Torsten Asmus/iStock via Getty Images

Main Thesis & Background

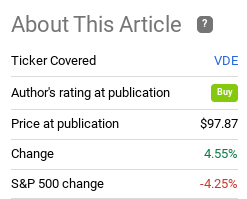

The purpose of this article is to evaluate the Vanguard Energy ETF (NYSEARCA:VDE) as an investment option at its current market price. This is my preferred option for Energy exposure and a fund I have held for a long time. I most recently added to it back in July, when I wrote about it with a very bullish outlook. In hindsight, VDE has indeed performed quite well, vindicating this thesis. While the gain of 4.5% is not overwhelming, it still handily beats the S&P 500:

Fund Performance (Seeking Alpha)

While this performance looks strong, we should bear in mind that in the shorter-term VDE has been struggling. In the 10 weeks since that review, yes, VDE is up. But over the past month, the story has not been nearly as positive:

1-Month Performance (Seeking Alpha)

This puts VDE firmly in correction territory. Because of this, I thought it was time to take another look at this ETF to see if I should protect the little profit that is left, or if the correction marks a buy opportunity. In my view, the latter is the bigger story here, and I will explain why in detail below.

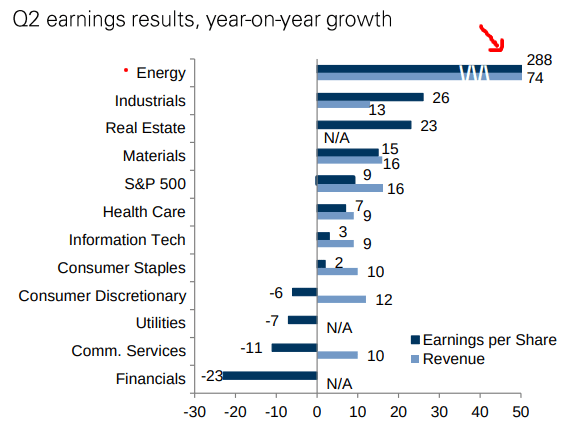

Earnings And Revenue Growth Bests Other Sectors

A primary reason why I find Energy attractive is the relative attractiveness of the sector. Clearly, this is an area that has been a big winner in 2022. The good news behind this is that it has happened for the right reasons. Revenue and profits have soared for the sector on a year-over-year basis. While this is always a positive, what is encouraging to me is how much stronger the growth is compared to the rest of the market (by sector):

EPS and Revenue Growth YOY (by sector) (Goldman Sachs)

This suggests there is plenty of merit to holding and adding this exposure. Energy has been seeing strong gains on all fronts, including share prices. To me, this means the correction in VDE offers a chance to buy in to quality, rather than an excuse to flee.

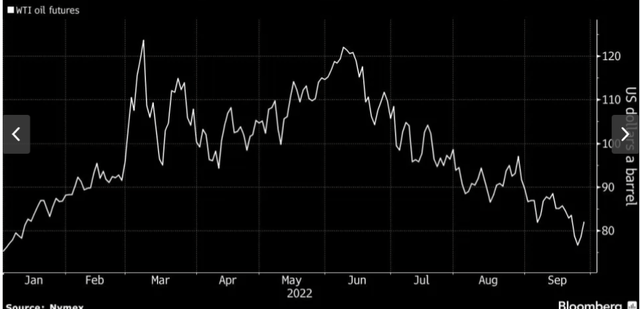

Oil Prices Have Retreated Too Fiercely In My Opinion

I now want to look at the oil market, as this has a major impact on the fortunes of funds like VDE. While not the only consideration, it is most certainly paramount. In this vein, investors are probably a bit unnerved at the moment as oil prices have been dropping quite consistently. In fact, current prices reflect that oil has given up almost all the gains it enjoyed since the beginning of the calendar year:

This is certainly not “good” news for energy investors. The issue I have here is that I do not believe it is entirely justified. To be fair, we have seen legitimate reasons for a pullback – the release of SPRs in the United States, a rise in production by OPEC+, and a continued normalizing of supply-chains.

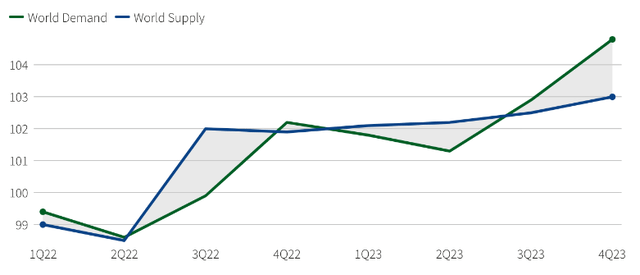

However, I would propose that oil is ripe for a push to the upside. The market is getting too complacent and focusing on the bearish news, rather than on the factors that could push oil higher. The most important factor to consider in this outlook is the supply-demand imbalance in global markets. Q3 has already seen world demand eclipse supply. This backdrop is expected to widen going in to 2023, representing the opportunity as I see it:

World Supply vs Demand (crude oil) (OPEC+)

This begs the obvious question – if demand is outpacing supply, why has oil been dropping?

The answer primarily has to do with recession risks. While demand has been set to rise consistently in Q4 (and OPEC+ still believes it will), that has been called in to question of late. This is due to the U.S. perhaps already being in a recession, with more global economies to follow. The logical result would be a decline in oil demand going forward.

My thought on this is not necessarily that we won’t see a recession. But I am less concerned of that risk now because the market has seen oil sell-off to the point where a lot of the recessionary risk is priced in. Could it go lower? Of course. But supply is set to remain limited heading in to the new year. This suggests more upside potential than downside potential in my opinion. For example, OPEC+ has already stated earlier this month they are going to consider cutting production. Similarly, the U.S. cannot continue to release SPRs, as those are drying up quickly. The only way we are going to see more meaningful supply is from onshore drilling – something that is not likely to happen in this political environment.

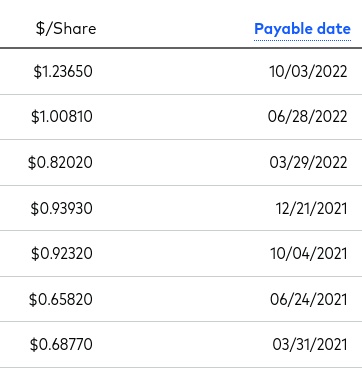

The Dividend Is Very Supportive

Looking at VDE in particular, there is another strong supporting factor for buying this fund. As a “Dividend Seeker”, the income stream is very important, and also very attractive. If we annualize the last four distributions the fund is yielding very close to the 4% mark. That is relatively high compared to most individual stocks and even dividend-paying ETFs. Furthermore, I expect this yield could increase going forward, all other things being equal. The reason being dividend growth has been very strong in 2022. This is more pleasing to me than the current yield.

For perspective, notice that each distribution in Q1, Q2, and Q3 in 2022 were up handsomely from a year ago:

VDE’s Distributions (Vanguard)

As you can see, this represents dividend growth just shy of 35% for the calendar year. This ties back to the revenue and earnings gains this sector has enjoyed throughout 2022. The fruits of this have been passed on to the shareholders of the underlying companies (namely Exxon Mobil Corp (XOM), Chevron Corp (CVX), and ConocoPhillips (COP)). This is one of the most supporting factors for buying in to this sector and fund.

Geo-Political Risks Remain – A Tailwind For Oil and Energy

My next point is one that is not “good” for the world, but could be a positive factor for higher energy shares. I am referring to geo-political risks, which namely will send commodity prices higher. The primary risk in 2022 has been the Russia-Ukraine military conflict, which had sent oil price soaring in Q1 and Q2. After backing off recently, I fear the recent mobilization of more Russian troops could lead to an escalation in the conflict. Oil prices have been so far unphased by this development, but I am not convinced it should be ignored.

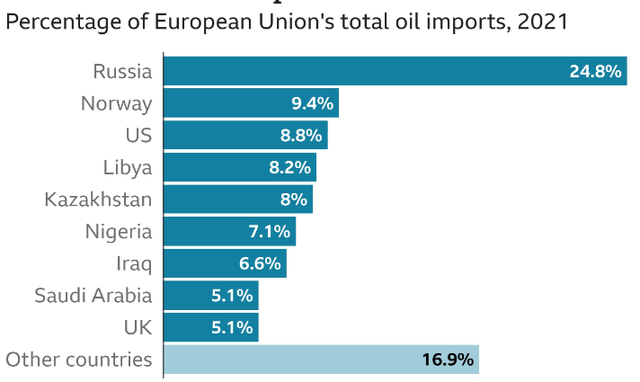

Now, I am not an expert on eastern European conflict resolution. But it seems to me, there is meaningful uncertainty over what will happen to oil supply as a result of any troop movements and/or more intense fighting. Furthermore, since the crisis is not coming to a resolution any time soon, the EU import embargo for crude oil from Russia is set to come to fruition. This is going to remove quite a bit of supply from a key consuming trading bloc, with the likely effect of driving up prices. To understand why, consider that the EU was getting roughly one-quarter of its gas from Russia, pre-invasion:

EU’s Oil Imports (By Origin) (BBC)

The conclusion I draw here is this is a really good hedge for any upcoming volatility in equity markets and supply-chains driven by the Russia-Ukraine conflict. While a net negative stocks as a whole and on a humanitarian level, the impact to the Energy sector could be a positive. This is key to why I want to beef up my exposure. I expect gains, but it also should serve as a hedge in case stocks continue to get rattled going forward.

“Windfall” Taxes Concern Me

Through this review I have certainly painted a bullish picture. I stand by that, and will indeed by adding to VDE in the short-term. However, this is by no means a “risk-free” investment idea. Investors should recognize that VDE has had a great run in 2022 and stocks/sectors/themes don’t usually just go in one direction. We have already seen a sharp correction in the near-term, and there is certainly the risk more pain is coming. This is especially true if recession fears keep dominating headlines and investors want to flee cyclical, economically sensitive sectors like Energy. In addition, if we see a peaceful resolution in Ukraine, that will almost surely send oil prices lower. If that happens it will be good for the globe as a whole, so I am willing to take a hit to my Energy positions in that case!

While those are headwinds to keep in mind, the one that is of greater concern to me is regulatory risk. This has to do with governments, notably in the EU and North America, who have representatives wanting to tax what they consider to be “windfall” profits in certain sectors. The top of which is Energy.

This is an important consideration, and one I find will grow in importance if Democrats continue to hold majority positions in Congress post the 2022 mid-term elections. With U.S. consumers worried about inflation and high energy costs, it is very likely we will see populist, anti-oil company messaging aimed at capturing some of the profits this sector has enjoyed. While this idea may sound far-fetched, it shouldn’t, and has growing support among the political class. In fact, just a few weeks ago the International Monetary Fund published a report spelling out how governments can go about taxing this “windfall”, which could easily be used as a blueprint by regulators and elected officials around the globe.

I certainly view this very negatively and a form of government market interference that I detest. But I will use this opportunity to caution readers to evaluate the risk of such a proposal becoming reality, and factor that in to their outlook for VDE heading in to the new year.

Bottom-line

Oil prices and Energy shares are down in the short-term, but rather than just anxious, I am getting greedy. I see this as a buying opportunity for what has been the best performing theme in 2022. I believe the market structure is already pricing in a large demand decline, driven by recessionary fears. This means downside is much more limited than it was before. If we avoid a recession globally, or one occurs that is less severe than expected, then significant upside is present.

Furthermore, structural issues in the oil market around investment and capacity have not been solved. The price has dropped over future economic conditions, but supply remains well under global demand needs. Case in point, the U.S. has had to deplete SPRs just to keep the price from roaring higher. OPEC+ has the ability to counter-balance this action, and the organization has indeed already been suggesting lower production going forward. Finally, even if we do see a recession, after a recession comes recovery – and with it – higher oil prices. During bleak times and/or recessions, that is precisely when you want to buy this exposure, in anticipation of better days ahead. Therefore, I will keep on adding to VDE ETF, and suggest readers give this fund some consideration at this time.

Be the first to comment