Mar Fernandez Navarro/iStock via Getty Images

SNDL Inc.’s (NASDAQ:SNDL) fiscal 2022 third quarter earnings came on the back of several acquisitions carried out in a year whose main highlight has been a broad collapse of valuations, sentiment, and hope across the cannabis industry. The year-to-date transformation of the company has seen it change its name from Sundial, engineer a 1-for-10 reverse stock split, and close the acquisition of competitor Alcanna. SNDL is not standing still. The company swept up Valens (VLNS) in an all-stock deal worth C$138 million, entered and then closed a stalking horse offer for the assets of bankrupt cannabis retailer Superette Ontario, and most recently bought Zenabis, a Vancouver-based low-cost indoor cultivator that also went bankrupt.

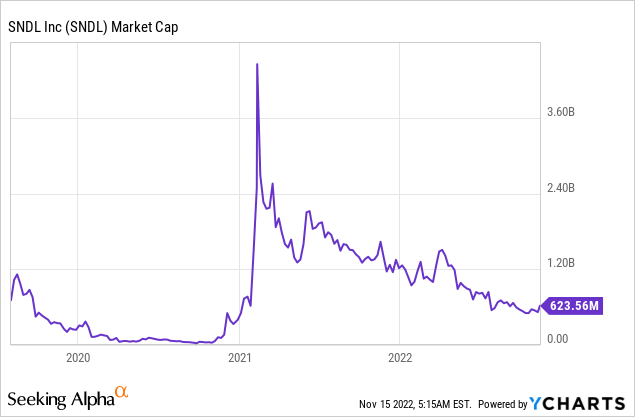

The intense consolidation of a sector that once flew above the sun has been an unfortunate but expected outcome of the material hype that preceded the now infamous October 17, 2018 start date for recreational Canadian cannabis sales.

Dreams of a large and fast-expanding international total addressable market (“TAM”) that would give rise to a breed of agile companies set to challenge not only the stalwarts of pharma but multinational alcoholic beverage firms have turned dark. The TAM was overestimated and Canadian black market sales initially proved too sticky. The country’s regulatory environment has also been too burdensome and broadly averse to permitting the type of operational gearing that supports sustained profitability for a large number of operators.

SNDC’s Revenues Surge Ahead With Profitability In View

SNDL’s fiscal 2022 third quarter earnings were published yesterday and saw the company realize revenue of C$223.7 million. This was a material 1,500% increase from the year-ago quarter and was driven by the Cannabis Retail segment bringing in revenue of C$66.2 million, a 985% increase over the year-ago quarter. SNDL’s transformative C$320 million purchase of Alcanna, Canada’s largest retail liquor chain, was closed earlier this year. This gave the company a majority interest in Nova Cannabis’ Value Buds retail sales network to drive revenue higher for the quarter.

The company’s Liquor Retail segment brought in revenue of C$152.5 million, a year-over-year growth of 1%. Cannabis Operations grew by 49% year-over-year to reach C$11.8 million. This was all set against a net loss for the quarter that grew markedly to reach just under C$100 million. However, this was mainly constituted by an exceptional non-cash impairment charge of C$86.5 million. SNDL is actually profitable and generated an adjusted EBITDA of C$18.3 million which was up by 169% sequentially. This drove a record positive operational cash flow of C$8.6 million, up from a loss of C$17.9 million in the prior quarter and an even larger loss of C$56.2 million in the year-ago quarter.

Hence, SNDL clearly has its eye on the bud in regard to its consolidation strategy. This will play a mission-critical role in this stage of the cannabis corporate collapse. It will form a tool to expand revenue, competitive moats, and geographical reach.

There remains a risk that SNDL repeats the same mistakes as some other players like Aurora Cannabis Inc. (ACB) by doing too much too quickly to the detriment of its balance sheet. But the company held cash and equivalents of C$988 million and no outstanding debt.

The Immense Collapse

Cannabis is likely to enjoy some level of demand inelasticity in a recession. This places SNDL in a good position as the broader macroeconomic context deteriorates. To be clear, the company cannot afford to overburden its balance sheet with too many loss-making entities as the capital market conditions dry up. But SNDL has a fortress balance sheet and has not had to raise cash through a share offering since the summer of last year. The collapse of cannabis companies has reached a crescendo and the ongoing consolidation will prove to become a watershed moment in the years ahead.

The benefits of consolidation for SNDL are not immaterial. For example, the synergies from the Valens buyout will see the company boost its overall cannabis market share to 4.5% to become a top 10 player. It will also deliver around $10 million of annual cost savings for the combined entity to help drive upwards of $15 million of additional EBITDA on an annual run-rate basis when aggregated with other initiatives.

The industry is consolidating, and SNDL now finds itself as a key player with a balance sheet able to capitalize on bankrupt companies still with great assets. The previous high level of competitors was never going to work. SNDL now has a generational opportunity to likely buy assets for discounts to their fundamental value whilst exercising restraint on cost and aggressively chasing synergies to build value for its embattled common shareholders. SNDL is one to watch until the uncertainty and risk around just how much synergies it can realize can be ascertained in future quarters.

Be the first to comment