shaunl/E+ via Getty Images

On Tuesday, November 1, 2022, Texas-based electric and natural gas utility CenterPoint Energy, Inc. (NYSE:CNP) reported its third-quarter 2022 earnings results. At first glance, these earnings were reasonable, as the company beat the earnings expectations that were put forth by analysts and managed to post year-over-year revenue growth. This is not exactly unusual for a utility, however, as these companies all have something of a reputation for delivering slow and steady growth over time. This is one of the reasons why they are so popular with conservative investors, as their stability tends to make them good picks to ride through times of economic weakness, such as we are experiencing now.

CenterPoint Energy certainly showcases that overall stability in these results, and its five-year growth plan promises to give investors an attractive total return over the coming years. Unfortunately, investors must pay through the nose for these good things, as CenterPoint Energy also has one of the highest valuations in the sector. The company certainly has a lot to offer if the price drops a bit, though, so investors are certainly advised to keep an eye on the stock and watch for a good opportunity to jump in.

As my regular readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from CenterPoint Energy’s third-quarter 2022 earnings results:

- CenterPoint Energy brought in total revenues of $1.903 billion in the third quarter of 2022. This represents an 8.81% increase over the $1.749 billion that the company reported in the prior-year quarter.

- The company reported an operating income of $384 million during the reporting period. This compares quite favorably to the $280.0 million that the company reported during the year-ago quarter.

- CenterPoint Energy increased its long-term capital spending plan to include an extra $2.3 billion by 2030. This money is intended to be used to increase the resiliency of the company’s electric grid as well as replace some of its older assets with modern ones.

- The company declared a quarterly dividend of $0.18 per share, which was in line with its previous dividend.

- CenterPoint Energy reported a net income of $202.0 million in the third quarter of 2022. This represents a 7.34% decline over the $218.0 million that the company reported in the third quarter of 2021.

We can certainly see the company’s overall stability reflected in these highlights as a few figures changed very little year-over-year despite the fact that the economy is much weaker now than it was in the third quarter of 2021. This is a defining characteristic of CenterPoint Energy due to the nature of the product that it provides. As an electric and natural gas utility, the company provides electric and natural gas service to residences and businesses in Texas, the surrounding states, as well as parts of Indiana and Minnesota. The majority of the company’s operations outside of Texas are natural gas, though. These are products that most people consider to be necessities to function in modern society so they will usually prioritize paying their utility bills ahead of other expenses during times when money gets tight. As I have discussed in various recent articles, that is largely the case for many families in America today, as rising food and energy bills have forced many to cut back on luxuries in order to prioritize spending their money on the most needed items.

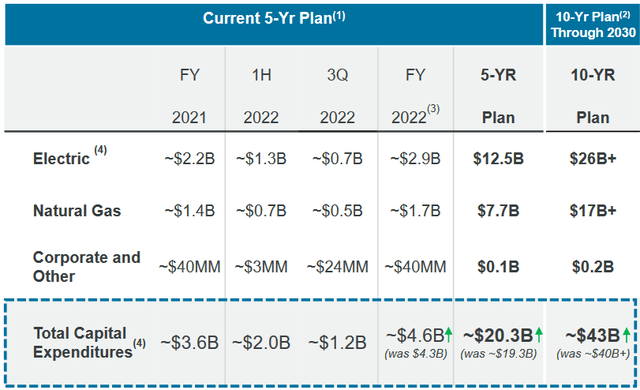

As investors, we are not likely to be satisfied with simple stability, though. We want to see growth. Fortunately, CenterPoint Energy is well-positioned to give this as the company is in the process of growing its rate base. The rate base is the value of the company’s assets upon which regulators allow the company to earn a specified rate of return (usually around 10%). As this rate of return is a percentage, any increase to the rate base should allow the company to raise its prices in order to earn this allowed rate of return. The usual way in which a company grows its rate base is by investing money into upgrading, modernizing, and possibly even expanding its utility-grade infrastructure. CenterPoint Energy is planning to do exactly this as the company stated in its earnings report that it intends to invest $20.3 billion over the 2021 to 2025 period and $43 billion over the 2021 to 2030 period into growing its rate base:

These are larger numbers than what the company was planning over most of this year. As stated in the highlights, CenterPoint Energy increased its planned spending by $2.3 billion recently to bring the total up to approximately $43 billion. Management was not specific on exactly what this extra money will be used for, but we were provided some information. According to Dave Lesar, President, and CEO of CenterPoint Energy,

“We are equally excited to provide an updated capital plan that increases our previous $40B-plus customer-driven capital plan by $2.3 billion to nearly $43 billion through 2030. This incremental capital will be dedicated to further distribution system resiliency, reliability, and grid modernization, as well as transmission upgrades in our Houston Electric area that should benefit our customers. Another $3 billion of capital opportunities have been developed, which would be additive to our capital plans through 2030 as we look to add it efficiently and prudently over time.”

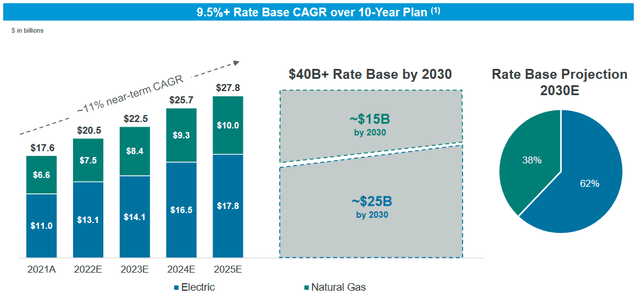

The fact that Mr. Lesar specifically mentioned Houston Electric is interesting, since that is by far the company’s largest electric utility. We will discuss later in this article what that could mean. For now, let us focus on the growth that the spending plan should result in since that is one of the most important things in determining what our potential return on investment could be. In short, it should be sufficient to grow the company’s rate base at an 11% compound annual growth rate over the 2021 to 2025 period and boost the company’s rate base to approximately $40 billion by year-end 2030. That works out to a 9.5% compound annual growth rate over the full ten-year period:

At this point, there will likely be many readers that point out that the company’s rate base growth is likely to be far less than the amount of money that it is spending to generate that growth. This is partly due to depreciation. Basically, due to depreciation, the value of the things that comprise the company’s rate base is constantly declining. Thus, in order to actually grow the rate base, the company must spend enough to overcome the depreciation that its existing assets experience as well as the costs of the desired amount of increase. It needs to do this constantly too since the newly purchased assets will also begin to depreciate as soon as the company puts them into service. In addition to this, the company will likely retire some old assets as a part of its investment programs. We have seen this a lot with coal-fired power plants over the past few years as utilities seek to reduce their carbon emissions. CenterPoint Energy has stated that it will be retiring the Culley 2 coal plant in 2025 so this statement applies to CenterPoint Energy as well. The value of that plant will be completely removed from the company’s rate base once it is retired so this will be a drag on rate base growth as well.

Although the company’s rate base will grow at about an 11% compound annual growth rate, its earnings per share may not grow at the same pace. One reason for this is that regulators do not always approve rate hikes right away so the company’s actual earned rate of return off of the rate base fluctuates a bit from the allowed value. However, the more important reason is that the company will issue both common equity and debt to finance its capital expenditures. The increased common share count dilutes some of the impacts of earnings growth. With that said though, investors today should expect a fairly reasonable rate of return. Management has guided for an 8% compound annual growth rate of the company’s earnings per share through 2024 and a 6% to 8% earnings per share growth rate thereafter. When we combine this with the company’s current 2.56% dividend yield, we get a projected total return of 10% to 11% over most of the next decade, which is a reasonable return for a utility.

It is not exactly a well-kept secret that electric vehicles (“EVs”) will almost certainly become more common over the coming years. We are seeing many automakers begin to market these vehicles and, while they certainly do not make sense for all people at this point in time, they make a lot of sense for a typical urban or suburban commuter that does not drive particularly long distances every day. CenterPoint Energy has been working to deploy charging stations all around the city of Houston, Texas that will of course be powered by its electricity.

The company also has a program for its customers to get charging infrastructure installed in their own homes. When we consider the amount of electricity that an electric car requires, this could prove to be a profitable endeavor for CenterPoint Energy. The company states that each electric vehicle purchased by one of its customers should increase the company’s profit by about $80 per year. CenterPoint Energy currently serves about 2.8 million electric customers so if each of them was to purchase only one electric vehicle, that works out to an extra $224 million in profit for the company annually. When we consider that the company had a third-quarter operating income of $384 million, that is a fairly significant profit increase. Naturally, at least some of the company’s investments into the “resiliency” of the electric grid are intended to support this process.

It is always important that we look at the way that a company finances its operations before we make an investment in that company. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This is usually accomplished by issuing new debt and using the money to repay the maturing debt, which can result in a company’s interest expenses increasing following the rollover depending on the market conditions. In addition to this, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes the firm’s cash flow to decline could push it into insolvency if it has too much debt. Although electric utilities like CenterPoint Energy typically have remarkably stable cash flow, bankruptcies are certainly not unheard of in the sector so we should still always keep this risk in mind.

One metric that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity will cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important. As of September 30, 2022, CenterPoint Energy had a net debt of $15.005 billion compared to a total shareholders’ equity of $9.989 billion. This gives the company a net debt-to-equity ratio of 1.50, which is generally reasonable compared to many other utilities. Here is how that compares to some of the company’s peers:

|

Company |

Net Debt-to-Equity |

|

CenterPoint Energy |

1.50 |

|

DTE Energy (DTE) |

2.22 |

|

CMS Energy (CMS) |

1.81 |

|

FirstEnergy Corp. (FE) |

1.87 |

|

Entergy Corporation (ETR) |

2.14 |

As we can see, CenterPoint Energy has the lowest overall leverage of any company out of this peer group. Please note though that only those peers that have reported their third-quarter numbers are included in this comparison so there are certainly some with more attractive ratios that were excluded. The takeaway though is that it does not appear that CenterPoint Energy is using too much debt in its financial structure. It does not appear that investors have too much to worry about here.

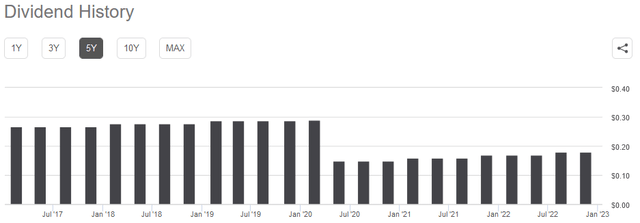

One of the major reasons why investors purchase shares of utility companies is because they tend to pay out higher yields than companies in other industries. CenterPoint Energy is certainly not an exception to this as the company currently yields 2.56%, which is substantially higher than the 1.65% yield of the S&P 500 index (SPY). CenterPoint Energy does not, unfortunately, have the long track record of dividend increases like many of its peers have. The company instead cut the dividend back in mid-2020 and although it has been increasing it annually since then, it is nowhere close to the amount that the company was paying prior to that time:

The company’s seeming desire to grow its dividend is something that is fairly nice to see in today’s inflationary environment, however. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays out. Thus, we need to keep increasing our incomes in order to offset this effect and maintain our expected standard of living. The fact that CenterPoint Energy generally increases its dividend over time helps to accomplish that. With that said, the fact that the company did cut back in 2020 is quite disappointing but it is important to keep in mind that anyone purchasing the stock today would receive the current dividend and yield so it is not really worth worrying about the company’s past. The important thing is how well the company can maintain its dividend today. After all, we do not want to find ourselves the victims of a dividend cut since that would reduce our incomes and most likely cause the company’s stock price to collapse.

The usual way that we analyze a company’s ability to maintain its dividend is by looking at its free cash flow. Free cash flow is the money that was generated by a company’s ordinary operations that is left over after it pays all its bills and makes any necessary capital expenditures. This is the money that can be used for things such as reducing debt, buying back stock, or paying a dividend. In the third quarter of 2022, CenterPoint Energy reported a negative levered free cash flow of $1.0838 billion. This is obviously not enough to pay any dividend, let alone the $138.0 million that the company actually paid out. This is thus rather concerning on the surface.

However, it is not unusual for a utility to finance its capital expenditures through the issuance of equity and especially debt while financing its dividend out of operating cash flow. This is mostly because of the incredibly high cost of constructing and maintaining utility-scale infrastructure across a wide geographic area. In the third quarter, CenterPoint Energy reported an operating cash flow of $347.0 million, which was more than enough to cover the $138.0 million dividend and leave the company with a bit of money left over for other things. Overall, this dividend does appear to be reasonably sustainable and investors probably do not need to worry too much about another potential cut.

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a utility like CenterPoint Energy, one metric that we can use to value it is the price-to-earnings growth ratio. This ratio is a modified form of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to the company’s forward earnings per share growth and vice versa. However, almost no stock has a price-to-earnings growth ratio that is that low in today’s highly inflated market. This is especially true in the low-growth utility sector. Thus, it makes sense to compare CenterPoint Energy’s valuation to that of its peer group to see which stock currently offers the most attractive price.

According to Zacks Investment Research, CenterPoint Energy will grow its earnings per share at a 3.53% rate over the next three to five years. That seems a bit low considering the company’s rate base growth over the same period. We will discuss what that might mean in just a few moments. At the analysts’ growth rate, the stock has a price-to-earnings growth ratio of 5.74 at the current price. Here is how that compares to the company’s peer group:

|

Company |

PEG Ratio |

|

CenterPoint Energy |

5.74 |

|

DTE Energy |

3.08 |

|

CMS Energy |

2.45 |

|

FirstEnergy Corp. |

2.33 |

|

Entergy |

2.52 |

Clearly, at Zacks’ growth estimate, CenterPoint Energy currently appears to be tremendously expensive relative to its peers. The stock price would have to decline by around 50% in order to be reasonably valued. However, as was just mentioned, the Zacks’ earnings per share estimate seems to be very low. If we assume that the company will grow its earnings per share at a 6% rate, which is at the low end of management’s guidance then that drops its price-to-earnings growth ratio down to 3.52 at today’s price. If we use the high end of management guidance, the price-to-earnings growth ratio works out to 2.64 at today’s price. The company still looks expensive but not tremendously so. It still might make some sense to wait for a bit of a dip in the share price, though, just to add a margin of safety.

In conclusion, CenterPoint’s third-quarter earnings results showed the usual stability that we expect from a company like this. Its growth plan going forward is incredibly ambitious but it may pay out, especially if electric cars do end up seeing the kind of popularity growth that many people expect them to. The company’s balance sheet is fairly strong but unfortunately, the stock valuation appears a bit stretched. CenterPoint Energy has some real potential, but it might be a good idea to wait for a dip in the stock price before buying in.

Be the first to comment