Lukasz Kochanek

Company Overview

Sonos, Inc. (NASDAQ:SONO) is an American developer and manufacturer of audio products best known for its multi-room audio products and portable speaker systems. Sonos offers sound systems for all uses, from living rooms to outdoor events. Their products can “seamlessly” connect with each other using Wi-Fi and generally get good reviews.

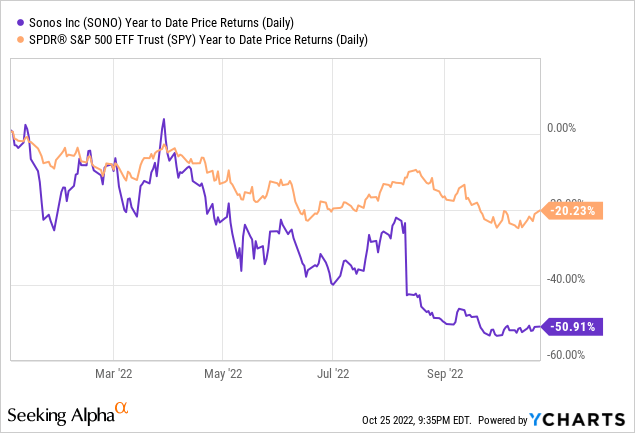

Sonos completed its Initial Public Offering in August of 2018, raising ~$250 million at a ~$1.5 billion valuation in the process. Year-to-date, Sonos stock price has underperformed the market significantly, more than halving since the beginning of the year. Meanwhile, the S&P 500 in the same time period has only declined by -20.2%. The company’s market capitalization currently stands at near $2 billion.

Disappointing Results and Guidance

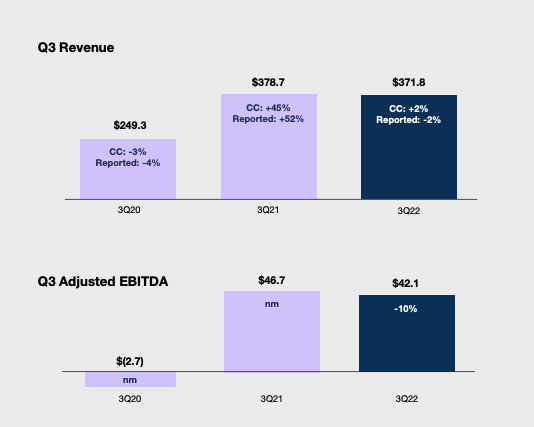

Sonos has had a subpar Q3 2022 (reported in August 10, 2022), most notably its substantial deceleration in top line growth. The company reported a -2% YoY Q3 revenue growth, which on an inflation-adjusted basis, leads to a negative decline. This is substantially below the level of growth seen in the same quarter last year, when the company reported a 52% YoY growth. Management cited “softer consumer demand” and “supply chain issues” as reasons for the minimal revenue growth – both factors that are likely to persist for the foreseeable future. The company also substantially revised its guidance for the year downwards, projecting a 1% – 2% YoY growth for Fiscal Year 2022, compared to its previous projection of 14% – 16% YoY growth. The large downward revision is substantial in our view.

Q3 2022 Earnings

Intense Competition

Sonos operates in an industry with substantial competition from companies that sell premium audio products and smart speakers. Sonos states that they have 2% share in the global audio market. With countless players spanning from Sony, JBL, Amazon, Apple, Bose, Bang & Olufsen, and more, Sonos operates in a saturated market and a consumer base that has a wide selection of choice. As smart speakers become more popular, Amazon and Apple – two tech behemoths – will have a greater say in the audio market in the future.

Though Sonos tries to differentiates its product line by emphasizing connectivity and other connected features, our view is that there are many compelling substitutes for the product in various dimensions, from brand prestige to design. Therefore, we view the saturated industry and formidable competition as major headwinds for the company’s future prospects.

Recession Risk

We believe Sonos is susceptible to high risk stemming from a deteriorating economy. In the most recent earnings, Sonos already made it known that weaker consumer demand has impacted the company’s top line performance. As the economy worsens in the U.S. and abroad, we are likely to see continued deterioration in the demand for Sonos products, as quite simply, audio products are a consumer discretionary good, and for some, a luxury good to purchase when there’s high disposable income. Upgrading speaker setups and buying nicer speakers are likely to be pushed back as consumer sentiment weakens further and people struggle with higher rates of inflation.

Uncertain Valuation

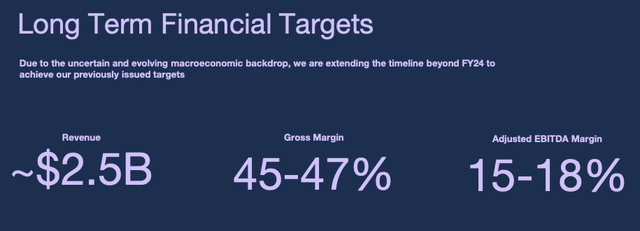

The company projects that its “Long Term” financial targets are going to be a revenue of $2.5 billion, with an Adjusted EBITDA Margin of 15-18%. In the most recent earnings, the company extended the timeline “beyond FY24” citing “uncertain and evolving macroeconomic backdrop.” Assuming that the company meets this goal to FY 2027 in the next five years, that pegs the Adjusted EBITDA in 2027 to $375 million to $450 million. Using a 8x EBITDA multiple and taking the midpoint of the EBITDA margin estimates, that is a valuation of $3.3 billion in 2027. Discounting that back to today’s dollars using a 10% discount rate gives us a valuation of $2.0 billion valuation today, which is not far off from current levels. As a result, we don’t believe that there’s enough reward for the risk that investors would take given the numerous cyclical headwinds facing the business.

Conclusion

We are recommending a “HOLD” on this company due to the fact that there remains many questions to be answered on the company’s short to medium-term prospects. Valuation remains reasonable based on the company’s own financial targets and guidelines, and we would like to see growth come back to the company. Our “HOLD” thesis is not without any risks, as higher than expected Q4 performance or better than expected recovery in the U.S. and global economy could change our conservative thesis.

Be the first to comment