Michael Vi

Thesis

Palantir Technologies Inc. (NYSE:PLTR) bears were taken by surprise last week as the market forced a steep post-earnings selloff before erasing its initial post-earnings losses.

Accordingly, PLTR continued to be supported along its long-term bottom, as we highlighted in our previous article. Hence, bears who tried to anticipate a breakdown of its May lows were sorely disappointed, as the market forced them to flee rapidly as it reversed PLTR’s selling pressure.

Our analysis suggests that the market remains tentative over a material re-rating of PLTR. As such, investors expecting a significant upward move to regain PLTR’s bullish bias need to be patient.

In addition, given PLTR’s growth premium, we believe the market could be parsing whether management could improve its growth cadence through FY24, given the notable deceleration in FY22.

Maintain Buy.

Palantir Needs To Justify Its Growth Premium

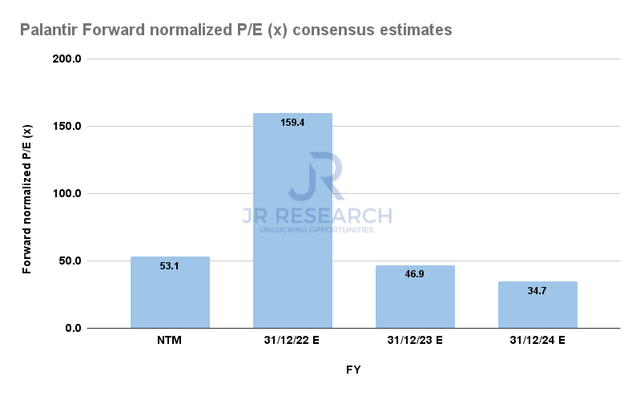

PLTR last traded at an NTM normalized P/E of nearly 55x, well above its software peers’ median of 26.2x (according to S&P Cap IQ data). It’s also well above the S&P 500 software industry forward P/E of 25.5x.

Hence, there’s little doubt that PLTR is still priced at a substantial premium, behooving the company to demonstrate robust growth to justify its valuation.

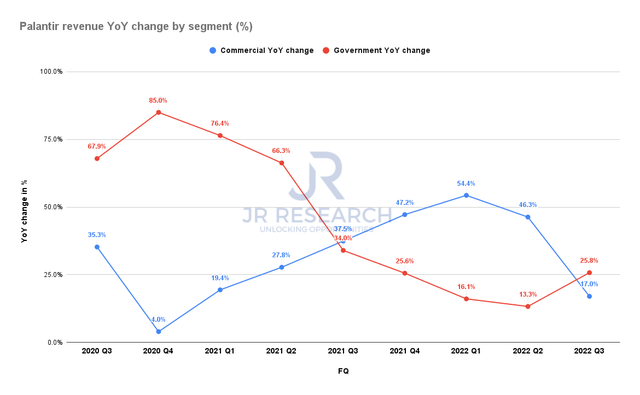

Palantir Revenue by segment change % (Company filings)

However, Palantir likely disappointed investors as its growth cadence continued to slow in Q3. As seen above, Palantir’s commercial revenue increased by just 17.8%, down significantly from Q2’s 46.3%.

However, its government revenue improved from Q2’s 13.3%, with revenue growth of 25.8%.

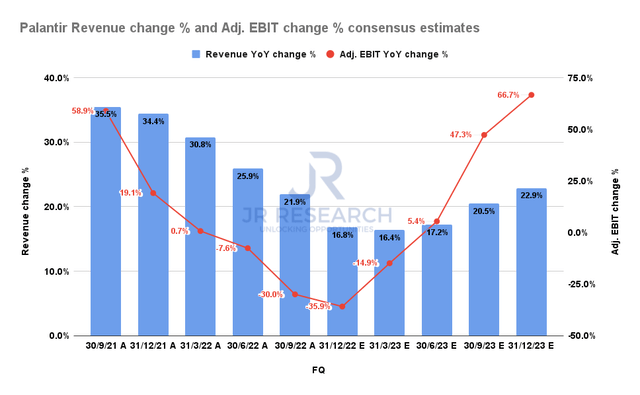

Palantir Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

Accordingly, Palantir is expected to post revenue growth of just 16.8% in FQ4, with adjusted EBIT declining by nearly 36%. Notably, Palantir’s operating metrics are projected to bottom out in FQ4 before recovering through FY23.

Furthermore, the company’s revised guidance was much better than the previous Street projections in September when we last updated. Hence, it was pretty surprising that the market sent PLTR into an initial post-earnings selloff following its Q3 release.

PLTR forward earnings multiples consensus estimates (S&P Cap IQ)

However, we believe that the market remains concerned over the growth premium embedded in its valuation. Despite the potential for a significant earnings recovery through FY23, the market could reflect increased execution risks through the worsening macroeconomic outlook.

Notwithstanding, we believe the Street estimates have likely been de-risked, as Wall Street remains neutral on PLTR. However, for PLTR to justify an FY24 earnings multiple of nearly 35x requires robust execution by management.

We still see the potential for re-rating at the current levels, as its peers in the Software ETF (IGV) have a weighted average P/E of 39.5x, with much lower forward earnings growth of 6.9%.

Hence, we postulate that PLTR could be re-rated if the market anticipates that CEO Alex Karp & team could execute well over the next couple of years. But, for now, PLTR is still likely to trade within a tight range undergirded by its long-term bottom.

Is PLTR Stock A Buy, Sell, Or Hold?

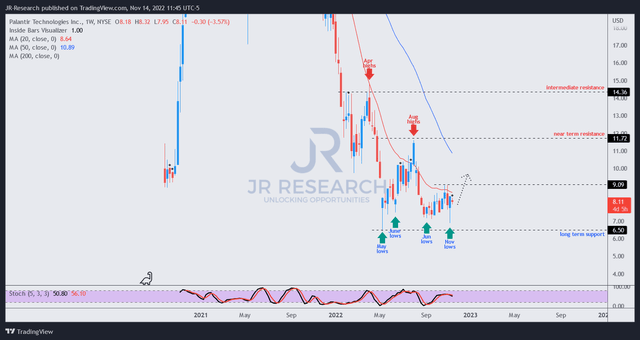

PLTR price chart (weekly) (S&P Cap IQ)

As seen above, PLTR held its November lows robustly, as buyers returned to prevent sellers from threatening its May lows last week, post-earnings.

As such, we postulate that PLTR should continue its consolidation zone along the current levels. Therefore investors can consider deep pullbacks toward its May lows to add exposure, as it has held firmly over the past seven months.

However, we believe a re-rating of its August highs is unlikely without a broad re-rating of its SaaS peers. Also, the need for PLTR to retake the $9 level is critical to sustaining its recovery.

Investors should be prepared for further near-term downside volatility if the buyers continue to find significant challenges to lift PLTR’s momentum above that zone. Accordingly, investors should layer in over time to capitalize on PLTR’s downside volatility, improving their cost basis.

Maintain Buy.

Be the first to comment