EU ANALYSIS

- Positive EU consumer confidence and sentiment data.

- Divergence between Fed and ECB.

- Attention turns to inflation data.

- Breakout to be confirmed on EUR/USD.

EURO AREA FUNDAMENTAL BACKDROP

EU ECONOMIC AND INDUSTRIAL SENTIMENT BEATS ESTIMATES WHILE CONSUMER CONFIDENCE COMES IN AS EXPECTED

As expected, the Eurozone consumer confidence and sentiment indicators came in largely in line or above forecasts after yesterday’s German and French statements lead the way.

Source: DailyFX economic calendar

ECB HOLDS FIRM TO LOWER FOR LONGER

This week saw meteoric rises in U.S. Treasury yields causing a broad based sell-off in equity markets around the world. The Germany 40 (DAX) was one such victim but has since recovered some lost gains today. The spillover was noticed in European government bonds as well but to a lesser extent as ECB President Christine Lagarde reiterated the transitory inflation outlook for the Eurozone – in contrast to the Federal Reserve who announced a more hawkish stance as tapering is likely to start later this year.

The greenback is trading significantly higher this morning on the back of higher yields with the EUR/USD pair breaking below key support levels.

UPCOMING EUROZONE AND U.S. INFLATION IN FOCUS THIS WEEK

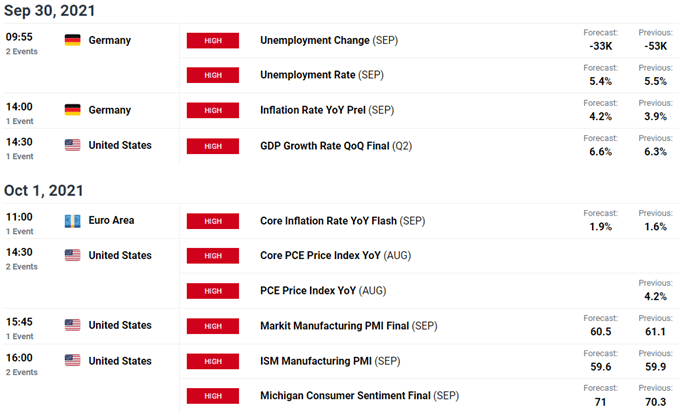

With inflation all the rage at the moment and the ECB dismissing current elevated levels, another print higher than expectations (see economic calendar below) could put additional pressure on the ECB to alter its viewpoint. A precursor to Eurozone inflation figures will come tomorrow via the German (EU’s most influential economy) announcement. U.S. inflation will also be closely watched with the Fed’s preferred metric of inflation (Core PCE) is scheduled for Friday and PMI’s to close off the week.

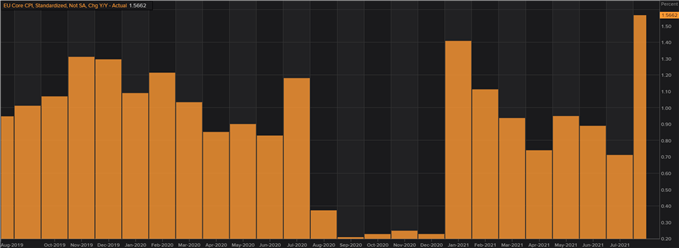

EUROZONE CPI:

Source: Refinitiv

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

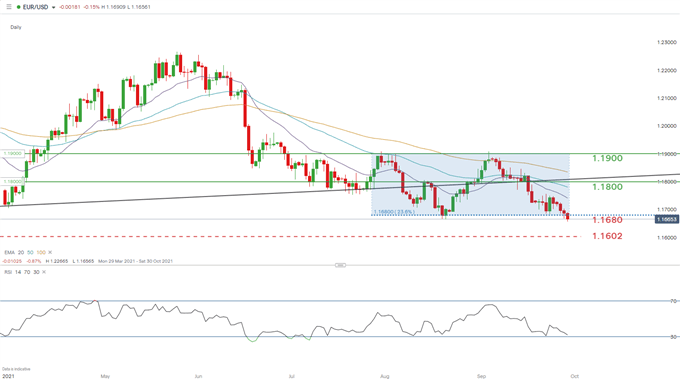

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The rectangle pattern mentioned in last week’s analysis has been breached this morning as prior supportat 1.1680 (23.6% Fibonacci level) failed to hold off EUR/USD bears.

The Relative Strength Index (RSI) is yet to extend into oversold territory which suggests there may be more room for additional downside. The November 2020 swing low will serve as the next level of support at 1.1602. High impact economic data this week will give further directional bias to the pair but it is hard to ignore the strong downtrend short-term.

A pullback within the rectangle (blue) and daily candle close above 1.1680 will likely result in a continuation of the pattern with sentiment shifting to the upside.

Resistance levels:

Support levels:

- 1.1602 – November 2020 swing low

IG CLIENT SENTIMENT DATA PROMOTES NEAR-TERM DOWNSIDE

IGCS shows retail traders are currently distinctly short on EUR/USD, with 65% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment and the fact traders are net-long is suggestive of a bearish inclination.

— Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter: @WVenketas

Be the first to comment