anusorn nakdee

Published on the Value Lab 22/7/22

An interesting idea we came across was Westlake Chemical Partners LP (NYSE:WLKP). This is an ethylene play in principle but has characteristics that makes its cash flows exceptionally stable. Moreover, from a game theory point of view we can expect the contracts that offer them this stability to endure even after expiry. The stock can almost be treated like a perpetuity where income comes from the dividend which yields substantially above risk-free rates despite little counterparty risks and very limited commodity risk with only upside on volumes. We think that this company is rather attractive for dividend investors.

Overview

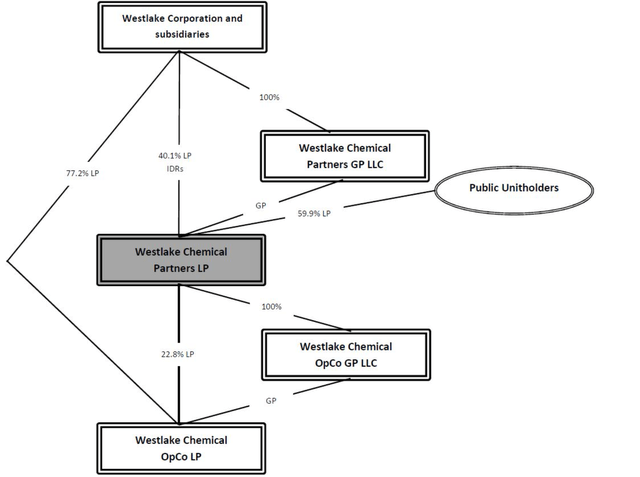

Westlake, which is the company who avails of the ethylene produced by the WLKP ethylene production facilities and pipelines, owns a majority of the interest within the assets of WLKP. However, technically WLKP fully controls the assets as the 100% owner of the general partnership, therefore exercising control over the distribution, where WLK’s exposure to WLKP’s assets is through limited partner assets, owning around 80% of the LP units, where the balance is again owned by WLKP in addition to their GP shares. These LP shares are the securities that entitle owners to the cash flows produced by the ethylene production facilities, and shareholders in WLKP see their cash flows coming from the 22.8% that WLKP owns in the ethylene production facility OpCo.

Dead-safe Cash Flows

Why would ownership of units in an ethylene facility OpCo constitute a special opportunity? The cash flows are extremely safe, both for a guaranteed period based on sales contracts, but also for the longer-term based on very clear incentives by stakeholders.

Sales Contracts

The ethylene sales agreement went into force at the WLKP IPO in 2014 and remain in force till 2026. This is a cost-plus pricing agreement where on the feedstock and other operating costs WLKP charges $0.1 in markup. WLK has to buy 95% of the ethylene produced by the OpCo, with the balance going to third-parties. The only time this agreement might not guarantee a markup on 95% of production is if the facilities produce more than 3.8 billion in output. Then WLK has an option to purchase 95% of the increment beyond the 3.8 billion maximum commitment. In any case, the capacity of the facilities is ordinarily around 3.7 billion so there’s not even a risk of WLK not exercising that option and forcing WLKP to sell at worse conditions to third parties. Therefore, the cash flows, especially as the company is riding on current assets more than buying or developing new ones, are massive as it racks up depreciation and FCF.

Easy Incentive Considerations

The other concern investors might have is around what happens in 2026 when the agreements need to be renewed. Firstly, we’ve covered Westlake before and it is a profitable company with attractive markets. They’ve compounded a lot of value and have made excellent corporate strategy choices over the last many years. The CEO of WLK is also the CEO of WLKP. Moreover, WLK owns most of the share in the revenue generating assets. So, if WLKP is currently operating with a good deal, most of that value is anyway captured by WLK. In any case, the deal is likely rather fair, and similar conditions are reasonable to expect at the rollover.

Valuation and Conclusions

With the housing shortage creating secular tailwinds for WLK, there is even the chance that WLKP grows its asset base. For now, the company produces about $350 million in cash flows which on a conservative balance sheet but considering minority interests constitutes a FCFY equal to the dividend yield at a 7.5%, where all the FCF is paid out.

Given the security of the cash flows, the substantial spread over the risk-free rate shows how attractive this dividend is. Current 10Y treasury yields, which are the same as the earnings payback period based on WLKP PE of 10x, yield 2.8%. Even if rates rise to 5%, there is a 2.5% premium on the risk-free rate for an asset that is probably below-average in terms of corporate risk. WLK counterparty is solid, especially as it shifts to more specialized exposures, and the incentives otherwise support the agreements in place. At a higher premium, the low risk and supported economics of the issue make it a very nice income play for dividend investors. The risks are really quite limited, especially when the debt of WLKP is held by WLK too. As long as WLK is solvent (doesn’t even have to do particularly well) WLKP is guaranteed volumes of to 95% of 3.8 billion into their production at a fixed markup. It’s a nice buy at 7.5% perpetuity-style dividend. Don’t expect growth on that.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment