onurdongel/iStock via Getty Images

Summary

I recommend a BUY rating on Daimler Truck (OTCPK:DTRUY). One of the few long-standing businesses in the commercial vehicle sector, DTRUY has been around for quite some time. In terms of progress and expansion, this places it in the lead. DTRUY is positioned to be a market leader in the coming years as plans to electrify commercial vehicles progress.

Company overview

DTRUY is one of the leading global manufacturers of vehicles. They boast of manufacturing famous trucks such as the Mercedes-Benz Actros, the Freightliner Cascadia and the well-known FUSO Canter. Other brands sourcing vehicles from DTRUY include Western Star, BharatBenz Setra, and Thomas. Along with the sale of trucks and buses, they also provide customers with tailored financial services.

In line with the sale of trucks and buses, they provide customers with tailored financial services.

Importance of the transportation industry highlighted with increasing globalization and urbanization

The market demand for transport products and services is fueled by the gradual interaction and integration of commercial companies worldwide. 11% of the world’s GDP comes from the transport and storage of goods and services, which is where commercial trucks and trucking services fit in. The following market factors can explain why the demand for commercial trucks and services is on the rise:

- GDP growth: Global GDP growth is gradual as a result of increased productivity, increased government spending, increased investments, and even increased human consumption.

- A rising global population: an increase in demand commands an increase in supply. More people equate to more consumption and, hence, more production. As production increases, there is an increased need for an efficient transport system and, thus, more demand for logistic services.

- Ongoing urbanization: the switch to urbanization creates a bigger market for both commercial buses in the city and commercial trucks to deliver goods both to the urban and rural population.

High barriers to entry in the truck industry

The commercial truck and bus industry is a highly specific niche. Key aspects determine the success or failure of a manufacturer. This feature limits the number of OEMs who compete in the global market. The key aspects include:

- Customization: commercial trucks and buses are tailor-made to suit the different customers and the varying terrains that they will operate in. Governing laws and regulations also differ from country to country, and manufacturers must customize the vehicles to suit the respective countries.

- Service Network: A major concern for the existing and upcoming markets is the availability of high-quality service parts. A functional service network is necessary for a manufacturer to command a higher share of the market.

- Digital Services: There is a digital shift across all commercial markets. For the transport industry, OEMs are required to digitize vehicles and fleet management. This places expectations on the manufacturers.

- Technology: OEMs differ in the digital solutions, data-driven services, and the technology they offer alongside their vehicles and trucks. The changes in the market dictate that manufacturers should align themselves with dynamic technologies.

Global scale player

DTRUY is a major player in the transportation industry around the world. Due to its size and resources, it is able to invest in the research and development of cutting-edge technologies like vehicle e-mobility in strategically important markets like Japan. In addition, the Group’s ability to share technologies across its operations helps it maintain its position as a global technological leader. They also run a global aftersales service network, which mitigates the impact of economic cycles from vehicle sales.

Revenue quality to improve with growth of service offerings

Advanced companies sell their products as an advantage to selling their services. Once a product is bought, services relating to it are bought repeatedly. This explains DTRUY’s goal to switch from vehicle sales to providing advanced services. Offering both vehicle sales and services, improving vehicle operation will strengthen customer relationships in the long term.

Services that customers seek include:

- Workshop services,

- Maintenance plans,

- Spare parts,

- And services for the engagement of customer operations

The tailored financial services offered by DTRUY also allow for leasing packages and allow for vehicle insurance brokerage and banking services. Ultimately, DTRUY aims to transition to an integrated service model to offer tech-enabled solutions, autonomous driving systems, and financial services. This will build a base for offering advanced services by the year 2030.

Investment in technology to ‘futureproof’ the business

With the world’s organizations and governments championing and transitioning to zero-carbon emissions for the environment, DTRUY is employing its research and development hubs to accelerate the transition from ICE (Internal Combustion Engines) to ZEV (Zero Emission Vehicles). DTRUY’s products are currently powered by diesel engines, a situation set to change in the next 10 years. DTRUY is committed to leading the way to zero emissions and offering alternative drivetrains.

Valuation

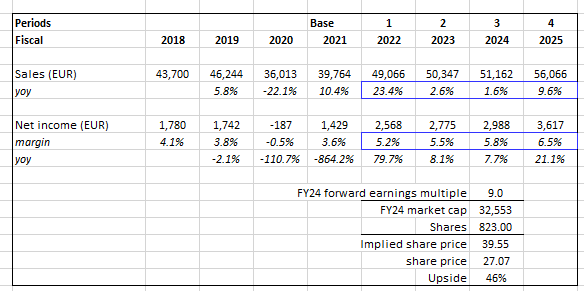

At the current stock price of EUR27.07 and 823 million shares, the market cap is ~EUR22.3 billion. I believe the current valuation is an attractive entry point for investors as my model suggest ~46% upside. I want to highlight that my model estimates are largely in line with consensus estimates, as I think they are fairly reasonable and DTRUY should be able to meet them.

In FY25, I expect it to generate EUR56 billion in sales and EUR3.6 billion in earnings. This will be driven by continuous growth initiatives. Net margin to expand to 6.5% in FY25, giving it a market cap of EUR32 billion and a stock price of EUR39.55 in FY24, assuming it trades at its average forward earnings multiple of 9x in FY24.

Author’s estimates

Risk

Cyclical industry

The heavy-duty commercial truck industry is sensitive to business cycles. In high seasons, revenue generated is high, but during economic downturns, low revenue is achieved. This implies low purchasing during low economic times for DTRUY during any economic contractions.

Competition from incumbents

DTRUY faces fierce competition from mature industry players like TRATON, Isuzu, Hino, and Volvo. In a market with few trusted industry leaders, it might be hard to break even.

Conclusion

DTRUY is a good investment because I believe it is undervalued. DTRUY is one of the few well-established companies in the commercial vehicle industry. This puts it ahead of the curve in terms of development and growth. The R&D hubs of DTRUY are an investment in future technologies. With commercial vehicle electrification in the works, DTRUY is well-positioned to be a market leader in the coming years. The value of industry leaders is bound to rise as the logistics industry is expected to expand in the coming years. DTRUY is one of the industry’s top leaders, and so I think their value is expected to rise as well.

Be the first to comment