Nataliia Tymofieieva/iStock via Getty Images

Published on the Value Lab 11/11/22

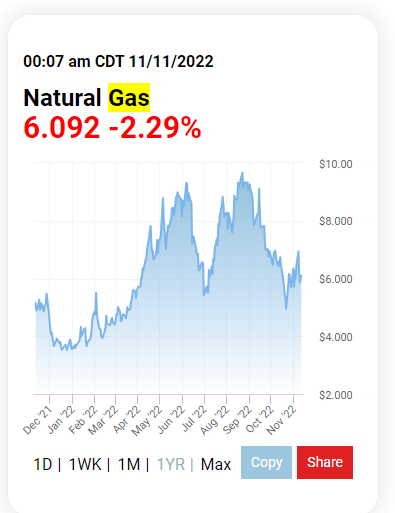

Westlake Chemical Partners (NYSE:WLKP) sells ethylene for PVC production to Westlake (WLK), which is a producer of finishing for housing. The CEO of WLKP is the CEO of WLK as well, and the vast majority of the ownership of WLKP is in the hands of WLK – about 80%. There is a procurement agreement that will run until 2026 that guarantees prices for the ethylene that WLKP produces and sells to WLK. This allows WLKP to pay a stable dividend, and with CPI data showing that inflation is slowing, and perhaps rates too, we think that it might be an attractive moment to lock in the WLKP dividend yielding around 8%. With natural gas also retreating in price, which was a headwind for WLKP margins, we are even more convinced of the WLKP dividend.

CPI Note

The CPI report has shown that inflation has moderated slightly from its high levels. Going from 8.2% to 7.7% is a relief for markets because it tells us that this inflation isn’t impossible to tackle. While headline figures were helped by lower oil and gas prices, core figures also retreated from highs. Ultimately, whether this had anything to do with rate rises is a little unclear. Perhaps a cooling off took the pressure off bottlenecks, and that certainly has had a beneficial impact from the supply side, but job creation continues and demand drivers in the US seem strong still. Europe has more of a supply-side issue than the US, where signs of a recession are there, but inflation remains troubling.

With peak interest coming into sight, bond or bond-like cash flows with longer durations may be more interesting now. We like WLKP which has super stable cash flows and a strong dividend yield of 8% in order to make a longer duration cash flow play while prices are discounted and rates possibly peaking soon.

Q3 Review

WLKP looks promising from a dividend safety point of view. The retreat in natural gas prices is making their ethylene production more profitable. From a volume point of view, they are guaranteed procurement from WLKP at fixed markup for volumes even greater than what they currently produce. There is very little scope for volatility, with the only real volatility coming from volumes. This procurement agreement is in force till 2026, and there’s not much incentive for things to change at that point either because WLKP is already owned mostly by WLK, essentially their only customer who similarly reaps the earnings that come into WLKP.

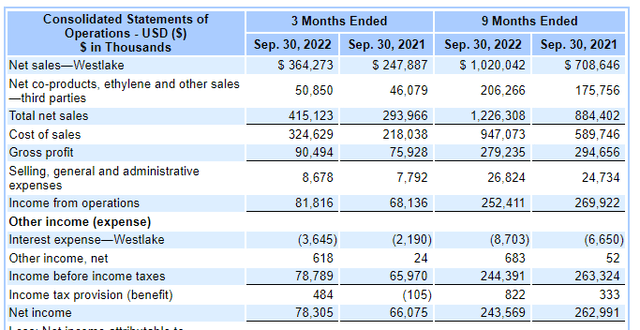

Thanks to reduced pressure from gas prices, gross profit grew YoY this quarter, where last quarter it shrunk by quite a lot, more than 20%. Indeed, the declines on a 9-month basis are coming from the particularly weak Q2 that took the brunt of the pop in gas prices.

Gas Price (oilprice.com)

There was a big retreat from Q2 highs, more than 40%, actually. The fundamentals of WLKP have returned to a very attractive level.

Bottom Line

The run rate dividend is about 8.2%, and it was confirmed once again at the end of October. Over the 5% risk-free rates, and the 4% longer-term risk-free rates that we are still seeing on the yield curve, the more than 3.5% premium seems a good deal considering the low risk profile of WLKP. With the upside potential on natural gas being fairly limited from here, with winter already underway too, we don’t think margins will be that much more pressured for WLKP. With an 8% yield being a great long-term return to lock in while markets are still pretty low and pretty volatile, we think the total return from WLKP will be good from these levels, despite what happens in markets. If they rise, a yield like this will become rare again. If they don’t this yield will continue to pay out, and has a margin over risk-free rates to not become anti-economical. WLKP seems a buy to us.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment