DuxX/iStock via Getty Images

Investment Thesis

AutoNation, Inc. (NYSE:AN) has reported strong financials with increased revenues and substantial increase in profit. In 2021, more than 50% of the company’s sales originated from its digital channels. The company continues to invest in digital capabilities, store expansions, and intends to grab more market share. The company’s plans and favorable situation creates a buying opportunity.

An Overview of the company

Fort Lauderdale, Florida based AutoNation, Inc. was founded in 1996 and operates as an automotive retailer in the United States through its subsidiaries. AutoNation provides a variety of automotive products and services, such as new and used vehicles, as well as parts and services like automotive repair and maintenance, wholesale parts, finance and insurance products, and other collision services.

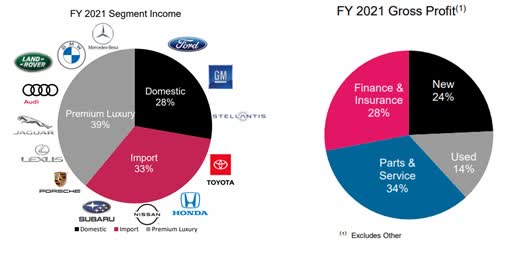

During the year 2021, the company sold approx. 90% of its new vehicles manufactured by Toyota (TM), Honda (HMC), General Motors (GM), Ford (F), Stellantis N.V. (STLA), Mercedes-Benz, BMW (OTCPK:BMWYY), and Volkswagen Group (OTCPK:VWAGY). The business is divided into three business segments: domestic, import, and premium luxury. These segments sell retail automotive brands shown in the chart below under franchise system.

AutoNation

These franchises also sell used vehicles and auto finance and insurance products and provide repair and maintenance services.

As shown in the above chart, AutoNation has a comprehensive brand position with a diversified portfolio which provides customers a broad range of brand/product selections. The company has a comparative high-income mix of 39% in high margin premium luxury segment.

AutoNation generates 38% of gross profit from vehicle sales while finance and insurance contribute 28%, and parts and service contribute 34% of gross profit.

Industry Factors

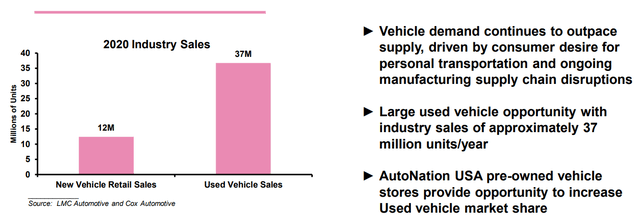

The total market size of new vehicle sales in the US was 15.1 million units in 2021, 14.6 million in 2020, and 17 million in 2019. In 2021, the demand for new vehicles was strong due to low interest rates and customers’ desire for personal transportation. However, inventory shortages, caused by component shortages and disruptions in the manufacturers’ supply chains, had an adverse impact on new car volumes.

A global shortage of computer chips due to the Covid-19 pandemic has slowed auto manufacturing, fueling a price increase for used vehicles. In fact, the demand for used cars is so high that many owners are getting more price for their used cars than what they bought it for! It seems that this trend may sustain for a while.

Competitive Environment

AutoNation operates in a very competitive industry. There are approx. 16,700 franchised dealerships in the US, which deal both in new and used vehicles.

New vehicle unit volume has been impacted by reduced availability of inventory due to supply chains disruptions. The company expects new vehicle inventory shortages to persist in 2022.

Price, selection, location, service and online and mobile offerings are the primary competitive factors in the automotive retail industry. AutoNation’s competitors include Carvana (CVNA) and CarMax (KMX).

Competitive Advantages

With an 83% brand awareness, AutoNation is America’s top-rated automotive retailer. Used vehicles are competitively priced and come with a 5-day, 250-mile money-back guarantee, a limited warranty, and store-to-door delivery options. AutoNation’s development in the United States offers a promising chance for growth and capturing a larger share of the used vehicle market. The company is focusing on digital capabilities to drive cost efficiencies and capture market.

In November 2021, the company acquired Priority 1 Automotive Group, Inc. with 410 new employees, and adding $420 million in annual revenue.

Financial Performance

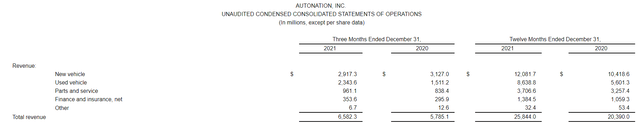

In Q4 2021, the company’s revenue was $6.6 billion, up 14% from the same period in the previous year. Net income increased by 156% to $387.1 million in Q4 2021 compared to the last year. The gross profit per vehicle for the new vehicle retailed increased substantially by 132% to $6,450 from $2,775 compared to the year-ago period primarily due to strong demand and reduced availability of new vehicles.

For the year 2021 revenue was up 27% to $25.8 billion from the last year. Net income increased by 260% to $1.37 billion in 2021 from $381.6 million for the year 2020.

AutoNation repurchased 3.1 million shares of common stock for an aggregate purchase price of $382 million in the fourth quarter of 2021. As of February 15, 2022, AutoNation’s remaining board authorization for share repurchases was roughly $776 million. AutoNation had around 62 million outstanding shares as of February 15, 2022.

Growth Prospects

AutoNation Group is a major automotive retailer in the United States. The company owns and operates 339 new vehicle franchises from 247 stores in the US and sells 33 different new vehicle brands.

AutoNation sees a massive opportunity in the used vehicle industry of 37 million annual unit sales. The company has shown strong sales performance of 26% increase for the year 2021, compared to the prior year period. It is planning to expand its used vehicles business.

As of December 31, 2021, the company has 9 AutoNation USA used vehicle dealerships, 57 AutoNation-branded collision centers, 4 AutoNation-branded automobile auction operations, and 3 parts distribution centers.

The company established its ninth used vehicle dealerships AutoNation USA store in Phoenix, Arizona, in November 2021, and its tenth AutoNation USA store in Charlotte, North Carolina, recently. Over the next 12 months, the company expects to open 12 more stores.

AutoNation has focused its capital investments on possibilities with the best return on investment and expand its geographic footprint and gain market share in the used market. It intends to establish around 130 new AutoNation USA used vehicle dealerships by the end of 2026.

The company has a long-term target to retail more than 1 million units per year.

Valuation

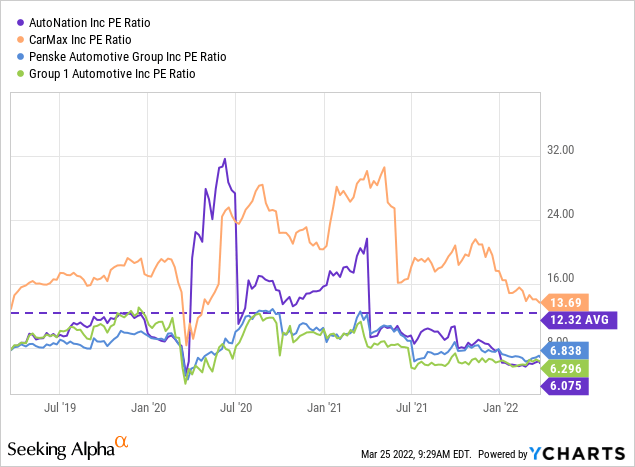

AutoNation stock is trading at an attractive valuation compared to its top peers. Its P/E ratio of around 6 is the lowest among its peers.

Moreover, the stock’s P/E ratio is also lower than its historical average level of 12.3. It is worth noting that the lower P/E is due to the higher earnings that AutoNation generated lately. The high growth rate may not maintain in future when chip and supply chain shortage issue is resolved.

Still, there are several growth drivers, as discussed above that can boost AutoNation’s growth.

Seeking Alpha’s proprietary quant ratings rate AutoNation stock as “Hold.” While the stock is rated high on valuation, profitability, momentum, and revisions, it is rated low on the Growth factor.

Risk Factors

- AutoNation operates in a highly competitive industry which requires the company to provide best services, focus on sales and marketing, and continuous digital upgradation.

- AutoNation faces risks from the high growth of online and mobile platforms that consumers are preferring. Even though AutoNation is investing heavily in digitalization, it may fall behind newer platforms and players in this growing segment.

- The company may not enjoy higher prices as it did in the past when the pandemic and chip shortages boosted prices of used cars. This may hurt its growth rate once the shortage is resolved.

Conclusion

Despite the intense competition in the industry, AutoNation has generated impressive revenue and profit in the fourth quarter and full year. The company’s professional team, digital capabilities, selection of vehicles, and strong demand has played a major role to achieve this performance. It is investing heavily in growth and digitalization that should fuel growth in the coming years. The stock is trading at an attractive valuation.

Be the first to comment