David Ramos

Introduction

In a recently-published article, I highlighted three stocks that I believe offer tremendous long-term value thanks to the current bear market. Especially in light of economic circumstances, I looked for strong and safe business models, high yields, and stellar balance sheets. One of the companies that I discussed was Verizon Communications (NYSE:VZ). In this article, I am solely focusing on that company as I believe that it deserves way more attention than a short “shoutout” in my prior article. While the company’s stock price is suffering for a reason, given that high inflation and rates are hurting its ability to attract new customers, I believe that the market is too negative. The yield has reached an incredibly attractive level, its valuation seems way too low, and its business is everything except in trouble.

Hence, in this article, I will explain why I like Verizon and what investors need to be aware of before buying.

So, let’s get to it!

What’s Going Wrong?

There are basically two related factors pressuring the stock price of America’s second-largest telecom service corporation.

Macro Factors

These factors are basically the reason why I wrote the article I mentioned in the introduction of this article.

Economic growth is slowing down while inflation remains too high. Hence, the Federal Reserve is now (aggressively) hiking rates into economic weakness.

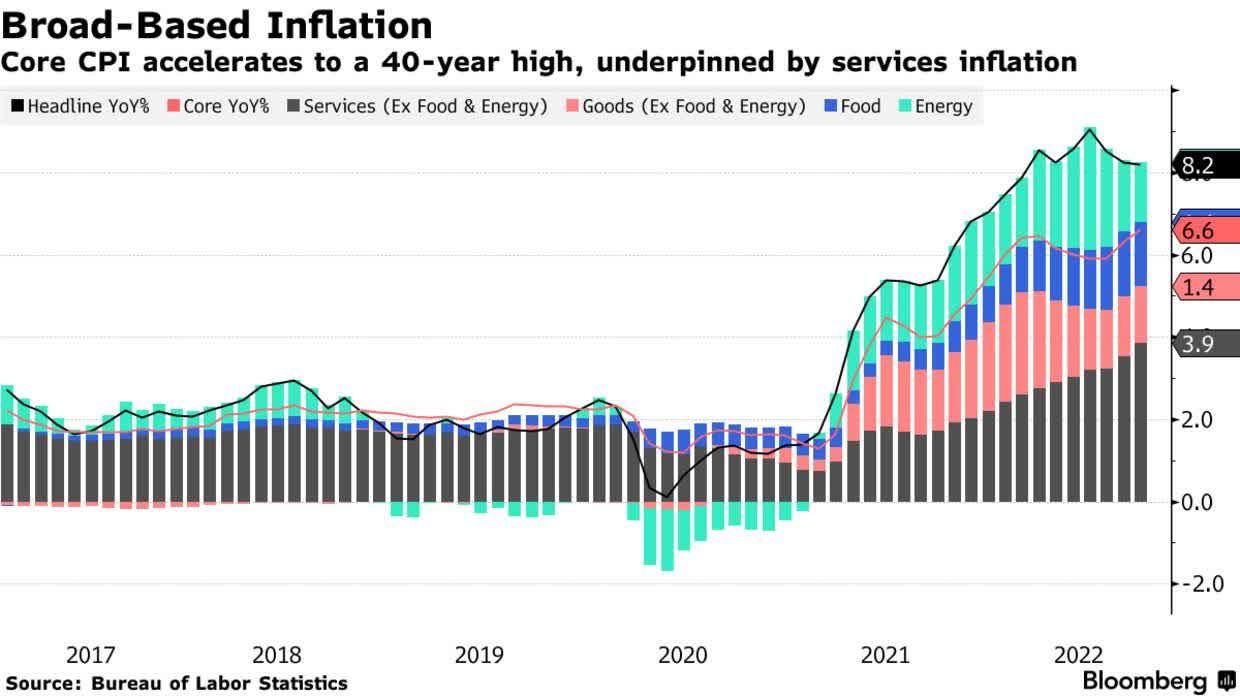

That’s an issue because, despite the economic weakness, inflation remains high. September consumer prices came in at 8.2%, 10 basis points higher than expected. Core inflation (excluding food and energy) reached a 40-year high. In other words, what used to be just energy inflation is now inflation in every key category. This is made worse by labor and supply shortages, and other related factors the Fed cannot directly impact. That’s the worst part, the Fed can weaken demand to pressure inflation, but it cannot address the supply side.

Bloomberg

Because of these developments, the period of “easy” money has ended.

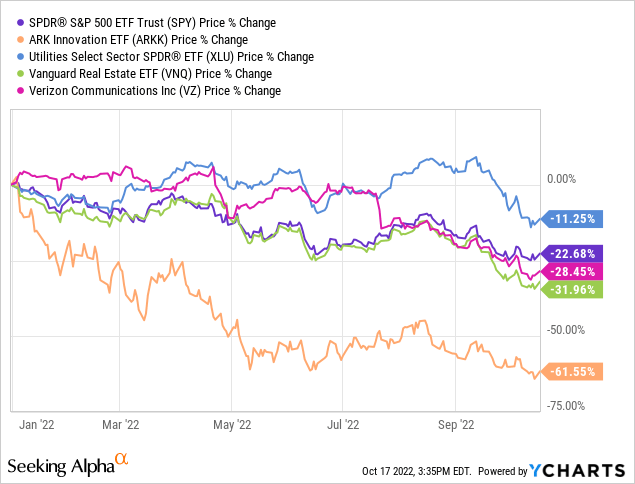

The result is stock market carnage. However, not only technology/growth stocks that desperately need low rates are getting hit hard, but weakness is also hurting companies with defensive business models – like telecommunication companies, utilities, and REITs.

The problem for defensives like communication stocks, REITs, and utilities, is that most companies in these sectors have a lot of debt. That is because they can deal with it because of anti-cyclical cash flows, but also because they require a lot of external cash to grow.

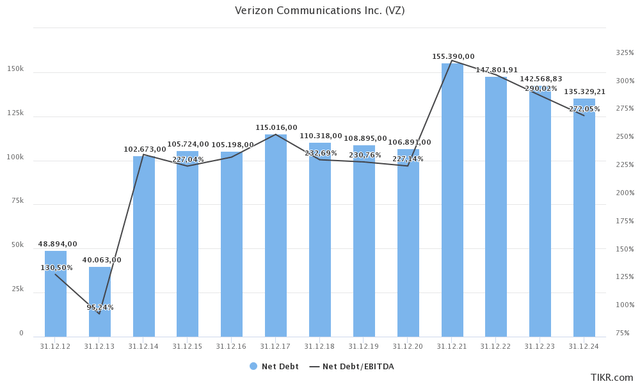

Verizon, for example, has $143 billion in expected 2023 net debt. That is almost equal to its $156 billion market cap. The good news is that net debt is expected to be “deleveraged” to roughly 2.7x EBITDA in the years ahead.

Moreover, after its 2Q22 results, the company commented on its debt load in light of rising rates:

We exited the quarter with $130.6 billion of net unsecured debt, a sequential improvement of $5 billion, resulting in a net unsecured debt to adjusted EBITDA ratio of 2.7x. In a period of rising interest rates, our balance sheet is in a strong position, with less than $2 billion of unsecured bonds maturing in the next 18 months.

Struggles To Grow The Business

Verizon isn’t a fast-growing business. Incorporated and headquartered in New York, in 1983, the company has grown to one of the largest telecommunication companies in the world. Roughly 70% of its sales are generated in its consumer business where the company provides consumer-focused wireless and wireline communication services. This segment has 115 million wireless retail connections, roughly 7 million wireline broadband connections, and approximately 4 million Fios video connections.

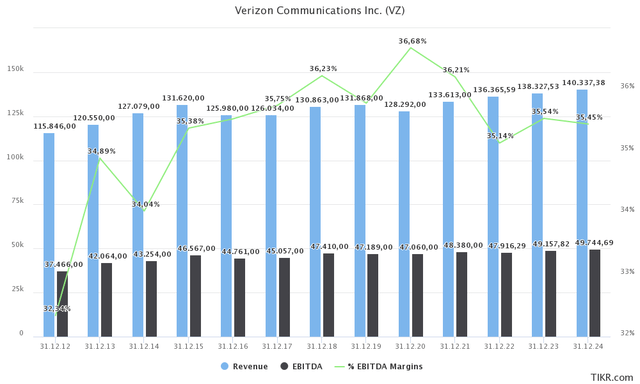

The company operates in a highly competitive space, which has become very mature. It’s also very price-sensitive, which we will discuss in this article. As a result, VZ revenues are barely growing.

Revenues are expected to grow from $121 billion in 2013 to $140 billion in 2024. If these estimates turn out to be correct, that would indicate 1.2% annual compounding growth. That’s not a lot, and unless a miracle happens, it’s well-below inflation.

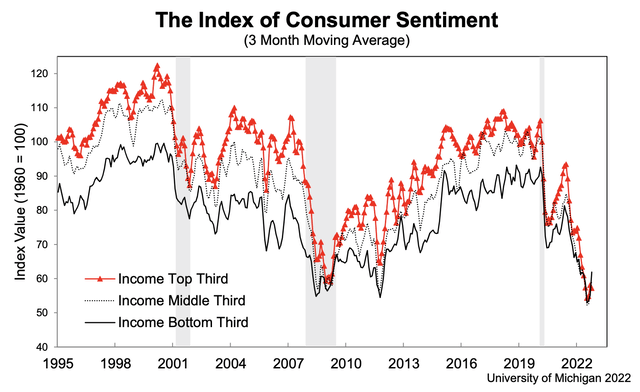

Speaking of inflation, it’s somewhat of a worst-case scenario as it happens at a time of (related) consumer weakness. Not only is consumer sentiment weak in all income groups, but it’s also at levels equal to the bottom of the Great Financial Crisis.

As we head into the company’s 3Q22 earnings, the focus will be on the company’s ability to hike prices in a competitive environment with an even bigger focus on affordability.

As reported last week:

Chief Executive Officer Hans Vestberg, speaking at Goldman Sachs Group Inc.’s media and telecom conference Wednesday, said that the price increases have caused a “churn bubble” in the current quarter. He said raising prices was still “the right decision,” however.

A subscriber decline would mark the third straight quarter in which Verizon trails its two main rivals, AT&T Inc. and T-Mobile US Inc., in new customer acquisitions.

The company reported just 12,000 new phone subscribers in the second quarter after suffering a loss of 36,000 in the first.

Moreover, according to the company:

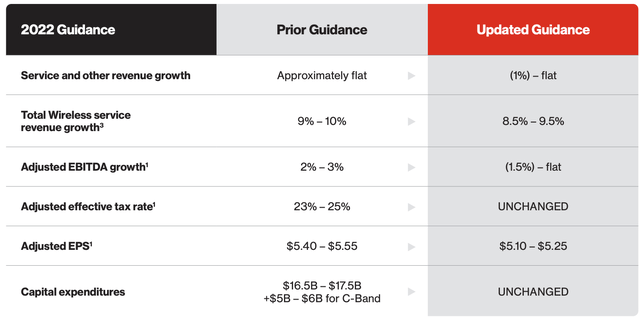

The inflationary environment is clearly impacting consumer behavior. And we also saw intensified competition for consumer attention. The result was a significant impact on our gross adds. Based on our performance this quarter and [Indiscernible] of the landscape, we are updating our financial guidance by lowering our expectation for service and other revenue, adjusted EBITDA, and adjusted earnings per share.

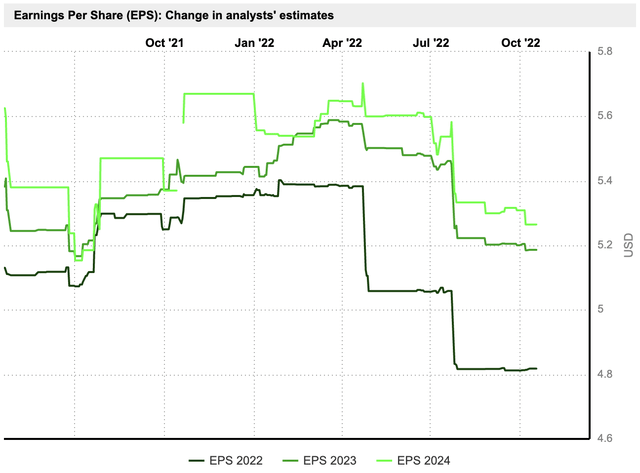

Looking at the chart below, we see that expectations have come down quite a bit. Full-year 2022 EPS estimates were at $5.40 in the first quarter. They are now at $4.80. The same goes for 2023 and 2024 estimates, which have all come down in the past six months.

This year, management also lowered guidance twice.

These developments aren’t reasons for the company to change its business. However, it is causing Verizon to look for growth in other areas. For example, the company will start selling a pay-as-you-go home wireless internet service for $45 a month. That’s the company’s second big product for the prepaid market in many months.

This service, which will benefit people without landlines rivals T-Mobile US’ $50-a-month Metro broadband, which it launched in March.

With that said, contrarians are starting to wake up at current prices.

Verizon’s Dividend – A Trigger For Contrarians

While bear markets aren’t fun, they come with great buying opportunities.

Verizon is one of these companies. Despite sluggish growth and macro headwinds, we’re at a point where a lot has been priced in. People are now starting to focus on what really matters here. The company has a solid business model and the ability to generate high and steadily rising cash flows for its shareholders – the dividend.

Now, contrarian funds are buying. As reported by Bloomberg:

Funds run by Capital Group, Federated Hermes Inc., Invesco Ltd., GQG Partners and other firms snapped up millions of Verizon shares in the three months ended June 30, regulatory filings show. Those bets proved to be premature, since the company in July lowered its forecast for the second straight quarter, sending the stock plunging.

[…]

“Verizon is well-positioned to benefit from ongoing 5G wireless subscription growth along with its leading position in prepaid wireless and new growth opportunities in fiber and fixed broadband connectivity,” said one of the bulls, Ivan Feinseth of Tigress Financial Partners.

The telecom industry is capital intensive and Feinseth says that “Verizon’s strong balance sheet and cash flow enable ongoing investment in spectrum expansion and growth opportunities.”

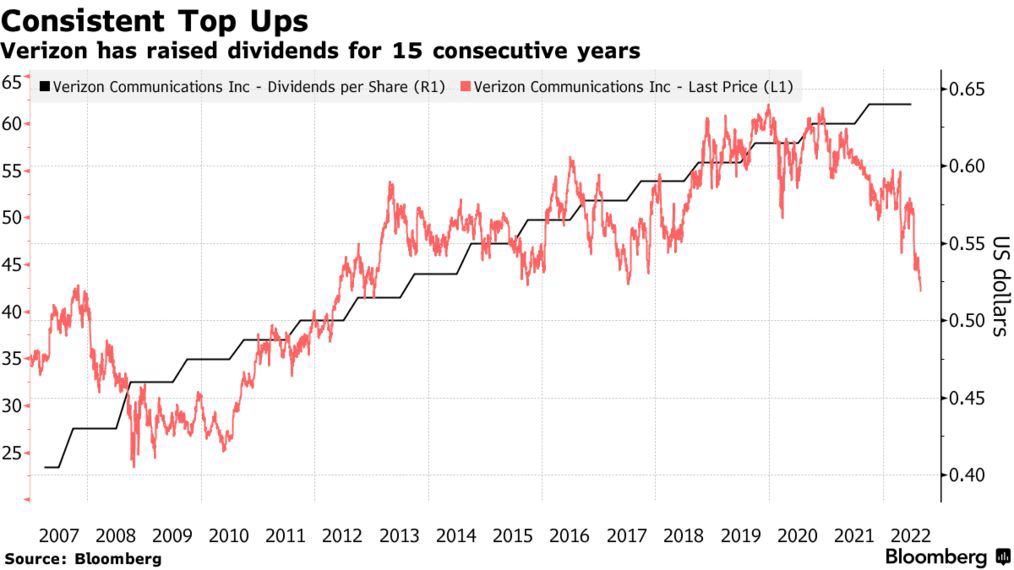

The company behind the VZ ticker has raised its dividend for 15 consecutive years.

Bloomberg

The company’s most recent dividend hike was on September 6, when management announced a 2.0% hike. That’s not a lot, but it’s in line with past hikes. Also, we’re now dealing with a very juicy yield of 7.2%.

Over the past 10 years, the average annual hike was 2.5%. That’s fine considering the high current yield. It should also allow investors to maintain purchasing power under “normal” circumstances.

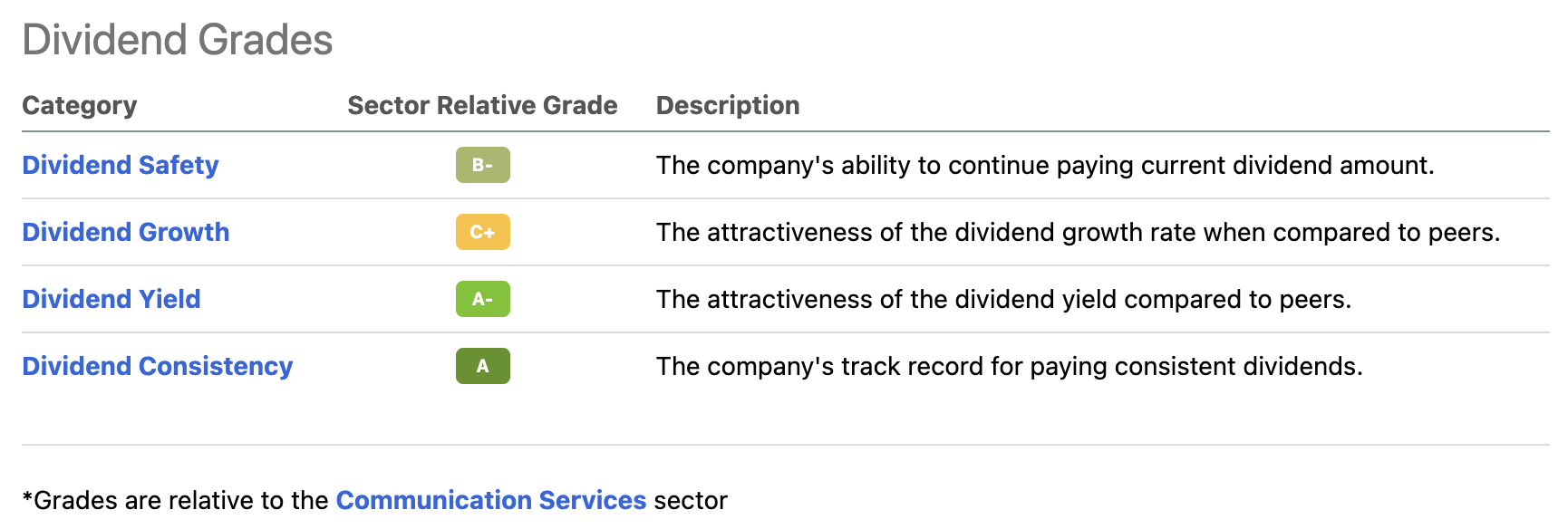

Seeking Alpha

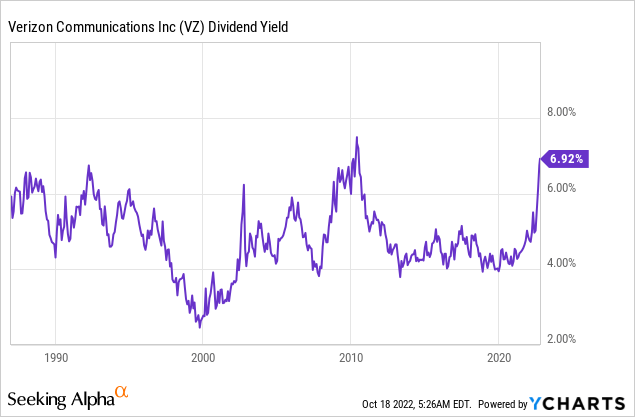

Not only does the company have a good-looking dividend scorecard, but it also has one of the highest yields in its history.

A yield of more than 7% looks like a tremendous deal given that VZ isn’t dead money. Far from it, actually.

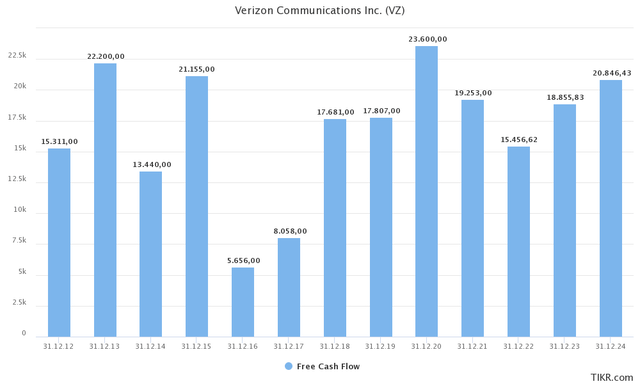

Like revenues and EBITDA, free cash flow isn’t growing either. However, it is providing fertile ground for consistent dividend hikes. If we assume that free cash flow rebounds to $21 billion in the years ahead, we’re dealing with an implied FCF yield of 13.6%, which implies there is a lot of room to grow the dividend in the future. After all, the dividend accounts for roughly half of its free cash flow. Moreover, the balance sheet isn’t risky. The same goes for the net income payout ratio, which is roughly 50%, using next-twelve-months EPS.

In other words, Verizon is one of the few stocks on the market with a very high yield, and a payout ratio close to 50%.

Valuation

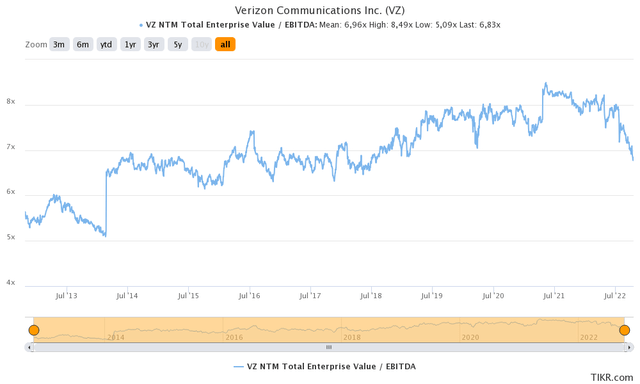

Verizon is trading at 6.4x 2023E EBITDA. That is based on a $315 billion enterprise value, consisting of its $156 billion market cap, $143 billion in 2023E net debt, $15 billion in pension-related liabilities, and a mere $1.0 billion in minority interest.

That’s the lowest forward valuation in roughly 10 years.

It also helps that the implied free cash flow yield is close to 14%, as we calculated in this article. The same goes for the dividend yield, which is close to an all-time high.

Takeaway

In this article, we started by discussing the reasons behind Verizon’s poor performance this year. The company is hit by an ugly mix of high inflation, poor economic growth, weak consumer sentiment, and an aggressive Fed. This is hurting so-called “yield stocks” and the company’s growth plans.

However, the company is far from troubled. It enjoys a healthy balance sheet, steady income, and the ability to use this balance sheet and cash flow to invest in growth in the years ahead.

Its dividend yield has increased to one of the highest levels ever, crossing 7.0%.

In addition to an EV/EBITDA valuation close to 6x, I believe that Verizon has become a very attractive contrarian play.

While the market isn’t out of the woods yet, income-seeking investors might enjoy initiating a position or adding to an existing position.

The dividend, valuation, and bearish market sentiment provide us with an attractive risk/reward.

(Dis)agree? Let me know in the comments!

Be the first to comment