z1b

Investment Thesis

UiPath (NYSE:PATH) is down more than 80% since its IPO. All along the way, investors have been eager to buy the dip.

And all along the way, whether the rally was at $70, $50, $30, or during the summer in the mid $10s, every rally was met with bears taking back control.

And while there’s a lot of validity to the bear case, I also have to question whether Barclay’s recent downgrade of PATH might not be a little too late for the party.

Even while I recognize that a lot of the problems that got UiPath to where it is today have not been solved, I have to acquiesce that a lot of negativity has already been priced in.

What’s Happening Right Now?

Investors welcome some respite as high-beta stocks get their day in the sun.

The problem with investing is that during a bear market, there’s a lot of smoke. There’s a lot of attention being focused on the pain of investing. And having a positive outlook doesn’t sound particularly astute.

Along these lines, investors have been itching for any reason to clamber back into “secular growth stories”.

UiPath’s Near-Term Prospects

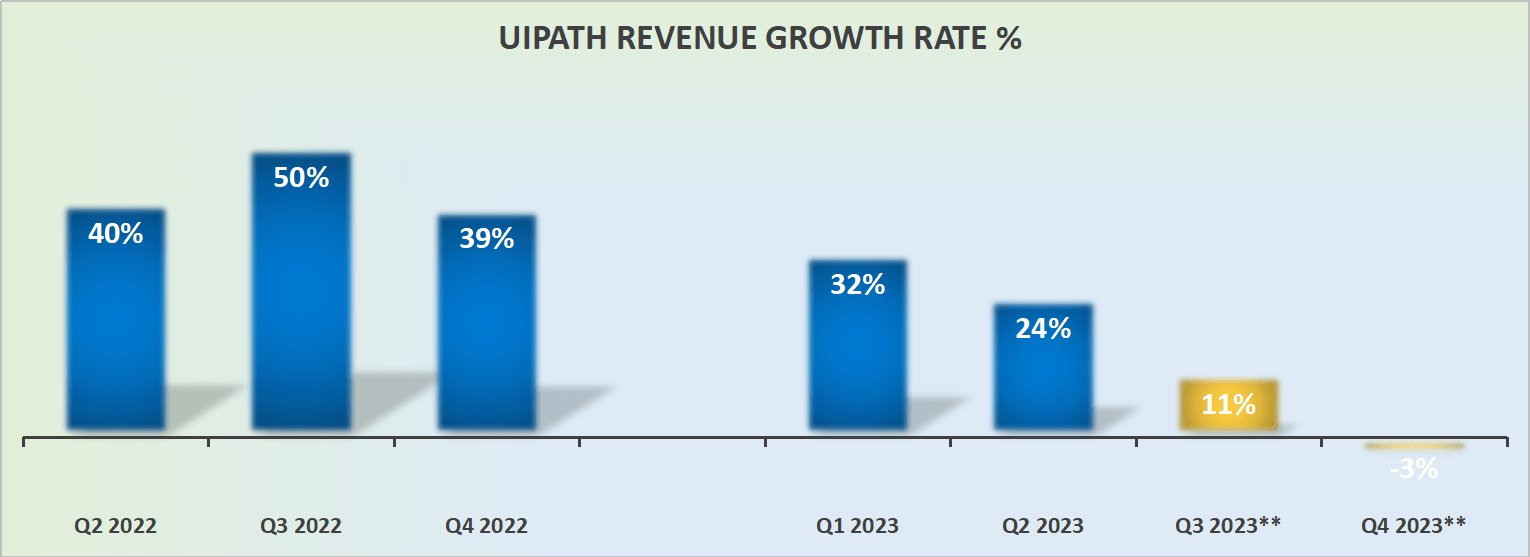

And this is the problem for UiPath. As you can see in the graphic that follows, UiPath’s revenue growth rates coming out of Q4 2023 (ends January 2023) are expected to be marginally negative.

Author’s work

If we rewind the clock just a few months, UiPath was viewed as a very fast-growing company, posting a high 30s% CAGR.

There’s no doubt that the pace of change here has taken many investors by surprise. In essence, we are now going through a period of resetting investors’ expectations.

What we previously thought of as a sticky SaaS business, turns out not to be so sticky.

Do Profits Still Matter?

As SaaS companies continue to push towards scalability, is a compelling narrative enough to drum up enthusiasm for tech companies?

This is a highly contentious issue. For many investors, having executive teams with a lot of stock-based compensation (”SBC”) is a necessary evil.

That being said, when management is watching the value of their SBC take-home package melt up alongside the sliding share price, that’s going to dampen morale.

Naturally, this begs the question. How will UiPath retain executive talent? If previously, you could give out ”free money” using your stock as currency, that is no longer the case.

On yet the other hand, one positive consideration is that UiPath holds $1.7 billion of cash and equivalents and nil debt.

That means that even if executives request higher cash compensation packages to offset the erosion in the value of their ”out-of-the-money” options, there’s enough money on the balance sheet to provide UiPath with ample flexibility.

PATH Stock Valuation – TIAA

The problem for UiPath is that today There is an Alternative (“TIAA”). And what made sense when rates were at 0%, is very different from the set of opportunities available when rates are at 4%.

And for now, there are these odd bear market rallies that get investors eager to deploy their capital only to see it mowed down in the coming few days and weeks.

Is there a scenario where UiPath at 6x forward sales, with nearly no top-line growth, is a bargain? If there is a viable scenario, I’m not seeing that unfolding from here.

The Bottom Line

Yet I would have been much better off if instead of correctly forecasting a bear market, I had focused my attention through the decline on finding stocks that would turn $10,000 into a million dollars.

Bear market smoke gets in one’s eyes it blinds us to buying opportunities if we are too intent on market timing. (Thomas Phelps)

Here’s what I believe. As investors, we should tap ourselves on the back. We’ve made history in 2022. We’ve just embraced a historic meltdown of equity markets. They’ll be talking about 2022 for the next 10 years.

After 10 years, this pain will be forgotten and new concepts will emerge and new players will emerge.

Everything will be different, and yet, everything will be the same. The same fear and greed.

But this is the most important takeaway. The likelihood that the next twelve months will be as bad as the previous twelve months is extremely limited.

Even if PATH goes up and down over the next twelve months, that’s a lot better than straight down.

Be the first to comment