photoman/E+ via Getty Images

Meta’s (NASDAQ:META) stock have experienced a 50% decline YTD and is now the fifth largest holding under the $52 billion iShares Russell 1000 Value ETF (IWD) at roughly 1.7% of net asset value. Today, shares of Meta trades at just 12.6x forward P/E, a discount against 14.1x of IWD and 15.9x of the S&P 500. While it’s tempting to see Meta as a value stock that could theoretically correct to the upside when the broader market recovers, I believe this may not be the case given Meta is no longer the business it once was.

It’s no longer about advertising

There’s no question that Meta is a dominant social media platform with 3.6 billion users that spend time on either Facebook, Messenger, Instagram and WhatsApp on a monthly basis. This enormous network effect has given Meta a massive competitive advantage and enviable margins that smaller competitors such as Snap (SNAP) and Pinterest (PINS) can only dream of. Though revenue from Family of Apps (FoA), which consists primarily of advertising, is expected to slow down materially to $124 billion (+7% YoY) in 2022, Meta will likely deliver a FoA operating margin of roughly 44% and EBIT of $54 billion, a figure larger than the market cap of Snap and Pinterest combined.

The problem, however, is that investors are increasingly looking beyond Meta’s core advertising business as it faces numerous issues from slowing growth to Tik Tok to more than $10 billion in lost revenue from Apple’s (AAPL) privacy updates that prevent apps from tracking various user activities on all iOS devices. Already, Google’s (GOOG) Android, which has a 70% market share worldwide, is looking to follow Apple’s path with its Privacy Sandbox, though maintaining a friendly tone that things will remain largely the same in the next two years (likely due to antitrust concerns).

Why is Zuckerberg trying to take Facebook into the metaverse?

With a mature user base and a challenging privacy landscape, Meta understands it can no longer rely on just digital advertising as it cannot collect user data the way it used to (Snap has indicated some of the lost signals will never be recovered). Meta doesn’t exactly own any popular hardware (eg. iPhone), nor does it own any operating system such as iOS and Android. In other words, not owning an ecosystem like Apple and Google is a highly concerning issue for Mark Zuckerberg, as Facebook will ultimately just be one of the many thousands of apps on an iOS device, subject to what Apple may or may not do in the future.

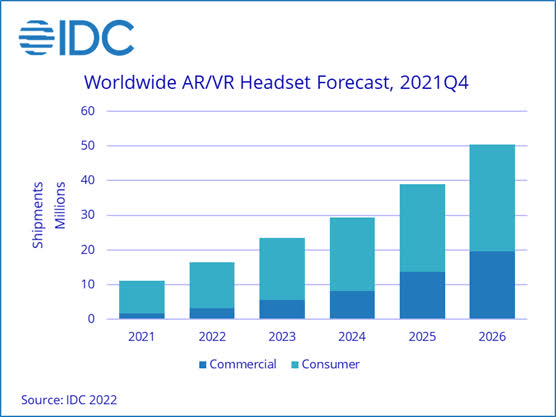

This is why Meta is desperately trying to get into the metaverse, which through its Oculus VR headsets will allow Meta to have more control over user data by functioning as a gatekeeper between users and content creators. Since most consumer electronics are already saturated with fierce competitors like iOS and Android in smartphones, Microsoft in PCs and game consoles, and Roku in smart TV’s, it makes sense for Meta to establish a leading position in something that is still in an early phase: AR/VR headsets. Per IDC, shipments of AR/VR headsets grew 92% in 2021 and is expected to grow 47% in 2022 to reach 16.5 million. By 2026, that number is estimated to reach 50 million (see below).

IDC

In 2021, Meta’s Oculus Quest 2 was the best-selling product with a 78% share in the AR/VR market. The second player, DPVR, had only 5.1% share. While Meta is clearly the leader in the space, its success came with a massive cost as the company deliberately sells the Oculus headsets at a loss. In 2021, Meta’s Reality Labs (RL) division had revenue of $2.27 billion (+100% YoY), but an operating loss of over $10 billion. In 2022, RL is expected to lose almost $15 billion against $54 billion in operating income from FoA, taking 13 percentage points out of FoA’s estimated 44% EBIT margin. On the bottom line, consensus 2022 EPS points to a 15% YoY decline to $11.7.

How cheap is too cheap?

Meta traded at 14x forward earnings not too long ago when investors believed the stock to be cheap by any textbook measures. In today’s environment, however, such a low multiple can no longer hide the fact Meta’s earnings outlook remains highly concerning as the company burns through billions of cash in building a long-duration asset like the metaverse. In addition, Apple’s mixed-reality headset (could launch in January 2023) certainly did more harm than good from a sentiment perspective. If Apple can quickly deploy the new device by leveraging the App Store, which is already available to 1.8 billion iOS devices worldwide, what incentives do creators have to sell their content on Horizon Worlds when Meta is looking to charge a 47.5% platform fee vs. App Store’s 30%?

In the end, I see an increasingly unfavorable outlook for Meta given the core advertising business has likely reached pull penetration and the metaverse venture will continue to consume significant corporate resources without demonstrating a viable path to profitability. While Meta’s shares certainly score well on valuation at under 13x forward earnings, cheap can always get cheaper, and buying the stock based on valuation is an expensive sport.

Be the first to comment