BalkansCat/iStock Editorial via Getty Images

Investment Thesis

After a lost decade for oil companies, we believe there is upside in Suncor (NYSE:SU) once again. The industry underinvested in exploration, and the government increased the money supply significantly, causing a surge in oil prices. While oil is always volatile, Suncor’s 4% dividend appears safe for long-term investors. We estimate a return of 11% per annum over the decade ahead.

The Oil Sands

Suncor operates in the oil sands of Canada, the world’s largest crude oil deposit. Western Canadian Select oil sells at a discount in the market as it is more difficult to refine, but that doesn’t stop Suncor from making a profit. Suncor has impressively reduced its break-even price to $35 per barrel WTI. The company also sits on impressive proven oil reserves, in fact, Suncor could be the “last man standing” in a world that’s running out of oil. The oil sands reserve has an estimated lifespan of 28 years, far more than Suncor’s European and U.S. peers:

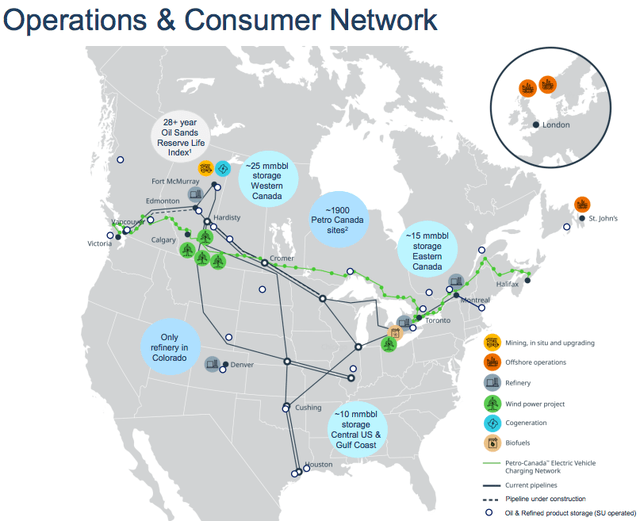

Suncor’s Operations (Suncor Energy)

The Long-Term View

Suncor was a poorly managed company over the past decade. The company struggled through a period of low to moderate oil prices. Using 10-year average earnings, Suncor’s cyclically adjusted PE (CAPE ratio) is 26. If nothing else, this points to weakness in the company’s downstream business. We believe its Canadian competitor, Imperial Oil (IMO), has a much better downstream business and integrated model. With oil prices above $100 per barrel, Suncor sits on record earnings.

The future does not have to mirror the past. Suncor got a new CEO in 2019 and has since made a slight reduction to its break-even oil price while keeping its long-term debt manageable. Suncor benefits in an environment of high oil prices.

Shareholder returns will depend largely on the price of oil, so let’s see what’s in store. The Balance expects Brent Crude prices of $66 per barrel in 2025, $89 in 2030, and $132 in 2040. This indicates we may be at a near-term peak in the price of the commodity. With electric vehicles taking to the road, oil demand will eventually peak; estimates range from 2025-2035.

Suncor’s Future Growth

In the year ahead, Suncor is planning to pay out around $2.1 billion in dividends. This is well covered by its current free cash flow of over $6 billion. We believe the company will have ample cash flow to buy back 2-3% of its shares outstanding per annum.

For our projection, we’re using a 2032 Brent Crude price of $96/barrel, which gives Suncor some organic growth from here. Combined with the buybacks, we estimate Suncor can grow its earnings per share at 5.5% per annum.

Valuation

Our 2032 price target for Suncor is $70 per share, indicating a return of 11% per annum with dividends reinvested.

- 5.5% per annum growth results in 2032 earnings of $5.82 per share. We’ve applied a terminal multiple of 12. By 2032, the industry should be in secular decline. However, Suncor will still have ample oil reserves and will benefit from selling a scarce resource. Suncor is also investing in power, hydrogen, and renewable fuels to position itself for the future.

Risks

The risks for Suncor lie with management. For this thesis to play out, management will have to improve Suncor’s working capital and continue to pay down debt. This will help the company navigate periods of low oil prices (Suncor had negative free cash flow in 2020). Management will also need to repurchase shares aggressively when the stock trades at a modest valuation.

Of course, the price of oil is always a risk, but we believe the estimates provided by The Balance are conservative. Suncor should work to improve its refining business, to further shield itself against downturns.

Conclusion

Suncor faces an industry that will eventually hit peak demand, but it is well-positioned to be the “last man standing,” with 28 years of oil sands reserves. The company reduced its break-even price to $35 per barrel, but it will need to improve the efficiency of its downstream business. It will be a volatile ride, but we believe Suncor’s cash flow machine can return 11% per annum in the decade ahead. This projection is with a conservative oil price forecast and presents favourable risk/reward. Investors will need to watch how management is handling the balance and share buybacks. With that said, we have a “buy” rating on the shares.

Be the first to comment