algre/iStock via Getty Images

After a recent selloff, Vale S.A. (NYSE:VALE) shares have become quite attractive. Vale is one of the largest mining companies in the world. Its primary source of revenue is derived from iron ore sales. Other important materials to its top line are nickel and copper.

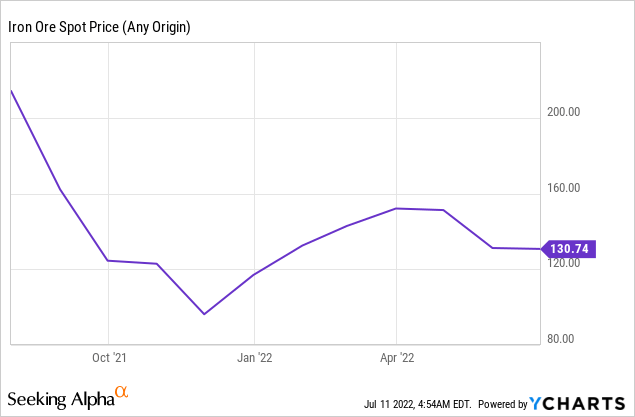

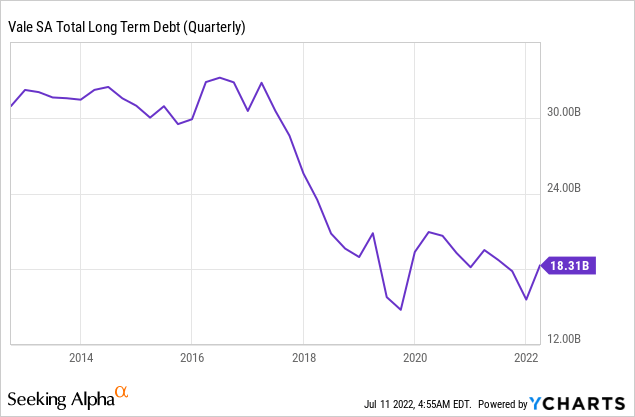

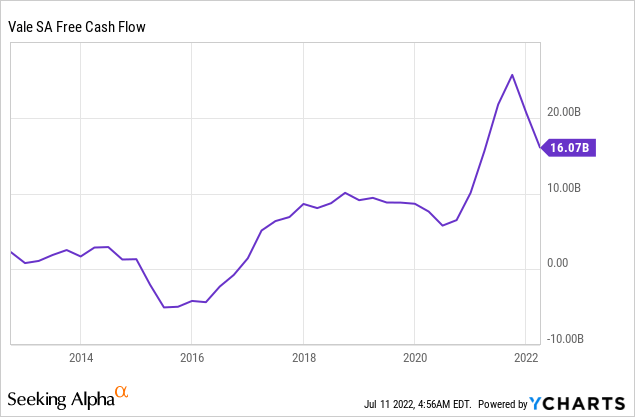

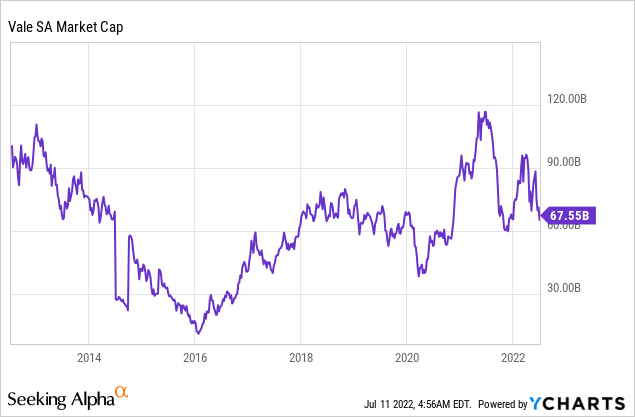

China continues to deal with COVID-19 in its unique strategy way, and this has been weighing on iron ore prices. Vale’s market cap is back to $67 billion. It has around $9 billion of net debt ($18 billion in gross debt) and generates $19 billion in free cash flow. Its cash flow is unlikely to hold up and is notoriously volatile, but that’s not the end of the world, as its capital structure appears quite robust.

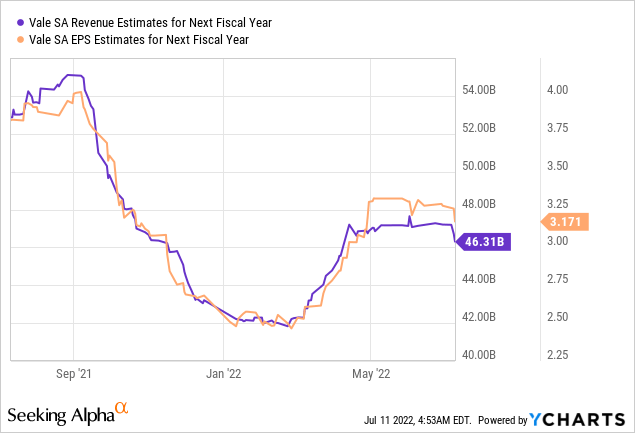

Recession fears are reflected in analyst estimates for revenue and, to a lesser extent, EPS in the next fiscal year.

Shaving the estimates makes sense, as iron ore prices have recently retreated a bit and are unlikely to hold up during a potential recession.

What’s remarkable is how much mining giants are cleaning up their balance sheets (see my recent BHP article) and refraining from large acquisitions that destroy shareholder value.

Vale Cashflows are very strong compared to the last ten years. Cashflows are expected to come down as the economy cools as the Fed fights inflation.

Vale’s market cap hasn’t made a lot of progress over the past decade while both its cash flow and net debt position are much more positive.

Commodities are trending down on recession fears, but I believe this may be opening up an excellent buying opportunity. I’m not convinced commodities, as a sector, will be as prone to price drawdowns as they’ve been historically. It is true that China won’t be growing as explosively as it has in the past. However, something that’s often forgotten is how 6% or even 4% growth of what’s now a huge pie (2nd largest GDP in the world) still requires massive absolute growth.

Mature (but huge economies) like the U.S. and the Euro area are on a path to overhauling significant parts of the energy infrastructure. The energy transition requires a lot of commodities to supply sufficient windmills, solar panels, and batteries. New or adapted energy infrastructure, and electric vehicles all require lots of steel (i.e., iron ore), copper, nickel, cobalt, etc.

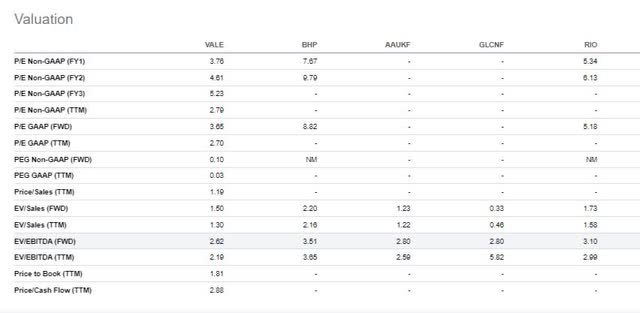

Miners valuations (SeekingAlpha.com)

With a P/E of 3.76x and EV/EBITDA of ~2.6x Vale just looks very cheap to me. Its large-cap peers, BHP Group (BHP), Anglo American (OTCQX:AAUKF, NGLOY), Glencore (OTCPK:GLCNF), and Rio Tinto (RIO, RTNTF, RTPPF) look almost equally cheap. I’m currently generally favorably disposed to the entire industry. There are a few things I especially like about Vale which provided me with an angle to obtain exposure here.

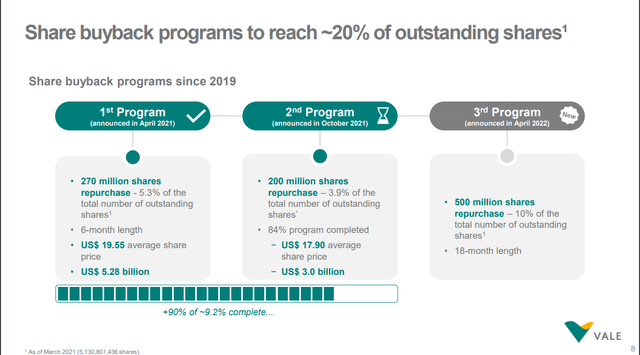

Vale has a recent history of buybacks and has put a massive program in place. The program is to buy back 10% of shares. That’s in addition to being committed to paying a dividend equal to 50% of cash flow.

Vale buyback program (Vale earnings presentation 2022)

CFO Pimenta commented on the buyback program in the most recent Vale earnings call:

Yes. I think Eduardo covered well, right? So we’ve — given where the stocks are trading, we continue to believe this is probably one of the best, if not the best investments that we have is to buy back our own share. We’ve been very active, as we’ve seen in our prep remarks. We’ve purchased almost 10% of Vale in the last 12 months. So that will take us to an almost 20%. So this is certainly very accretive for our shareholders, and we’ll continue to put a lot of effort on that, as you saw in our announcement last year. It doesn’t mean we cannot do extraordinary dividends. I think we will assess at its due time. Of course, it will depend on our cash flow for the year. We are very constructive for the year despite some of the challenges that we are all seeing. We continue to be very constructive in our ability to generate strong cash for the year.

So I think — and on top of that, we do have already a very well-established dividend policy, right, with a payout of 50%. So to Eduardo’s point, I think we can do both. But certainly, at today’s valuation, buying back our own share is highly accretive from our perspective.

CEO Bartolomeo also commented on this program, and I’m sharing the verbatim comments because they are important reasons why I’m getting involved here:

Okay. Thanks, Rodolfo. Maybe the answer is a growing cash cow, big, big cash cow because I think nobody has the opportunity of growth that Vale has, right? I won’t go back to the rationale about the share buybacks because we believe that’s permanent. That’s the best investment that we can have. So we are buying back value at iron ore prices of $60, whatever, you price at where we are today. So we are buying iron ore company about $60. So that’s the rationale about buyback. But when you look at iron ore itself, when we talk high quality, we don’t buy the story that iron ore is a mature, dying business. We are a growing Class 1 iron ore business. We can grow up to 400 million tons with high quality. Nobody can do that. So we’re going to need cash. We’re going to use the cash for that. So number one, use of cash is to grow in quality within iron ore, and goes back to Andreas’ previous question around the difficulty of license set that we have to overcome as well. So first one is grow iron ore.

Bartolomeo ends up calling Vale a “growth cow” because of the optionality it has to grow production in iron ore, copper, and nickel without major acquisitions. The company also believes it will be able to deliver “green” nickel in the future. A product that should be in high demand with electric vehicle manufacturers. Nickel can be used in batteries while a lot of alternatives aren’t always produced in the most environmentally friendly of ways. If the electronic vehicle market continues to grow, this will increasingly be scrutinized, and green Nickel could very well fetch substantial premiums.

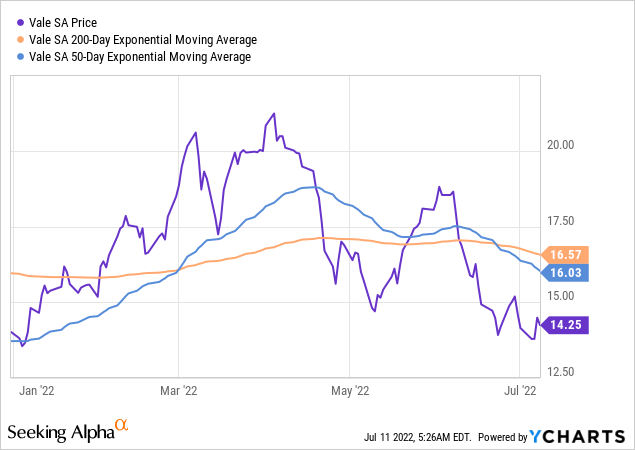

I really like the valuation Vale is trading at. Even among large-cap peers, it is trading at the bottom end of the ranges. At the same time, the company has de-risked its balance sheet, and this bodes well for future realized volatility of its stock price. Finally, the company has a buyback in place. It’s impossible to know the exact parameters of the buyback policy, but generally these plans become more aggressive as the share price trades further below a 200-day moving average or has similar technical rules. Vale is trading below its 200-day as well as the 50-day moving average.

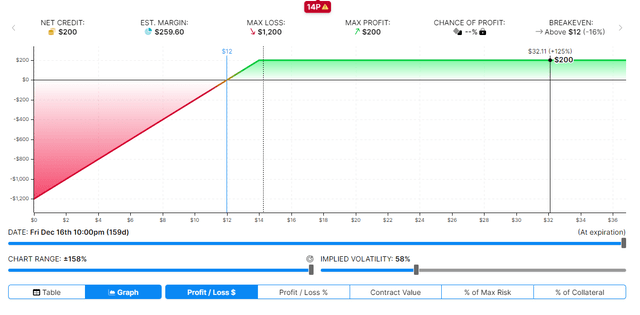

What I did, and keep in mind this is very risky, is to sell a December $14 put. These trade around ~$2. This means my maximum loss is $1200 per contract. My maximum upside on the trade is $200. At $12 the contract breaks even at expiration. Graphically, the exposure looks like this:

Put exposure Vale (optionstrat.com)

The buyback program and management confidence it is happening at attractive prices add to my conviction the buyback is likely strong whenever Vale’s share price is stalling or falling. That should strongly decrease the odds the share price ends up substantially down over the next few months. I’m not sure if commodity producers are going to be in high demand with a potential looming recession, but I like the premium on this contract vs. the risk of a sustained share price decline.

As we near the expiry date, I’ll be more likely to roll over the contract to avoid holding an extremely volatile position. This is especially true if the contract is still near the money.

A risk is a large special dividend (which seems unlikely to me as management appears to prefer buybacks), but it would hurt this strategy especially badly as option prices get adjusted downwards.

Be the first to comment