kyletperry

Going into the end of the year, many investors look to reevaluate their portfolio and their holdings. I have spent the last couple of weeks taking a look at my holdings, and I have made a couple of changes in the last month. One of the major changes was deciding to sell my position in Magellan Midstream Partners (MMP). I still like the company, but I like Enterprise Products Partners (NYSE:EPD) even more. Today’s article will be covering the reasons that Enterprise is my largest position, and I’m still holding onto every unit.

Insider Ownership

While it should seem obvious that high insider ownership leads to a management that is aligned with shareholders, I think it is a factor that is commonly overlooked in today’s stock market. Enterprise’s management currently owns 32% of the outstanding units, so I think it’s safe to say that they will act in the best interests of their investors.

While that may seem obvious, I wanted to do some quick back of the napkin math to make it crystal clear to readers why I think they can trust Enterprise and their management team. Enterprise currently has a market cap of $54B. Management owns 32%, or approximately $17B, of the company’s units. With a 7.6% yield, that means management is cashing in well over a billion each year in distributions. It’s safe to say that should incentivize them to keep hiking the distribution at a solid clip, in my view.

A Large and Growing Distribution

There aren’t many places investors can find a yield over 7% that has been hiked for 24 years in a row. While MLPs are typically considered yield investments, many have had to cut distributions due to ill-advised acquisitions and too much leverage. Enterprise also has one of the best coverage ratios in the industry at 1.8x. This should provide them with plenty of room to continue to hike in the future.

To be honest, this was a big factor for me in why I chose to sell Magellan and hold onto every unit of Enterprise. Magellan has a long streak, but the distribution growth was slower, and the coverage ratio was much tighter. I think we will see continued distribution raises for the foreseeable future for Enterprise on top of the already juicy 7.6% yield. The other reason I chose to stick with Enterprise is the cheap valuation.

Valuation

Not only is Enterprise more attractive on the distribution front than Magellan in my opinion, but it also has a valuation that is a couple of turns cheaper. Magellan is still cheap at 9.8x cash flows, but Enterprise is even cheaper. Enterprise sits at 7.2x cash flows today, which is an absolute steal. There aren’t many cheaper options out there (Energy Transfer (ET) comes to mind), but Enterprise is the best option in my mind when you look at other factors like insider ownership and management.

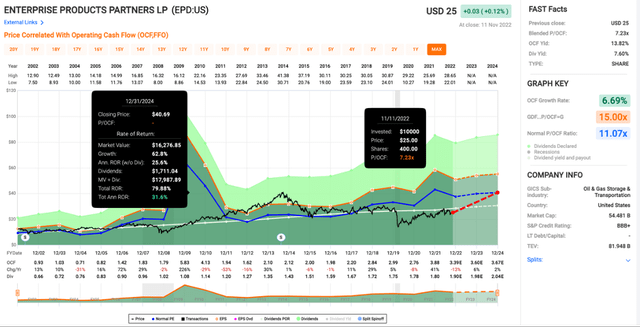

Price/Cash Flow (fastgraphs.com)

While the 7.6% yield gets you most of the way to a double-digit return, I think the potential for multiple expansion is what could lead to truly impressive returns. Over the last two decades, units have averaged an 11.1x cash flow multiple. Even if the valuation only expands to a 10x multiple, that will put units in the mid-$30 range. If the estimates are accurate, and we see a return to the normal 11.1x multiple, that will put units at $40. I try not to get too excited when it comes to the companies I own because emotions are the enemy of logic and reason, but I do think Enterprise is likely to provide an attractive mix of income and capital gains over the next couple of years. One of the things that could help with a return to a normal multiple is the increase of the unit buyback program.

Increasing Buybacks

Enterprise hasn’t been all that interested in buying back units in the recent past. During Q3, they repurchased 3.9M units for $95M. This brought the total YTD to 5.3M units for $130M. While this seems like a tiny buyback for a company with a market cap of $54B, my guess is that we will see buybacks start to increase in the coming quarters, especially if management doesn’t find any attractive acquisition opportunities like they did with Navitas earlier this year.

While many companies have gone overboard with their buybacks in recent years, I think that management has shown impressive restraint when they could have plowed more into buybacks. Ideally, they would have been more aggressive with buybacks after the COVID selloff, but hindsight is 20/20, so it’s hard to gripe about it too much. Moving forward, I would guess that Enterprise will buy back anywhere from 0.5% to 1% of the outstanding units, giving investors a small capital return bump on top of the juicy distribution.

Conclusion

Even after selling Magellan, my portfolio is still overweight in the midstream sector, a position I don’t mind at all in these turbulent markets. In my view, Enterprise is the best risk/reward proposition in the entire sector, even after a solid performance YTD in a down market. When it comes down to it, there are four main reasons I like Enterprise enough to make it the core holding of my portfolio. The first is insider ownership. To put it bluntly, management owns enough units where I feel confident they’re aligned with me.

Throw in a 7.6% yield that is growing consistently (and has plenty of room to grow with the coverage ratios) and a 24-year growth streak, and I like my chances to collect growing distributions for years to come. Units are still too cheap at 7.2x cash flows, and I’m expecting we will see some multiple expansion in the next couple of years. Add in a buyback program that is poised to grow, and Enterprise ticks all the boxes for me. I plan to hold these units for a long time, and if the opportunity presents itself, add to my position in the future. While many say that low-risk/high-reward opportunities don’t exist, I think that is exactly what Enterprise is today, which is why it is my largest position.

Be the first to comment