DNY59/iStock via Getty Images

Introduction

The phrase “May you live in interesting times” has long been attributed to an old Chinese proverb or possibly a curse depending on whether you view an interesting life as enriching or as hectic and chaotic. While current historical research suggests there is no Chinese connection to the phrase, I’m of the opinion that we do indeed live in interesting financial times that have the potential to be highly enriching.

Share prices of many preferred stocks and unit prices of baby bonds have been hammered of late. This is particularly true for mortgage REITs, BDCs, and some of the insurance firms. Many of the fixed income securities I’m following and accumulating are subject to near-term fixed to floating (FTF) rate conversions or rate resets. I believe this particular class of fixed income securities provides a tremendous opportunity to enrich those willing to do the necessary due diligence and invest.

What Is Driving This Opportunity?

The US Federal Reserve has doubled down with the hawkish language on deflating our current bout of inflation by reminding everyone listening that the overnight rates will likely need to rise further and be held high longer. New US T-Bill auctions of late have not gone well with lackluster demand putting further upward pressure on longer-term rates. In my opinion, this is most likely due to the additional securities the Federal Reserve is rolling off their balance sheet. In the US, where buyers are highly dependent on mortgage loans, the resale market is taking a dive. Home resales have been declining faster over the last two months than was the case during the 2008/2009 recession. Across the pond, the UK financial system has become stressed causing the interest rate on UK gilts (government bonds) to rise faster than planned necessitating intervention to stabilize the UK gilt prices.

There are few economic or financial islands of note in the world today so what happens in the US impacts global financial systems and vice versa. We are beginning to see the rapid rise in interest rates causing stress in our global financial systems. While nothing yet has broken, if the Federal Reserve continues to tighten at its current torrid pace, something will break. I expect we will see one more 50 to 75 basis point increase on November 2, followed by a couple of 25 basis point increases in 2023. That would put the overnight rates in the range of 4% – 4.5% mid-2023.

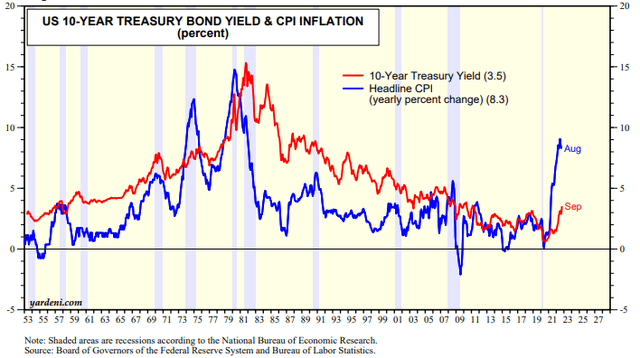

Once it is clear the rate of inflation is trending lower and the Federal Reserve is done with its monetary tightening cycle, I fully expect fixed income yields to begin to moderate and prices begin to rise. The historical chart below shows in a snapshot what I expect to see sometime in 2024.

Federal Reserve Board of Governors

The chart above illustrates a few very interesting points.

- While our current rate of inflation is the highest we have seen since the early 80s, it is nowhere near as bad now as it was then.

- The sloping red line (10-year T-bill rate) illustrates the ~40-year bull market in bonds.

- The inflation rate and bond yields are well correlated.

- Bond yields will drop (prices will rise) shortly after the rate of inflation turns over.

It is probably obvious without stating it, but I am focused on longer-term investments. My definition of short term is within a couple of years (versus months). I’m very focused on getting my portfolio positioned to capitalize on the downslope of that red line when our current bout of inflation turns over. The slope won’t be as long or quite as steep as it was in the early 80s in my opinion, but it will likely be significant and that is where the most money will be made in fixed income investments.

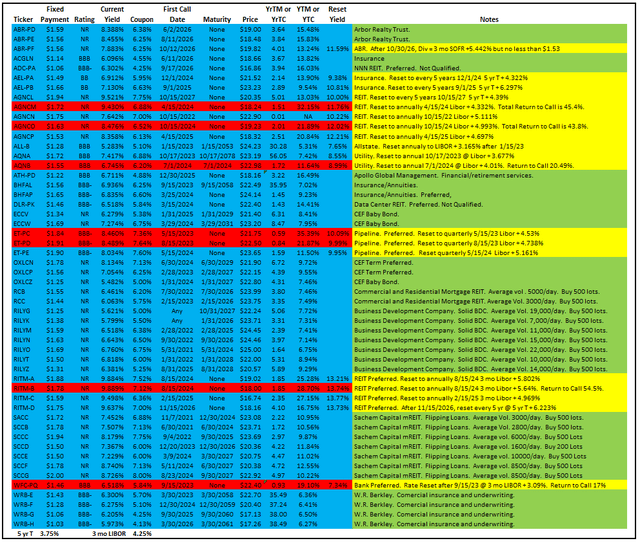

Fixed Income Opportunities

Since my last article on building a bond ladder (more correctly a fixed income ladder), the potential opportunities provided in the fixed income space have improved further. Since my initial article on upcoming fixed income opportunities, I have trimmed my spreadsheet listing of baby bonds and preferred stock down to something more manageable. While it is still subject to further shrinkage or expansion, the securities I’m focused on now are shown in the spreadsheet table below.

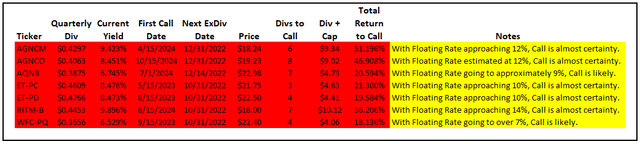

Both baby bonds and preferred stock are combined in the spreadsheet table. Those securities highlighted in red are those that I have started to accumulate. The red highlighted securities currently offer potentially very rich returns, a couple in excess of 50% over the next two years. The spreadsheet table below provides a more accurate estimate of potential return, more so than the YTM/YTC column in the table above.

I think the table columns are self-explanatory but, for clarity, the Total Return to Call column is calculated by accounting for the dividend stream up through the First Call Date plus the capital gain between the par value ($25) and the current Price all divided by the current Price. The last numeric column is total return (not annual) assuming the security is called on its First Call Date.

Considering these securities are all fixed to floating rate conversions on the First Call Date, and I expect those reset rates (found in the first table) will exceed the cost of new money at that time or shortly thereafter, I believe those securities will be called. I’m also OK if the securities do not get called on the First Call Date as I’ll be collecting a much higher coupon payment after the fixed to floating rate conversion. Could the current prices drop a bit further? Sure, but the current risk-weighted returns are pretty darn good.

Conclusion

The Federal Reserve’s current rate cycle has provided investors with fixed income investment opportunities that have not been available for decades. Those opportunities are readily available and have a lower investment risk than the corresponding common equity investments offer. We may see yet higher interest rates and corresponding lower bond and preferred stock prices, but I believe the Fed will have to slow the pace of increasing rates beginning in 2023 to prevent breakage and fallout from some part of the financial system. I’m planning on having my portfolio structured to capitalize on the price appreciation when inflation and interest rates start heading down.

Disclaimer: This article is intended to provide my opinion to interested readers and to serve as a vehicle to generate informed discussion in the comment postings. I have no knowledge of individual investor circumstances, goals, portfolio concentration, or diversification. Readers are strongly encouraged to complete their own due diligence on any stock, bond, fund, or other investment mentioned in this article before making their own investments.

Be the first to comment