Editor’s note: Seeking Alpha is proud to welcome Valerie Ballesteros, DBA, MSFE, MBA as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Tippapatt/iStock via Getty Images

Capital Expenditure Definition

Capital expenditures (capex) are one two types of expenditures that are central to financial decision-making and analysis. Expenditures are the utilization of a firm’s capital to fund business activities and decisions. Capital expenditures are for the purchase, acquisition, or maintenance of fixed or physical assets held for a period greater than one year, which are used for growth or expansion.

How to calculate CAPEX and the CAPEX formula

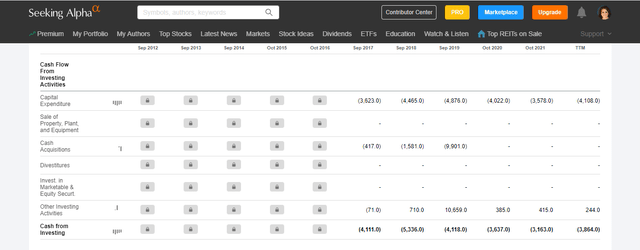

To calculate CAPEX, there are two methods using a firm’s financial statements. The first method draws from the cash flow statement. Under the cash invested section of the statement, capital expenditures are listed as a single line-item entry (see DIS Cash Flow statement attached below):

Figure 1

Cash Flow Statement for (DIS) The Walt Disney Company

Seeking Alpha

The second method uses data from the income statement and balance sheet and applies the following formula:

Capital Expenditures=PP&E (year 2)-PP&E (year 1) + Depreciation

PP&E is the line item that represents property, plant, and equipment asset value for a given year. Depreciation is a noncash item, which is used in accounting calculation but is not cash that is expended (i.e., does not actually leave the firm but is instead just written off), so it must be added back to the cash value of the net PP&E assets.

Types of capital expenditures

You can think of capital expenditures (capex) as long-term, less frequent utilizations (uses) of capital. For example, the costs of buying a new building, acquiring a competitor firm, expanding into a new market, or adding technologies for creation of a new product or service could be considered a capital expenditure. Capital expenditures are typically larger in amount, require longer planning and execution, and involve more risk. These should be distinguished from operational expenses (opex) which are current expenditures directly used in operation or production, like payments to vendors for supplies, rent or utility payments, insurance, or weekly payroll expense for production workers. It helps to think of expenditures in terms you would as a household. There are daily living expenses (like rent, groceries, and car insurance) that address our current needs and current objectives to live and work daily. We also have long term needs and objectives (like purchasing or renovating a home, purchasing a car etc.) that allow us to build necessary resources to grow and progress.

Capital Expenses vs. Operating Expenses

The short-term and long-term distinctions apply to a business organization and can be helpful to categorize capital expenses for operations, and capital expenses for growth. Operating expenditures that are ongoing are typically used in production while one-time, infrequent expenses are typically capital expenditures. The following lists compare an operating expenditure and a capital expenditure:

Operating Expenditures

- Rent/lease payments

- Insurance

- Payments to vendors

- Expenses for production

- Utilities/subscriptions

- Employee payroll/benefits

Capital Expenditures

- Real estate purchase

- Purchasing equipment

- Acquisition of a competitor or supplier

- Expansion of production

- Upgrades to technology

- Construction of a wellness facility

Negative vs. Positive CapEx

Capital expenditures are key indicators of the efficiency in use of capital which can positively or negatively affect margins (i.e., profit on product). Capital expenditures can indicate a company’s commitment potential to future growth or expansion of the business. So, it is necessary to understand what a negative capex or positive capex amount would indicate to an analyst or investor.

On the cash flow statement, it is important to understand that negative numbers indicate money leaving the firm (i.e., capital outlay). In the case of capital expenditures, if there is a significant amount of money leaving the firm, since it is an investment of capital, it could indicate that the company has spent a significant amount on investing in long term assets. That could indicate an aggressive plan for future expansion, a major project, or a major upgrade in newer technologies. Spending on investment activities, while negative on the cash flow statement as a capital outlay, can be positive indicators of a firm’s potential for future growth.

By contrast, when investing cash flow balances are positive on the cash flow statement, which indicate inflows, this could result from a firm selling investment or capital assets (divested) that have not yet been replaced with new assets. Such divestitures might not be a good signal for the firm in the long term, if they impede the growth or maintenance of the company’s business operations. It is important for investors to analyze and interpret what the data says about what is happening within the company and what decisions managers are making to utilize capital effectively.

What Capital Expenditure Mean to Investors

Understanding capex allows investors to evaluate a company’s management of firm capital. More importantly, it helps investors evaluate accountability and responsibility for the vision and execution of financial decisions that impact an organization’s profitability. Investors can evaluate how managers are utilizing capital for future growth. By evaluating the data on financial statements, like PP&E expenditures on a balance sheet and depreciation on an income statement, investors can see if and how a firm is acquiring long-term assets. They can evaluate whether asset values are increasing through additions, which could indicate to investors that a firm has plans or projects for expansion of operations and is using current cash flow in pursuit of this. If investors review a cash flow statement and see negative cash flow in the investing section of the cash flow statement, this implies that current cash flows are being spent for long-term investment.

Investors as individuals understand that good management of short-term expenses allows them to take advantage of and participate in investment opportunities which will lead to long-term wealth accumulation. For investors, a firm’s ability to efficiently manage short-term operational expenditures and manage the risk and return of capital expenditures impact long-term firm value. Understanding concepts like capital expenditures is a crucial skill component that allows investors to better understand a firm’s activities but more importantly, understand how those activities may impact shareholder wealth.

Be the first to comment