Solovyova/iStock via Getty Images

On Thursday morning, with G-III Apparel Group (NASDAQ:GIII) down a lot, I started to aggressively buy the stock. I’m writing to share my very straight forward thought process as to why as well as share a number of other ‘monster’ sized bets I’ve made in 2022. And for perspective, prior to this past Thursday morning, I don’t believe I’ve ever owned G-III shares.

On Wednesday night, after the bell, G-III reported its Q3 FY 2022 results. The company missed its Q3 numbers and took down its full year guidance by roughly $0.60 per share. Ahead of the print, consensus estimates were calling for $3.60 of EPS. After the Q3 FY 2023 miss, management took down its full year FY 2023 guidance to a new and lower range of $2.90 to $3 of EPS. Also, the company revealed that its long-term licensing agreement with PVH Corp. (PVH) would be winding down, mostly at the end of calendar year 2025 and 2026.

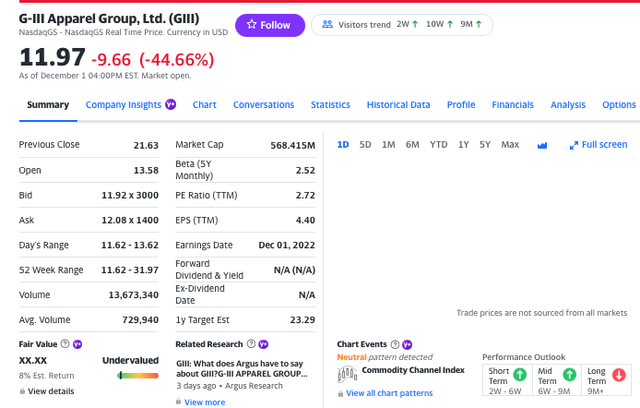

As you can see, on Thursday, December 1, 2022, G-III shares were taken to the woodshed and closed down 45%, with 13.7 million shares changing hands (this means 28.5% of GIII’s entire share count changed hands!).

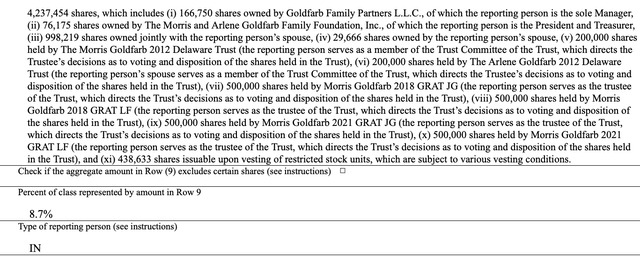

Before we get into the weeds, I want to point out a few items. The long time CEO, Morris Goldfarb, is dumb as a fox.

And by the way, this crafty fox, owns a cool 4,237,454 shares or 8.7% of the equity.

Secondly, and although the balance sheet is a wee tad stretched, at least at the moment, per GIII’s Q2 FY 2023 10-Q, they have board authorization to buy up to 9.2 million shares. And yes, that is shares…..

In March 2022, our Board of Directors authorized an increase in the number of shares covered by our share repurchase program to an aggregate amount of 10,000,000 shares. Pursuant to this program, during the three months ended July 31, 2022, we acquired 811,874 of our shares of common stock for an aggregate purchase price of $16.6 million. The timing and actual number of shares repurchased, if any, will depend on a number of factors, including market conditions and prevailing stock prices, and are subject to compliance with certain covenants contained in our loan agreement. Share repurchases may take place on the open market, in privately negotiated transactions or by other means, and would be made in accordance with applicable securities laws. As of September 6, 2022, we had 9,188,126 authorized shares remaining under this program and 47,486,633 shares of common stock outstanding.

(G-III Apparel’s Q2 FY 2023 10-Q)

Next, I will share why I aggressively bought GIII shares.

Q3 FY 2023 Conference Call Highlights

If investors actually listened to the 77 minute conference call, which kicked off at 10:30am EST, Thursday, December 1, 2022, Morris and CFO, Neal Nackman, provided a number of reasons, at least in my view, as to why this massive sell-off should be aggressively bought.

(All quoted material is the from Q3 FY 2023 conference call)

1) $27 million and one-time demurrage charges dinged Q3 FY 2023 gross margins:

Most of the Q3 FY 2023 EPS miss was from one-time demurrage charges.

The lack of additional space in our warehouses, along with port congestion and the logistical challenges related to trucking, all contributed to us incurring approximately $27 million of demurrage charges in the third fiscal quarter, resulting in a one-time 250 basis point negative impact to our gross margin percentage. Demurrage charges are paid to steamship carriers for delays in picking up freight from their terminals and were the most significant contributor to the decrease in our gross margin percentage for the quarter. We expect that the additional warehousing space we have now secured should eliminate almost all demurrage charges in the future.

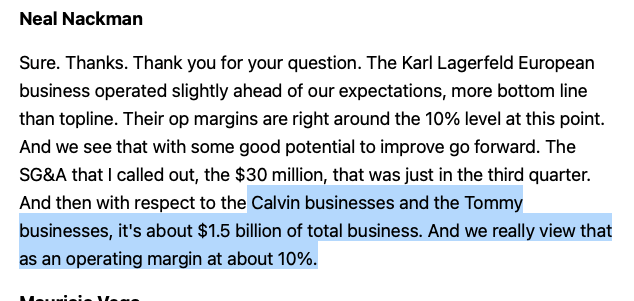

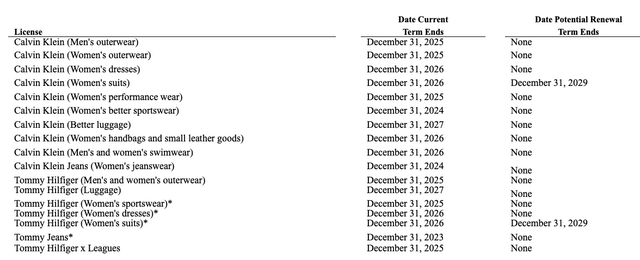

2) G-III still has three years left on the vast majority of its PVH’s licensed third party manufacturing deals (Calvin Klein and Tommy Hilfiger brands).

See the schedule below:

So, yes, it represents about half of current revenues, but this is only 10% operating margin business. Secondly, they have three full years to continue to generate the EBITDA, from these licensing deals. This is ample time for Morris & Company to adjusted and pivot.

GIII’s Q3 FY 2022 Conference Call

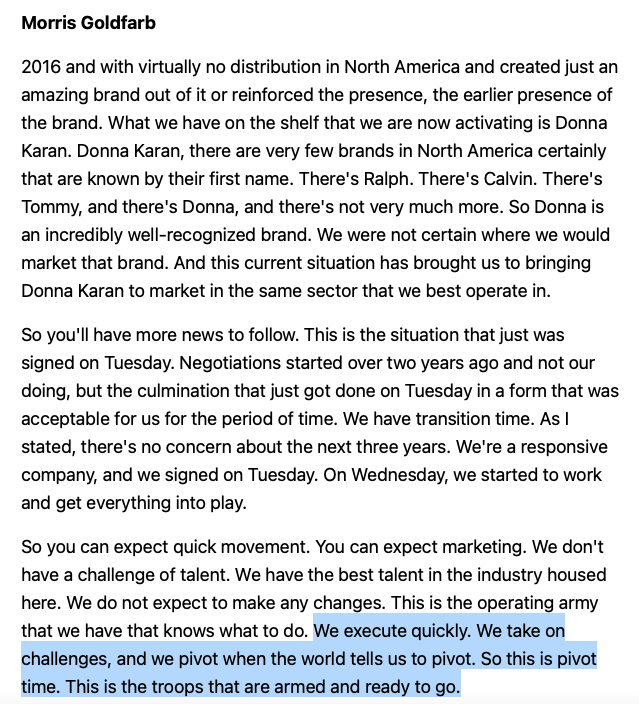

And as you can see, Morris discussed how well they executed, since 2016, with their owned Donna Karan brand. Secondly, he and the troops are geared up and ready to go into battle! Not sure about you, but I know I want to bet on companies that have long time executives at the helm. In addition, I want to bet on CEOs that have lots of equity capital and reputation capital, at risk.

GIII’s Q3 FY 2022 Conference Call

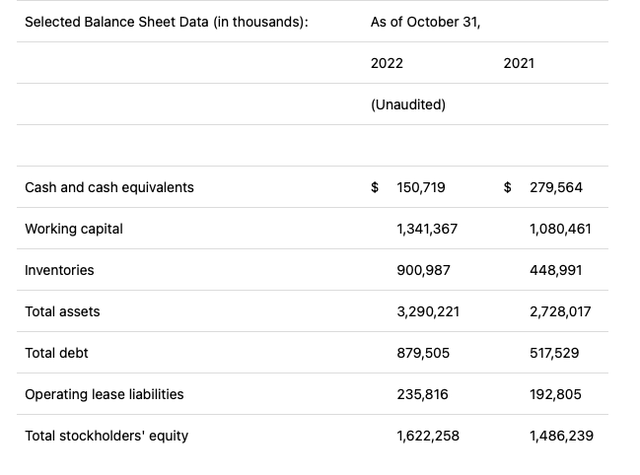

3) About that stretched balance sheet

When it rains it pours. The trifecta, of missing Q3 FY 2023 results, announcing the end of the PVH licensing agreement, albeit mostly at the end of December 2025, and a stretched balance sheet were the accelerant, aggressively poured on the fire by the algos and short sellers.

As of October 31, 2022, GIII has $728 million of net debt. However, YoY, inventory is $450 million elevated. So perhaps, $600 million is right and normalized number, for inventory. When that inventory get converted to cash, and it might take a few quarters, that is $300 million that will get earmarked for mostly debt pay downs.

On $270 million of Adj. EBITDA, this fiscal year ending January 31, 2023, $450 million of pro-forma debt is less than two turns of leverage. Not a big deal!

G-III Apparel’s Q3 FY 2023 Earnings Release

Moreover, at $12.79 per share (a $614 million market capitalization) and $1.34 billion enterprise value, on a pro-forma basis, when that inventory gets converted to cash, the enterprise value drops to $1.04 billion, holding the $12.79 per share stock price constant.

And per yesterday’s call, GIII has $440 million of liquidity.

We have already and will continue to temper our buying into next year to also take account of our inventory levels. We ended the quarter with a net debt position of $728 million compared to $238 million in the prior year. This increase is predominantly related to the Karl Lagerfeld acquisition, which we funded with cash on hand as well as the increase in our inventory position. We had cash and availability under our credit agreement of approximately $440 million at the close of the quarter. We believe that our liquidity and financial position provide us the flexibility to take advantage of acquisition opportunities and invest in our future growth. We expect our availability to grow significantly as we normalize inventory levels.

Other Monster Sized Bets, I’ve Made In 2022

If you are familiar with my work, hence my name, ‘Courage and Conviction’, then you should be well aware that I’ve been known, from time to time, to swing the bet aggressively. If I think I’ve a great idea, then I tend to aggressively bet it. Please note, though, my timing can be off, even if, the idea, ultimately, is well judged.

Enclosed below, I will quickly share a few ideas that I wrote up and bet aggressively, in 2022. Also, a few of them were never shared on the free site, as I can’t just share every good on the free site. That said, I’m sharing G-III Apparel, with only a few day lag here.

The purposes of me sharing some of my largest sized bets, in 2022, is to provide the readers with perspective on the type of ideas that I bet aggressively.

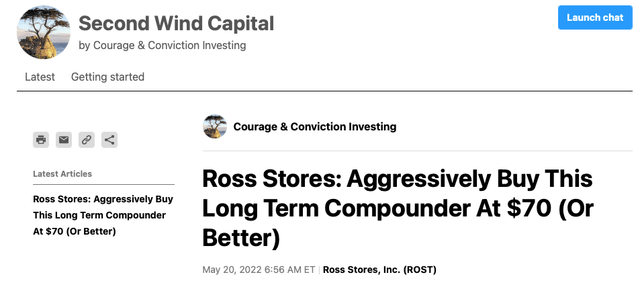

1) On the morning of May 20, 2022, I wrote up Ross Stores (ROST), at $70, before the bell. The article title says it all.

As of this past Friday, Ross shares were changing hands at $119.

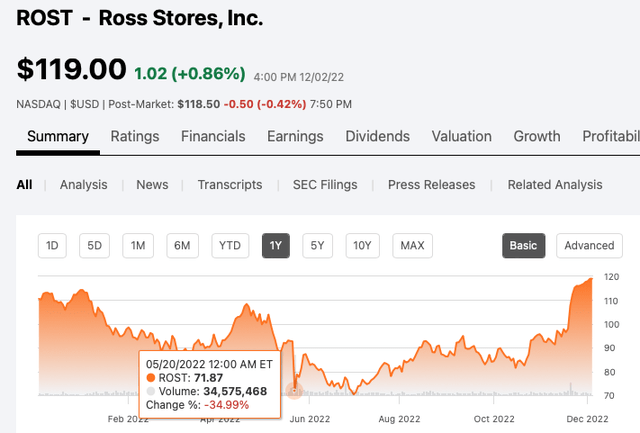

2) Then there was Netflix (NFLX) (published on the free site, April 21, 2022)

My April 21, 2022 Free Site Write Up

And you’re gosh darn right I’m still long and strong NFLX.

Snapshot of my long position in Netflix

Incidentally, behind the scenes, to my marketplace group, I was banging my drum, saying my NFLX target is $400. This was back at $175, when it wasn’t fashionable to do so.

On Second Wind Capital, I wrote this update, on July 6, 2022.

Back on July 6th, you could have bought all the Netflix you wanted, in the low $180s.

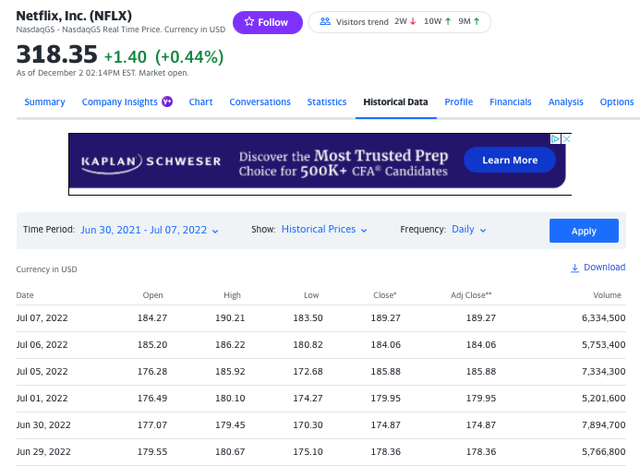

3) On September 6, 2022, I wrote a great piece on Build-A-Bear (BBW)

The piece highlighted the then ridiculously low valuation, the pristine balance sheet, the aggressive share buyback programs, and the upcoming catalyst of BBW’s 25 year anniversary, where they were offering limited time special merchandise to commemorate 25 years in business.

That said, although I made good money on BBW, my portfolio had a big drawdown, in September 2022, and quite stupidly, I booked profits far too soon here. The thought process was to offset some of the sting from that September 2022 drawdown. This proved to be a very costly portfolio management error, on my part, as I left serious money on the table.

By the way, BBW shares closed north of $25, this past Friday, December 2nd.

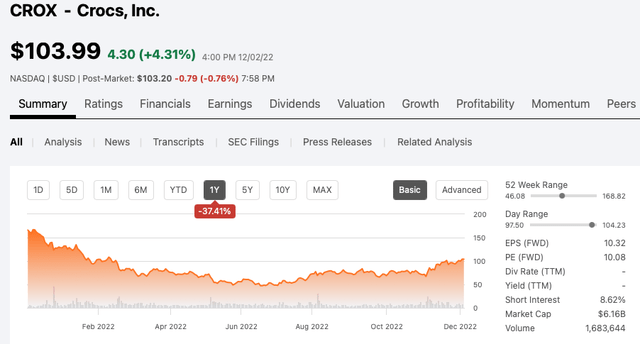

4) By late Q1 and early Q2 FY 2022, Crocs, Inc. (CROX) was a 15% sized bet, in the portfolio. Unfortunately, though, I sized it up at cost basis of $79. As it turns out, the CROX’s share traded as low as $46.08, on July 1, 2022. So I was wee tad early here.

As a result, and despite CROX shares closing north of $100, this past Friday, I actually sold all my shares, at $75, for a modest loss. Candidly, the big drawdown from $79 to $46 meant my conviction wavered. Timing is everything, and clearly, my timing was off here. That said, ultimately though, I got the fundamental read on the business correct. It is hard to stomach that big of a drawdown on a max sized position (As a general rule – 15% is my sizing maximum for my best ideas).

5) Then there is Advanced Emissions Solutions (ADES).

Advanced Emissions Solutions is my largest sized bet in my portfolio. I own a LOT of shares, across accounts, in the low $4s. I’ve had a core position in the name since Q1 2021. I did sell half on the move over $8, in May 2021, but I aggressively bought more shares in the low $4s, more in the mid $3s, and more in the high $2s.

ADES has $4.25 per share in cash, but its 15 month Strategic Review resulted in a controversial merger announcement with privately held Arq as opposed to an outright sale. A few weeks ago, I did speak with the CEO of ADES, Greg Marken, for a solid 60 minutes. His thought process for the deal actually make a ton of sense and three years from now, assuming the deal is approved, and chances the merger won’t gander enough votes to win approval, at least in its current form, the stock could be trading at $10 or $15. I’m just not sure ADES holders want to wait three more years for the chance of a home run. Moreover, again, it is unknowable if the deal will ultimately get approved (a majority vote is required to win deal approval by shareholders). Long time ADES shareholders have been torched here, and with the stock trading under $3, I’m not sure the ADES team has the votes to win approval.

And to be clear, I’m on the fence as to how I am going to vote my block of shares.

Putting It All Together

I could go much, much deeper here, on G-III Apparel. However, it is easy to get lost in the weeds. I would argue that Morris Goldfarb and team have built a very good business and they are very capable operators. The company was hit with a perfect storm, a trifecta of bad events. Secondly, I would argue that stock dramatically overreacted here.

Over the coming weeks, I’m anticipating that Morris will be an aggressive buyer of the stock, in his family trust, and / or the team will be clever enough to buyback one million or two million shares, on its 9.2 million share authorization. The stretched balance sheet probably limits the buyback to no more than 2 million shares acquired, if I had to venture a guess.

An individual as hard working and as smart as Morris is clever enough to take advantage of the market throwing the baby out with the bathwater. I would argue anything under $15 per share represents excellent long-term value. And based on the subtext of G-III Apparel’s Q3 FY 2023 conference call, Morris is a big believer in the long-term outlook for his company.

My Year-to-Date Portfolio Performance

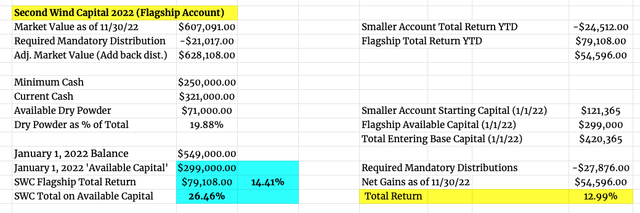

Also, in case you are wondering, as I’ve discussed a number of big bets in 2022, some were very good, and other not so much, here is my portfolio performance through November 30, 2022.

Second Wind Capital Performance

I have two portfolios that I manage. Through November 30, 2022, the smaller account is down 20.2% (or down $24.5K). The larger flagship account is up $79K. As I’m required to maintain $250K of cash, at all times, in the flagship account, on a total capital at risk basis, my blended portfolio performance is +13%.

Also, in the larger flagship account, despite being required to hold a lot of cash, over the past three years, I’ve generated a 43% 3 year compound annual return here.

As Eric Church says in his song, ‘Some of It’, “If it’s close, swing the bat”. Well, I certainly swung the bet on GIII.

Be the first to comment