Scott Olson/Getty Images News

Introduction

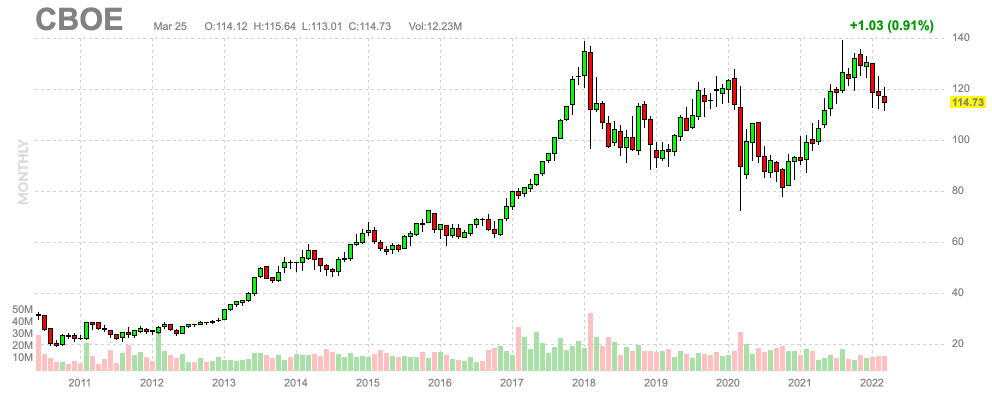

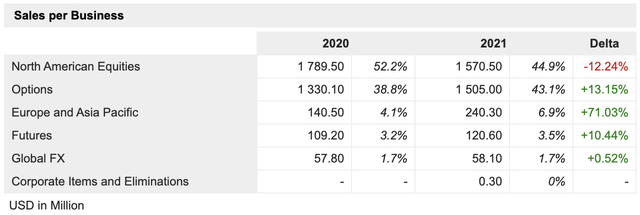

The S&P 500 is down roughly 5% year-to-date while I’m writing this. The Tech-heavy ETF (QQQ) is down close to 10%. While none of this is a lot – historically speaking – it won’t hurt to look for stocks that offer opportunities because of their poor performance this year. One of them is Cboe Global Markets Inc. (BATS:CBOE), a stock I’ve discussed in the past. The reason why I didn’t pull the trigger is that I bought its peer Nasdaq (NDAQ), which I bought on weakness at $172.95. In this case, I believe that CBOE is too cheap because of its ability to generate free cash flow used for dividend growth and debt reduction. The implied free cash flow yield is now close to 6.0%, which is too high in this market. While the market will likely remain volatile, I believe that the dividend growth crowd will like the opportunity the correction in CBOE’s stock brings to the table.

A Great Report Card

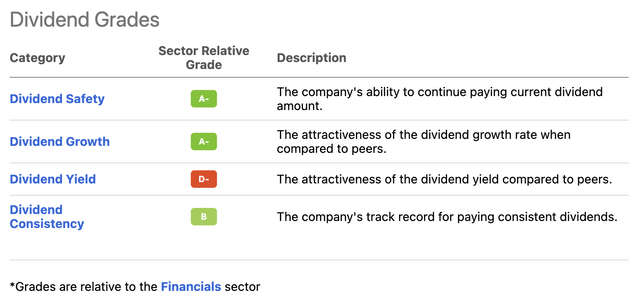

I’m not a big fan of automated grading systems in general. That’s why you’ve never seen me rank stocks. Stocks are way too individual and “fluid” to be analyzed based on a set number of financials. However, I do like the Seeking Alpha dividend grading, and I’m obviously not paid to say that.

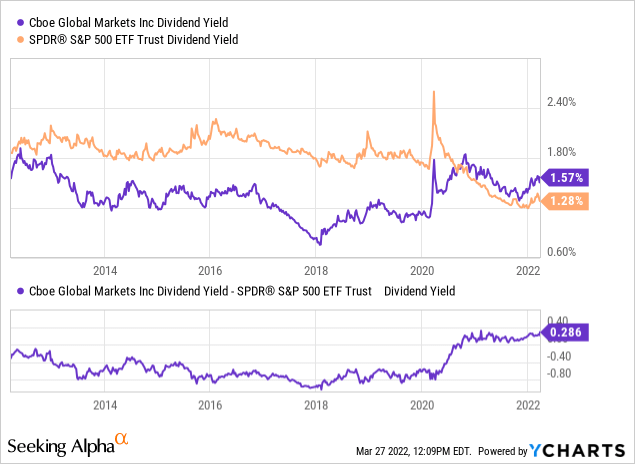

In the case of CBOE, we’re dealing with very satisfying grades. In this case, the company is being compared to the financial sector. The industry the company is operating in is financial data and stock exchanges. Bear this in mind when looking at the company’s dividend yield grade, which is a D- (not exactly what you want to see as a potential investor).

However, please be aware that the financial sector is dominated by large money center banks like JPMorgan (JPM) or Bank of America (BAC) as well as a big number of high-yielding regional banks, which increases the average dividend yield.

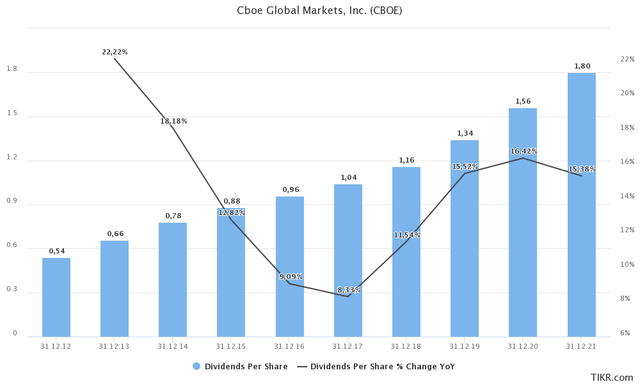

In the case of CBOE, the company pays a $1.92 annual dividend per share. This translates to a 1.7% yield based on its current price of $114.73.

That’s above the S&P 500’s yield of roughly 1.3%. As the chart below shows, the S&P 500 yield has fallen off a cliff after the pandemic. Capital gains have outperformed dividend growth, leaving income-seeking investors in the dust. Most started to search for yield in above-average-risk places.

Please note that YCharts has not yet updated the Cboe yield. Hence, the yield difference is not 29 basis points, but closer to 40 basis points. This gives CBOE the highest yield “premium” of the past 10 years after yielding less than the S&P 500 prior to the pandemic.

With that said, let’s discuss why the dividend is consistent, fast-growing, and safe – the other three items on the scorecard.

CBOE Comes With (Dividend) Growth & Safety!

CBOE is like a money printer. Shareholders make money whenever people trade, to put it very bluntly.

In my last Cboe article, I wrote that:

whenever someone places an options trade using CBOE products, its investors win. That’s the best thing about CBOE and a reason why I pick companies that return cash to their shareholders based on simple daily things.

For example, my railroad investments benefit from transportation demand, defense companies return cash whenever governments place new orders, and consumer stocks benefit when people spend their money on products and services. In this case, CBOE offers trading across a diverse range of products in multiple asset classes. This includes options, futures, U.S., Canadian, and European equities, exchange-traded products, global foreign exchange, and volatility products based on the VIX index.

The company has the exclusive right to offer exchange-listed options contracts in the United States on the S&P 500 index, the S&P 100 Index, the S&P ESG Index, and many more. The same goes for FTSE Russell Indices and various MSCI indices. The company also has a deal with Dow Jones, which covers the Dow Jones Industrial Average. CBOE is also the leader in volatility trading via the Cboe Volatility Index VIX.

In 2020, roughly 63% of total sales less cost of revenues was generated by the company’s transaction and clearing-based business, which basically means that if people trade more options and related derivatives, CBOE will make more money.”

Moreover, what I love about Cboe (and it’s the reason why I own NDAQ) is that the company is moving towards rapid growth in recurring, non-transaction revenue.

Cboe and its peers have a major benefit (among others): they have so much data. Hence, Cboe is using its data and access solutions segment to breach a $33 billion annual industry called financial market data. In this segment, the company aims to reach 7-10% annual growth over the medium term. In 4Q21, the company delivered 21% growth in recurring, non-transaction revenue.

The result is steady long-term growth. Because the company benefits from higher transaction volume, it does not suffer during short recessions as it results in accelerating short-term trading “demand”, but it’s not severe enough to lower trading activity in the longer term. That’s a risk during longer recessions. Initially demand spikes after which it falls and remains subdued.

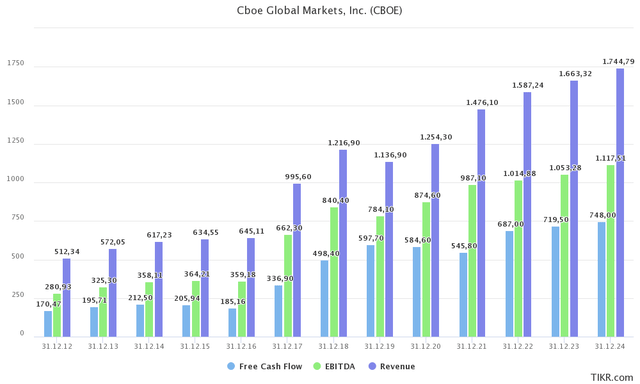

Growth is impressive. In 2012, the company did $281 million in EBITDA. Free cash flow was $170 million. Note that free cash flow is basically net income adjusted for non-cash items and capital expenditures. It’s cash the company can spend on dividends, buybacks, and debt reduction. In 2024, EBITDA is expected to reach $1.1 billion. Free cash flow could come in close to $750 million. This implies the following 2012-2024E growth rates for revenue, EBITDA, and free cash flow:

- Revenue: 9.9%

- EBITDA: 11.1%

- Free cash flow: 12.1%

Needless to say, these growth rates are impressive.

With that said, let me give you an example of the dividend’s safety. If CBOE is able to do $720 million in free cash flow in its 2023 fiscal year, it translates to an FCF yield of 5.9% free cash flow yield using its $12.3 billion market cap.

As I said, the current dividend yield is 1.7%. This implies a ton of upside. And that’s exactly what investors are benefiting from.

The most recent dividend hike was announced in August of 2021. The hike was 14.3%.

Over the past few years, dividend growth has been consistently close to 15%. Seeking Alpha data shows that dividend growth has been 15.0% per year over the past 10 years. This growth rate is 13.7% over the past 5 years and 15.7% over the past 3 years.

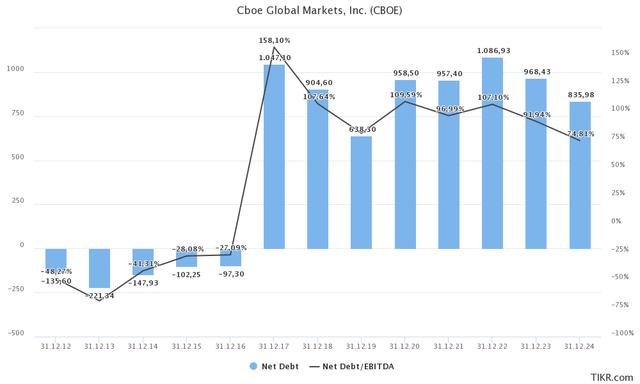

I expect that dividend growth remains high because of free cash flow and because the company has a healthy balance sheet. Its net debt ended the 2021 fiscal year at just $960 million. That’s less than 1.0x EBITDA. Prior to 2017, net debt was negative (more cash than gross debt). In 2017, the company acquired BATS Global Markets, which pushed net debt to a new high. Even back then, the net leverage ratio was low. I have little doubt that Cboe will continue to engage in M&A, but unless the company does something extremely stupid, it’s really hard to turn this balance sheet into a liability for investors.

What this means is that the company does not need to prioritize debt reduction over dividend growth, which is another reason why dividend growth is so high.

With this in mind, we’ve covered dividend safety, consistency, and growth.

So, what about the valuation?

Valuation

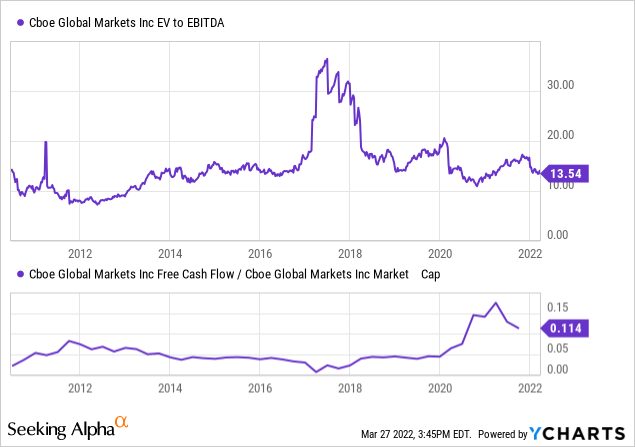

The company has a $12.3 billion market cap. Its net debt load is expected to average roughly $1.0 billion over the next two years. This gives us an enterprise value of $13.3 billion. That’s 12.7x next year’s expected EBITDA of $1.05 billion.

That’s a very attractive valuation – especially because the implied free cash flow yield is close to 6.0%. That’s simply too high in this market and I believe that buyers will come rushing back once they trust this market again.

Right now, the average price target is $137 according to FINVIZ, I believe that it’s fair. Even at that price, the stock would not be overvalued.

Takeaway

CBOE is a fascinating company. It’s flying under the radar, which is undeserved. Revenue, EBITDA, and free cash flow growth are high thanks to the company’s dominant position in financial markets and its ability to use its data segment in its favor due to (expected) growth in recurring non-transactions.

Because of high free cash flow and 2022 market weakness, the company is trading at a very attractive price. I don’t know how fast the stock can rebound and/or if there’s more downside – the market is very volatile right now – but I do know that long-term investors are in a good place.

FINVIZ

If you’re long, use weakness to add to your position. If you’re not long but looking for quality dividend growth, look no further.

(Dis)agree? Let me know in the comments!

Be the first to comment