imaginima/iStock via Getty Images

Article Thesis

Oil and oil-related equities have performed well in the recent past. The macro picture has been helpful, as oil prices have risen to multi-year highs. At current commodity price levels, many oil producers will be extremely profitable – compared to that, some are still a pretty good value. In this report, we’ll highlight a couple of attractively-priced oil equities, with Canadian Natural Resources (NYSE:CNQ) being our top pick.

Oil Macro Picture

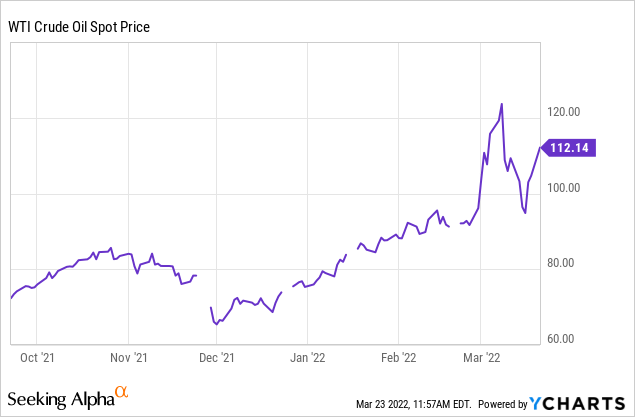

The current Russia-Ukraine war has made oil prices jump well above $100 per barrel. WTI is trading for around $115 per barrel at the time of writing, but prices have been very volatile, moving by several dollars in a single day over the last couple of weeks.

Even before the current crisis, oil prices were pretty high and the macro picture was compelling. In mid-February, oil traded in the low $90s, which was the highest level seen since 2014. The current war has thus not lifted oil prices from a low level to a high level. Instead, the Russia-Ukraine war has lifted oil prices from an already relatively high level to an even higher level.

Oil prices were trading above $90 per barrel prior to this crisis because of strong fundamentals. Economic reopening around the world has resulted in a steep demand uplift. At the same time, energy companies around the world have invested reluctantly for many years, since 2014’s oil price crash. The very weak oil prices during the initial phase of the pandemic further amplified the reluctance to spend on new projects. Due to strong oil demand and weak supply growth, the macro picture for oil has thus been positive even before the Russia-Ukraine war.

In this environment, oil companies are highly profitable. This is the case with oil in the $80 or $90 range, and even more so the case with oil trading well north of $100 per barrel.

1: Canadian Natural Resources

Canadian Natural Resources is an oil sands player in Canada. The company’s assets have a very long reserve life and low decline rate, and low proportional costs. Setting up an oil sands mine is quite costly, but once these high initial costs have been paid, the asset is a low-cost cash flow machine for many years. Canadian Natural Resources has set up these assets in the past, which means that investors can enjoy the benefits of these low-cost, low-decline assets going forward.

Even before the recent steep increase in oil prices, CNQ was a cash flow monster. During the fourth quarter, CNQ generated free cash flows of around C$2.9 billion. This is equal to around US$2.3 billion. CNQ was thus operating with a free cash flow run rate of more than $9 billion during Q4 – when oil prices were way lower than today:

We see that WTI mostly traded around $80 in Q4, with prices in the $60s in early December. The average for the fourth quarter thus was somewhat below $80 per barrel, and yet CNQ generated massive cash flows. In 2021, oil prices are way higher, on average, so far. On top of that, CNQ has guided towards production growth of a couple of percentage points this year. Between production growth and oil price tailwinds, CNQ’s annual free cash flow should climb by several billion dollars this year, relative to the Q4 run rate. I estimate that free cash flow would total around US$15 billion a year if oil were to average $100 for the whole year. It is not certain whether oil will be this high for the entire year, of course. But it seems likely that oil prices will remain above the high-$70s level seen in Q4, which should lead to free cash generation well north of $9 billion this year, especially once we account for the expected production growth this year.

Since CNQ is valued at just $72 billion today, the valuation is highly attractive. At the Q4 run rate, CNQ offers a free cash flow yield of 13% and trades at a free cash flow multiple slightly below 8. Considering the macro tailwinds from higher oil prices, that seems highly attractive. The company has deleveraged its balance sheet in recent years and is now forecasting that a larger portion of free cash flows will be used for shareholder returns, compared to the past.

Management has thus raised the dividend by 28% in March, which is one of the largest dividend increases both in the company’s history and compared to what other major oil producers have offered in recent years. The new dividend, which yields 3.8%, is covered at a 3.4x rate at the Q4 free cash flow level, whereas the coverage rate is 5.5x based on my free cash flow estimate in a $100 oil price scenario. Clearly, CNQ has ample surplus free cash flow even following this huge dividend increase. More deleveraging will likely be a result of that, but the company also plans to buy back shares aggressively. The company’s current buyback authorization allows Canadian Natural Resources to buy back 102 million shares, equal to around 10% of the company’s share count. Depending on the average oil price this year, CNQ might be able to complete the entire program in a single year. For reference, CNQ bought back around 5% of its shares last year, when oil prices were considerably lower than they are right now. To me, this indicates that investors can expect a hefty buyback yield going forward, as long as oil prices remain at attractive levels of $80, $90, $100, or even more.

2: Exxon Mobil

Exxon Mobil (XOM) is one of the largest integrated oil companies in the world. Despite its market capitalization of $350 billion, shares aren’t expensive at current prices, however. The company generated $31 billion in free cash in 2021, which equates to a free cash flow yield of around 9% at current prices. This does not yet account for the fact that 2022 will most likely be a considerably stronger year than 2021. Production growth from low-cost assets such as the Permian Basin or XOM’s Guyana assets, as well as significantly higher commodity prices should lift Exxon Mobil’s cash generation substantially this year.

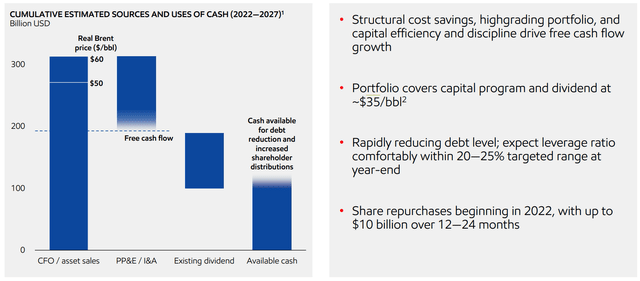

In the above chart, we see that XOM indicates that its dividend and capital program are safe with oil trading as low as $35 per barrel. With oil trading at $60 per barrel, XOM would generate free cash flows of around $200 billion in 2022-2027, or slightly more than $30 billion a year. Oil prices are currently around $55 higher than the price per barrel Exxon Mobil used in the above estimate. Using some back-of-the-napkin math, XOM, with liquids production of around 2.4 million barrels a day, could generate free cash flows of $60 billion a year with Brent at $100 per barrel. Today, the price is considerably above that level, which indicates even higher cash flows. In a $60 billion free cash flow scenario, XOM would be trading with a free cash flow yield of 17%, which shows the stock’s potential if oil prices remain high.

3: BP

BP (BP) is another supermajor that trades at a very inexpensive valuation and should generate massive free cash flows this year.

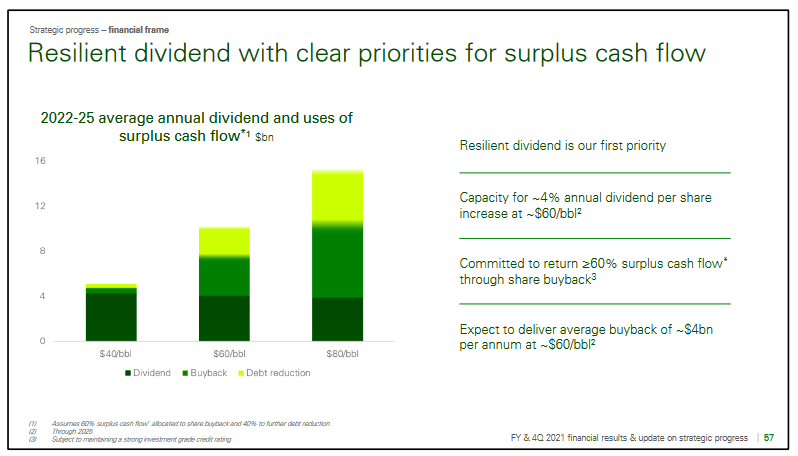

BP presentation

In the above chart, we see the free cash generation outlook for different oil price scenarios. The most aggressive one uses a Brent price of $80 per barrel – at the time of writing, Brent is trading at $119. With oil at $80, BP would generate around $15 billion in free cash a year, with capital expenditures already being accounted for. Extrapolating the forecasted free cash flow growth between the $60 per barrel scenario and the $80 per barrel scenario, I believe that free cash flows will come in around $20 billion if Brent averages $100 this year. In that scenario, which implies a reduction versus current oil prices, BP’s free cash flow yield is 20%, as BP’s market capitalization is just $100 billion today. When we consider that investments in the oil and gas portfolio, as well as investments in new energy assets are already accounted for, a 20% free cash flow yield is incredibly attractive. The dividend yield is slightly above 4% right now, the remaining free cash would be used for either buybacks or debt reduction.

Takeaway

Oil prices have experienced a jump due to the current Russia-Ukraine war. But even before this crisis, the macro picture for the energy industry was highly constructive. Underinvestment, combined with strong demand growth, could lead to a multi-year bull market for oil and oil equities.

Many oil stocks are still inexpensive at current valuations. This includes Canadian Natural Resources, Exxon Mobil, and BP. All three offer solid dividend yields, buybacks, and considerable upside potential if oil prices remain at a high level.

Be the first to comment