JHVEPhoto

Investment Thesis: While the stock could have scope for longer-term growth, I take the view that investors will continue to remain apprehensive in the short to medium-term.

In a previous article back in May, I made the argument that National Bank of Canada (TSX:NA:CA) could potentially see further loan growth across the non-retail sector if Canadian business growth remains robust – in spite of the risk that residential mortgage demand could decline as interest rates rise.

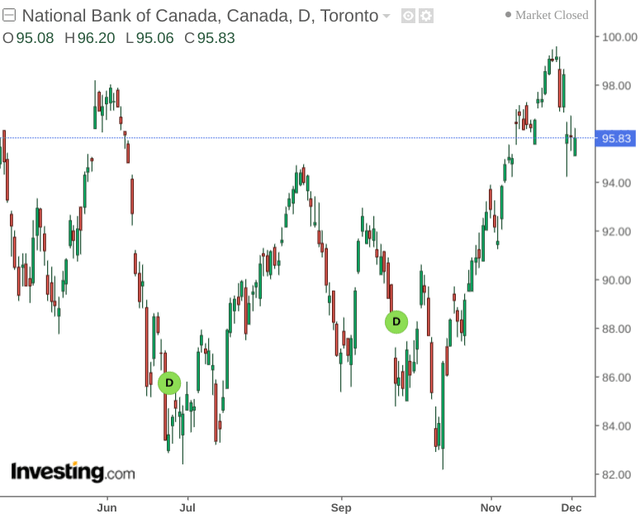

Since then, the stock has remained more or less stationary:

The purpose of this article is to assess whether the previous growth drivers that I had cited for National Bank of Canada still hold, and whether the stock could see upside going forward.

Performance

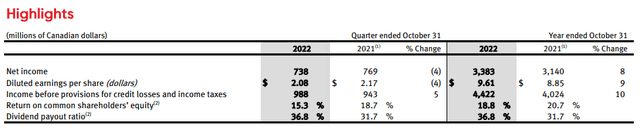

When looking at most recent quarterly performance for the National Bank of Canada, we can see that although diluted earnings per share is up by 9% on a year ended basis as compared to the previous year – diluted earnings per share is down by 4% on a quarterly basis as compared to 2021.

National Bank of Canada Press Release Fourth Quarter 2022

The bank cites higher provisions for credit losses due to a deteriorating macroeconomic situation as a key contributor to the drop in net income and earnings.

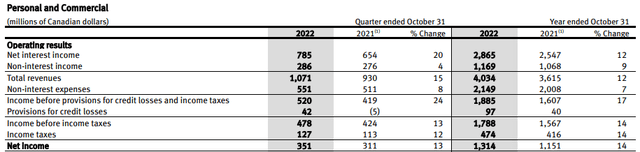

For instance, we can see that across the Personal and Commercial segment – which is the bank’s largest segment by net income – net interest income was up by 20% on a quarterly basis and 12% on a year-ended basis.

National Bank of Canada Press Release Fourth Quarter 2022

However, we can also see that the increase in provisions for credit losses had reduced net income across this segment on a quarterly basis.

Additionally, when looking at the loans mix for the National Bank of Canada, we can see that loans for the residential mortgage segment were up by over 10% as compared to October 2021, and this accounted for just under 40% of loans for the most recent quarter, as compared to 41% for October 2021.

National Bank of Canada Press Release Fourth Quarter 2022

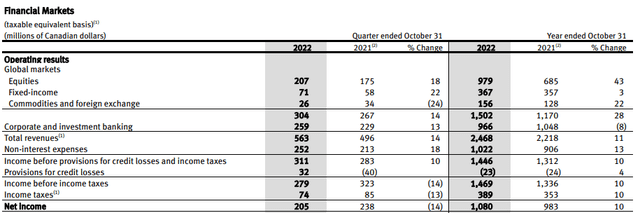

In terms of the financial markets segment – which is the second largest segment by net income – we can see that while revenue growth was 14% on a quarterly basis as compared to last year – an increase in the provisions for credit losses brought down net income:

National Bank of Canada Press Release Fourth Quarter 2022

It is also notable that the majority of growth came from Equities and Corporate and Investment Banking.

Looking Forward

The National Bank of Canada has continued to see growth across its main business segments. However, an increase in the provisions for credit losses has stalled overall net income growth.

Going forward, the provisions for credit losses could increase if the bank envisages that the macroeconomic situation is set to deteriorate.

Additionally, while higher rates have been accompanied by a rise in net interest income, we saw from most recent results that growth in non-interest income has been more modest. This could make the bank vulnerable if rates become too high and thus demand for loans drop as a result – thus harming net interest income growth.

When looking at performance across the Financial Markets segment – we saw that Equities and Corporate and Investment Banking collectively accounted for over 80% of revenue growth. In the event of a recession – this segment as a whole could see a decline in growth if equity performance deteriorates significantly, and corporate and investment banking activity starts to slow.

For these reasons among others, investors seem to be cautious of the stock at this time. While overall net income growth on a year-ended basis has continued to remain positive, provisions for credit losses could increase if the macroeconomic situation deteriorates further – and the particular segments that have contributed to net income growth could be at risk under such a scenario.

Conclusion

To conclude, National Bank of Canada has seen little growth on a price basis since May. While net income growth has continued to remain positive on a yearly basis, the bank could see significant headwinds if a potential recession significantly harms growth in net interest income as well as activity across the Financial Markets segment.

While the stock could have scope for longer-term growth, I take the view that investors will continue to remain apprehensive in the short to medium-term.

Be the first to comment