madsci

Introduction

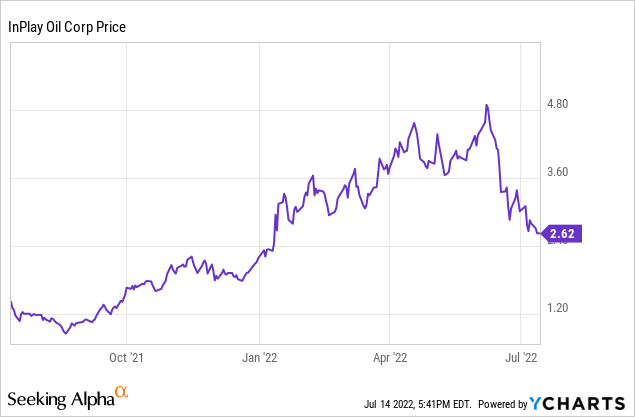

As explained in a previous article, I ended up with a position in InPlay Oil (OTCQX:IPOOF) after my position in Prairie Storm Resources was converted into InPlay Oil upon the successful completion of the acquisition by the latter. As this used to be a relatively small position and I don’t want to lose track of my positions I was considering selling InPlay Oil but as mentioned in the previous article, there were plenty of reasons to back off from that trade. InPlay’s share price has now fallen an about 15% but I’m turning increasingly bullish and instead of considering selling the position, I’m seriously contemplating buying more shares.

I will continue to refer to InPlay Oil’s Canadian listing as this is the most liquid listing and I’d recommend to trade the company’s shares on the TSX where it’s listed with IPO as its ticker symbol. The current share price is just around C$2.6, giving the company a market capitalization of around C$225M. The average daily volume in Canada is in excess of half a million shares.

The Q1 results have set the scene for the rest of the year

To explain why I think InPlay Oil should remain a position in my portfolio, it’s useful to fall back on the Q1 results as that will allow me to work with up-to-date numbers using an oil price which is pretty similar to the current spot price.

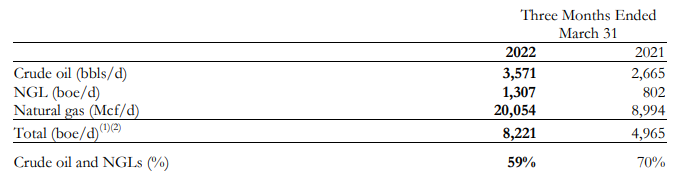

InPlay Oil is a small producer. That has its benefits but also has disadvantages as an issue with one of the wells would have a bigger impact on the total result. In the first quarter of this year, the average production rate was just over 8,200 barrels of oil-equivalent per day and surprisingly oil only represented less than 45% of the output. The NGLs added about 15% so the total liquids production came in at 59% of the consolidated output.

InPlay Oil Investor Relations

This also means InPlay Oil has been exposed to very high natural gas prices during the second quarter. The average realized prices were C$116 per barrel of oil, C$48 per barrel of NGL and C$5.18 per Mcf of natural gas.

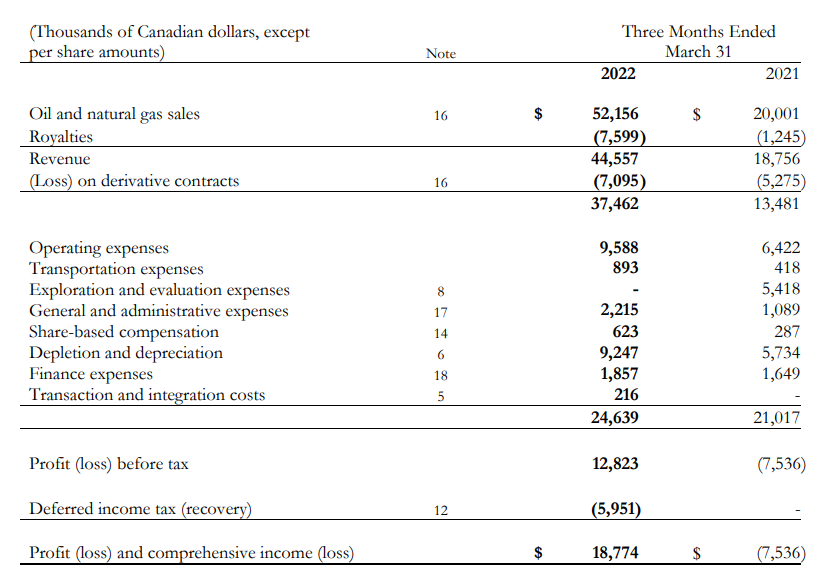

This resulted in a total revenue of C$44.6M including the payment of almost C$7.6M in royalties. The company also deducted the C$7.1M in (realized and unrealized) hedging losses from the revenue so the net reported revenue came in at C37.5M.

InPlay Oil Investor Relations

The operating expenses clearly confirm InPlay as a low-cost producer: The operating expenses are just over 20% of the pre-hedge revenue while the company is hardly paying any transportation-related expenses thanks to the excellent access it has to existing systems. The net income in the first quarter was C$18.8M but this includes a C$6M tax benefit. On a more normalized basis, the EPS would likely have been about 50% lower at C$0.11 which would still be highly attractive for a company trading at just around C$2.60.

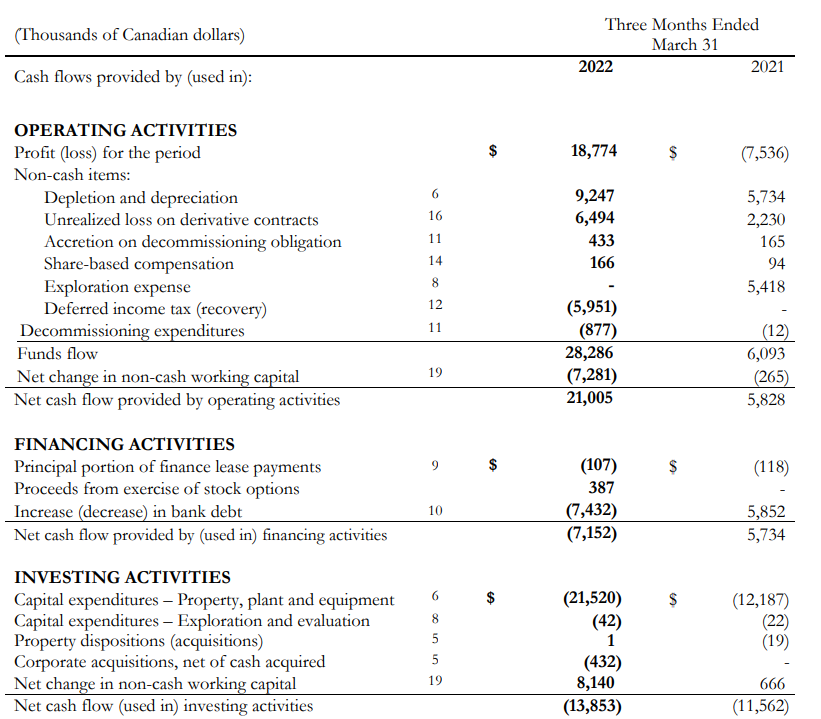

The operating cash flow was approximately C$28.2M after deducting the lease payments and after adding back the almost C$6.5M in unrealized hedging losses. This means only C$0.6M in hedging losses were actually realized in Q1 so we will continue to see realized hedging losses in the next few quarters.

InPlay Oil Investor Relations

What’s really important is the capex, which came in at C$21.5M. This indicates the free cash flow was less than C$7M which would be very disappointing, but keep in mind InPlay has been front-loading this year’s capex. The full-year capex was hiked to C$64M but this also includes growth capex as the full-year production rate will be about 10% higher than the Q1 production rate. In the previous article, I estimated the sustaining capex to be around C$30M. Even if I’d use C$40M (C$10M per quarter) the adjusted free cash flow in Q1 would have been around C$18M on a sustaining basis.

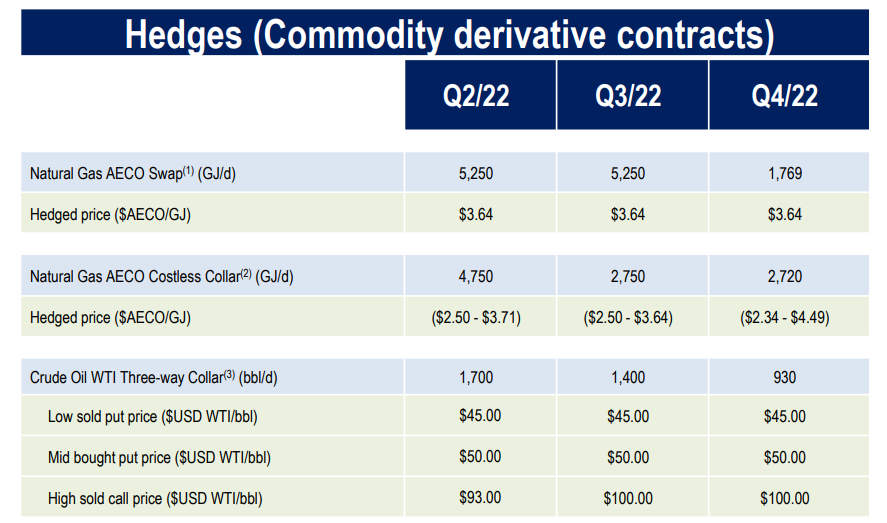

We will see some pain in Q2 as the company had hedged about 10,000 GJ/d of natural gas which is about half of the anticipated production (which is expressed in Mcf/day) but given how strong the natural gas price was, the unhedged portion will make up for this and I think we will likely see a similar realized natural gas price of just over C$5/Mcf in Q2.

InPlay Oil Investor Relations

Whether oil trades at $100 or $80, I don’t really care

With 86.5M shares outstanding as of the end of March, the annualized free cash flow result indicates the FCF per share will be around C$0.83 based on the Q1 performance. That’s great, but I also wanted to see how the company sees its free cash flow evolve using a lower oil price.

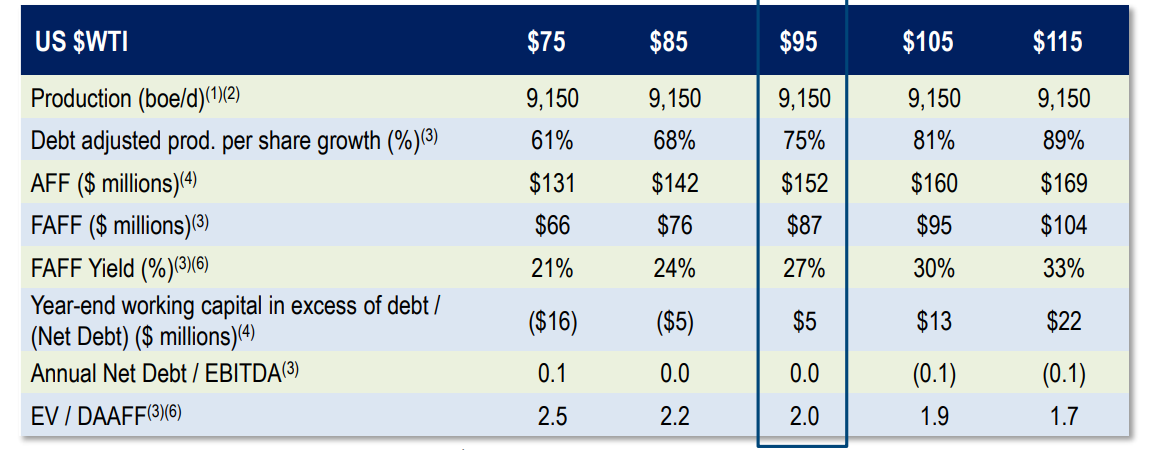

The image below shows the sensitivity analysis provided by InPlay. We clearly see that even at $75 WTI the operating cash flow will be C$131M and the free cash flow will be C$66M.

InPlay Oil Investor Relations

There are two caveats here. First of all, this calculation still includes the growth capex so the underlying free cash flow result would be closer to C$100M if one would only take the sustaining capex into consideration.

Secondly, while the company provides the oil price sensitivity, it sill uses a natural gas price of C$6 on an AECO basis, and that may be a little bit too optimistic. But $75 oil may also be too pessimistic in that scenario so for now I’m just sticking with the Q1 result on an annualized basis to determine how attractive InPlay Oil is.

The net debt as of the end of March was just C$71M so this will decrease really fast. I was expecting InPlay to settle on a new credit agreement, but the company has been kicking the can down the road for the past month. Perhaps it’s holding out for a better deal as it shows a Q2 result with a lower net debt. I’m not worried about the extension of the credit facility whatsoever as the debt could almost be repaid by the end of the current calendar year.

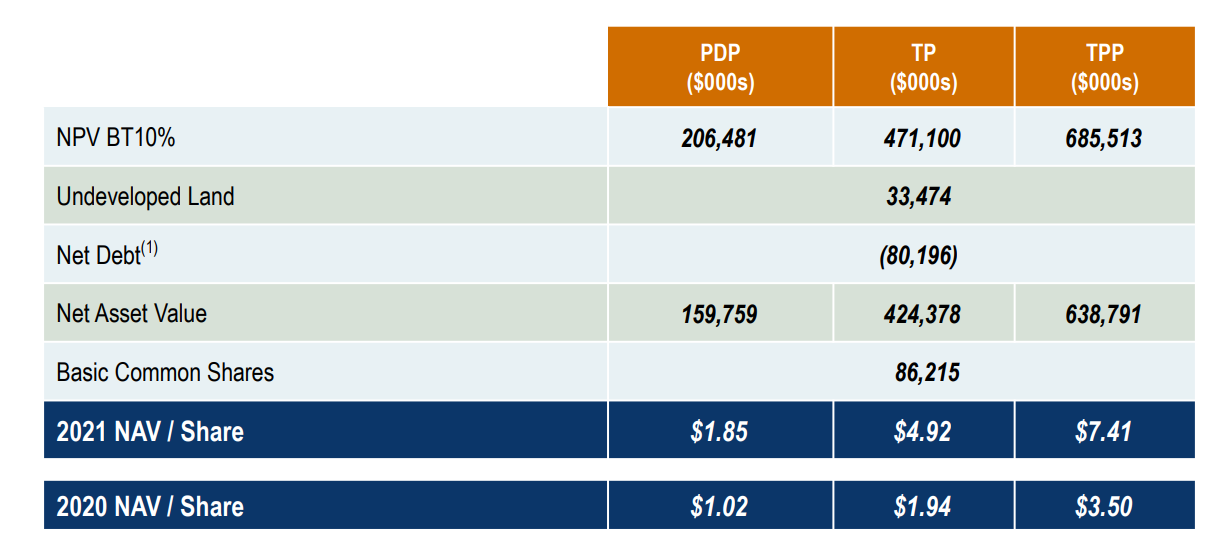

Another important reason for me to hold onto the shares is the PV-10 valuation of the 2P reserves. Those are estimated at in excess of C$7/share which is almost three times the current share price.

InPlay Oil Investor Relations

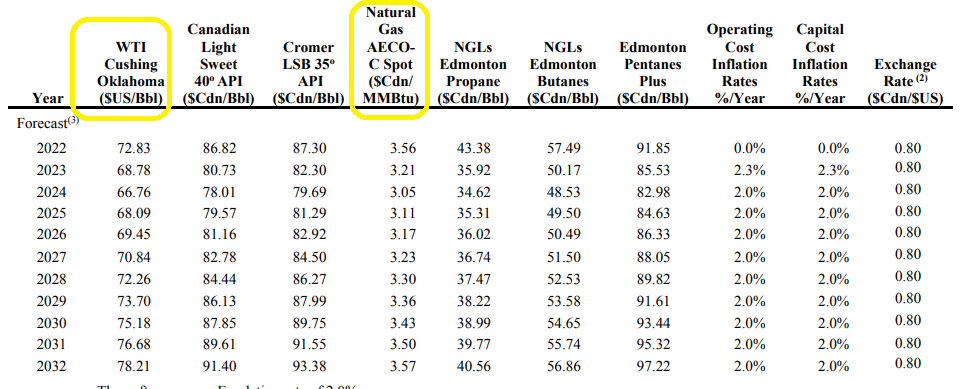

And I think it’s important to emphasize that calculation was based on substantially lower oil and gas prices, as you can see below.

InPlay Oil Investor Relations

Investment thesis

InPlay’s second quarter should be excellent as the average oil price exceeded US$100/barrel on a WTI basis. Q3 will very likely be weaker but that doesn’t mean there isn’t any upside potential at InPlay. Even if I would apply US$75 oil and C$4 AECO, InPlay is in a good shape. The net debt will almost be entirely gone by the end of this year and then there’s nothing standing in the company’s way to further increase the capex to continue to increase the production rate by a double digit percentage. Even at an increased production rate of 10,000 boe/day, the existing 2P reserves are underpinning a 16+ year reserve life.

So rather than being a seller, I’m actually considering adding to my position.

Be the first to comment