Roman Mykhalchuk/iStock via Getty Images

Published on the Value Lab 11/7/22

RPM International (NYSE:RPM) is the beginning of our coverage of building products companies. They produce and install waterproofing products, but they also produce coating for construction and other purposes, even food, which goes into their specialty chemical business. They aren’t very commoditized, and their markets have a certain degree of non-discretionary, especially waterproofing, but overall they are going to be exposed to macro pressures, and they have been already in the weaker geographies. This isn’t some untouchable company, and they trade way above other businesses that have similar cyclicality and profiles. We don’t think their valuation is justified.

Q1 Note and Primer

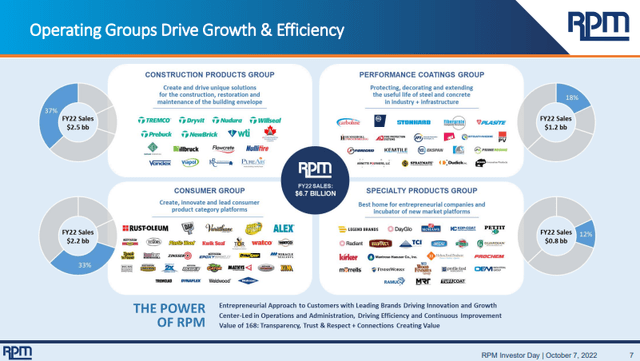

RPM is exposed to construction trends in most of its segments. The least exposed is the consumer products group segment or CPG, which is where their major waterproofing products brands are. This accounts for 37% of revenue. The other segments produce chemical products used in flooring, lamination, fire resistance and anti-rust. A lot of these sell in the performance coating group, which also includes some industrial products like fiberglass products, and these sell primarily to contractors. A lot of these products are in the performance coatings group, which is 18% of revenue. The other commercial segment is the specialty products group which sells specialty wood treatments, wood coatings, powder coatings, even nail polish and enamel products, but also food coatings. This is about 12% of revenue.

The only segment that really sells to end-consumers directly is the consumer group segment, which contains a lot of tile sealants and other coating products for DIYers. Some of these brands are well known, and you’d find them at your local hardware stores.

Operating Groups (Investor Presentation)

About 30% of revenue comes from abroad, and in particular the CPG segment is exposed abroad. Organic growth was 16% and it would have been 4% higher were it not for FX headwinds. This was the only segment that saw margin decline. This was in part due to strikes in Canada but also macroeconomic pressures from Europe as well as inflationary and procurement issues. Segment EBIT declines 5%.

In every other segment, we saw about a 75:25 split between pricing driven revenue growth and volume. PCG grew 19% apparently driven by reshoring of manufacturing in the US, which required construction by their customers. SPG grew 11% thanks to a slow burn from working through backlog now that semiconductor supplies have come back, and the consumer group grew 24%. The growth in the consumer group was particularly strong due to the acquisition of new plants that were meeting pent-up demand, specifically the Corsicana plants in September 2021. This greater supply of downstream resins has superpowered the current growth and likely will not be repeated.

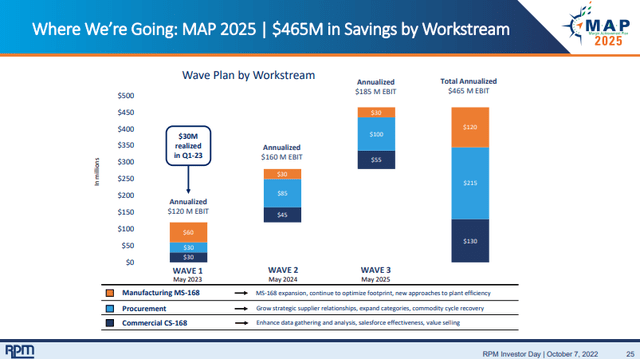

All other segments saw double digit EBIT growth, with consumer showing triple digit, and this amounted to the total 33% EBIT growth of the company. The reason for this was the successful progress of the MAP cost improvement programme. Targeted savings are about $465 million annualised, which is almost 6% of revenue. The full realisation should come by 2025. It will progress in waves and create a secular push for earnings growth.

Cost Improvement Programme (Investor Presentation)

Remarks

The MAP is an important note, because it explains in part the RPM premium. EBIT will grow about 50% just from margin expansion, excluding the effects that are driving sales including pricing ahead of inflation as well as volumes. On a forward multiple basis that would assume about a 12x EV/EBITDA multiple assuming no revenue growth. The lack of volume growth would be consistent with the current macroeconomic environment. Even within waterproofing, which is the more recurring segment, volumes are expected to decline. Where home prices are falling over 15%, we can expect that development environment to fall out in residential to put pressure on contractors. Energy markets have been strong, as have some strategic markets like onshoring of capacity, but in general the pressure is there on these construction-related segments. We should note that pricing growth should continue as pricing usually lags outside of consumer by half a year.

Still, compared to Nordic Waterproofing which trades at a 7x EV/EBITDA, RPM looks to be overvalued, especially when Nordic doesn’t have some of the more cyclical construction exposures that RPM has. RPM is not cheap, and where lots of building products companies have been ruined in their stock prices by the current market, RPM seems to be an exception. MAP will help grow EBIT regardless, but the current multiple bakes that in into forward, 2025 figures, when MAP is fully realised. Overall, it’s not cheap enough.

Be the first to comment