Mohammed Haneefa Nizamudeen/iStock via Getty Images

Company Snapshot

Agenus, Inc. (NASDAQ:AGEN), is a clinical-stage biotech firm that is attempting to make a mark in the field of immuno-oncology (I-O). AGEN’s I-O assets, which include antibody-based therapeutics, adoptive cell therapies (carried out through MiNK Therapeutics – (INKT), in which AGEN owns a 78.7% stake), vaccines, and adjuvants (rendered via SaponiQx, another subsidiary of AGEN) could potentially be used to fight cancer and immune-related diseases by activating and augmenting the immune response of the body.

Do note that as things stand, the company has no products approved for commercial sales, and its topline primarily comprises of R&D-related sales, service revenue, and royalty-related sales. Currently, AGEN and its partners (some fairly notable names, including the likes of BMS (BMY), Merck (MRK), Gilead Sciences (GILD), etc.) are also in the midst of engaging in over a dozen preclinical and clinical antibody programs.

Why Did Agenus Stock Go Up In June?

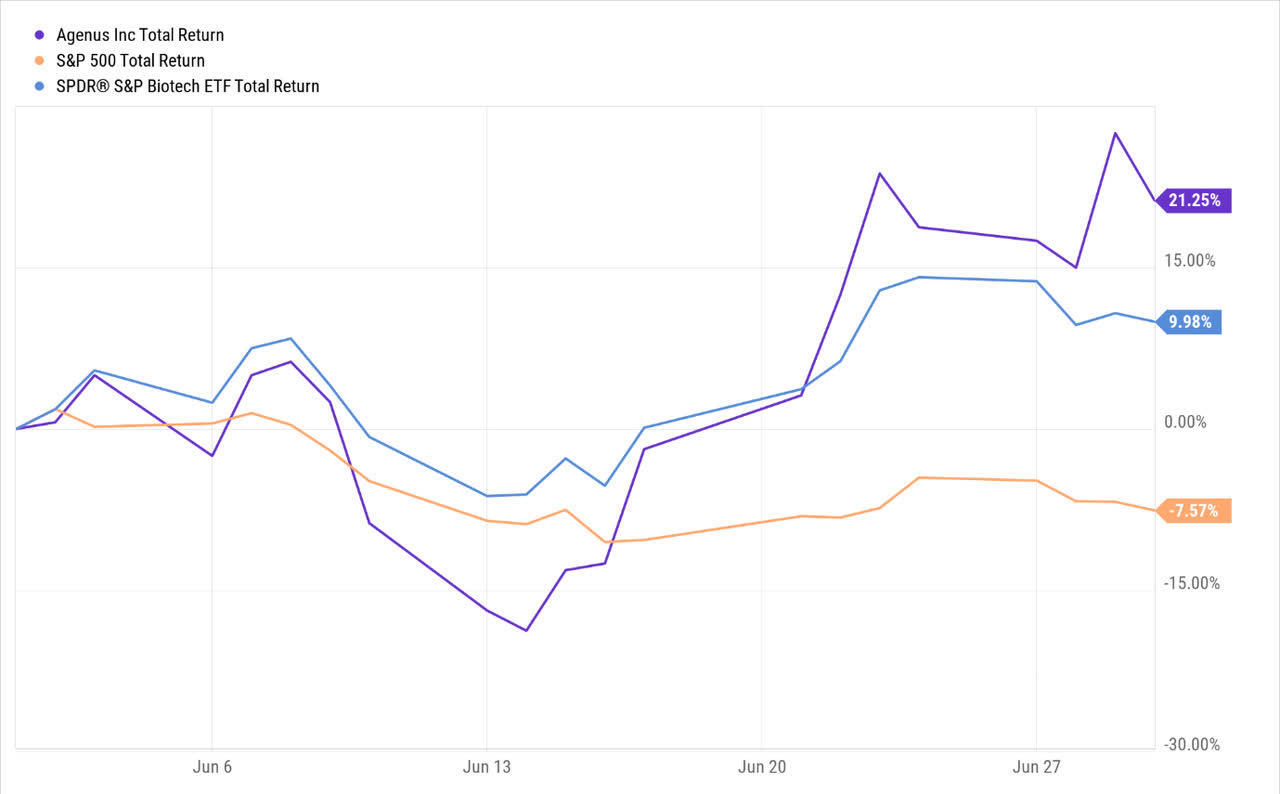

2022 has been an abysmal year for biotech stocks, with the SPDR S&P Biotech ETF (XBI) contracting by ~32% and underperforming the broader markets by 1.66x. If you thought that was bad enough, think about how poorly AGEN has fared, down by nearly 40%. Things could have been substantially worse if not for last month’s stellar performance where the AGEN stock had surged by ~21%, even as the broader markets were down by 8% or so.

In fairness, AGEN hasn’t consistently outperformed the S&P 500 or its biotech peers all through June; rather, much of this has come through in the latter half of the month, after the stock had dropped to its lowest point in 13 years. Before we touch upon the main driver of the late June outperformance, it’s important to contextualize the status quo that AGEN is looking to change.

Consider something like colorectal cancer; it is fast becoming an omnipresent phenomenon and is currently reported to be the third most common form of cancer in the world. Traditionally, immunotherapy treatments have had very limited success in treating cancers of any kind (20% success rate), and colorectal in particular, has been highly resistant to this form of therapy. 95% of colorectal cancer patients are classified as those possessing MSS (Microsatellite stable) colorectal tumors, or cold tumors which are generally unresponsive to treatment. Consequently, without effective treatment, the median expected survival range is rather low, at a little over half a year, at best.

Well, AGEN is looking to change this, and at the center of their portfolio is this anti- CTLA-4 novel compound- Botensilimab (AGEN 1181) which has the potential to end up as a blockbuster IO agent as – unlike other alternatives in the market- it can stimulate responses even in cold tumor patients. It does so by attaching itself to CTLA-4 (a protein that dampens the body’s immune response) and stimulating both the innate and adaptive branches of the body’s immune system. AGEN has been exploring the prospects of using Botensilimab, both as a monotherapy and also alongside its PD-1 antibody- Balstilimab (AGEN 2034).

In effect, developments on this front have been instrumental in driving the AGEN stock in June. AGEN recently came out with promising data on a phase 1b study that involved combining on 41 patients with cold tumors (or MSS CRC). The study showed that AGEN’s combination of Botensilimab and Balstilimab resulted in superior response rates and durability, relative to other existing immunotherapies and minimum or comparable side effects. Almost a quarter of the 41 patients responded either partially or completely to the treatment (also 50% objective responses with greater than 50% tumor reduction), whilst it was also largely tolerated with no significant adverse events.

What’s heartening about these developments is that cold tumors are not limited to colorectal cancer alone; cold tumors are also an integral part of the likes of endometrial, pancreatic (AGEN has been engaging in preclinical tests combining botensilimab and chemotherapy), and cervical cancers. If AGEN can get its act together and prove higher response rates, the scope here is enormous.

What’s The Outlook?

AGEN is currently in the process of enrolling patients for its clinical trials of the Phase 2 Botensilimab programs, for not just colorectal cancer, but pancreatic cancer and melanoma as well. AGEN intends to kickstart these trials sometime in the current quarter and to finish all three by the end of this year.

Besides that, investors should also watch out for developments with regards to AGEN 1571, an ILT2 antibody designed to attack tumor associated macrophages. The company recently procured an IND filing from the FDA and plans to engage in phase 1 clinical trials sometime this year. This would be a particularly difficult terrain to crack as there are atleast seven other peers (including the likes of Merck, Immune-Onc Therapeutics, and Jounce Therapeutics) that are involved in the development of ILT2 antibodies.

Another potential catalyst on the anvil is AGEN2373, a CD137 antibody that Agenus is developing for Gilead Sciences (until a certain option decision point after which the latter will have the option to acquire exclusive rights). AGEN2373 is believed to have a competitive edge over other alternate molecules, particularly on account of its ability to ameliorate liver-related complications. At the end of Q1, Agenus had received a $5m clinical milestone from Gilead as per the AGEN2373 option agreement but could potentially receive another $5m milestone payment, in addition to a $50m option exercise fee if all goes to plan. Longer-term, if the option is exercised this collaboration could prove to be particularly lucrative as Agenus could receive another further $520m in aggregate milestone payments, in addition to potential royalties. AGEN will also have the option to opt-in for a 50:50 profit share and co-commercialization rights for the US market. Having said all that, investors shouldn’t get carried away as Agenus’ track record with Gilead isn’t particularly great. Previously, the latter had chosen to return and terminate the license agreements for two other bi-functional anti-bodies- AGEN1423, and AGEN1223.

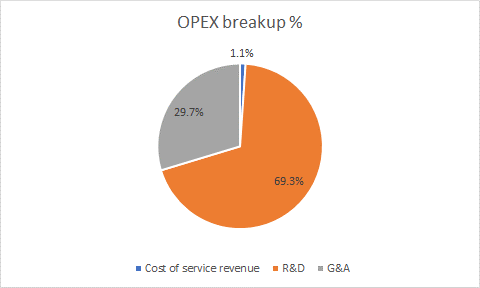

Investors should also keep an eye out for developments on the operating expense front, as management had stated their desire to curtail resources towards some of their old programs (this won’t include any Botensilimab related work); over the last four quarters, the bulk of the opex has come from R&D related spend which accounts for ~69% of the opex base (average of the past 4 quarters). The other major contributor is G&A expenses. Opex per quarter over the last four quarters has averaged around $66m and management is now targeting savings of 5-10%, so one should be looking out for Opex (excluding contingent purchase price adjustments) figures within a band of $60m-$63m in the quarters ahead.

AGEN quarterly report

AGEN also appears to be relatively well-stocked with cash and liquid resources to the tune of $263m (although there has been a sequential decline of $44m) which should be enough to cover at least four quarters worth of OPEX. This could reduce the risk of near-term dilution, a narrative that has afflicted AGEN for a long time now.

Closing Thoughts- Is AGEN Stock A Buy, Sell, or Hold?

If you’re a bargain hunter and have a predilection for biotech stocks, I reckon the AGEN stock could be something to keep an eye on. Consider the 5-year snapshot of the relative strength of the AGEN stock vs. its biotech peers (as represented by the XBI ETF); we can see that this ratio is currently trading closer to the lower end of the range and is still well off the mid-point of the range, implying favorable risk-reward.

Stockcharts

However, before you consider going long, it’s important to also consider the price action on the standalone chart of AGEN. We can see that until recently the stock had been following a descending channel pattern; in June it broke out of its channel and on the 29th of June we also saw a surge well outside its upper Bollinger band (which is 2 standard deviations away from its 20DMA). Notice also the shape of the 29th June candle, a reversal shooting star candle that has triggered a pullback of sorts.

The more prudent strategy would be to wait for this pullback to persist till the midpoint of the Bollinger bands (which is your 20DMA), which would also coincide with the upper boundary of the old channel that the stock had broken past. If the stock can continue to demonstrate strength and build a base above the upper boundary of the channel ($1.66 levels), I reckon one may consider a long position with a potential exit point of around $3 which represents the next major resistance. For now, the AGEN stock is a HOLD.

Be the first to comment