Lemon_tm

Our view

Meta Platforms, Inc. (NASDAQ:META) (“Meta”) appears to be out of favor with investors. Whether it’s fear of competition from TikTok, skepticism about the company’s investment in metaverse, or just plain dislike of Mark Zuckerberg, most coverage about the company tends to be negative.

There are some genuine headwinds facing the company. User growth is slowing while competition from TikTok and privacy changes introduced by Apple (AAPL) contributed to the company reporting its first ever year-on-year decline in quarterly revenue. The company also continues to lose around $10 billion p.a. on its investment in the metaverse. However, it is important to step back and put all of this into perspective.

Despite the decline in revenue, the number of people using Meta platforms on a daily basis continues to grow and its platforms continue to be the dominant social media platforms globally. With around 3 billion daily users, more people use Meta products than consume Coca-Cola products on a daily basis. It is only natural that user growth would slow eventually.

The headline loss of $10 billion from the company’s investment in the metaverse isn’t as significant as it appears. The existing legacy businesses are cash cows and the company is investing less than 20% of the profits from these into its metaverse vision. Even so, the company still generated a net profit margin of 20% and a return on invested tangible capital of 40%.

While mass adoption of the metaverse is likely still a few years away at the earliest, we see a number of key catalysts this year not fully anticipated by the market which could mark a significant turning point.

Meta is expected to release its latest and most advanced VR headset to date in time for the Holiday season, while other key players such as Apple are rumored to be working on similar products. Meta’s annual Connect event, which usually takes place in September or October, should also bring more news on the company’s progress and vision for metaverse.

Meta is currently valued at around 10 times net earnings meaning investors could expect to see moderate compound returns in the range of 8% – 15% in the next decade, even with no or only low-single digit earnings growth. And this is assuming that the company continues to invest around 20% of the profits from its traditional platforms into the metaverse at a loss.

While we believe the emergence of the metaverse is inevitable, the form it will ultimately take will be uncertain. However, at current price, we see Meta as providing low-risk, high-reward exposure to the huge but uncertain potential of the metaverse. For that reason, we rate it a “Buy” at the current price.

Business review

Overview

Since 2020, Meta has grouped its business into two segments: Family of Apps and Reality Labs.

Family of Apps comprises all of the company’s well known social and messaging platforms including Facebook, Messenger, Instagram and WhatsApp. These platforms account for 98% of the company’s revenues, almost all of which comes from advertising on mobile devices.

Reality Labs encompasses the company’s expansion into virtual / augmented reality and the “metaverse”. Unlike its traditional business, this also includes a serious move into consumer hardware with existing products including the Meta Quest 2 (aka Oculus Quest 2) VR headset and the Facebook Portal devices.

User base

Prepared by author. Data from company reports.

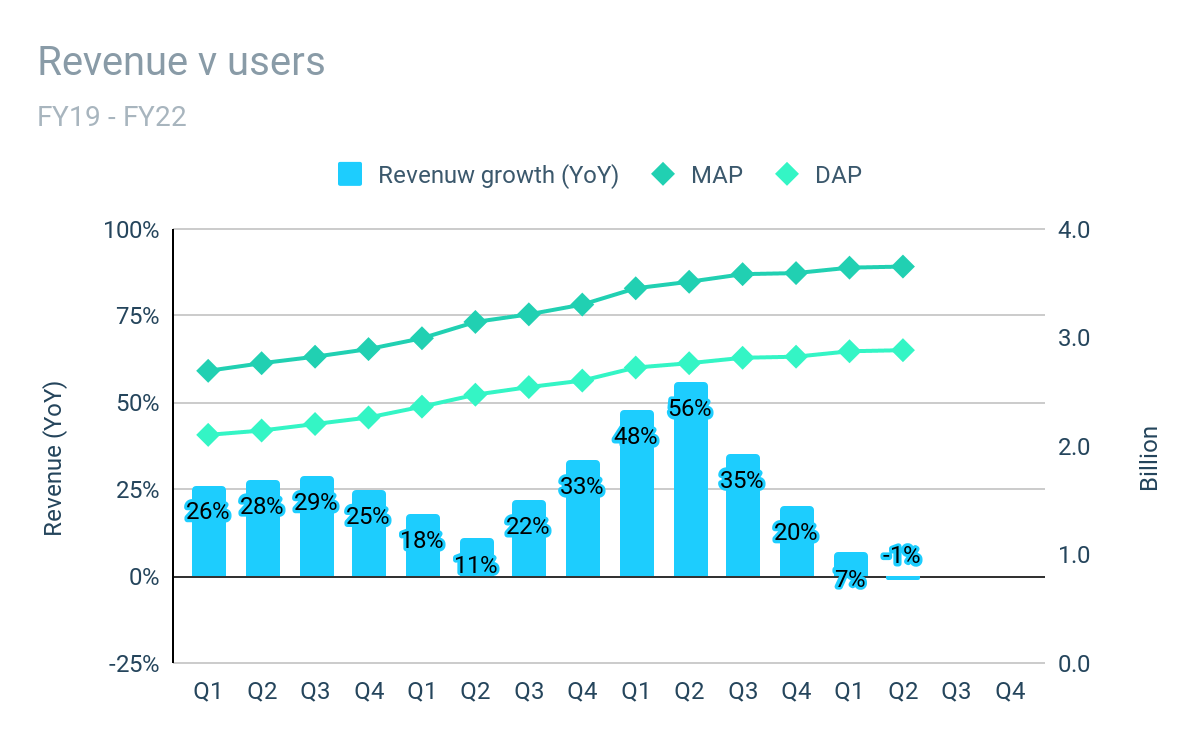

In the company’s most recent quarterly earnings update released on 27 July 2022, it reported a year-over-year decline in quarterly revenue, the first ever such decline in the company’s history.

While a decline in revenue is never welcome news, it is important to put it in perspective. The decline was less than 1% and was measured against a period where there was strong user engagement and demand/pricing for advertising driven by Covid-19 factors. It was also not surprising to see revenue decline as the comparative period was prior to the changes introduced by Apple in iOS 14, which has limited the ability of Meta to track ad performance.

The decline also wasn’t reflected in the size of the company’s user base, with Monthly Active People (“MAP”) and Daily Active People (“DAP”) both increasing, albeit at slowing rates. However, with around three in every four of the global online population already using Meta platforms daily, it is inevitable that user growth would slow.

Since user numbers aren’t a problem, the decline in revenue was due to a drop in Average Revenue Per Person (“ARPP”), which is a factor of user engagement – which includes frequency and duration of use – and the ability of the company to monetize user attention.

When it comes to user engagement, 80% of people who use Meta products on a monthly basis also consistently use them on a daily basis. There are no statistics available on user duration, but we suspect that both duration and monetization has been impacted by competitive pressures.

Competition

Prepared by author. Data from Statista.

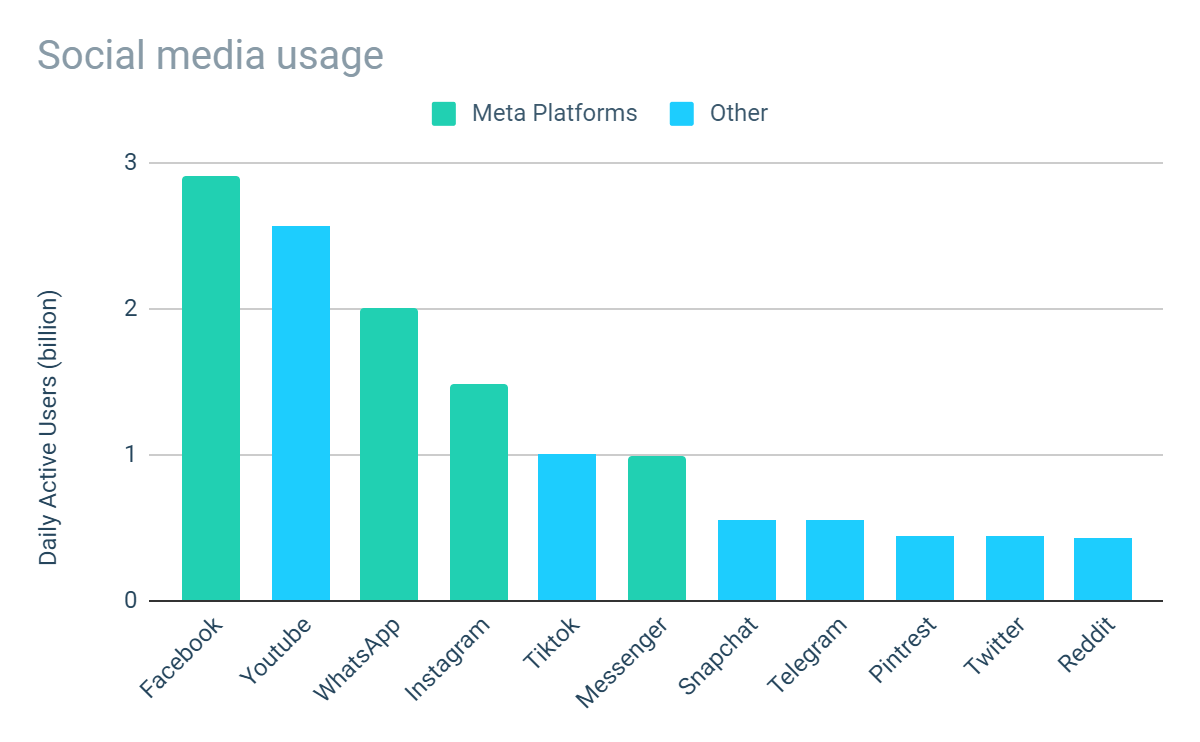

The competition for user attention on social media is intense, with TikTok being the latest major competitor for Meta users’ attention. Since TikTok was released outside of China in 2017, it remained in relative obscurity before exploding in early 2020 at the outset of the pandemic and reportedly now has around 1 billion daily active users.

In 2021, Meta introduced its short-form video feature, Reels, in response to this competition from TikTok. The company continues to prioritize user retention and engagement at the expense of revenue generation by putting more emphasis on its Reels features, which is not currently monetized to the same extent as Stories or the traditional News Feed.

TikTok is not the first competitor and it certainly won’t be the last. In recent years there were concerns that the company was losing younger users to alternatives like Snapchat. While young people are more likely to use Snapchat than Facebook or Instagram, it currently attracts only a fraction of the users that Meta does.

Despite intense competition, Meta continues to dominate the social media market with four of the top six social media platforms according to Statista. This domination means Meta can easily put pressure on new entrants through the adoption of new features, which are usually difficult to protect and easy to replicate. It has worked successfully in the past and will likely work successfully again.

The META-verse

Prepared by author. Data from company reports.

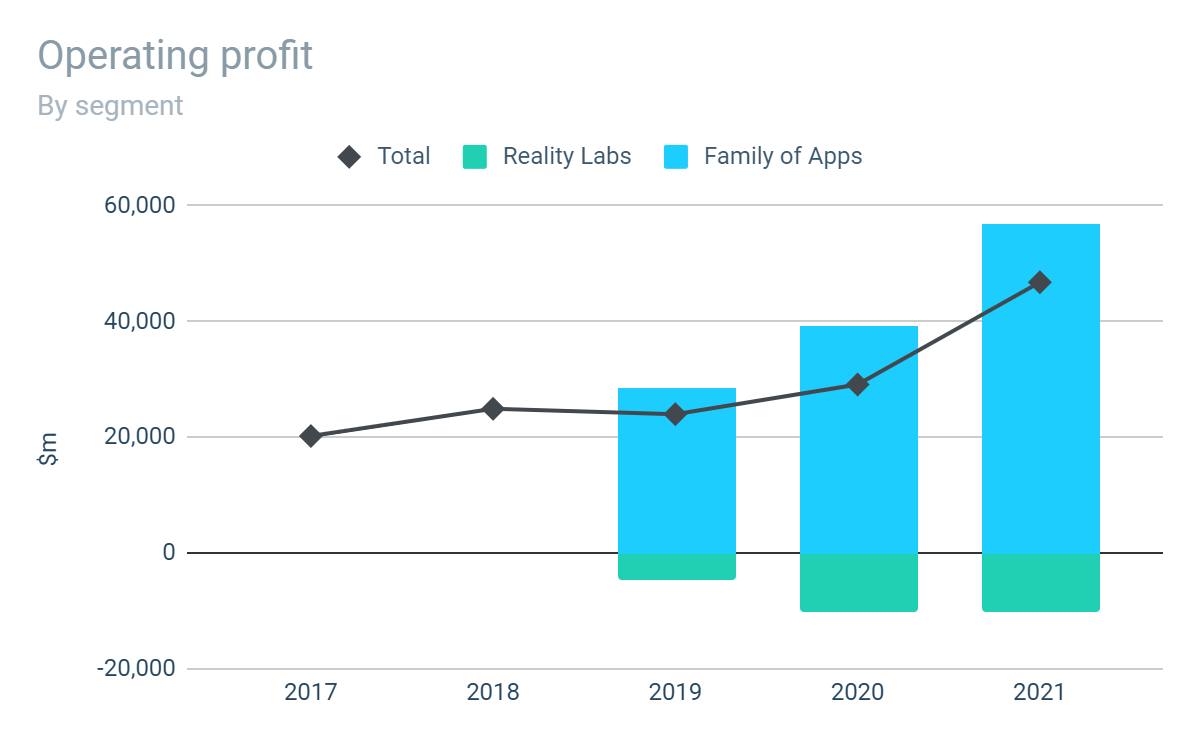

It has been widely reported that Meta is losing around $10 billion per year on its investment in the metaverse. While the headline figure appears a lot, it is also important to put this in context.

An investment of $10 billion per year is equivalent to less than 20% of the operating profits generated by the Family of Apps business. While it is accurate to describe this as a “loss”, it is also important to recognize that it is in the form of investment that has the potential to drive significant future profits.

We see the emergence of the metaverse is an inevitability. By that we mean people will interact with the digital world in increasingly immersive ways, as well as participate in an increasing number of activities in virtual spaces. While the success of Meta’s investment into its metaverse is highly uncertain, the potential upside is huge for a limited amount of downside risk.

We see the company’s investment in the metaverse as a necessity rather than a frivolous project. The long-term relevance and survival of the Meta platforms may well rely on it. It would be short-sighted to not divert a minor proportion of profits from the existing businesses into what may well be the next great transformation in technology-based human social interaction.

Aside from developing the virtual world, Reality Labs is also Meta’s serious step into consumer hardware. While Meta is less experienced than its peers, it hasn’t prevented the company’s venture into VR from being successful. The company’s most recent VR headset, the Meta Quest 2, has been well received and continues to be rated the best VR headset by CNET, despite being 2 years old and seeing a recent $100 increase in its retail price.

An expansion into hardware marks a significant change in the company’s business model, which will bring margins and returns that are significantly lower than the platform businesses. However, the profitability of the hardware itself will unlikely to be the main priority.

The first step in building a successful metaverse is to attract users, who will require compatible hardware to access it. Rather than being a profit-generator in its own right, the hardware will likely be used as a basis to capture market share and to start building the scale needed for a successful ecosystem. An additional benefit will be that Meta is less reliant on third-party hardware, reducing the likelihood that it was face issues like those caused by changes made by Apple.

Trading performance

Prepared by author. Data from company reports.

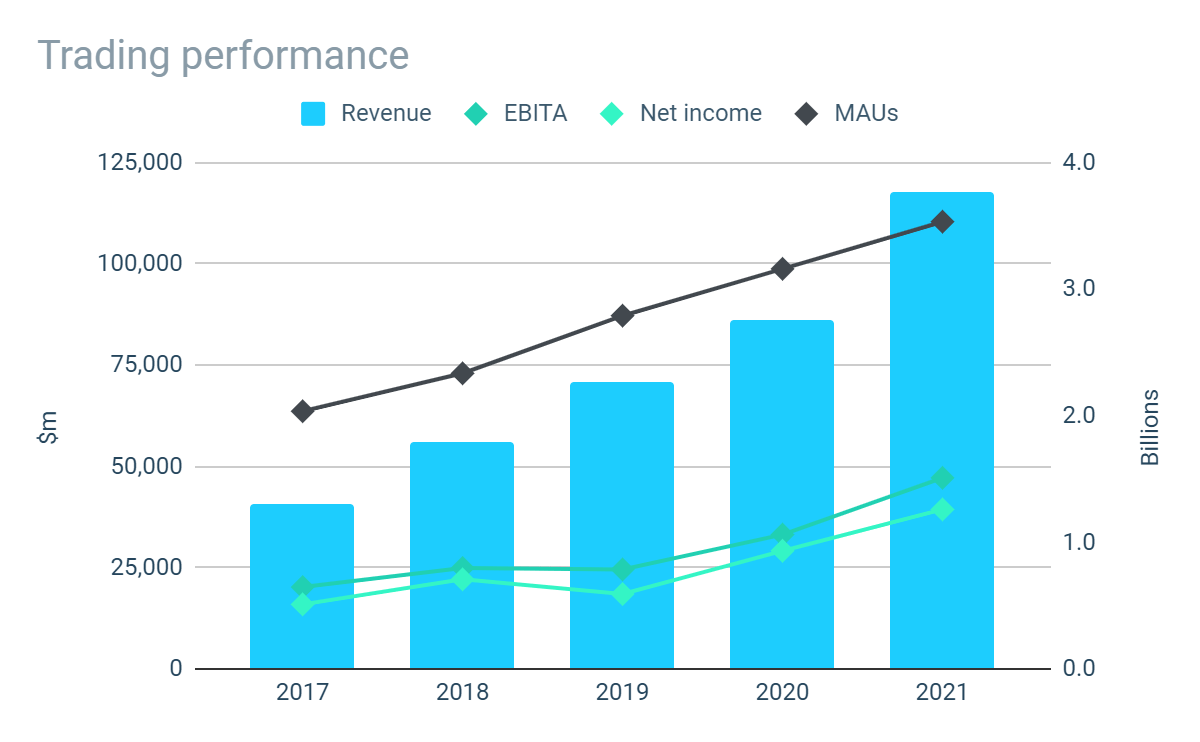

It is also important to take a step back and view the recent trends in the context of the company’s wider financial performance.

Since 2017, the company has grown its revenue at a compound annual rate of 24% – twice as fast as it has increased its user base in the same period. This was in part accelerated by the strong results achieved in FY21. After the initial uncertainty and reduced marketing spend brought on by the pandemic, ecommerce accelerated and demand for advertising pushed pricing higher.

The company has done a very good job at converting these ever-increasing revenues into ever-increasing profits. The Family of Apps businesses are hugely profitable, consistently generating an operating margin in excess of 40%. Even after spending $10 billion on its Reality Labs business in FY21, the company generated a net profit of $19 billion – equivalent to a net margin of over 20%.

After a period of such strong performance, it is not surprising to see revenues decline, especially as company prioritizes long-term factors – user engagement and its metaverse vision – over short-term earnings.

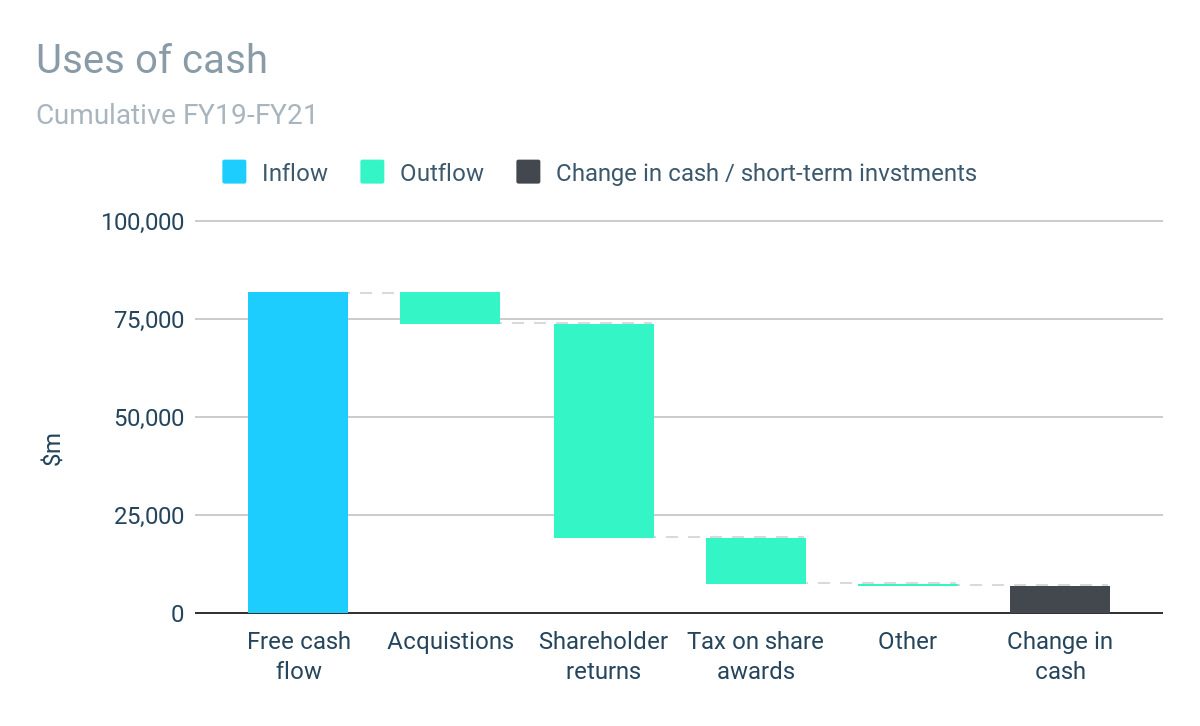

Prepared by author. Data from company reports.

The existing businesses generate significant profits but do not require a lot of capital investment to maintain, with between 90% – 100% of profits converting into free cash flow. The majority of this cash is being returned to shareholders through the company’s share repurchase program, which has no expiry date but currently has a further $24 billion authorized – equivalent to around 6% of the current shares outstanding. And this is all while maintaining a healthy cash position of almost $50 billion and no debt.

Outlook

There are a number of challenges which will likely impact the performance of Meta in the short-to-medium term. With user growth slowing and the steps being taken to address the competition likely meaning reduced monetization, there is likely to be pressure on the company’s revenues.

Add to that an increasing cost base – including additional investments in infrastructure as well the continued investment in Reality Labs – and it is a recipe for depressed earnings. And this comes at a time when the macroeconomic environment is likely to put pressure on consumer spending and corporate marketing budgets, reducing demand for the company’s advertising services.

In the medium-to-long term, the extent to which Meta can grow its earnings will depend on its ability to monetize the users of its existing platforms at an increasing rate and the success of its Reality Labs investment.

Key catalysts

With the short-term outlook generally negative and mass-adoption of the metaverse still a long way off, it is difficult for investors to find reason to get excited about Meta. However, we think there may be a number of key catalysts which could change investor sentiment as well as accelerate consumer awareness and adoption of the metaverse which are not fully anticipated by the market.

“Project Cambria”

The first is the highly anticipated release of the company’s new premium VR headset. The headset, formally known as “Project Cambria”, was announced at Meta’s Connect in October last year. While no date has been confirmed, its release is believed to be on track for some time in Q3 or Q4 this year.

Details about the headset are limited, but it is rumored that it will be called the Meta Quest Pro and will include a number of premium features compared with the current model. This is expected to include eye and facial expansion tracking, high-resolution pass-through in color for enhanced mixed-reality experiences, and a much slimmer form factor.

All of this will come with an increased price tag with the device expected to retail at $799 – almost double the price of the current model. If the latest images circulating online are accurate, then it is a sleek and impressive looking piece of kit. All of the latest information about the release can be found here.

It is not only Meta who are taking the transition to VR/AR seriously. Other key players, notably Apple, are rumored to be working on VR or AR devices. While the release of hardware by Apple and others will represent competition for Meta, the release of VR/AR products by a major consumer electronics brand should only accelerate awareness and adoption of the metaverse by mainstream consumers.

Meta Connect

The second potential catalyst is Meta’s annual Connect event.

At the event last year, the company announced its re-brand to Meta and showcased its progress and vision for the metaverse. Coupled with the release of the latest hardware, further updates and teasers on the company’s progress in the metaverse could ignite increased excitement and/or wider interest in the company’s metaverse expansion. No date for this years’ event has been confirmed, but it usually takes place in September or October so should align well with the release of Project Cambria.

We are still in the very early stages of the VR/AR technology revolution, with adoption largely confined to gamers and enthusiasts. The release of Meta’s upgraded device, as well as potential releases by major hardware players such as Apple, have the potential to be key catalysts – not only in relation to investor sentiment surrounding Meta, but also in the longer-term journey to mass adoption of the technology.

Risks

Competition

The company’s ability to attract, retain and engage users has a material impact on its financial performance. However, the company has a proven ability to adapt, retain users and successfully transition them through new features amidst pressure from competition.

Reliance on third-parties

Meta’s apps are distributed through and run on third-party software operating systems and devices. As highlighted by the changes made by Apple in iOS 14, unilateral changes by these third-parties can impact the ability of Meta to monetize their products.

Metaverse investment

The emergence of the metaverse is inevitable. However, it is in the early stage of development and it is difficult to know if Meta’s investment will be successful.

Regulation

There is a general trend of increasing regulation of data privacy which can impact the ability of Meta to monetize its platforms. Specifically, the company is facing having to withdraw its services from the EU due to a lack of a data sharing framework. Agreement in principle has been reached between the US and EU but the details have yet to be finalized.

Valuation

Meta has three major components to it: its profitable Family of Apps business; its cash reserves and marketable securities; and the loss-making Reality Labs.

As of 25 August 2022, the company’s Class A shares trade at around $163, giving a total market capitalization of $438 billion. Excluding the company’s significant cash position (including short-term investments) of $40 billion as of 30 June 2022, this implies a valuation of $398 billion for the combined operating businesses.

Our approach to valuing operating businesses centers around determining the true underlying earnings power of the business or “owner earnings.” In the case of Meta, we feel that reported net income is a reasonable proxy for owner earnings. Based on FY21 net income of $39 billion, the operating businesses are valued at around 10 times current earnings.

As Meta is composed of two operating segments with entirely opposite characteristics at this time, looking at the valuation multiple on a blended basis does not paint an accurate picture. Our preferred approach is to consider each of these separately.

Family of Apps

Looking at the Family of Apps business in isolation, we estimate that net income for this business alone in FY21 was around $48 billion. If we assume that the full $398 billion valuation of the operating businesses is fully attributable to Family of Apps, this would imply a price-to-earnings multiple of 8 times.

While Reality Labs is currently loss-making, in practice it would be reasonable to assume at least a small proportion of Meta’s market capitalization is attributable to the growth prospects of the business. In this case, the Family of Apps business is actually being valued at less than 8 times owners earnings.

As always, we do not attempt to calculate a specific intrinsic value for the Family of Apps business but consider the implied returns under various scenarios. These include the following assumptions:

| Key assumptions | Lower | Mid | Upper |

| Net earnings growth | 0% | 3% | 5% |

| Price-to-earnings multiple | 12.5 | 15.0 | 17.5 |

Our scenarios assume little-to-no growth in net income from the Family of Apps business reflecting the slowing user base growth. As a result of the reduced growth assumptions, we have also assumed that the company trades at a valuation multiple well below its historical average.

The scenarios modeled imply an annual compound return of 9% even if the company sees no growth in net income in the next decade. However, if we assume only a modest growth rate of 5% annually, which is a quarter of the annual growth achieved in the last five years, the implied annual compound return increases to 16%.

These returns exclude the impact of the company’s investment in Reality Labs. Assuming the company continues to invest 20% of the operating profits from the Family of Apps business into Reality Labs, these returns reduce but are still respectable in the range of 8% – 15% given the prudence of the growth/multiple assumptions and the massive potential upside from the metaverse investment.

Even modest improvements in the performance of Reality Labs could drive a significant increase in Meta’s valuation. Not only would reduced losses from Reality Labs improve the overall profitability of Meta, signs of possible success could also result in investors willing to pay a larger multiple as risk decreases.

Reality Labs

Given the inherent uncertainty of the Reality Labs business, any attempt to estimate its intrinsic value at this time would be spurious.

Reality Labs currently generates a loss of around $10 billion p.a., which is equivalent to 8% of the company’s total revenue in FY21. Another way to look at this is that the company would need 8% of its current user base to be active users of its metaverse in order to break-even at the current expense run-rate, assuming it achieved the same ARPP as the Family of Apps.

The Family of Apps business currently generates around $32 p.a. per user on average from advertising. If Meta was a paid-for service like Netflix, that would equate to each user paying a subscription of $2.67 per month. While everything regarding Reality Labs is highly uncertain, there are reasons to believe that there will be many more opportunities for monetization in the metaverse compared to the Family of Apps business.

For a start, the immersive 3D experience should provide for many more opportunities for Meta to sell advertising or promote products than is currently available through a 2D News Feed. The technology behind VR should also enable the company to gather more data and create insights far beyond what the current platforms allow. For example, the addition of eye-tracking features in the latest VR headset will give the company the ability to know exactly where and when users are looking. With capabilities like that, you start to get a sense of the potential power of the metaverse for Meta and marketers.

The metaverse will also bring new income streams beyond advertising which don’t currently exist in the Family of Apps business. We see many potential avenues for revenue including income from the sale of hardware, offering paid-for services through platforms such as Horizon Workrooms, and commissions from the sale of games or virtual items through online marketplaces. Like any transformational technology, there will be many more opportunities which aren’t even currently comprehended.

Given the additional revenue streams that Reality Labs will bring, it is easy to see how Meta could generate significantly more than the $2.67 in monthly revenue than it currently achieves through its traditional platforms. If that is the case, Meta would only need to attract a very small minority of its massive user base to start to make its metaverse vision a reality.

While we see the emergence of the metaverse as inevitable, the form it will take on is highly uncertain. However, if anyone can successfully transition the average consumer into the metaverse, who better than Meta with its huge financial resources, 3 billion users, leading hardware and long track record of moving its ever growing user base through evolution in its platforms.

Conclusion

Meta is a story of two extremes: a highly-profitable cash generating business, with a loss making and uncertain metaverse vision.

As value investors, we are not fans of speculative investment and like to be certain we are getting more than we paid for. In the case of Meta, we feel that the highly profitable Family of Apps business at such a low valuation multiple provides us with the margin of safety we require, while providing exposure to the Reality Labs with huge potential upside and only limited downside.

In that sense, we see it as the best of both worlds and rate it as a “Buy” at the current price.

Be the first to comment