Brandon Bell

Perhaps more than any other O&G company, Occidental Petroleum (NYSE:OXY) shareholders have greatly benefited from Russia’s invasion of Ukraine and the resulting increase in the prices of oil and gas. I say that because, as most of you know, OXY CEO Vicki Hollub took on nearly $40 billion in debt – including the infamous $10 billion loan from Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) in the form of 8% preferred stock and warrants – in order to snatch shale operator Anadarko Petroleum away from Chevron (CVX) back in 2019. The Anadarko deal included paying a $1 billion break-up fee to Chevron.

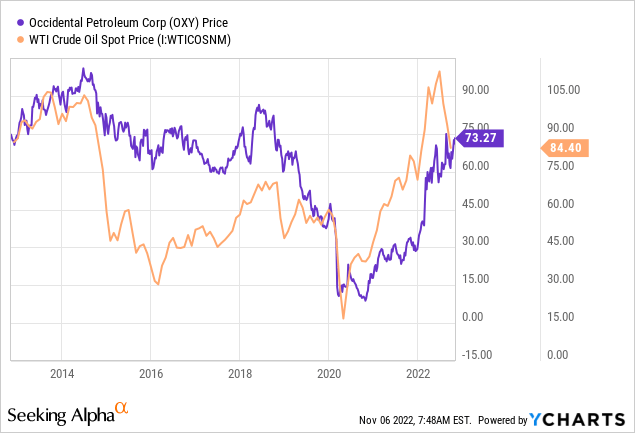

OXY’s large debt load, combined with oil demand destruction and plummeting O&G prices as a result of the global pandemic, pushed the stock down to under $9/share in October of 2020 (see graphic below). There was even talk of potential bankruptcy. But boy, what a difference a couple years can make. This year, OXY has ridden the wave of higher and war-impacted O&G prices to be among the hottest stocks (sometimes the hottest stock) in the entire S&P 500. Today, I’ll take a look at the progress OXY has made this year to repair its balance sheet, preview Q3 results (due out Wednesday), and take a look at what to expect going forward.

Background

Occidental Petroleum used to be what was generally considered to be kind of a middling oil and gas producer with a nice chemicals business on the side that threw off solid income for its shareholders. Indeed, as recent as March 2020, OXY paid a quarterly dividend of $0.79/share. That was good enough for a 7.5% yield when the stock was cut in half after the ~$55 billion deal to buy Anadarko closed in August of 2019. Then the pandemic hit in the spring of 2020 and the stock plummeted along with the price of oil and gas. The quarterly dividend was cut for the first time in decades (to one penny). There was even talk of potential bankruptcy as interest on long-term debt ballooned to over $1.4 billion in 2020 and $1.6 billion in 2021. CEO Vicki Hollub was on the hot-seat (to put it mildly …) as the company muddled through the challenges of the next two-years.

Then Russia decided to invade Ukraine in late February of this year, oil and gas prices jumped higher, and suddenly there was a clear line-of-sight into a much brighter future for OXY and its shareholders. And the company has certainly not wasted the opportunity to significantly accelerate repairing its balance sheet and “right the ship.”

In Q2, OXY generated net-income of $3.6 billion, or $3.47/share. Chemicals segment OxyChem generated a record $800 million in quarterly pre-tax earnings and that contributed to record quarterly free cash flow of $4.2 billion. During Q2, OXY paid down another $4.8 billion in debt ($8.1 billion YTD) and in totality has cut its long-term debt load to $21.7 billion, down by ~50% since a high of nearly $40 billion.

While OXY was paying down its debt-load, other O&G companies have been funneling their massive free cash flow generation directly to shareholders in the form of dividends and buybacks. However, OXY has arguably turned the corner in that regard as well. In February, OXY increased the quarterly dividend to $0.13/share. During Q2, the company initiated a $3 billion share repurchase program and through August 1st had repurchased 18 million shares for $1.1 billion. That equates to an estimated $61.11/share. The stock closed Friday at $73.27.

Q3 Preview

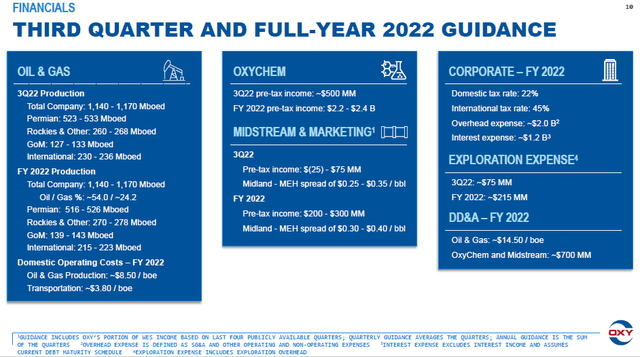

OXY gave Q3 guidance during its Q2 Presentation:

OXY

On the Q2 conference call, OXY CFO Robert Peterson commented on full-year production expectations:

We expect production in the second half of 2022 to average approximately 1.2 million BOE per day, which is notably higher than the first half of the year. Higher production in the second half of the year has always been an expected outcome of our 2022 plan, in part due to ramp-up activities and scheduled turnarounds in the first quarter.

That being the case, the mid-point of Q3 guidance (1.15 million boe/d) would be ~3,000 boe/d higher than Q2’s 1.147 boe/d. However, the bigger factor in Q3 will likely be lower realized pricing. I say that because peer ConocoPhillips (COP) – which, like OXY, also is a big shale producer with Brent-based global production – announced its average realized price in Q3 was $83.07/boe. While that was 46% higher than the $56.92/boe COP realized in Q3 of last year, it was down $5.50/boe sequentially from the $88.57/boe realized in Q2 (see ConocoPhillips Drilled A Gusher In Q3).

In addition, and despite raising full-year OxyChem pre-tax income guidance to a midpoint of $2.3 billion, note that expected Q3 pre-tax income for OxyChem is expected to be ~$300 million lower as compared to Q2.

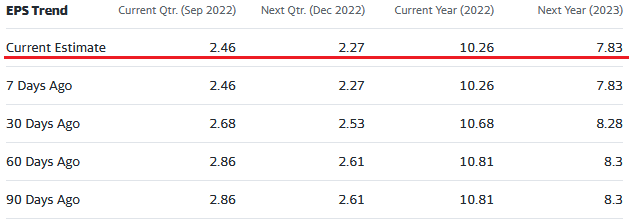

Add it all up and Q3 consensus earnings estimates have been trending lower over the past 90 days, will be significantly below Q2, and have settled at $2.46/share:

Yahoo Finance

That would be 29% lower than Q2, but obviously a substantial improvement over the loss of $0.10/share in Q2 of last year.

As for Q4, note that during the first half of the year, OxyChem generated $1.57 billion in pre-tax income. Considering Q3 guidance is around $500 million, that implies that Q4 will be “light” (~$250 million). However, so far in Q4 oil prices have started to climb heading into winter, and since oil production for OXY is weighted to Q4 this year, prospects for a strong Q4 are still good and I would expect EPS estimates to rise if the current price of Brent and WTI stay anywhere near where they currently are ($98.57/bbl & $92.61/bbl, respectively) through the end of the year.

Going Forward

As you might expect, OXY will likely continue to focus capex on the Permian Basin: For full-year 2022, the mid-point of Permian capex guidance ($1.8 billion) equated to ~44% of OXY’s total capital plan. That’s more than the Rockies, GoM, International, and OxyChem combined. However, note that Permian production in Q2 was 493,000 boe/d – down from 504,000 boe/d in Q2 of last year (-2.2%). Clearly, OXY is resisting the temptation (and political pressure …) to increase production in order to combat inflation and Americans’ pain at the pump.

Perhaps more interesting is OXY’s adoption of a “Zero-In” logo with the goal of achieving net-zero carbon emissions by 2050. OXY already is the established leader in enhanced oil recovery (“EOR”) by injecting CO2 into wells in order to recover additional volumes of oil & gas. Indeed, EOR production was 130,000+ boe/d in 2020.

A recent article in MarketWatch quoted CEO Hollub:

We have it documented that it takes more CO2 injected into the reservoir than what the incremental barrels from that CO2 that are produced will emit when they’re used.

The recent “IRA” legislation pushed through Congress by the Biden administration (I call it the “Clean Energy Act” …) puts financial incentives behind CO2 sequestration. For example: Occidental can get $60/ton in tax credits if CO2 is stored in the ground during the EOR process, or $85/ton if the company just buries it in the ground.

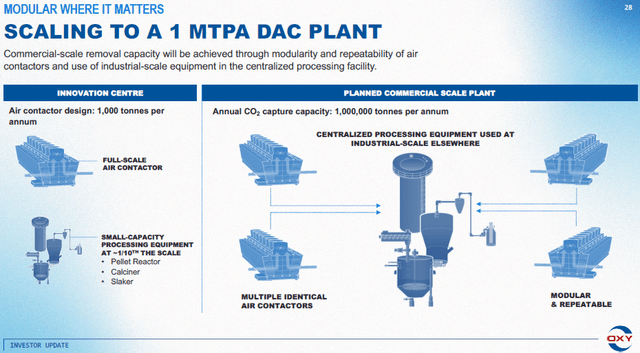

There are even higher incentives if companies obtain CO2 using an experimental technology called direct-air-capture, or “DAC.” DAC is basically sucking CO2 directly out of the atmosphere. OXY is spending ~$1 billion to build the world’s largest DAC facility in Texas. Hollub plans to build as many as 70 1-MTPA (mega ton per-annum) direct-air-capture facilities by 2035. The plan focuses on designing a modular and repeatable 1 MTPA DAC plant (see graphic below), as explained in OXY’s Low Carbon Ventures Presentation given back in March. This is a very detailed presentation and I encourage all energy investors to give it a read, as well as the companion transcript from the presentation.

OXY

Some environmentalists don’t share optimism about the plan because the obvious problem is that Americans will now effectively be paying for OXY (and potentially other O&G producers as well) to go after more oil and gas production via EOR. While those “net-zero” barrels might be better in climate terms relative than a traditionally produced barrel, it still encourages more oil production. Only time will tell how this will all pan out and what the true “all-in” costs of the plan will be.

Regardless, CEO Hollub clearly believes EOR is a big part of OXY’s future. The MarketWatch article previously referenced said Hollub thinks that the last barrel of oil should come from EOR and that:

I think there could be a world where we do stop drilling new wells. To increase recovery from the remaining conventional reservoirs is something that’s kind of like a best kept secret for the United States. Nobody very much realizes that, but that is there. And that gives us that longevity beyond what some people are forecasting.

Risks

Being a commodity price taker in the O&G and chemicals markets, OXY would obviously be negatively affected by a global economic slowdown and potential recession. In addition, the company needs to continue to make progress on reducing gross debt to the “high teens.” Share buybacks at market-cycle highs could also be destructive of shareholder capital.

EOR is a relatively high-cost means of production. DAC could make it even more so.

Valuation

Consensus FY2023 estimates for OXY are for EPS of $7.83 (see graphic above). At Friday’s close of $73.27, that means the stock is trading with a forward P/E of 9.4x. That happens to be less higher than the forward P/E of 8.0x for Exxon Mobil (XOM) and the same forward P/E as COP, a more similar comparison. That despite the fact that COP already has several notable advantages as compared to OXY: A stronger and investment grade balance sheet; a payout of $4.49/share in dividends this year versus only an estimated $0.52/share for OXY; COP has spent $6.58 billion YTD on share buybacks (as compared to $1.1 billion for OXY); COP averages ~600,000 boe more of average daily production; and COP generated a $1.7 billion more FCF in Q2 as compared to OXY ($5.9 billion versus $4.2 billion). The point is, while OXY has made significant progress in reducing its large debt-load, the company is still playing catch-up to its peers in terms of dividends and stock buybacks.

Summary And Conclusions

OXY has made the best out of the global impact of Russia’s invasion of Ukraine and the resulting windfall of higher global oil and gas prices. As of the end of Q2, the company has paid down $8.1 billion in debt this year. It also turned the corner of having to funnel nearly all free cash flow toward debt repayment and is now able to be much more shareholder friendly in terms of increased dividends and share buybacks. That said, as noted by the “Valuation” segment above, much of OXY’s progress appears already built into the price of the shares.

However, with no end in sight with the war in Ukraine, with shale O&G producers still exhibiting relative production discipline, and with OPEC+ apparently defending a Brent price in the $85-$90/bbl range, the outlook for OXY is still good. That being the case, I rate OXY a HOLD.

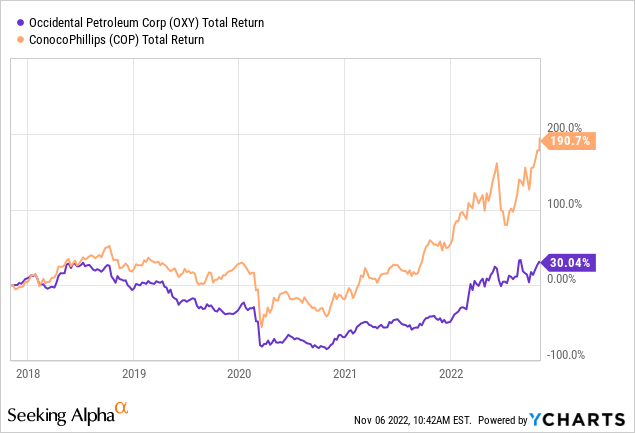

I’ll end with a five-year total returns chart of OXY versus ConocoPhillips and note that despite the big bull-run in the stock this year, COP has been the superior investment over time:

Be the first to comment