Adro_Hatxerre

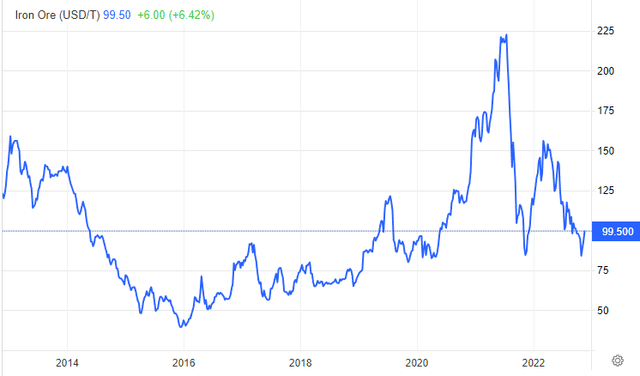

After seeing stellar gains in 2020, the global mining industry has fallen back down as economic demand wanes. Supply-chain shortages and production cuts led to considerable shortfalls in 2020 through 2021, causing the prices of virtually all minerals to rise. Of course, this shift was followed by renewed production, while high prices, and other exogenous economic factors, led to declines in demand. This pattern is seen most clearly in the sharp rise and fall in the price of iron ore. See below:

Price of Iron Ore into China (TradingEconomics.com)

Iron ore is now around as cheap as it was before 2020. The market was in a slight glut before 2018 as global production was growing quickly. In the US and many other countries, iron ore output has stagnated or declined since around 2019, mainly due to CapEx cuts from miners with low-profit margins. Production has declined slightly in 2022 due to China’s efforts to curb steel manufacturing (due to China’s energy shortage) and the Russia-Ukraine war. At the same time, demand has also declined due to the rapid construction slowdown in China and significant declines in European steel output (also due to its energy crisis).

China is, by far, the largest global importer of iron ore – accounting for ~70% of all global imports. Australia and Brazil are, by far, the largest exporters. Given this, the Brazilian mining giant Vale (NYSE:VALE) is highly dependent on fluctuations in iron demand, particularly considering much of its business is with China. Vale is an inexpensive stock today with a high forward dividend yield of 9.1% and a “P/E” of only 4.4X – nearly 40% below its Australian peer Rio Tinto (RIO). Vale has lost considerable value over the past year following the crash in iron prices, but with iron carving out a firm bottom, the stock may have positive prospects ahead of it. Of course, iron depends on Chinese demand, and, as detailed last year in “Vale: Iron Ore Collapse May Last Years,” the metal’s weakened prospects threaten Vale’s profit margins.

A Strange Macroeconomic Environment

The futures price of iron ore recently fell back to the $80-$90/T range, which is the same level it was exactly a year ago (before rising to $150/T). Iron was trading in this range from the end of 2019 to early 2020 before the shortage grew. Iron bounced off its low and is now at around $99/T, signifying firm support in the $80 to $90 price range. Iron ore is the most critical mineral for Vale’s profits, and most other base metals closely track iron prices. If iron is carving out a definitive bottom, Vale may be attractive since its downside risk is somewhat low.

The iron market, and indeed the entire commodity sector, is facing a strange economic dynamic that is historically rare; both demand and supply are stagnating or declining. In normal periods, demand for commodities rises at a slow pace depending on the economic cycle. When demand rises too far above supply, prices rise – eventually causing mining firms to increase CapEx and drive more excellent production. Often, this results in a “boom, bust” cycle within commodities – known as the “commodity supercycle.”

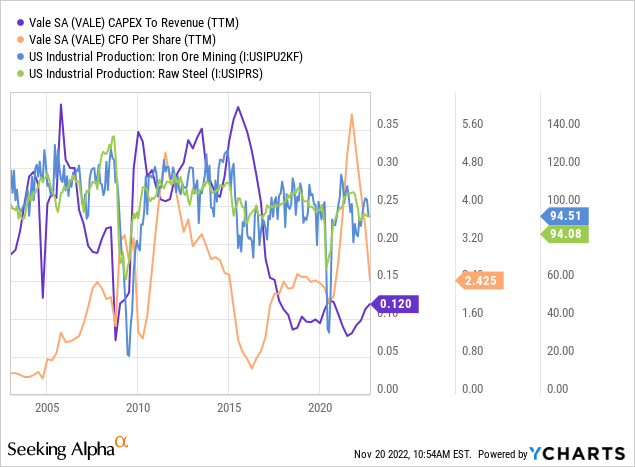

This pattern is illustrated in the lagged relationship between Vale’s cash flow and CapEx spending and steel and iron production levels. Though Vale is not a US company, US steel and iron production levels are a decent proxy for changes in western markets. See below:

During most of the 2010s, mining output rose quickly from earlier investments in the 2000s. That situation caused a general glut, chronically low prices, and meager profits. With capital investments low, mining output has stagnated since around 2018-2019. Global lockdowns created immense volatility, decreasing production while demand remained relatively high, resulting in high one-off cash-flows for Vale. This persisted until late last year, when the global economic activity began to peak amid the energy shortage and rising interest rates.

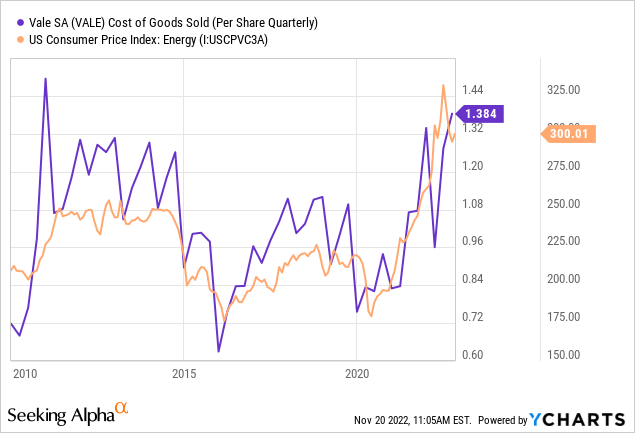

The global energy shortage is significant for Vale and its buyers, since energy makes up the bulk of direct production costs for most durable items. This relationship can be seen quite clearly in the correlation between Vale’s Cost of Goods Sold and the US Energy CPI:

Note although Vale is Brazilian, energy prices tend to be global, and its COGs are listed in USD, so it is sensible that its costs fluctuate with the US energy price index. Energy prices have soared globally since 2020 amid lasting production cuts. Although oil prices have declined, they likely continue to rise over a prolonged period due to a potential fall in output and a lack of inventories. Since steel producers, and other base metal purchasers, are also highly exposed to energy (as seen by the enormous wave of steel factory shutdowns), iron demand will likely remain low for some time. Thus, this crucial negative factor for Vale may worsen over the next year as production costs rise.

On the flip side, Vale, Rio Tinto, BHP (BHP), and most other large base metals miners have had meager CapEx spending over the past years. Even if China’s demand fails to improve, global iron production will likely decline. There is a long delay between CapEx spending and changes in output (since mining projects take years to complete), so it seems likely that supply will fall faster over the next two years than it has in recent years. Vale, and its peers, have been concerned about low demand for some time and have positioned accordingly. As such, it is not necessarily the case that iron prices will fall further amid declines in global durable production.

What is Vale Worth?

Vale’s economic situation is generally negative, but does not guarantee a fall in profitability. When supply and demand are both falling, it is hypothetically possible for prices to rise, although a significant rise in iron prices seems very unlikely. My base-case view is that iron remains around its current level and only rises if energy costs grow. Thus, Vale’s profit margins should remain near, or slightly below, their current level while its sales may decline slightly.

The company’s 2022 analyst consensus EPS estimate is $3.42, followed by ~$2.5 in 2023 and 2024, with revenue falling slowly over the coming years. I suspect Vale’s operating margins will slip back to ~20%, and its sales will fall to around $40B annually, giving it an expected annual EBITDA of about $8B. Given a 7X “fair-value” EV-to-EBITDA ratio, I believe the firm’s fair enterprise value is around $56B. Subtracting roughly $9.5B in net debt and other stakes, my estimated fair market value of its equity is $46.5B. That figure equates to a share price of ~$10.25, 32% below its current level.

The Bottom Line

My outlook may seem very bearish, but with iron prices back at long-term lows, production costs rising, and iron demand weak, it does not seem unreasonable for the firm to lose the abnormally high-profit margins it found over the past two years. There are reasons for hope that demand will rise, including electric-vehicle goals (benefiting non-ferrous metals demand) and a possible end to China’s restrictive lockdowns. In my view, neither of these factors is very strong in light of Eurasian natural gas shortages, which limit the productive capacity of most metal buyers. Additionally, while I believe EV demand will bring a rise in non-ferrous metal demand, in the long run, it seems unlikely to occur soon due to weak consumer buying power.

Vale also faces regional risks that may impact its profitability. Mining is a massive business in Brazil, and the country’s new leader, a former union leader, has proposed introducing a special royalty tax on mining. It is unclear if such a tax will be created, and given the declining state of the mining industry, it is not guaranteed or may be relatively small. Still, Vale is subject to higher political and regulatory risk factors than its foreign peers, which could grow if the country’s political environment continues to shift. That said, I believe this risk factor is smaller than those associated with the falling demand for base metals and the rise in mining production costs.

Overall, I am bearish on VALE and believe it will continue to decline over the coming months. VALE may seem cheap due to its low “P/E” valuation and high dividend yield. Still, it has a substantial risk of losing much of its earnings if operating margins continue to slide. While VALE’s fair value is well below its current price, I would not short the stock since it may rise temporarily, given iron’s apparent technical support. Further, Vale may remain flat until energy prices climb higher, as cost growth seems a more significant risk factor than a continued decline in commodity prices.

Be the first to comment