Thanakorn Lappattaranan/iStock via Getty Images

I have not written a story on Hamilton Beach Brands (NYSE:HBB) since March 2021, when Class A shares were trading hands at $18. The buy thesis was based on a specific price breakout pattern idea. Luckily, it rose 30% over the next several months, and I captured a quick gain. Really, I have not had an overwhelming feeling to buy this company again, until last week.

Share fluctuations since 2021 have been kind of a bad news, good news situation. The bad news for long-term holders is the stock quote gradually slid all the way to $9 in May, followed by a bull drift back to $12 in early November. The good news list includes (1) business operating results have improved markedly over the last 18 months, (2) the 2023 outlook is better than most companies, and (3) Hamilton’s current valuation is well worth the price of admission.

Considering the technical picture has improved rapidly since the summer, and price appears to be breaking out again out of a clear downtrend pattern, I plan to repurchase a position ASAP. My thinking is stronger-than-expected growth in 2023 could propel the quote closer to $20 per share 9-12 months from now, which would work out to a 70%+ annualized total return.

The Business

Hamilton Beach is a leading household small appliance maker, focused on kitchen gadgets. The business model is goods are manufactured overseas (mostly in China, with 78 suppliers in 2021) and shipped to North American consumers. Walmart (WMT) and Amazon (AMZN) accounted for 50% of 2021 sales.

Hamilton Beach Website Hamilton Beach Website

The latest quarterly earnings release for the September period contained a number of important updates from the company, including its plan to lower inventories, reduce debt and increase cash levels during the Christmas sales season. Perhaps more importantly, the company is launching new products geared toward a healthcare/medical slant for your family’s safety and well-being. Combining the Hamilton Beach brand name with outside trusted brand partners could lead to faster growth in 2023. Taken from the press link:

During the past year, the Company took many steps to introduce new products in the air purification, water filtration and home medical categories. New products in these categories are expected to generate revenue as they are launched in 2022 and into 2023 and gain momentum. To date, the Company has:

Introduced the first products in a new line of premium air purifiers under the Clorox® brand name as part of an exclusive multiyear trademark licensing agreement with The Clorox Company. The Company is pleased with consumer acceptance of these new products.

Launched the Smart Sharps Bin® from Hamilton Beach Health® powered by HealthBeacon® for at-home injection care management in the U.S. home medical market under an exclusive multiyear agreement with HealthBeacon plc. In the third quarter of 2022, the system became Medicare and Medicaid eligible, in addition to being FSA and HSA eligible, which is expected to drive increased adoption.

Entered into an exclusive multiyear trademark licensing agreement with Brita® and plans to launch a new line of countertop water appliances in early 2023.

Other notable operating achievements include terminating its main U.S.-defined pension plan, and settling/funding related transfers on its books soon, with a positive overfunding of $12 million. Also, a $10 million insurance claim check was received in early 2022 for changes with its Mexican assets. If the company can reduce the $60 million jump in 2022 inventories built because of supply-chain worries (a goal into April, according to the earnings call transcript), plenty of new cash is about to show up in Hamilton bank accounts.

I also like the idea of the company changing its retail/wholesale business in China and Brazil to a licensing model, effective at the end of last year. During Q3, the amount attributable to this change was $1.9 million, and for the first nine months, it was $5.9 million. For me, a royalty design, where other companies manufacture and help market the items, should increase margins and overall profitability for Hamilton, particularly if the partners are well-funded and aggressive. A final bullish operating highlight to contemplate is online sales now account for 35% of revenue. Keeping sales in-house vs. outsourced through physical store retail channels should support margins and overall income.

Crazy Cheap Valuation

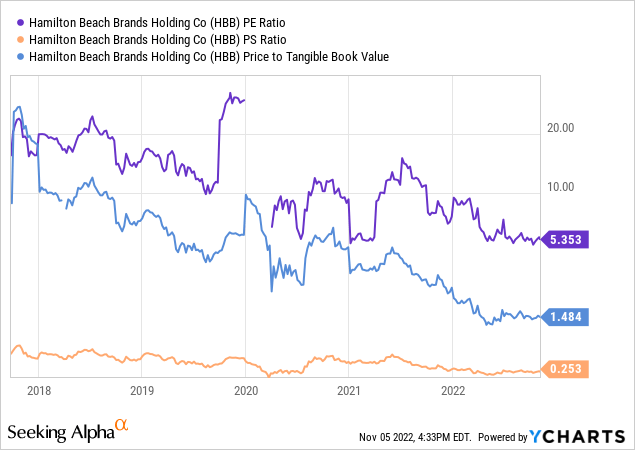

As I write this summary, Hamilton Beach is trading near its lowest valuation since going public in 2017 through a spin-off from NACCO Industries (NC). Below is a graph of basic fundamental ratio fluctuations on trailing operating results. Price to earnings, sales, and tangible book value are now trading at less than half of their 6-year averages (the full public history for this company), and are just above May’s extreme low level.

YCharts – Hamilton Beach, Price to Trailing Earnings, Sales, Tangible Book Value, Since 2017

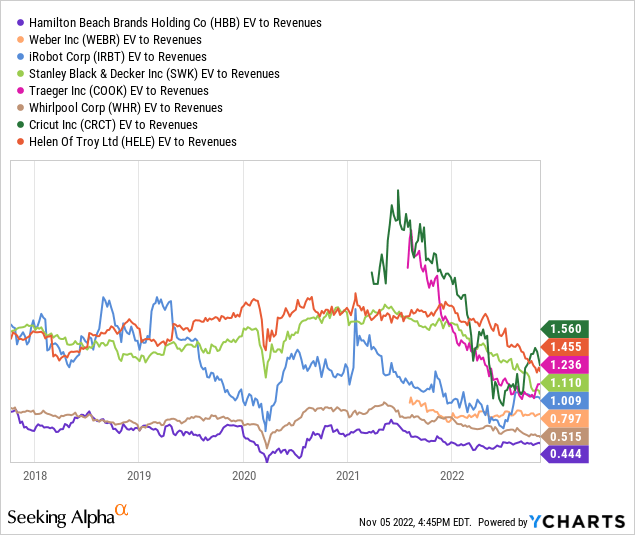

Versus competitors and peers in the home appliance space, the enterprise value (equity + debt – cash) to revenue ratio has usually traded at a large discount to others. Today’s 0.44x multiple is a 50% discount to the peer median average, and 30% discount to its 6-year history. This ratio highlights a solid foundation for price share gains in 2023, especially if sales climb faster. The peer group includes Weber (WEBR), iRobot (IRBT), Stanley Black & Decker (SWK), Traeger (COOK), Whirlpool (WHR), Cricut (CRCT), and Helen of Troy (HELE).

YCharts – Household Appliance Firms, EV to Trailing Revenues, Since 2017

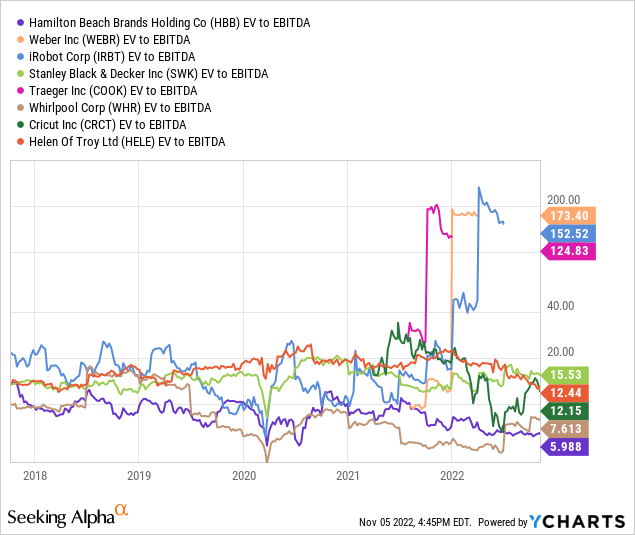

In addition, EV to EBITDA at 6x is the cheapest in the group, trading at less than HALF the median average.

YCharts – Household Appliance Firms, EV to Trailing EBITDA, Since 2017

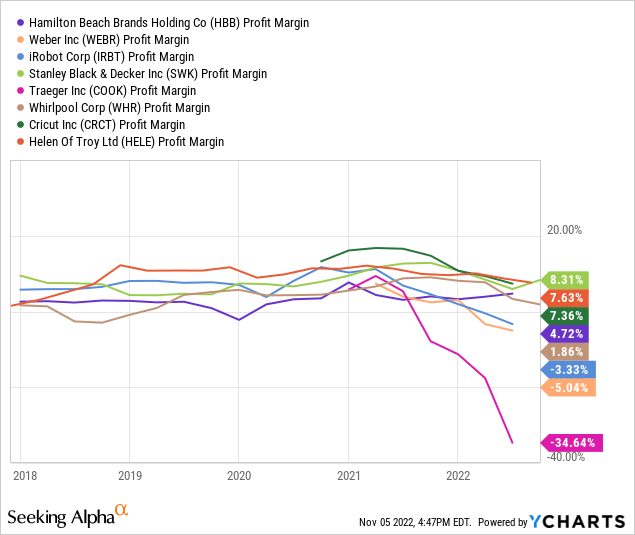

The company continues to make terrific strides with profit margins. The latest 4.7% net income rate on sales is near the median average, while the last few years have witnessed double the profit rate before the pandemic showed up. From company guidance, management expects margins will be strong yet again in 2023.

YCharts – Household Appliance Firms, Trailing Net Income Margin, Since 2017

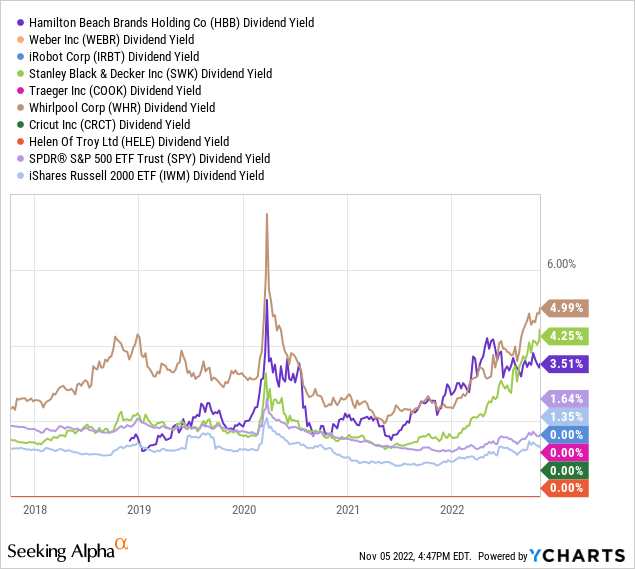

Management seems to be quite confident cash flows and earnings are on the right track. A cash return of capital through a $0.42 annually now works out to a nice 3.5% dividend yield, nearly the top reading for the peer group. Against the S&P 500’s trailing yield of 1.7% or small-cap Russell 2000’s 1.4% level, income investors might be interested in further research into the stock.

YCharts – Household Appliance Firms, Trailing Dividend Yield, Since 2017

Basing Pattern Ready To Break Out Again?

Again, the trigger or catalyst for my buy interest revolves around a momentum picture that looks ready to support a meaningful price surge. The below 15-month chart (adjusted for dividends) shows a bunch of overhead resistance converging in the $11.50 to $12.00 zone in early November. A green trendline drawn from November’s price high, the 200-day moving average, and the 50-day MA creation are all sitting around Friday’s closing quote.

The low 14-day Average Directional Index, which highlights a balanced share supply/demand and volatility setup, has often appeared at short-term bottoms in price (circled in blue). More positives included a super-strong Accumulation/Distribution Line and On Balance Volume reading. All told, if the price can get above $12 in the coming days, a sharp and prolonged price advance could be starting.

StockCharts.com – Hamilton Beach, Daily Changes with Author Reference Points, Since August 2021

Final Thoughts

Insiders and management control 33% of stock ownership (including Class B shares with 10 votes vs. 1 for Class A). Their interests are clearly aligned with retail investors, where the goal is to entertain accretive and conservative decisions to increase shareholder worth.

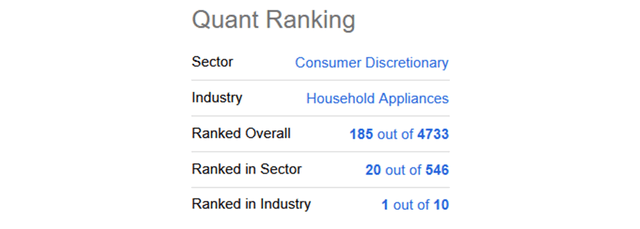

Seeking Alpha’s Quant computer-sorting system ranks Hamilton Beach as a top 4% choice today out of 4,733 stock alternatives.

Seeking Alpha – Hamilton Beach Quant Rank, November 6th, 2022

What are the risks? First, Hamilton Beach is a small company with $160 million in equity market cap and $300 million in enterprise value. Consequently, this investment holds greater risk than a blue-chip stock, from weaker diversification in product lines, sales channels, manufacturing sources, and consumer appetites.

For example, problems with the Chinese supply chain from COVID-19 shutdowns and/or the adoption of future trade restrictions/tariffs are real issues to watch. A weakening U.S. economy could cause pricing power and final demand to slip, dragging down profitability. Plus, today’s strong consumer ratings and market share in kitchen appliances are not guaranteed to continue forever if product quality turns sour.

The flip side of Hamilton, risk is potentially bigger rewards are possible, given its new healthcare products are adopted and demanded by consumers in 2023. For me, the whole investment equation, including fundamental metrics and technical trading action, points to a bullish future. While not guaranteed, I am willing to risk some of my capital in HBB shares.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment