turk_stock_photographer

Volatility is a value investors best friend, as that creates bargains for those who are willing to be patient. Perhaps that’s why many experienced value investors who have “been there done that” would rather quality companies that are trading at or close to their 52-week lows than their highs.

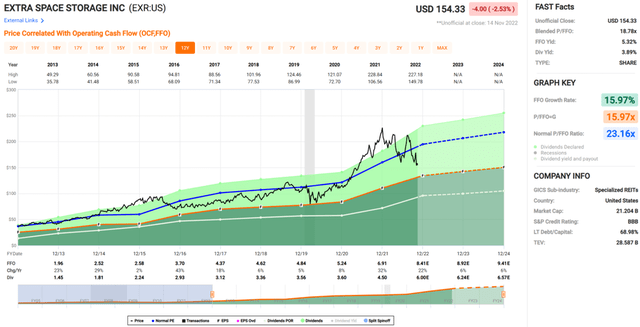

One such candidate is Extra Space Storage (NYSE:EXR), which is one a self-storage behemoth that’s now trading just a few points above its 52-week low, as shown below. In this article, I highlight why those sitting on the sidelines of this high quality REIT may want to consider layering into this name and get paid a decent yield to boot.

Why EXR?

Extra Space Storage is an S&P 500 company that’s headquartered in Salt Lake City, Utah, and is the second largest self-storage REIT in the U.S. At present, it owned and/or operated 2,327 self-storage stores in 41 states (up from 2,054 from just a year ago), covering 1.6 million units and 175 million square feet of rentable space. Beyond traditional self-storage, EXR also offers boat, RV, and business storage as well.

EXR continues to execute very well, as it increased same-store revenue by 15.5% and same store net operating income by 16.4% during the third quarter. The faster NOI growth over rental revenues implies that the company is demonstrating positive operating leverage through increased efficiencies across its platform. Moreover, same store occupancy remains strong, at 95.2%, although a bit lower than the 96.7% from the prior year period.

The company also continues to grow, as it added an impressive 116 operating stores in the recent quarter. Also encouraging, EXR added 22 net new stores to its third-party management platform. This is an attractive segment of its business, as EXR generates fees by tacking on 3rd-party privately owned stores to its management platform, enabling it to generate incremental fees above its traditional rental revenue.

As of the end of Q3, EXR managed a total of 1,201 stores, including 886 fully managed and 315 stores through joint ventures. Morningstar sees the little capital investment required for the 3rd party management platform as being a plus, as noted in its recent analyst report:

The company’s strategy is to invest in enhancing the coverage, scale, brand, and operating efficiency of its self-storage facilities that are located within a 3- to 5-mile radius of densely populated, high-income urban centers. Extra Space’s owned portfolio is the second-biggest in the United States, and its third party management business is the largest in the country, which has enabled it to expand its geographic footprint, data sophistication, and scale with little capital investment. Self storage is a highly fragmented industry with the five largest players owning 19% (including 5% by Extra Space Storage) of U.S. inventory, with the remaining 81% being owned by regional operators.

The outlook for the EXR appears to be strong, as its implied full year 2022 same store revenue growth is the highest in company record, on back of a strong 2021, which was its second highest revenue growth. Importantly, this is translating to strong bottom line growth, as Core FFO per share grew by 27% YoY in the first nine months of the year.

Looking forward, EXR has plenty of room to grow, as the self-storage market is highly fragmented with many individual private owners. Being the second largest player in the industry, EXR is well-suited to continue to consolidate this industry with a strong BBB rated balance sheet backed by a low net debt to EBITDA ratio of 4.6x.

Importantly, the dividend yield is currently a healthy 3.9% and is well covered by a 69% payout ratio, based on Q3 FFO per share of $2.16. The dividend has also grown along with the company’s bottom line, a 5-year CAGR of 13% and 11 years of consecutive growth.

EXR doesn’t appear to be particularly cheap at the current price of $154.33 with a forward P/FFO of 18.4. However, I believe its size, growth track record, strong balance sheet, and forward prospects justify the valuation. Plus, it also sits below its normal P/FFO of 23.2 over the past decade. Analysts have a consensus Buy rating with an average price target of $190, implying a 27% potential upside from the current price including the annual dividend.

Investor Takeaway

Extra Space Storage is the 2nd largest self-storage REIT and continues to grow through acquisitions and development while also increasing its dividend at a healthy pace. While it doesn’t appear to be cheap at the moment, I believe its long-term growth prospects warrant a premium valuation. With an attractive long-term valuation, I believe now represents a good “set it and forget it” entry point on this well-regarded name.

Be the first to comment