Jean-Luc Ichard/iStock Editorial via Getty Images

Microsoft Corporation (NASDAQ:MSFT) needs no general introduction. The company has grown into a powerhouse over the years and is now one of the most valuable companies in the world with a market cap of $1.92 trillion.

Over the past decade, shares of MSFT have rallied 760%, but have fallen out of favor in 2022 as the technology trade has lost its steam from the COVID-19 pandemic. On the year, shares of MSFT are down 22% and they are down 26% from all-time highs they reached in December 2021.

The shift to more of a work from home environment becoming the norm for many corporations along with the push for cloud has increased not only the need but the value of Microsoft to new highs.

However, with the pandemic now firmly in the rearview mirror as more and more Americans shift to it being part of life now, does Microsoft deserve to lose its luster?

The Case For Microsoft

Let’s briefly begin with how the company performed during its most recent earnings results that came out in late April, which was technically their third quarter.

The company reported a beat on both the top and bottom line when compared to analyst expectations. This is something MSFT investors have become accustomed to as they have beat on revenue and earnings for 12 consecutive quarters now.

Here are the Q3 results:

- Revenue: $49.36 billion vs analyst estimate of $49.05 billion

- Adjusted EPS: $2.22 vs analyst estimate of $2.19

Revenues on the quarter grew 18% year over year, which was a slowdown from Q2 that saw 20% yoy growth. According to CNBC, this revenue beat was the smallest on record since 2018.

Microsoft’s Intelligent Cloud segment, which includes its popular Azure cloud offering, generated $19.05 billion in sales, a 26% increase year over year, which also beat analyst expectations of $18.9 billion.

Operating income grew 19.5% to $20.4 billion, and operating margins increased by 40bps to 41%.

One area where the company was hit hard, and has been common across all business of late, was within SG&A. Sales and marketing costs were up over 10% while general and administrative costs were up over 11% on the quarter, which ate into gross margins.

So what is the case for Microsoft moving forward?

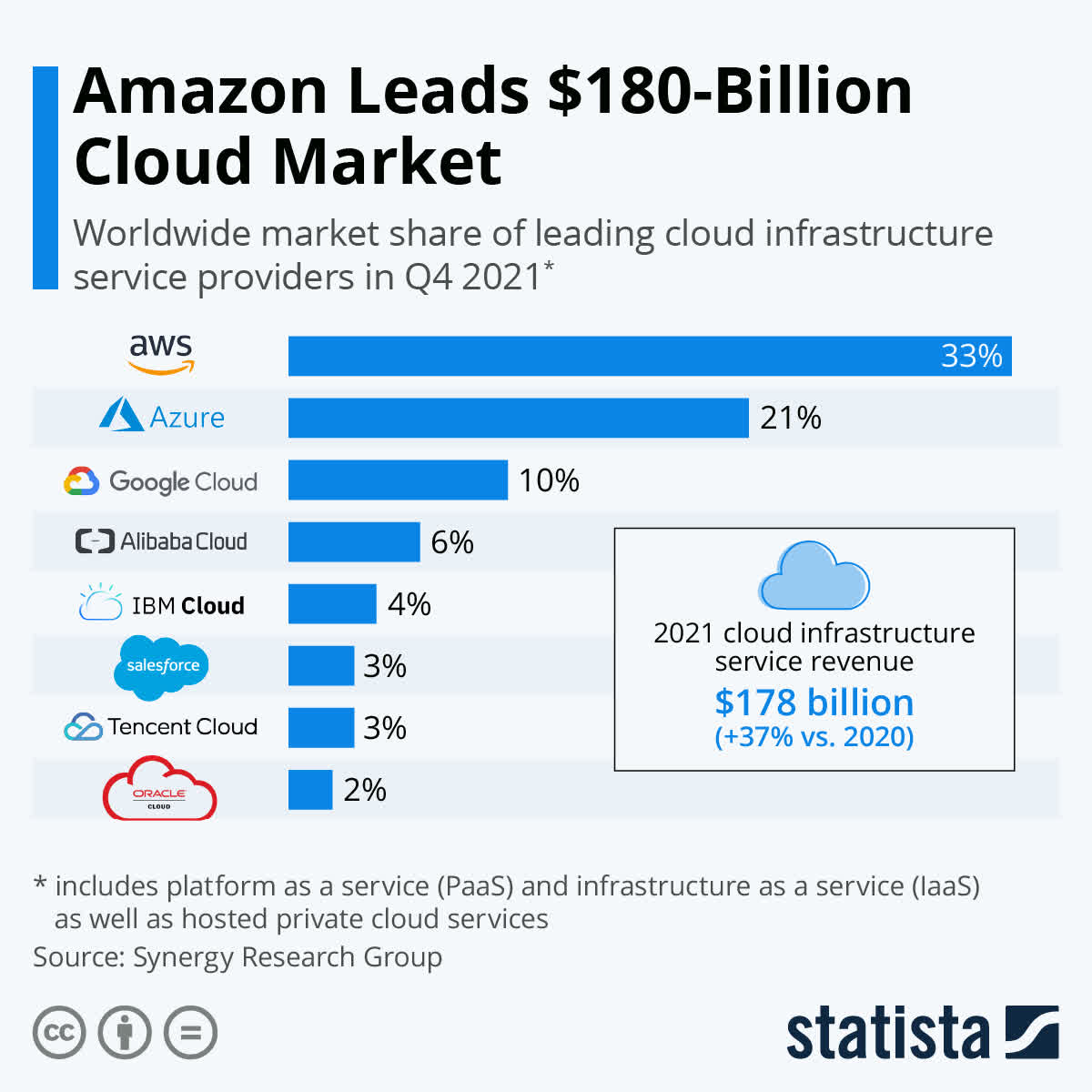

First, cloud is still expected to continue growing at a strong clip. Microsoft’s Azure business claimed the second highest market share in the world at 21%, trailing only Amazon’s (AMZN) AWS. Cloud revenue made up 45% of total revenue for the business in Q3.

Statista

The growth rate for Azure has ticked down slightly, but that is to be expected. Anything that is not new, cannot keep up a steaming growth rate like Azure has over the years. However, still remaining around a mid-40s growth rate over the next few years is more than reasonable for Microsoft.

The next major revenue driver for the business has been Microsoft 365, which is the cloud-based version of Microsoft Office. This segment accounts for roughly 25% of the company’s revenue.

The new subscription based model has provided more recurring income moving forward, although it was a hit to the business early on due to how accounting rules require subscription revenues to be accounted for, but the long-term gain for the business is big. As of the most recent quarter, Microsoft 365 had 165 million subscribers.

Gaming is a segment I believe has huge potential. Dying off are the legacy video game stores, similar to that of Blockbuster, and here are the days where gamers can now download their favorite new game right to their console. Gamers can also buy a Microsoft subscription that is paid monthly, giving them access to 100s of different games.

Microsoft is going through the process of acquiring Activision (ATVI) for $68.7 billion, but the deal still has some hurdles to overcome before becoming official. However, assuming the deal does go through, Microsoft would then control nearly 15% of the gaming industry.

In addition, taking gaming a step further, Microsoft xCloud would do away with the game consoles entirely. Instead, this would provide any gamer with an active internet connection to access its game portal. Huge potential all around this segment of the business, which is a reason I like the acquisition of ATVI.

A Total Return Investment

Tons of potential remains all around the business, which is great for shareholders. All of these segments continuing to outperform has allowed MSFT to continue returning money to shareholders.

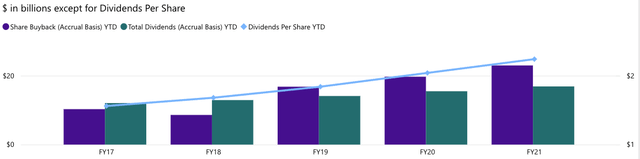

Microsoft has been doing this through the form of dividends as well as share buybacks, which makes them a total return investment.

Over the past five years, MSFT has increased the dividend an average of nearly 10% per year. In addition, they are a dividend contender having increased their dividend for 18 CONSECUTIVE years and counting.

Therefore, you are getting a solid increase each and every year and you are getting a raise EVERY year. All of this is backed by a very low payout ratio of only 26%, maintaining that the dividend is extremely safe at current levels.

In the slide below, you can see how buybacks and dividends continue to rise each and every year.

Can Microsoft Keep This Up?

All of this seems extremely bullish for the company, as they have a lot of levers to pull with plenty of runway, but could there be some obstacles moving forward? Absolutely!

Risks are there for every business, except for maybe an oil producer right about now.

However, although the company is a HUGE cloud player, there are other extremely large corporations in the space. We already know the likes of Amazon AWS, but right behind Microsoft is another mega-tech firm in Alphabet (GOOG)(GOOGL), who is also growing their Google Cloud segment at an extremely fast pace. The positive thing is the fact that there is plenty of room for multiple players in the space.

Another risk is in the company’s reliance to the PC space. Microsoft 365 relies on PCs, cloud generally relies on PCs, and the company sells their own PCs and tablets. As you know, we have had a major chip shortage worldwide that can affect revenues and guidance in the near terms.

The last point I will make in terms of risks has to do with the economy as a whole. It is clear that the US economy is headed towards a pending recession. Microsoft themselves is looking ahead and has decided to freeze hiring, along with other major corporations. A recession could impact technology spending, which would impact various segments across the business.

Investor Takeaway

When it comes to deciding whether or not to add shares of Microsoft, it can seem like a no-brainer. The company has a lot going for it and is pretty well diversified, but everything can come back to valuation.

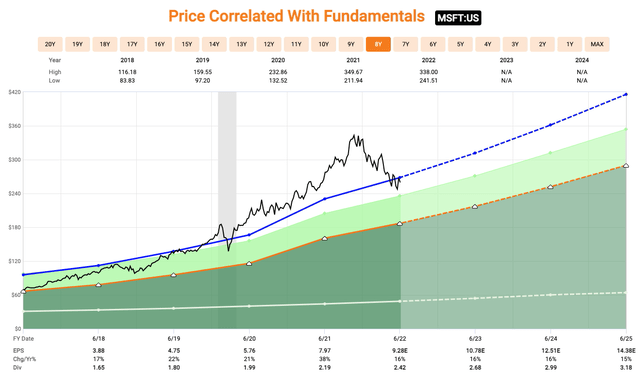

When the company hit its recent all-time high in December 2021, MSFT shares had an earnings multiple over 40x. I understand the company is growing still at a strong clip, but that valuation, along with many others within the tech industry were just getting out of touch with reality, hence the strong pullback we have seen.

We are in a much different economic era than a few years back when the economy was booming and monetary policy greatly benefited business growth. Fast-forward to today and we are likely heading towards a recession and the Federal Reserve is tightening its monetary policy.

However, an investment in Microsoft is one in a high-quality company with an extremely intelligent management team. MSFT is a rare AAA rated gem, one of the safest in the world.

The stock currently goes for about 24 times its expected 2023 earnings, which is significantly down from the 40x we saw last year. Over the past five years, shares of MSFT have traded at an average earnings multiple of 28.9x.

Currently, the average analyst price target for the stock is $352, suggesting 35% upside from current levels. However, I expect these targets to come down once we go through the next earnings season and a recession is more consistently priced into earnings.

While one could sit around and wait for the stock to pull back further, I also can’t argue with investors looking to take small nibbles at current levels. After all, you are getting a solid entry point here that was last seen in 2020.

Be the first to comment