Mario Tama

Shares of AutoNation, Inc. (NYSE:AN) have lost about 13% of their value over the past year; not a great result, but certainly far better than competitors like CarMax, Inc. (KMX), which have been halved. Following that company’s poor earnings report, investors may be worried about what AN will say when the company reports third quarter earnings on October 27th. However, given its more diversified revenue streams, I expect AN to fare well, and shares look attractive here.

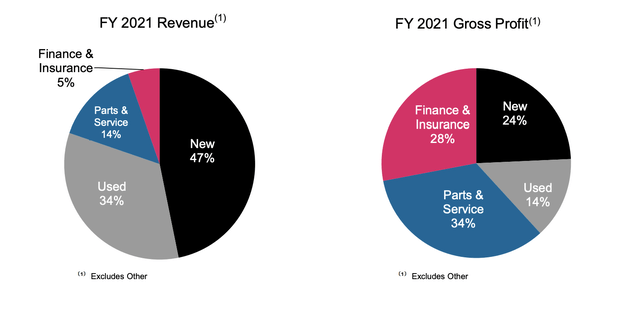

CarMax gets 77% of revenue from used car sales, and so the decline in used car prices we have seen in recent months was a particularly strong headwind. This is much less the case for AutoNation. Last year, used cars drove just 14% of profits. Its parts & services unit is actually the largest single contributor to profits. This positions AN better for periods of economic volatility, and it is why I struggle to see earnings falling much below $8 per share even in a moderate recession.

At the moment, though, AutoNation is doing far better. In the company’s second quarter, it earned a record $6.48, up 34% from last year. This per share growth is really eye-catching when one considers that revenue fell 1.6% to $6.87 billion, and operating income rose 5% to $558 million. In fact, net income fell 2.2%. This EPS increase speaks to just how powerful AN’s share repurchases have been. With the excess profits it has made from the surge in car prices, it has been aggressively returning capital to shareholders.

Last year, the company bought back $2.3 billion of stock. In Q2, AN, bought back $404 million of stock, or 6% of the company and authorized another $1 billion. These buybacks have been funded out of free cash flow, which totaled $750 million in H1, leaving net leverage relatively low at 1.4x. Over the past year, shares outstanding fell by 23% to 56 million. This is why EPS rose so dramatically even as net income fell. The shrinking share count will continue to support per share results even as company-level results moderate.

AutoNation has bought back so much of the company so quickly, it is important to keep this in mind when looking at a longer-term stock chart. At the end of 2019, the stock was about $50, and there were 90 million shares outstanding for a $4.5 billion market capitalization. While the stock has doubled, its market cap is only 25% higher at $5.7 billion. A return to its Q4 2019 market value would represent 20% downside to the stock, not the 50% one would think just comparing prices. The massive share retirement is one way AutoNation has used the boom of the past eighteen months to permanently enhance shareholder value.

Looking back at Q2 results, performance was strong across segments. In aggregate, new cars were a $33 million tailwind, while used cars were a $46 million headwind. SG&A expense was 55.4% of gross profit, down 110bp, as technology investments lower costs.

Profits per new vehicle rose from $4,153 to $6,106. Volumes were up about 2.5% sequentially to 57,890. Domestic brands account for 29% of sales, imports 41% and premium luxury 30%, giving AN access to a broad swath of consumers. New car inventories remain light, which should help to minimize margin contraction. Indeed, the value of all AutoNation’s inventory is up less than 3% year to date. It has not faced with excess supply it will need to mark down.

Used car profits fell from $2,239 to $1,915 per vehicle while volumes fell 3% from last year to 77,080. Finance & insurance profits were flat from last year at $368 million as higher profit margins offset the 15% decline in sales. After sales gross margins remain strong at 46% providing $482 million of gross profits, about one-third of total gross profits. Maintenance work is a critical and underappreciated part of AN’s profitability.

Now, we know that used car margins will moderate, and as the economy slows, so too will new car margins, even with inventories tight. Shares are discounting this already. At a $6 EPS run-rate, AutoNation has just a 4x P/E, so clearly, investors expect earnings to fall and its P/E to normalize. So where will earnings normalize to? Very simplistically, its lowest net income over the past 10 years was $317 million. At its June 30th share count, that would be $5.66 in EPS, giving the company an 18x P/E.

Now since 2012, it has done more than $1.6 billion in cash acquisitions. These new dealerships should contribute some profits, even during a downturn. This is why I prefer to look at the business units. If we run used cars at flat gross profits and cut new vehicle gross profit in half, operating income would fall $330 million or about $250 million after tax. Again, this assumption is saying the company no longer makes money on used cars, entirely wiping out the benefit of the boom over the past eighteen months. That is $2.18 in remaining earnings power from its financing and aftermarket operations.

In practice, during a downturn like this, the company would likely be able to moderate its SG&A spending as it could likely reduce headcount. A 5% SG&A reduction would enable finance, insurance, and aftermarkets gross profits to fall by over 8%, and the company would still run earnings of over $2 per share. Now, when the company reports Q3 results, it likely will show even more buybacks that reduced the share count by at least 1.5 million, bringing this up to about $2.05 in earnings per quarter.

In this deterioration scenario, I still get AN with over $8 in earnings power, meaning it trades at just a 13x P/E and could continue to repurchase about 5% of the company per year. In practice, I expect new and used car profits to hold up better than my downside scenario given tight inventories, which should keep earnings per share above $3 per quarter.

I would be a buyer here and believe shares can get to at least $120 or 10x my base-case earnings and 15x trough earnings. Its diversified business model means AutoNation still has ample earnings power if used car profits disappear and its share repurchases are incredibly powerful in limiting downside. AN is an attractive stock to own.

Be the first to comment