MicroPixieStock/iStock via Getty Images

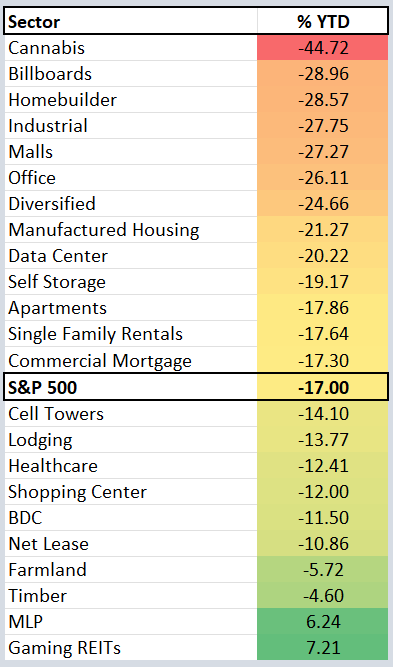

As I see it, the real estate investment trust coils are just about ready to spring. Many property sectors are underperforming year-to-date…

(iREIT)

But some of them have great potential to bounce back over the next six months.

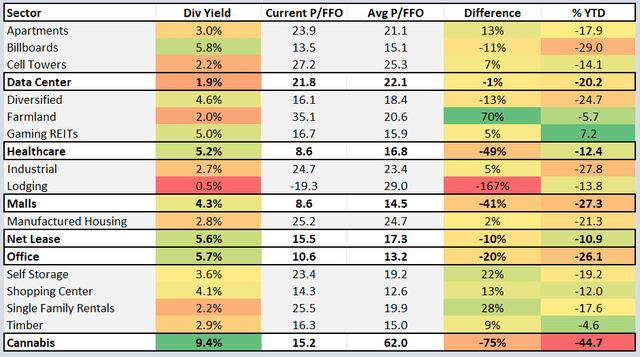

At iREIT on Alpha, we’re constantly screening for bargains within the vast universe of real estate stocks. So this isn’t the first time we’ve noticed how certain categories have become fairly valued…

While others are noticeably and even unreasonably cheap.

(iREIT)

Notably, data center, healthcare, mall, net-lease, office, and cannabis REITs are worth exploring. But cannabis, office, and skilled nursing are suffering from headwinds that must be analyzed closely.

There are risks to any investment, of course. Just some more than others.

So it’s important to understand supply and demand dynamics, as well as each company’s overall health – before getting your money involved.

REITs and This Inflationary Environment We’re In

Obviously, one of the primary overhangs we’re seeing for stocks across the board is record inflation. As Cohen & Steers explains:

“… the economic drivers of real assets are often directly or indirectly tied to inflationary trends. This linkage historically has resulted in outsized returns when inflation exceeds expectations.

“An allocation to real assets may therefore help to preserve future purchasing power, potentially offsetting the vulnerability to unexpected inflation that is historically common to traditional portfolios of stocks and bonds.”

Property values certainly tend to increase with the overall price environment due to rising costs of labor, land, and materials. And REITs in particular typically have high operating margins and low labor costs. Some commercial leases even have specific rent escalators tied to inflation.

That’s why we continue to recommend property subsectors with shorter lease durations that can swiftly take advantage of reflationary rents.

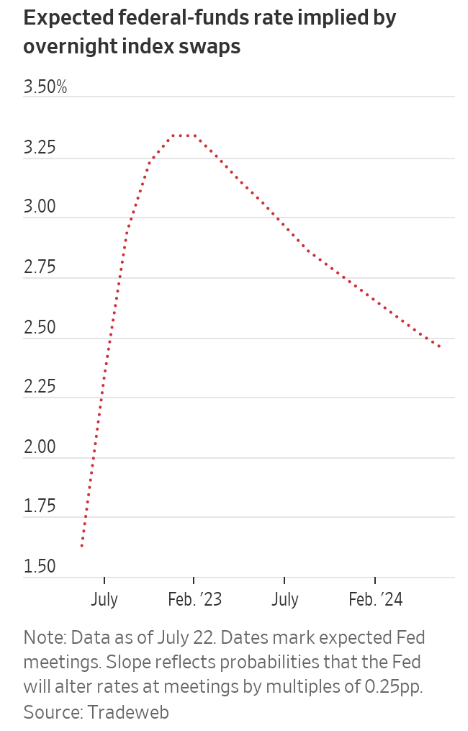

Now, we learned Wednesday that the Federal Reserve raised rates by another three-quarters of a percentage point. Moreover, according to The Wall Street Journal columnist Jason Zweig:

“The markets are predicting that, by the turn of the year, the Fed will raise its benchmark rate to roughly 3.3% from its current 1.50%-1.75%.”

And he added:

“The central bank will stop raising rates and, by June 2023, will begin cutting them.”

(Source: WSJ)

Sudden increases in interest rates easily fluster the larger markets in the near term, as we all very well know. (Though apparently not on Wednesday.) But when it comes to REITs, the economy’s path and job growth tends to have a greater impact.

Or said another way, the same environment that’s pushing the Federal Reserve to increase rates can benefit REITs in the form of higher rents. Plus, REITs’ characteristics can simultaneously make them an inflation buffer.

Historical Hints on Where REITs Will Go From Here

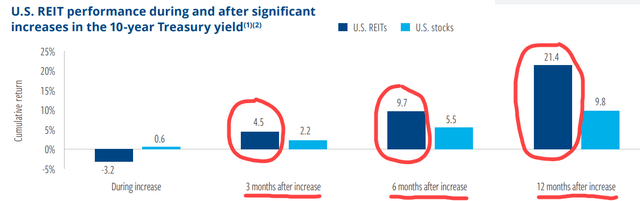

To put that into perspective, Cohen & Steers analyzed the 12 largest one-month increases in the 10-year U.S. Treasury yield dating back to 2000. The data showed that, while REITs have underperformed equities in the immediate aftermath of significant yield increases…

They’ve historically outperformed three, six, and 12 months after such increases.

(Source: WSJ)

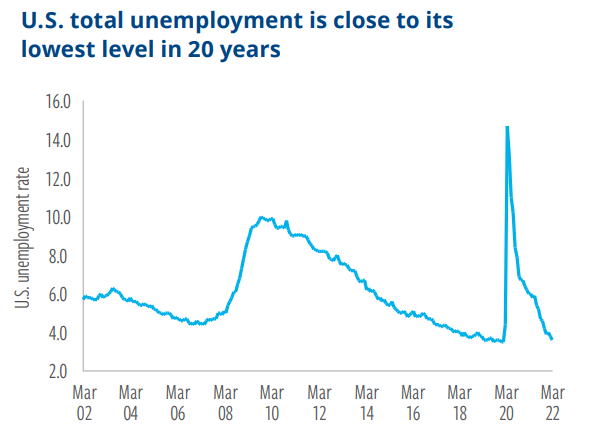

In this current environment, inflation remains elevated, growth prospects are slowing, and Treasury yields are rising. At the same time, consumers’ saving seem solid. And unemployment is maintaining historically low levels, with more job openings than unemployed people.

(Source: Cohen & Steers)

Of course, we know that earnings growth is the key to superior total return performance for stocks. And REITs are no exception.

As fundamental research analysts, we recognize that the only way to separate the wheat from the chaff is to focus on “wide moat” companies that generate steady growth by utilizing low-cost capital and economies of scale.

Our iREIT quality models are driven by dividend safety and dividend growth. So whenever we see companies that aren’t growing their distributions or even decelerating…

We’re quick to downgrade them to hold or sell status.

The keys in this cycle are durability, reliability, and predictable income. So the companies we recommend are supported by strong and healthy earnings growth.

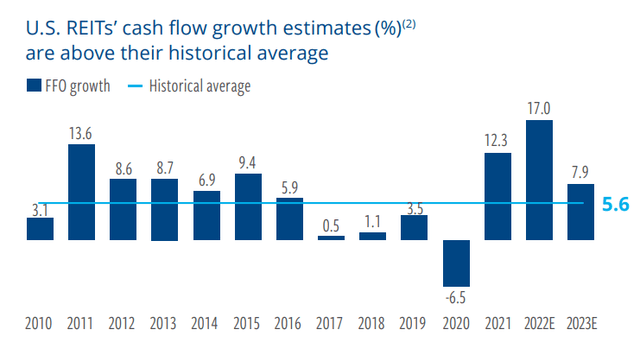

Speaking of such, beyond 2022, Cohen & Steers expects:

“… that dividend growth will remain attractive thanks to the cash flow-focused nature of REIT business models and their tax-advantaged distributions.”

Furthermore:

“… cash flow growth for U.S. REITs, as measured by funds from operations (FFO), is expected to reach 17% this year and 7.9% in 2023, well above its historical average of 5.6%.”

That means we’ve got something significant to go on!

(Source: Cohen & Steers)

#1 – STORE Capital

It can be daunting to think of how businesses can be impacted in a recession, especially in certain industries. Retail, for one, isn’t a sector that performs particularly well during such times of slowing economic activity.

Speaking of consumers, their sentiment has been at the lowest levels seen in quite a while. So it would be silly to recommend a retail REIT like STORE Capital (STOR), right?

Wrong!

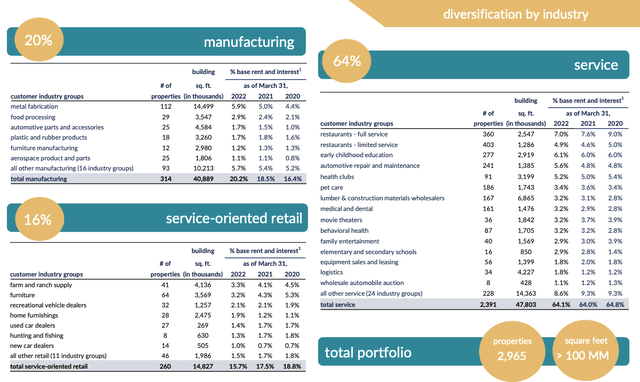

You see, STORE has a very diversified portfolio focused more on service and service-oriented retail. And these are more insulated than traditional retail.

The REIT has a portfolio that consists of nearly 3,000 properties, which are broken up into these industries:

- Service – 64%

- Manufacturing – 20%

- Service-oriented retail – 16%

Here’s a look at how STOR has built its portfolio:

(STOR Investor Presentation)

STOR is often compared to the gold standard that’s Realty Income (O), another retail net-lease REIT built eerily similar. STORE became public in 2014 under the stout leadership of CEO and co-founder Chris Volk.

Mr. Volk has since left the company, however, and co-founder Mary Fedewa now leads it.

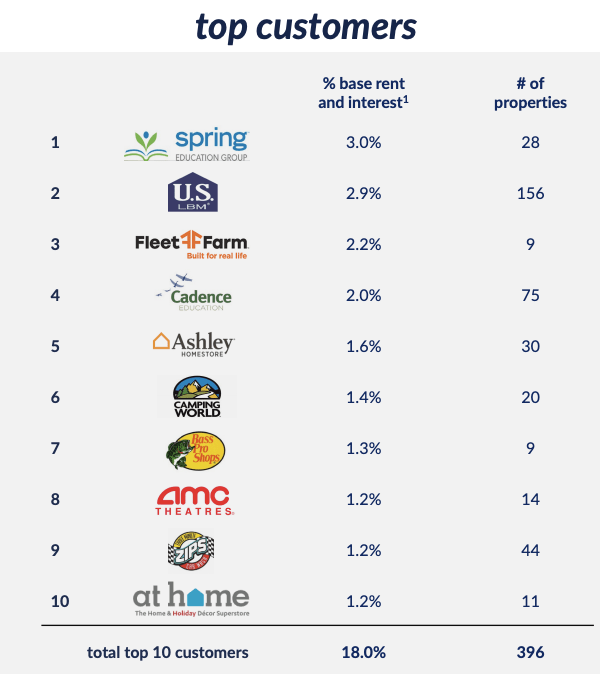

The company’s properties are leased out to 573 different customers. And no single customer accounts for more than 3% of total annual base rent. This provides a buffer, or margin of safety, in case a tenant has a rough time during a recession.

With that said, here’s a look at STORE’s top 10 tenants:

(STOR Investor Presentation)

In addition to a diversified and well-balanced portfolio, STOR also maintains a very strong balance sheet. The company has a debt-to-earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio of 4.1x. And its S&P credit rating is BBB, while Moody’s gives it a Baa2.

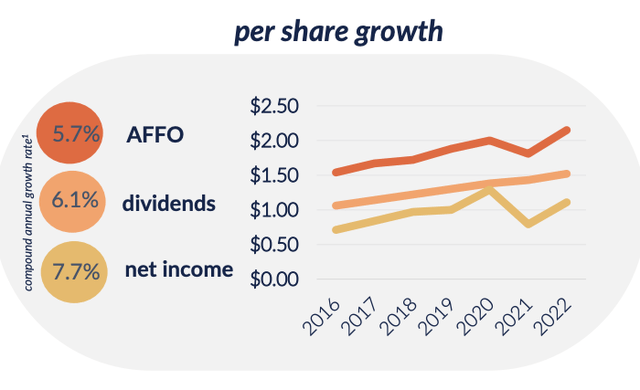

Since 2016, the company has been consistently growing its adjusted funds from operations (AFFO). That’s led to dividend increases each and every year. In fact, during that time span, AFFO has a compound annual growth rate – CAGR – of 5.7%. And its dividend has enjoyed a 6.1% CAGR.

(STOR Investor Presentation)

One great thing about REITs – and net-lease REITs in particular – is the long-term insights you get with them. With regular companies, you can forecast a year or maybe two years out. But with a net-lease REIT like STOR?

You can get a good understanding of what cash flow will look like for a number of years.

In fact, STOR has a weighted average lease term of 17.1 years. That’s the second longest in the subsector, trailing only National Retail Properties (NNN) at 18.2 years.

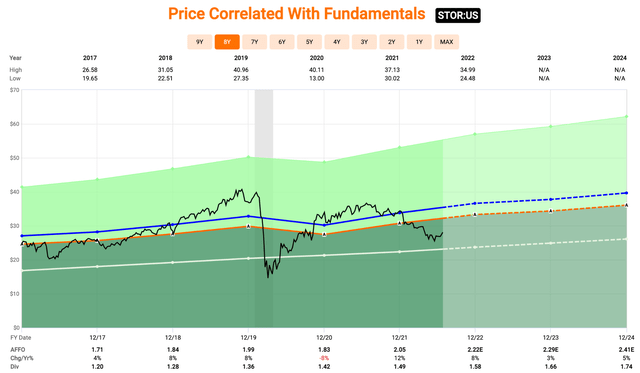

(Fast Graphs)

As you can see from the chart above, analysts expect 2023 AFFO of $2.29. Based on that estimate, STOR is trading at a forward P/AFFO multiple of 12.3x versus a 16.4x five-year average.

Over the past 12 months, shares have fallen nearly 25%, so it now pays a 5.5% dividend yield. But that high yield is well covered with an AFFO payout ratio below 70%.

Again, STORE’s diversified portfolio is filled with service-related tenants. Combined with its stout balance sheet, this should be plenty for it to withstand a looming recession… or one that’s already here.

We currently rate shares of STOR a Buy.

#2 – STAG Industrial

STAG Industrial (STAG) hails from the industrial and warehouse sector.

We mentioned how STORE Capital was similar to Realty Income in some ways. Well, so is STAG.

STAG is popular among retail investors especially due in part to its monthly dividend. It recently reported its Q2 results, which saw core FFO climb 7.7% to $0.54 on the quarter.

Revenue was $161.5 million with a 17.2% increase over the prior year. And same-store cash net operating income (‘NOI’) increased 4% with an occupancy rate of 98.1%, up from 96.9% a year ago.

STAG mentioned it sees tailwinds from macro-related events on the back half of the year. But that’s still more upbeat than many companies that have reported earnings thus far.

Over the past six months, shares have fallen over 20% due in part to the broader market selloff we’ve seen. That and some warehouse related comments made by Amazon (AMZN) during its Q1 earnings call.

It was regarding having too much industrial space. And Amazon added that it would be sub-leasing roughly 30 million square feet of space to others.

This sent shares of industrial REITs into a tailspin.

Does that warrant a 20% selloff in STAG though? Admittedly, AMZN is its top tenant and makes up 3.1% of its total base rent.

However, when you look deeper into the matter, AMZN management was merely making a short-term point. The company is obviously not downsizing its warehouse reach. In fact, it’s looking to upgrade its space in better areas that help it cut down on shipping costs.

STAG’s portfolio consists of 559 properties made up of 111.5 million square feet of space. And, unlike STOR’s very long weighted average remaining lease term, STAG’s is five years.

It has a BBB/Baa3 rated balance sheet from Fitch and Moody’s, respectively. On a leverage basis, STAG’s consolidated leverage ratio is 29.8% and its net debt/EBITDA ratio is 5.2x.

The REIT currently pays a dividend of $1.46, which equates to a 4.6% yield. Management still expects it to generate core FFO of $2.18, which would equate to a payout ratio of only 67%.

In other words, the dividend is well covered.

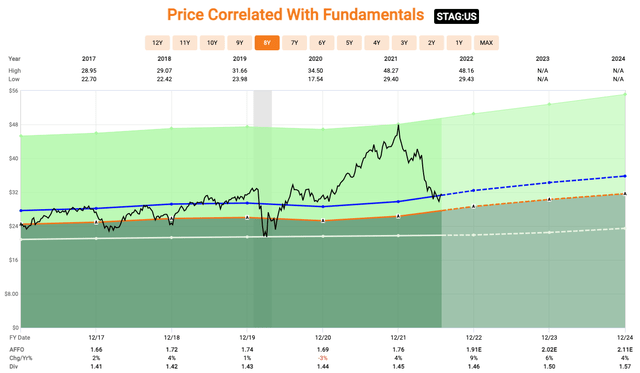

In terms of valuation, STAG currently trades at a forward P/AFFO multiple of 15.6x compared to its five-year average of 17x.

(Fast Graphs)

It proved during the pandemic how well industrial real estate can withstand an economic slowdown. In a time when REITs were seeing rent collections cut in half, STAG continued to collect well over 90% thanks to its particular tenant base.

Also, if you’re a believer in e-commerce’s continuing growth trend, a company like STAG is going to be a big beneficiary over the coming years. At iREIT on Alpha, we currently rate shares of STAG a Buy.

#3 – Digital Realty Trust

The final recession-ready REIT we’ll look at today is Digital Realty Trust (DLR).

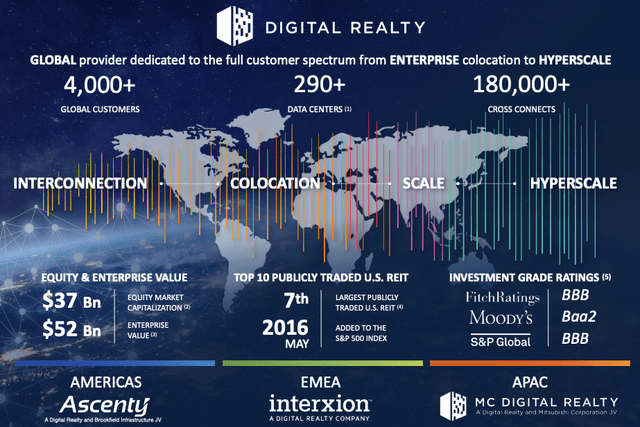

DLR is one of the largest data-center REITs on the market today with a market cap of $37.1 billion. It’s the largest global provider of cloud and carrier-neutral data centers and interconnection solutions.

If you work with a computer or mobile device, you understand the importance of the cloud. And you also understand the enormous amount it’s grown and continues to grow.

According to Precedence Research, the cloud computing market size will grow to roughly $1.6 trillion by 2030 – growing at a CAGR of 17.4% from 2022 to 2030. That’s an enormous market for cloud providers and also the oft-forgotten segment of data center providers.

Digital Realty has more than 4,000 global customers and more than 290 data centers across the globe.

(DLR Investor Presentation)

The portfolio has more than 35 million square feet of leasable space. Moreover, that figure continues to grow as more of DLR’s developed data center properties come online.

Some of DLR’s top tenants include technology and telecom names such as:

As 5G continues to roll out and 6G looms somewhere in the future, more companies are looking for data to be saved online, and autonomous driving gains more traction, the need for data centers will only continue to benefit.

The company also built up a reliable balance sheet with a BBB rating. It has a net debt/EBITDA ratio of 5.9x.

Among these three REITs, DLR has the lowest weighted-average remaining lease term of 4.8 years. That’s slightly below STAG’s. Over the past few years, DLR has been averaging between 2%-4% annual cash rental rate increases.

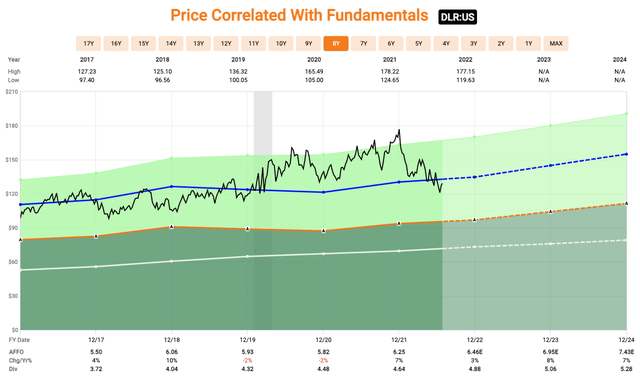

On the year, shares of DLR are down 26%. Then again, its peak valuation was simply unrealistic, especially for a REIT. At the start of the year, DLR was trading at a P/AFFO of 30x.

That’s well above its five-year average of 20.8x.

Currently, shares are trading at a forward P/AFFO multiple of 18.5x. This valuation is MUCH more intriguing, which is why we rate shares of DLR a Strong Buy.

(Fast Graphs)

Regardless of the economic backdrop, DLR is poised to perform well as demand for data centers continues. In addition, as already stated, it partners with many of the largest technology and telecom businesses in the world.

So rent collections are more likely to keep happening regardless of whether the economy dips into a recession or not.

In Conclusion…

Earnings season is upon us, and so far, results seem to have been “better than feared.”

What does this tell us?

It tells us we got way too pessimistic. Though that doesn’t change the direction the economy is headed in.

Regardless of how companies reported for the most recent quarter, it simply appears that many painted a dimmer picture on the remainder of the year based on how many cut guidance.

That’s why it’s important for you to be prepared to take advantage of pullbacks in the market. Many studies have shown that market volatility ends up being a shift of more wealth to the wealthy.

As we mentioned in a previous article, “When Rooting for a Recession: Cash Is King,” we’re not necessarily rooting for a recession. But we’re preparing for it.

Large market-wide pullbacks can offer generational opportunities for long-term minded investors.

Of course, we’re here to help you navigate the current environment. And to punch your ticket for “the Great American REIT Rally.”

But the only question left to ask you, one way or the other is this…

Are you ready?

Be the first to comment