Justin Sullivan/Getty Images News

GameStop (NYSE:GME), which once grabbed every headline and became an iconic meme stock, is slowly approaching the inevitability that its business model needs to change to turn a profit. Putting aside what made GME attractive to retail investors, the financials tell the story of a company that is unlikely to repeat its share appreciation success. On September 8th GME gained traction as shares jumped 6.6% premarket after announcing a partnership with FTX. Just 2 months later, FTX filed for bankruptcy, and what was looked at as a favorable partnership absolutely imploded. Split adjusted GME is trading -70% from its 2021 highs and is down -58.60% YTD. I do not see a path back to profitability, and its shares look overvalued for a company that is burning cash and has only had 1 profitable quarter over the past 10 quarters. GME could prove me wrong by overhauling its business model and fortifying its revenue stream, but in the age of digital downloads, I think the deck is stacked against them.

GameStop and FTX

The GME and FTX partnership stirred up some interest in September as GEM announced that it had entered into a partnership with FTX. The partnership would introduce GME customers to FTX’s community and its marketplace for digital assets. While GME would collaborate with FTX on its e-commerce and online marketing activities, GME would also carry FTX gift cards at their physical locations. At the time, FTX had tremendous momentum, and GME was tapped as FTX’s preferred retail partner in the U.S. The financial terms weren’t disclosed, but the deal certainly excited GME’s shareholder base. Fast forward 2 months, Sam Bankman-Fried stepped down as FTX’s CEO, and FTX filed for bankruptcy. GME is now ending its relationship with FTX and, in a tweet, stated that it would provide refunds to any impacted customers.

The ramifications of the FTX saga won’t be known for some time, and new information seems to be coming out each day. GME is still moving forward with its digital direction as GameStopNFT celebrated the launch of ImmutableX on @GameStopNFT and ran a limited-time promotion where its fees for both sellers and buyers amounted to 0.1%. While NFTs and many cryptocurrencies grabbed countless headlines, 2022 hasn’t been a stellar year for them. The recent implosion of FTX could prove to be an additional blow to GME’s strategy, as its implications could be widespread. If this was GME’s grand plan to expand its business segments and forge a path back to profitability, I wouldn’t be too optimistic. There is a possibility that the implosion of FTX will come under severe scrutiny from lawmakers as the entire crypto and NFT sector could be modified through countless regulations.

GameStop is burning cash, and its numbers don’t provide a path to profitability.

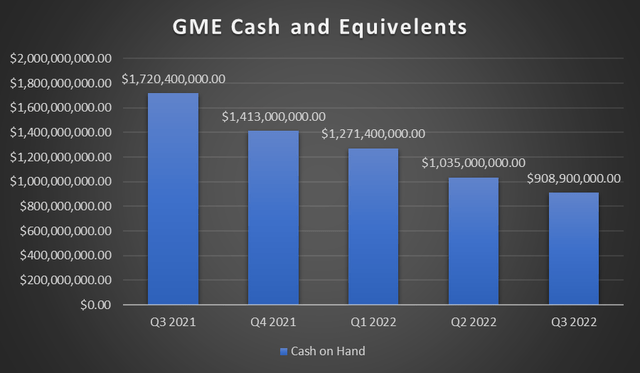

GME’s financial statements are a disaster, and I do not see a reason to be optimistic. All of the numbers I will review are split-adjusted. Starting with the balance sheet, GME issued more shares in Q2 of 2021, as their outstanding shares increased from 277.2 million to 300 million. This allowed GME to increase its total cash on hand from $694.7 million to $1.41 billion. Over the next 4 quarters, GME has burnt through $811.5 million in cash as its cash on hand declined -47.17% from $1.72 billion to $909 million. GME’s average burn rate is currently $202.88 million quarterly over the past year.

Steven Fiorillo, Seeking Alpha

GME has $3.01 in cash per share, and its tangible book value is $4.44 per share. Shares of GME trade at $26.01, which is a 587.84% premium on its tangible book value per share. One of the bright spots on the balance sheet is that GME has minimal debt. Only $32.1 million of long-term debt is on the balance sheet, with $8.9 million due as a current liability. Stripping away GME’s liabilities from its assets, $1.34 billion of equity is left on the balance sheet. GME trades at a $7.9 billion valuation, which is a 588.76% premium on its total equity. Regardless of my opinion on this valuation, GME continues to burn cash as it is not profitable. Every quarter that GME burns additional cash without diluting shareholders through issuing shares, GME’s cash per share, book value, and total equity will decline, and this could directly impact GME’s share price.

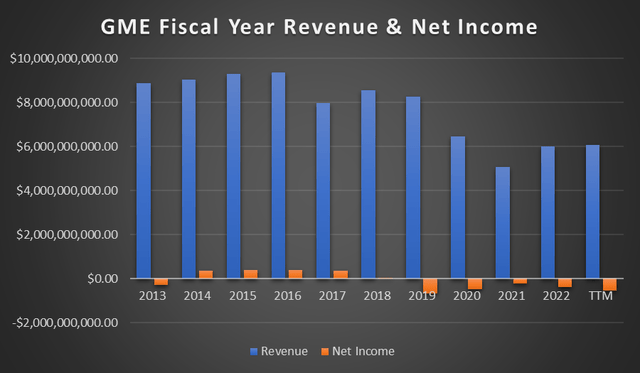

GME has only had 1 profitable quarter over the previous 10 quarters, as they generated $80.3 million of net income in Q1 of 2021. Over the past 10 quarters, GME has lost -$863.2 million after generating $13.61 billion in revenue. The bottom line is that GME hasn’t figured out a way to turn around its business model, and in the last holiday season, GME’s quarterly net income came in at -$147.5 million. GME’s problems started before the pandemic, and looking at the numbers on an annualized basis, GME lost -$673 million in 2019. Over the past 5 years, GME has generated $31.92 billion in revenue and lost -$2.26 billion. These numbers do not indicate that GME has established a road back to profitability. Even if GME turns the ship around, they were a low-profit business before its troubles. From 2014-2018, GME was profitable as it generated a total of $1.54 billion in net income, but this came out to a slim profit margin of 3.48% from the $44.21 billion in revenue GME generated over this period.

Steven Fiorillo, Seeking Alpha

The data indicates that the video game industry is going digital, which is bad for GameStop

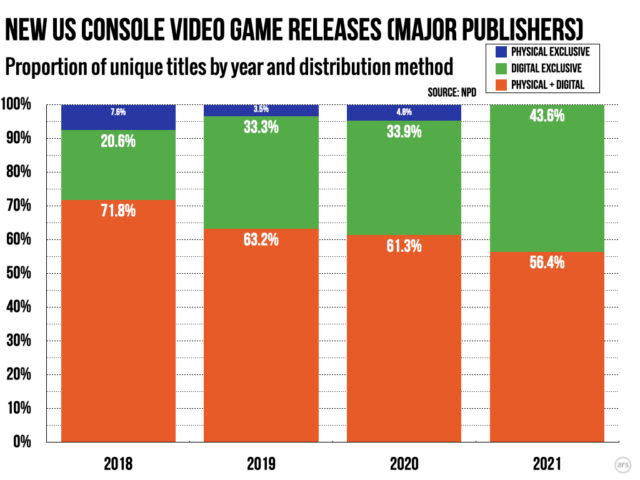

Physical games have been GME’s bread and butter as they not only get people in the store upon release dates but also create the massive secondary market that GME specializes in. It’s not a hard equation, when more physical games are sold, it increases the probability of the number of customers who will pass through GME’s doors to sell or trade their physical games increases. As the sale of physical games declines, there is less physical material to sell back or trade for other titles, which is a problem for GME. Without a massive secondary market, there becomes less of a reason for customers to enter a GME store.

In 2021, there were 978 unique titles for distribution via digital vs. 167 physical for PlayStation and 726 digital vs. 123 physical for XBOX. Both systems have seen their physical title titles decline YoY since 2018, and when you look at GME’s losses, they haven’t been profitable since 2018. The most interesting statistic to me is that 2021 was the first year that there wasn’t a single physical exclusive release from a major video game publisher. Within the sector, 43.6% were digital exclusive, and 56.4% were a combination of physical & digital distribution methods.

ARS Technica

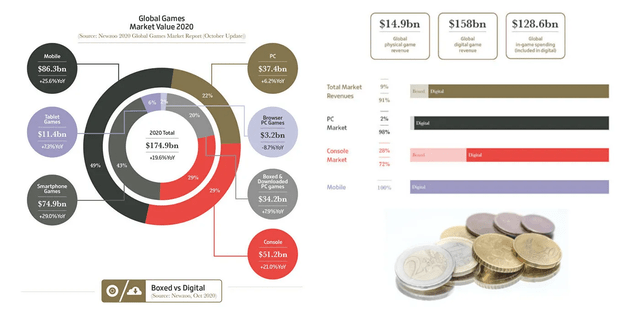

In 2020, the video game industry generated $174.9 billion in revenue; only $14.9 billion came from physical game sales. The snapshot of console sales tells an alarming story as 72% of the $51.2 billion in sales were digital-based systems without an optical disk drive. The trends indicate that the video game industry is going digital, and more gamers are opting for digital systems, which are rendering the relevancy of physical games obsolete.

Conclusion

I think that shares of GME are overvalued, as its main asset of cash continues to decline. GME has utilized enthusiasm for its shares to its benefit and eliminated a large portion of its debt while strengthening its balance sheet. The problem that I see is that GME has only bought itself time and hasn’t figured out a way to compete in an industry that’s going digital. GME’s financials do not indicate there is a path back to profitability, and each quarter of burned cash decreases its equity and book value which could negatively impact its share price. Until GME can show a path not just to profitability but a plan to gain market share and monetize its brand in a new era for gaming, I would be concerned that all GME is doing is delaying the inevitable.

Be the first to comment