kali9/E+ via Getty Images

I have been on the fence about EPR Properties (NYSE:EPR) because for several reasons. The pandemic wreaked havoc on many industries but arguably, some of the hardest hit were the businesses that rent EPR’s properties. EPR was forced to suspend its dividend from May 2020 thru June 2021. In July of 2021, EPR started paying its monthly dividend again at a -28.10% reduced rate. EPR’s funds from operations (FFO) drastically declined, and many of its financial metrics haven’t returned to pre-pandemic levels. For more than a year, EPR has traded sideways, and its share price also hasn’t returned to pre-pandemic levels. After reading through the financials, the latest investor presentation, and the 2021 annual report, I am no longer on the fence and think ERP is moving in the right direction. It may take some time for EPR’s share price to reach pre-pandemic levels, but management seems to be doing everything they can to restore the dividend to its former levels and generate capital appreciation for its shareholders.

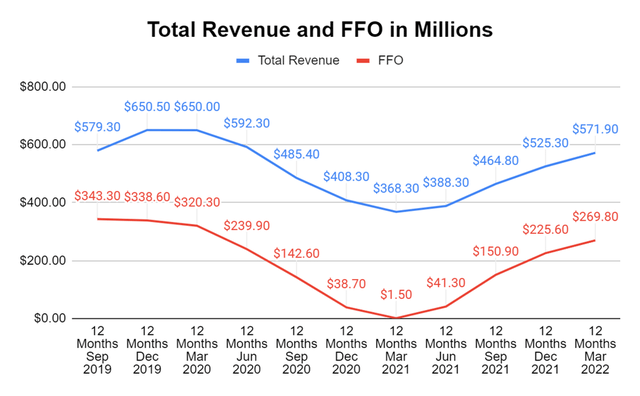

Breaking down EPR’s revenue and FFO on a TTM basis and how EPR is working its way back to pre-pandemic levels

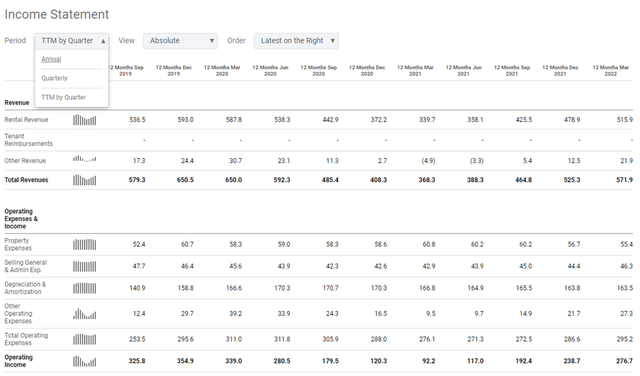

One of the aspects I love about the financial section on Seeking Alpha is the ability to look at different time periods, including annual, quarterly, and TTM by quarter. In this case, I am looking at EPR’s income statement as TTM by quarter because I want to get a sense of where EPR is compared to its operations pre-pandemic.

I spend a lot of time on the numbers because they can’t have multiple interpretations. You can spend countless hours learning about a business, but the numbers tell a story of what is actually occurring, not what may occur. I didn’t want to use annualized numbers for EPR because it didn’t generate enough detail for how I wanted to look at EPR. Using the TTM by quarter feature allows me to see how EPR has done financially throughout every cycle of the pandemic compared to its pre-pandemic levels. I took the financials from Seeking Alpha and created a line chart below showing EPR’s total revenue to FFO over the past 11 TTM by quarter periods.

EPR topped out with $650.50 million in revenue, which generated $338.60 million in FFO for the entire 2019 fiscal year. At the end of Q1, 2020, EPR’s numbers on a TTM basis didn’t decline drastically because this included 11 months of normality. As we can see based on a TTM period, at the end of Q1 2021, EPR saw its revenue decline by -$281.7 million (-43.34%), and its FFO declined by -$318.73 million (-99.53%) YoY.

What I like about EPR’s numbers is that since Q1 2021, EPR has produced 4 consecutive quarters of QoQ growth in revenue and FFO based on a TTM period. In just 1 year, there has been a drastic improvement in EPR’s financials as revenue grew by $203.6 million (55.28%), and its FFO grew by 178.86x. At the end of Q1 2022, EPR is now generating 87.98% of its pre-pandemic revenue and 84.25% of its pre-pandemic FFO. These are clear indications that there is light at the end of the tunnel and we could see EPR surpass its pre-pandemic revenue and FFO on a TTM basis sometime over the next several quarters.

Steven Fiorillo, Seeking Alpha

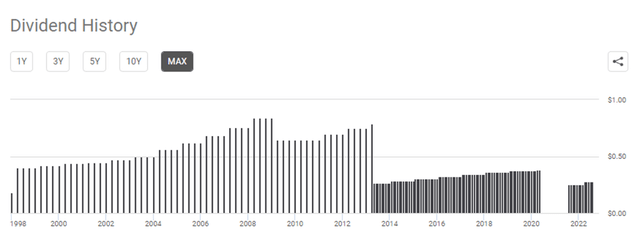

EPR’s dividend is getting back in the swing of things

EPR has a long history of being a dividend growth company. Back in 1998, EPR paid a quarterly dividend of $0.40 or $1.60 annualized. EPR provided investors with 10 years of annualized dividend increases bringing its dividend to $0.84 quarterly, $3.36 annualized prior to a dividend reduction in 2009. The dividend was reduced by -22.62% during the financial crisis but was back to growth in 2011. EPR had provided 3 annual dividend increases before changing its dividend from being paid quarterly to monthly. EPR provided 7 annual increases to its newly established monthly dividend, increasing the monthly dividend by 45.27% from $0.2633 to $0.3825 up until the pandemic occurred.

EPR’s dividend was halted in May of 2020 and didn’t resume again until July 2021. In July of 2021, EPR implemented a $0.25 monthly dividend or $2.50 annualized. EPR didn’t wait a full year and 8 months later provided its first dividend increase since halting the dividend in May of 2020. EPR now pays a monthly dividend of $0.275 or $3.30 annualized. Looking at the dividend history, EPR has been adamant about its dividend growth program, and the dividend recovered quite well after its reduction during the financial crisis.

I think the dividend increase that EPR provided over the winter is a strong indication that they believe their business is strong and their ability to generate FFO will continue to grow as time progresses. EPR is currently yielding 6.44% ($3.3/$51.28), and its dividend is paid monthly. Between the revenue & FFO trend from its income statement and the dividend history, there is no reason for me to believe that the dividend won’t continue to increase back to its previous levels over time unless something catastrophic occurs.

Humans weren’t built to stay indoors 24/7 and while someone may not partake in all of the experiences offered through EPR’s properties, experiences are a critical component of humanity’s social fabric.

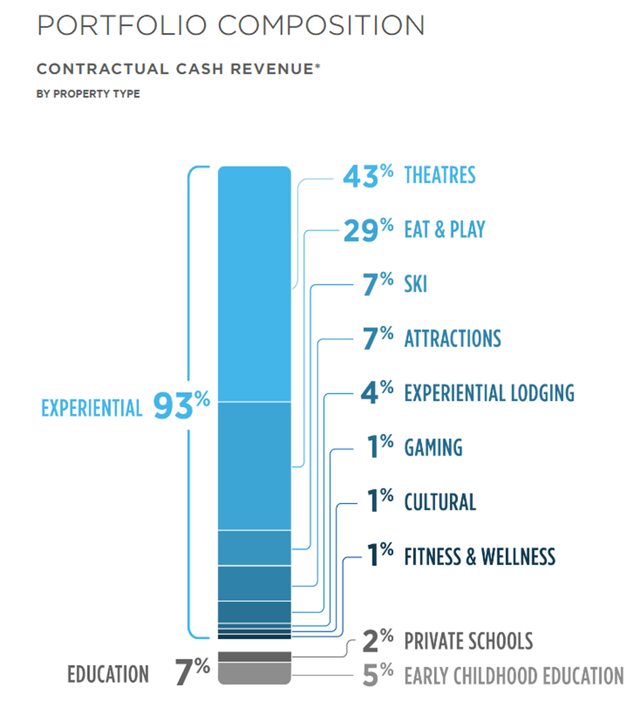

EPR’s properties provide experiences where people can enjoy life and create long-lasting memories. EPR has 355 locations with 200+ tenants throughout 44 states and Canada. EPR’s portfolio includes theatres, eat & play, attractions, skiing, experiential lodging, gaming, cultural, fitness & wellness, private schools, and early childhood education centers. EPR’s management team has a strategic focus on diversifying away from theatres to an extent as they generate 43% of EPR’s contractual cash revenue. EPR’s leases have a weighted average lease term of 14 years, with lease escalators that are generally 1.5% – 2% annually.

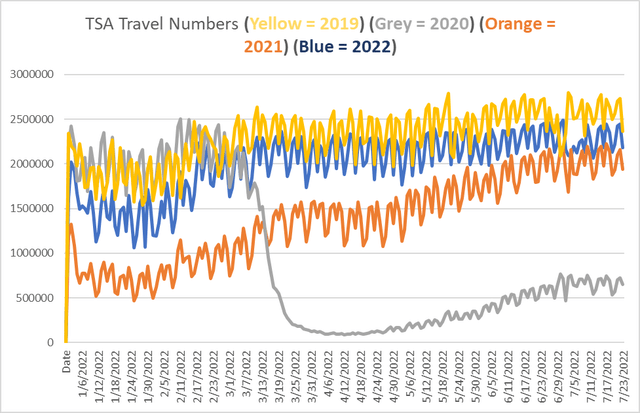

To get a sense of what is occurring, I looked at the TSA daily data and mapped it (chart below). My theory is that travel is correlated to people going out and doing things. In 2020 (grey line) travel demand dropped off a cliff. When I look at summer travel, it has sequentially increased each year, and the blue line, which represents 2022, is in-between 2019 and 2021 levels. When I think about EPR’s revenue being 87.98% of its pre-pandemic revenue, that’s a pretty close correlation to what air travel was in 2019 vs. what it is in 2022. Looking at what air travel was in 2020, 2021, and in 2022 it’s a clear indication that more people are getting back to normal. I believe air travel is a good indication of what people are doing, and as more people travel, that should be an indication that people will be looking for experiences instead of staying indoors.

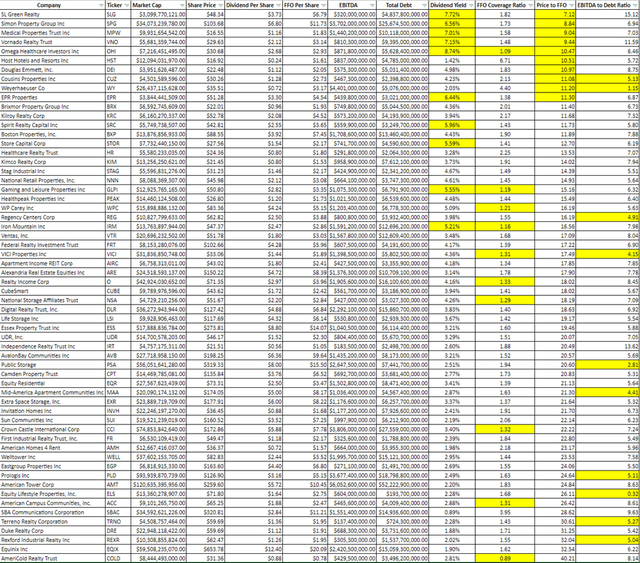

EPR’s valuation looks attractive at its current levels

I created an equity REIT valuation sheet which gets updated quarterly in the Barbell Capital group, where I look at dividend yield, FFO coverage ratio, price to FFO, and EBITDA to total debt levels. I use these as my valuation metrics to evaluate and identify income opportunities within the REIT sector.

The average dividend yield across these 60 companies is 3.79%. EPR is generating a 6.44% dividend yield which is almost double the group’s average. EPR has a 1.38x FFO coverage ratio on its dividend, whereas the group’s average is 1.76x.

The average price to FFO ratio is 18.16x across these 60 companies. EPR is trading at an 11.3x price to FFO.

The average EBITDA to debt ratio is 6.62x across the group, and EPR’s ratio is 6.87x.

I think EPR looks attractively valued. Its dividend yield is well above the group’s average with a good coverage ratio. It trades at a low price to FFO level and is in line with the group’s average EBITDA to Debt Ratio.

Steven Fiorillo, Seeking Alpha

Conclusion

EPR looks interesting as it’s still working on its recovery since the pandemic hit. EPR’s financial trend and dividend history indicate tremendous progress in getting back to pre-pandemic levels. When comparing EPR to the largest equity REITs it looks attractively valued. I think that there is a long-term opportunity as EPR has a long history of creating shareholder value, excluding the pandemic period. The TSA numbers continue to indicate that more people are getting back to normal, and that is favorable for EPR’s operators. If you believe that we will get back to pre-pandemic activity levels in the future, then EPR is an interesting REIT to research as it trades at a level that creates a value proposition.

Be the first to comment