilization during downturns. This would result in much lower profitability, or even sometimes in losses.

While there might still be some cyclicality left in the foundry business, we are much less concerned for Taiwan Semiconductor because most of its profits come from leading nodes, where it is one of only two foundries possessing the most advanced technology. The foundries focused on the more commoditized old nodes should be more worried. Taiwan Semiconductor has a long waiting list of customers that could replace a large part of the potential demand reduction resulting from a recession. Most of its competitors are confined to low-end manufacturing due to prohibitive costs and engineering know-how associated with the leading-edge technology.

TSMC’s Competitive Advantages

Taiwan Semiconductor’s competitive moat has multiple sources, including the patents and trade secrets necessary to manufacture the leading semiconductor nodes. This is not all, however, as the company is also a very efficient manufacturer, which combine to make Taiwan Semiconductor a low-cost producer for high technology chips.

Being able to manufacture the leading semiconductor nodes also has other advantages including improved energy efficiency for the customer’s end products.

Less evident, Taiwan Semiconductor also benefits from efficient scale dynamics. That is, where investment is very high and only one or two companies are needed. Examples of efficient scale include airports and pipelines. Once a company goes forward with the massive investment necessary to develop these assets, it makes little sense for another company to try to compete.

Taiwan Semiconductor Financials

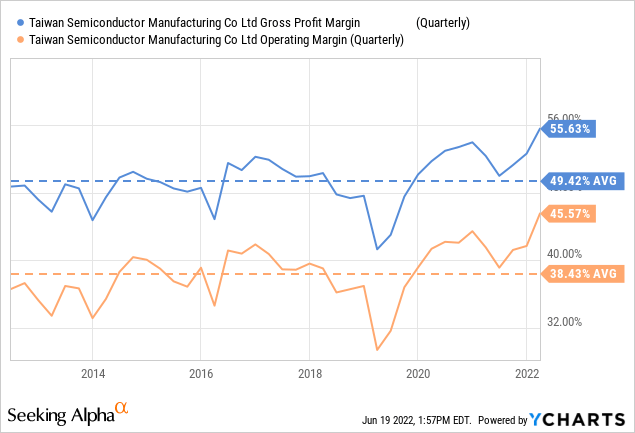

The strength of the competitive advantages is reflected in the significantly above average profit margins the company has maintained over the last decade. Few companies in the planet have operating margins above 40%, and the ones that do usually have a very strong competitive moat.

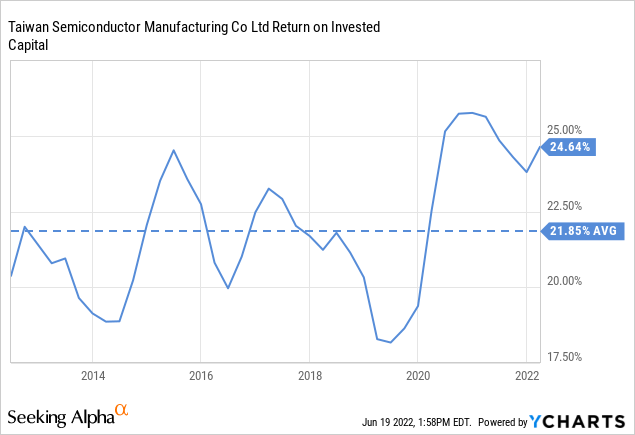

The competitive moat has also resulted in attractive returns on invested capital. Taiwan Semiconductor has averaged a ROIC of ~21% over the last ten years, and it has been higher recently at ~24%. This is not an asset-light company since it requires billions in investment. It is therefore close to the ideal business, one that can absorb enormous amounts of capital and still deliver very high rates of return on it.

Growth

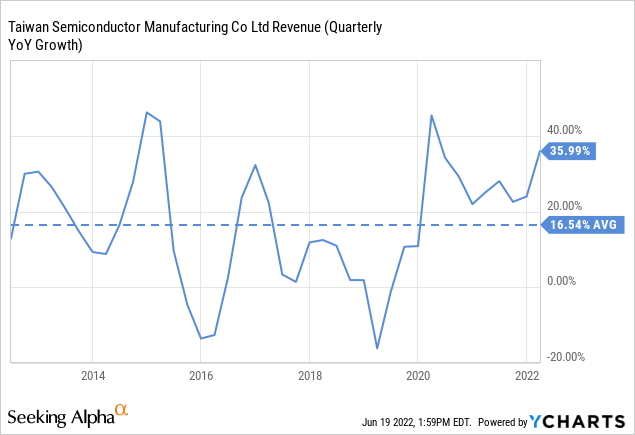

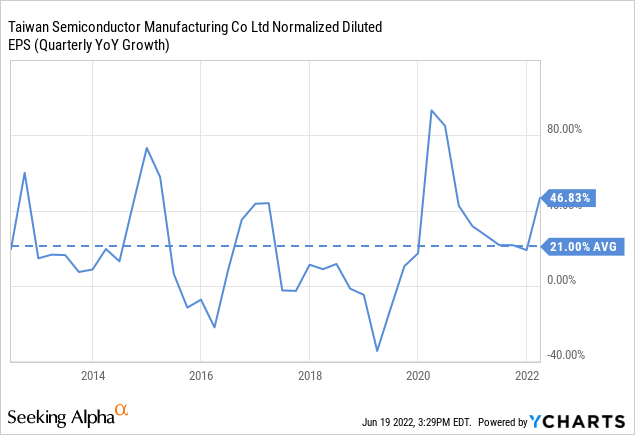

Another characteristic making Taiwan Semiconductor a superior business is the high growth it has delivered, growing revenue over the last ten years at a ~16% average. While it has been relatively cyclical, the average is high, and it has been higher than average in recent quarters, with the most recent one at ~36%.

While in previous cycles most of the semiconductor demand came from PC’s and mobile devices, it has broadened to include high-performance computing, automotive, IoT, and other smaller segments. This broadening should help moderate the cyclicality, as the strength in one segment could help offset weakness in another. Applications like machine learning and artificial intelligence are growing particularly quickly, and they tend to use GPUs/TPUs manufactured with the most advanced nodes. That is why we are happy to see that about half of Taiwan Semiconductor’s revenue comes from its two most advanced nodes, 5nm and 7nm.

TSM Stock Valuation

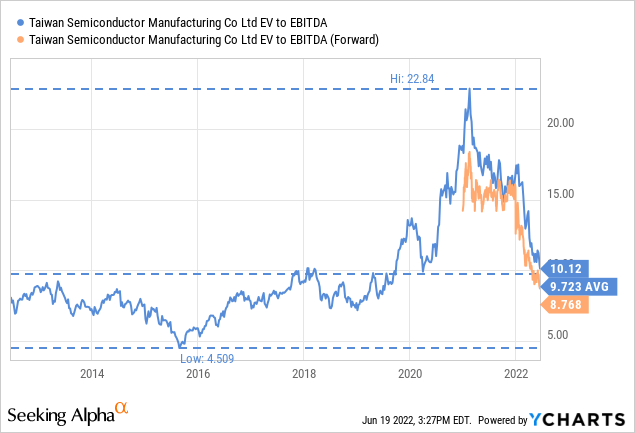

With the company firing on all cylinders and the share price having declined significantly, the valuation has become quite attractive. Despite the quality of the business, shares are trading at only ~10x EV/EBITDA, close to the ~9.7x average over the last decade. The forward EV/EBITDA is only ~8.7x.

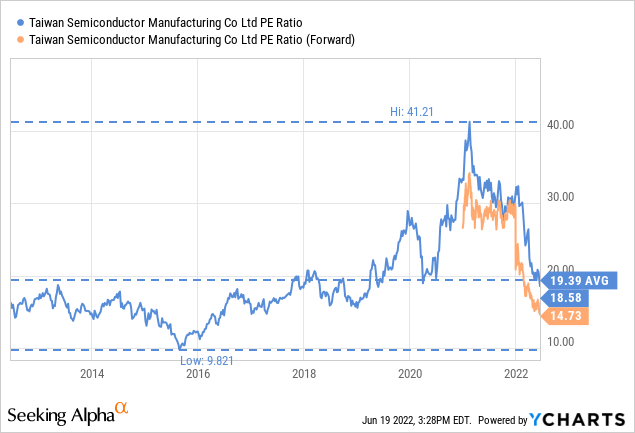

The price/earnings ratio is below the ten-year average of ~19x, at ~18.5x, and the forward p/e is only ~14.7x. These are cheap multiples considering the impressive margins, growth, ROIC, etc. that the business has been delivering.

Over the last ten years earnings have grown at an average of 21%. For our discounted cash flow model, we’ll assume growth is reduce in half to be conservative, and because of the size of the company it will start becoming harder to move the needle in terms of growth.

In our simple discounted cash flow model for the first three years, we use the average analyst earnings estimate as compiled by Seeking Alpha and assume 10.5% growth for the next seven years (half of what the company delivered the previous decade). We assume a terminal growth rate of 5%, and discount everything by 10%. We get a net present value per share of $179, which is more than 2x where shares trade currently. This shows how undervalued shares have become if the company can continue delivering growth of at least half its historical rate.

| EPS | Discounted @ 10% | |

| FY 22E | 5.77 | 5.25 |

| FY 23E | 6.30 | 5.21 |

| FY 24E | 8.05 | 6.05 |

| FY 25E | 8.90 | 6.08 |

| FY 26E | 9.83 | 6.10 |

| FY 27E | 10.86 | 6.13 |

| FY 28E | 12.00 | 6.16 |

| FY 29E | 13.26 | 6.19 |

| FY 30E | 14.65 | 6.21 |

| FY 31E | 16.19 | 6.24 |

| FY 32 E | 17.89 | 6.27 |

| Terminal Value @ 5% terminal growth | 357.87 | 114.03 |

| NPV | $179.91 |

TSMC Q2 2022 Guidance

We are encouraged by the strong guidance the company gave for the second quarter of 2022. The company expects revenue to be between $17.6 billion and $18.2 billion. They also expect gross profit margin to be between 56% and 58%, and operating profit margin to be between 45% and 47%.

Risks

The main risk we see with a long-term investment in Taiwan Semiconductor is that of technology obsolescence if competition manages to outrun them in semiconductor node development. So far, the company has done a terrific job staying ahead of the curve, investing heavily in R&D to make sure competitors are not able to catch up with them. In fact, the company has been reinvesting ~8% of revenue into R&D. That said, competitors catching up is a real risk, and probably the most important one here.

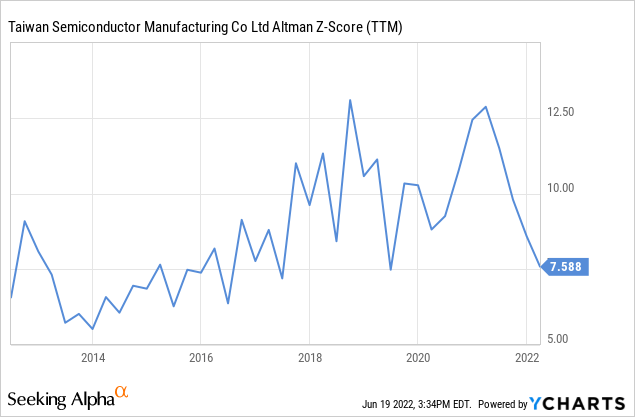

In terms of the balance sheet, we do not see any major liquidity risk, with the company having more cash and short-term investments than long-term debt, and the Altman Z-score being a very high 7.5.

Conclusion

We believe Taiwan Semiconductor is one of the most attractive businesses in the planet, and certainly one of the few companies with operating margins above 40%. The size of Taiwan Semiconductor’s competitive moat is enormous, which has allowed it to earn superior returns on invested capital and grow at a very high pace. Our estimate for fair value is $179, which means shares would return >100% if they were to trade in line with our estimated valuation. If you like the company this is probably a very good time to consider making an investment.

Be the first to comment