Alistair Berg

Gravity (NASDAQ:GRVY) trades cheaply because it should. This is not a vibrant videogame company, and its strategy isn’t built for long-term growth, just for milking the 20-year-old Ragnarok IP like a cash cow. Whether it’s over or undervalued is less clear, because they have growth and profits for now, but don’t invest in this thinking it’s a representative videogaming company and should follow broader secular support for games as entertainment. Their strategy is to gather low-hanging fruit rapidly before they rot. What is next for the company is unclear. The cash pile is nice, but you can’t just create a new title, especially in a market that is so competitive nowadays. We pass.

Gravity Strategy

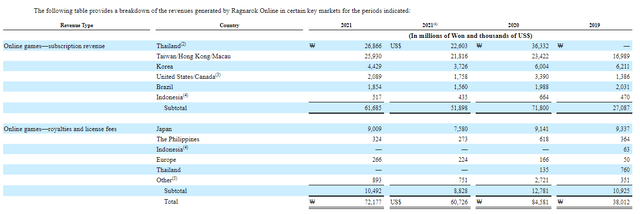

Ragnarok Online is an old MMO that a lot of people hold dear as an accessible game from their childhoods. There are plenty of fans, and they still play the PC version of the game from time to time. There’s not much wrong with this original title, except that it’s getting old. Videogames aren’t interesting forever, even World of Warcraft became stale after the 5th or 6th expansion. Ragnarok Online dominates the ‘Online Gaming’ segment, and it’s driven by nice economics from subscription revenues. People engage with the game much in the same way ageing fans go back to games like MapleStory and even RuneScape, although the Asian influences shared with MapleStory make it a closer comp to RO. They are managing to grow this game by introducing it into new geographies, specifically China. But China is not such a friendly market for gaming anymore. Thailand was a major new market that was responsible for most of the delta in online gaming revenues these last years. But it is now in decline, with the game sticking for a few years, which isn’t bad, but not forever.

Online Segment Revenues (20-F GRVY)

In general, the RO title is ageing. We look at it like a worse WoW. At some point, it will just go into an inevitable decline, especially since MMOs rely heavily on network effects. It’s a bit of a death spiral when that starts to happen over a more protracted period of time. But we don’t hate RO.

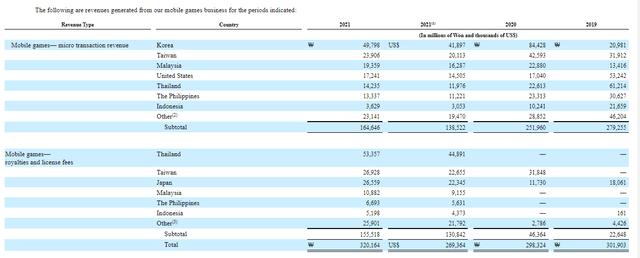

What we really don’t like is the mobile segment, which is by far the majority of the revenue. The strategy is to license out the Ragnarok IP to mobile developers who make low-quality pay-to-win ‘gacha games’ in many instances that really don’t stick. We see the shift as Gravity licenses out the IP as of late.

Mobile Segment Revenue (20-F GRVY)

The total revenues aren’t growing that fast. We think the probability that these games have rather short engagement periods as people get bored of P2W mechanics and grind-style games on mobile, which is anyway a medium that isn’t as dedicated for gaming and generally less engaging, is pretty high. While growth is being sustained by new releases under the Ragnarok IP creating licensing revenue, it’s just not very sustainable. Indeed, even in the licensing mode of making money, things aren’t blasting off, they already are trending into a plateau.

Conclusions

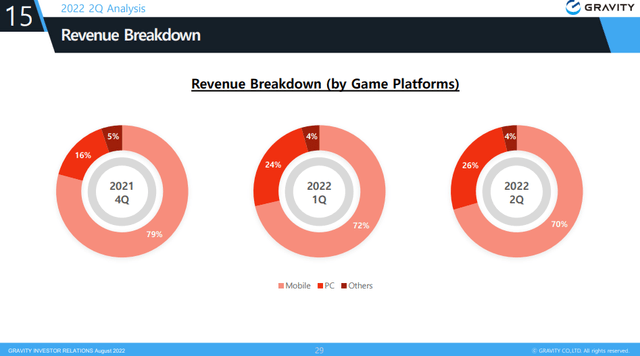

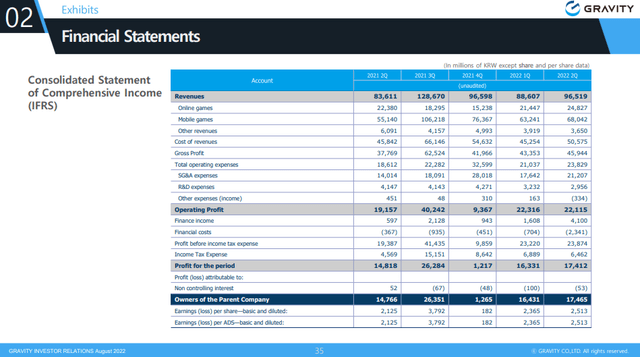

The relative resilience of the online gaming segment is evident in the Q2 results, with it growing in the mix.

Both are managing to produce QoQ growth, however.

Profits are managing to stay flat, which is good, especially with such a low multiple on the company of around 7x on an FWD PE basis. We just think that such a low multiple still makes sense when the franchise is so old, and the company has entered into the ‘milk to death’ phase with its IP. These mobile games are not on solid foundations, we are confident as people who know the gaming world well that it won’t stick long. They can keep selling the license to new launches, but it can’t go on forever, especially with the space of launching lower-quality P2W games being so competitive.

This is not some videogame company trading at an inexplicable discount, with the same profile as a company like Take-Two Interactive (TTWO) which is responsible for the periodic release of new engaging stories like the GTA installments, or Red Dead Redemption. The online gaming segment undergirded by Ragnarok Online is much more solid because a lot of people remember this game well and still like it, and can serve as a foundation for earnings, but it is also going to go in steady decline, showing signs already in its longer-standing geographies. The low multiple reflects the pretty unexciting product profile of the company.

Be the first to comment