Charday Penn/E+ via Getty Images

Author’s Note: This is the free version of a premium article published on iREIT on Alpha back in late October 2022.

Dear readers/subscribers,

Data Processing and IT companies haven’t been easy investments for the past year, with most of them crashing massively over around a 7-10 month period. Fidelity (NYSE:FIS) is a Fintech company, which is also most known for these services – fintech services, that is.

From trading at an extreme premium, the company is now trading at a massive discount to any sort of historical average we look at and now yields over 3% as opposed to the YoC I have on my original stake.

It’s time to take a deeper look and share why I believe this company represents a great investment.

What is Fidelity National Information Services?

FIS, or Fidelity National Information Services is a provider of fintech for merchants, banks, and capital market firms across the globe. It’s a large company with over 55,000 employees, headquartered in Jacksonville Florida. The company is both a Fortune 500 and an S&P 500 member.

On a high level, it’s an impressive business with an investment-grade credit rating, a yield that’s more than 4x covered by adjusted EPS, and a history of generating 14.63% EPS CAGR for the past 20 or so years. That means that it, in terms of earnings, vastly outperforms most companies.

The company facilitates the movement of $10T, in 79B transactions for 20,000+ clients across the globe. Its history is long, founded in 1968 as Systematics, later acquired by the ALLTEL Corporation, which was later acquired by Fidelity National Financial, and renamed into its current name.

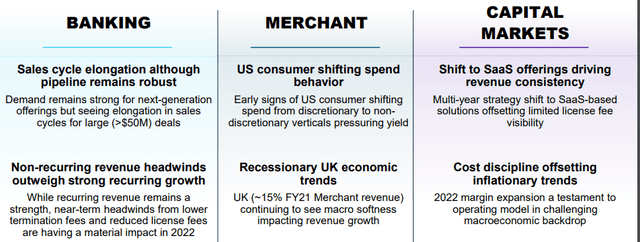

It does this through a number of operational segments, which are as follows.

These three segments focus on things like payment enabling, credit/debit and prepaid going from both e-commerce and from physical payment terminals. FIS is a high-level company, that includes the entire transaction chain, including authorization, settlement, customer services, chargeback, and retrieval processing. The company also offers VAP, such as security and fraud prevention, analytics, and FX as well as funding.

The company also helps banks, with processing and application, risk management, compliance, electronic fund transfers, payment, network services, and wealth/retirement solutions, aside from its capital market segment, which focuses on clients with sell/buy-side solutions, such as asset managers, brokers, security traders, insurers and the PE sector.

FIS does not sell through any other channel than in-house sales personnel with market expertise and usually tailors solutions specifically to the customer. In order to work with FIS, you usually have a fair amount of size to your business already.

Competition for company services does exist, but it’s primarily limited to the megacaps, such as Oracle (ORCL), SAP (SAP), and Fiserv (FISV).

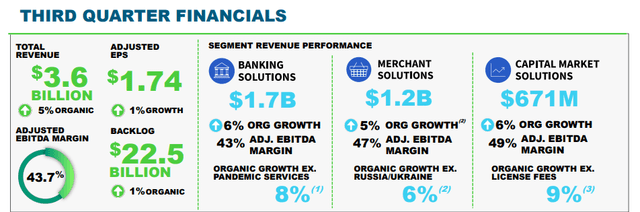

A high-level review of the business confirms that this is a business running billions of dollars’ worth of sales, with tens of billions in the current backlog.

And those numbers are just for one quarter.

You only have to take a glance at recent wins to know the caliber of customers the company plays with. With a backlog like this and continued organic growth thanks to increased activity in e-commerce as well as higher demand for payment solutions, it’s little wonder that business continues to increase. While I previously focused on the company’s initial work in crypto as well, I believe the shine off crypto is disappearing, which makes it a positive that the company only did just that – dipping a toe in it.

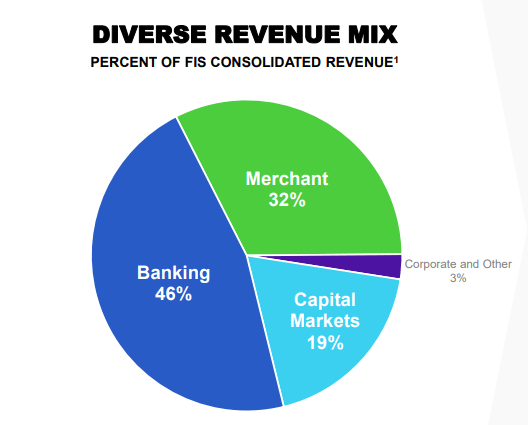

The company’s high-level sales revenue mix is superb especially when considering the current trends in the markets. FIS is in no way overexposed to the capital markets – it in fact remains its smallest segment by far.

FIS IR (FIS IR)

Most of the company’s overall revenue is usage-based with multiple-year contracts, creating very visible streams of revenue and potential profit over time. This company is quite forecastable, which we’ll see in a while when we move closer to the valuation – because forecasts are good, growing, and indeed stable.

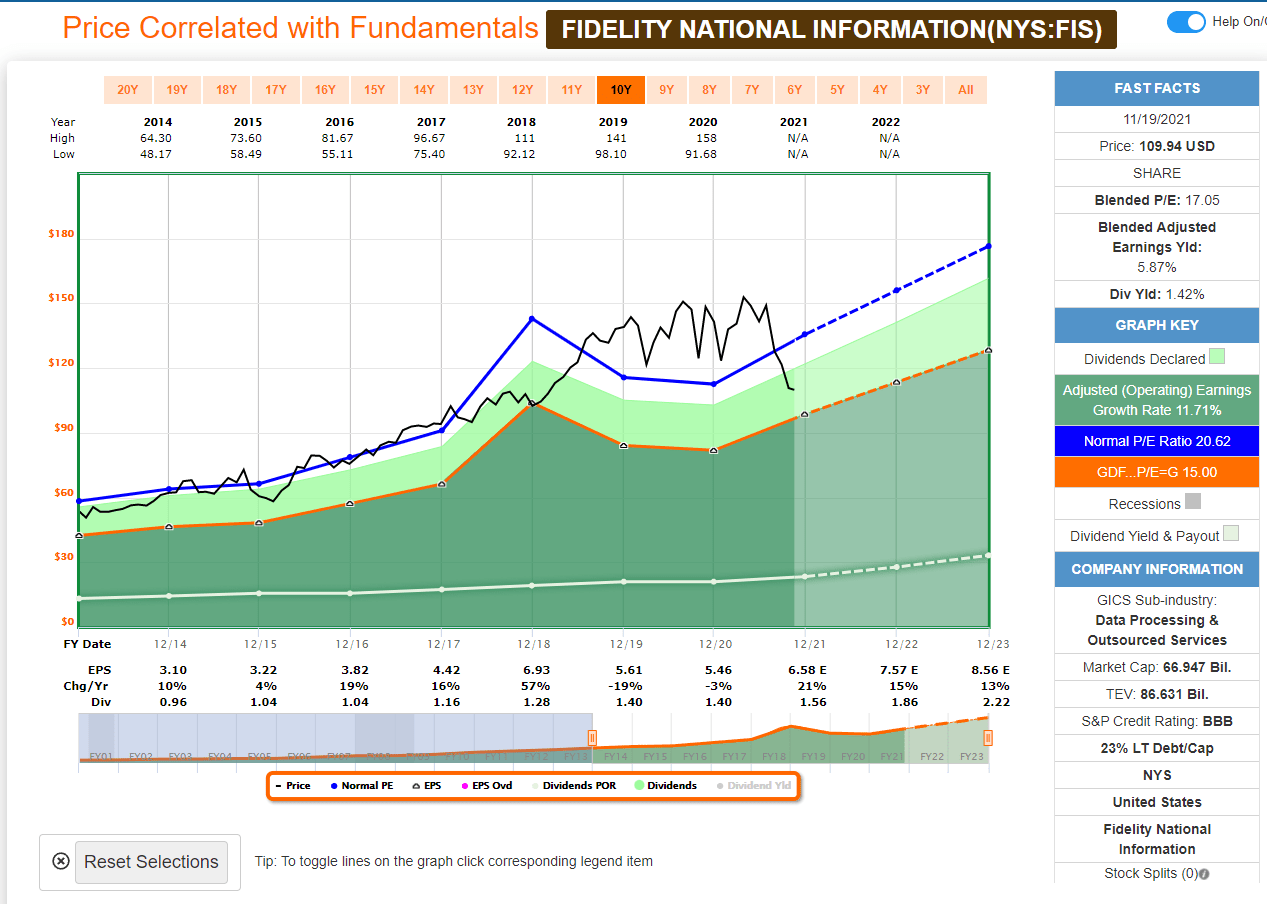

When I reviewed the company for the first time and dipped my toe in it, FIS yielded no more than 1.42% due to a massive premium in valuation. Dipping my toe at that time, almost exactly a year back, was a mistake on my part – I’m thankful that it was a mistake limited in its scope because the sizes of my initial positions are usually around or less than a thousand dollars.

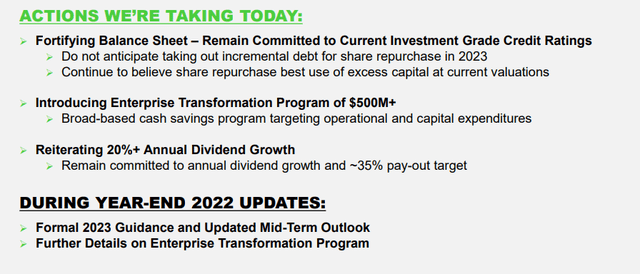

Company capital allocation priorities are clear – and the company has already announced that it intends to grow the dividend to a 35% payout ratio, with 20% annual dividend growth over the coming few years. This is also part of what has caused the company’s dividend to really shoot up in terms of yield.

The company has also lowered its leverage to below 3x, an important part of its goal and even more important a part of staying conservative in the current macro environment. Current global trends, that aside, favor the company highly, with volume growth in major networks. The merchant segment especially is seeing massive expansion. Regardless of physical or e-commerce, FIS will have “its share” of that revenue and of that profit.

The company has taken numerous actions to de-lever and shore up its balance sheet to handle the upcoming macro troubles.

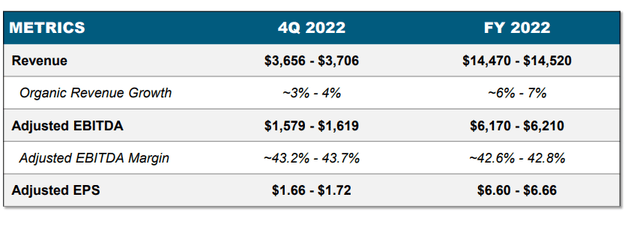

The company is also reducing spending by of upwards half a billion, reflecting the margin pressure seen in both Merchant and Banking solutions. While top-line growth remains strong, the amount of EBITDA per dollar of Revenue is dropping quite significantly. On a broad basis for 3Q22, the company managed to increase revenues by 5% organically, due to strength in banking and capital, offsetting significant weakness in Merchant (UK). Adjusted EPS, for that reason, is only 1% growth, and Adjusted EBITDA is insufficient to make up for the headwinds.

The company’s balance sheet is absolutely stellar. FIS has 2% interest on average, with current leverage of 2.9x, and enough capital to manage all of its obligations for the foreseeable future. Free cash flow easily covers dividends by a factor of more than 2.5x, and the company has repurchased $1B worth of shares. Dividend growth and payouts have a higher priority on the capital allocation ladder than does repurchases, which is rare for a growth company, but very welcome.

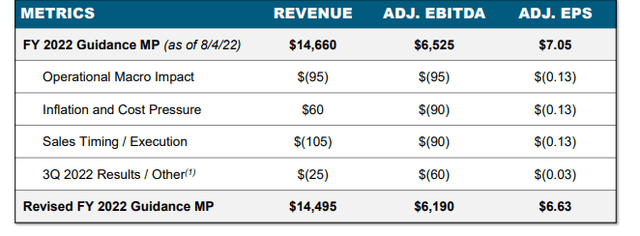

FIS somewhat adjusted its 2022E targets in the latest quarterly, only a few days back. Here is the current set of targets with revisions in place, as well as the old set of overall targets.

This might sound significant, but I don’t view it as that significant on a high level, given the company’s overall growth trajectory – which despite this, is quite excellent.

There are reasons for the punishing it’s receiving by the market at this time. The company’s move towards a merchant-centric business, which brings with it more volatility compared to its other segments, means it’s competing with companies like Global Payments (GPN), Block (SQ), and others. The advantage here, I see to FIS, given the brand awareness and pure transaction volume. The company can leverage its connections in banking and other segments – others cannot, in the same way. However, Merchant is indeed more volatile, as we’ve witnessed during the last half year.

Combine this with the fact that merchant growth is slowing, and some re-evaluation of the company’s valuation levels was in order.

Just not this much.

This is the drop I saw when I began investing in the business.

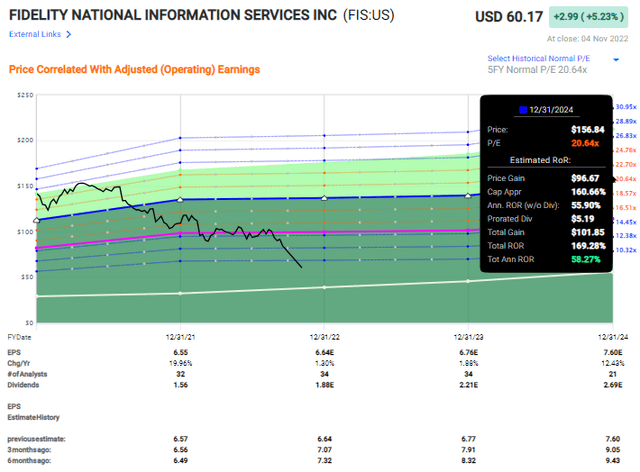

FIS Valuation 2021 (F.A.S.T Graphs)

It looked more appealing than – but it’s really nothing compared to what we’re able to see at this particular time. I don’t see any fundamental worries in the recent set of results – nor do I see signs that the top line is slowing down to a degree that would justify the following sort of valuation crash.

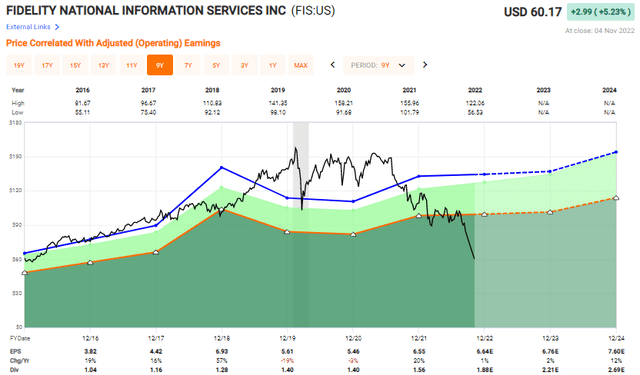

Fidelity Information Services Valuation

The valuation for the company, compared to above, has now dropped to this.

FIS Valuation (F.A.S.T Graphs)

I view this as now being in firmly “oversold” territory, to a degree where I recently bought more, and am planning to buy more still. The company now trades at a sub-10x P/E – that’s to a 10-year average of 20x P/E, despite being expected to grow EPS by around 1% this year, followed by 2% then 12% in the following years.

Even in the case of essentially flat, or 1-4% growth as the company adjusts to the new market, that makes this a potential reversal play. The return range starts at a 10x P/E for 2024E with a potential annual RoR of 16.5% and 3-year of 39% (that’s for 10X P/E) and goes up all the way to a 170% RoR and 58% annually – that’s for 20x P/E.

I don’t view either 10x or 20x as likely – rather somewhere in between. But that still puts us at a firmly market-beating rate of return between 16-50% per year.

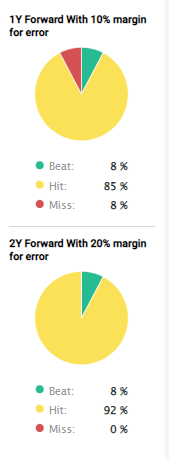

How likely are the returns to be that the current analysts are forecasting?

Oh, about 100%, including positive “misses” (or beats).

FIS analyst accuracy (F.A.S.T graphs)

The fact is, when it comes to this company, analysts don’t miss the target often. Even if the latest trends introduce a fair bit of volatility compared to the historical context for the business, it’s not de-railing the fundamental thesis.

To put it simply, dear subscribers, this is a textbook case of market overreaction.

This is exactly the sort of textbook case that I save money for being able to invest in. I intend to make FIS into an “actual” position (meaning over 1%) after this, and really stake out the company and start to follow it a lot more closely. I see the potential for doubling or tripling my investment here over less than 5-10 years – and that’s what my portfolio “lives” for.

After trading high for years, this is finally a tech stock I can start to get behind in terms of overall valuation and risk/reward ratio. At 9X P/E, this company is well below its average premium and based on its growth trajectory without any sort of 2-year historical 10%-year MoE adjusted forecast failure, could be an absolute blockbuster for the value-conscious investor.

I already didn’t paint FIS with a 20x P/E premium when I went into my first article. I went in at 17-19x P/E, but I’m lowering that to 15x – but not below 15x. At current fundamentals, the company easily warrants a 15x to me.

I believe that there is an upside to FIS here. I also believe that, barring anything unforeseen or truly negative, the market may well be done with punishing FIS here.

Because it no longer has a “poor dividend” – the dividend is actually damn good at this time – one of the drawbacks when investing in FIS has also disappeared.

In my last piece, which wasn’t a premium piece, the average target for FIS was close to $166 per share from 30 analysts at S&P Global. The amount of premium in that can be viewed as nearly ridiculous when seeing where the company has gone today.

Current average targets are for a share price of $90, which brings us an upside of 50%. But that is almost half the target analysts had a year back, which shows us two things.

1. The importance of sticking to conservative valuations and focusing on fundamentals, not on the inflated current-situation sentiments that have a tendency to rule today’s markets.

2. The importance of long-term investing and dividends.

At current average targets, 25 out of 31 analysts have a “BUY” rating for the company – and for once, I agree wholeheartedly with the street analysts. I believe a conservative PT of $90/share is pretty much where we want to be for the long term.

At a price of $90/share, we’re at 12x for 2024E, implying an upside of around 25% annually and 60% RoR in less than 3 years.

Good enough to invest in?

I believe so – and this becomes my base thesis for FIS as it is here.

I forecast slowing margin growth/normalization as well as slowing top-line growth, hailing from above all the pressured merchant side of things. All payment processors and data companies are facing pressure in this environment.

The trick is to re-evaluate them at the right sort of multiple in order to guarantee the lowest possible risk of long-term downside to your investment.

At a sub-10x P/E for FIS, with a bumped yield to almost 3.2%, I say “Bring it on”.

My PT is $90/share – and my position is “BUY”.

I recently invested $5,000 into FIS prior to it jumping 5% – but I’m about to push in $5,000 more in the coming week.

I believe there is a significant upside to be had.

This is the one software/IT company that I’m currently buying, with an exception of Infineon (OTCQX:IFNNY) – but an article on that is coming as well.

Questions?

Let me know.

Be the first to comment