Mining Park of Riotinto, Huelva, Spain. Jorgefontestad/iStock Editorial via Getty Images

Atalaya Mining Plc (TSX:AYM:CA), which has grown sales by 150% in five years, is sitting on top of about 4 million tons of copper and copper equivalent metals, 90 million ounces of silver, and 1.9 million ounces of gold. The company, if its plans come to fruition, will be well-positioned for the expected global copper boom as the world transitions to green economies. However, the near-term headwinds from Europe’s gas and electricity crisis hit the company’s earnings hard, leading to a Q3 EPS of -€4.70 and negative cash flow for the second quarter in a row. And, analysts are projecting fiscal year 2022 to register a free cash flow of -€20 million. The good news is the company has solid plans to address the energy crisis – including the construction of a solar plant and a long-term power purchase agreement at competitive rates. However, with respect to key valuation, profitability, and growth metrics, based on our would-be quant scores, Atalaya is underperforming both the sector and key competitors. Hence, we rate the stock a hold.

Growth & Prospects

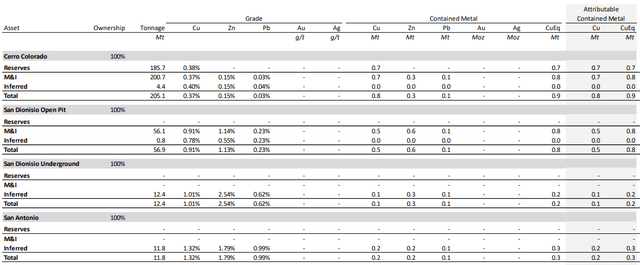

Atalaya Mining’s ongoing operations and projects are targeting over 4 million tons of copper equivalent metals in addition to 90 million ounces of silver and 1.9 million ounces of gold.

Estimated Resources Breakdown:

- 2.9 million tons of copper (66% measured & indicated; 34% inferred)

- 2.7 million tons of zinc (44% measured & indicated; 56% inferred)

- 90 million ounces of silver (16% measured & indicated, 84% inferred)

- 1.9 million ounces of gold (16% measured & indicated, 84% inferred)

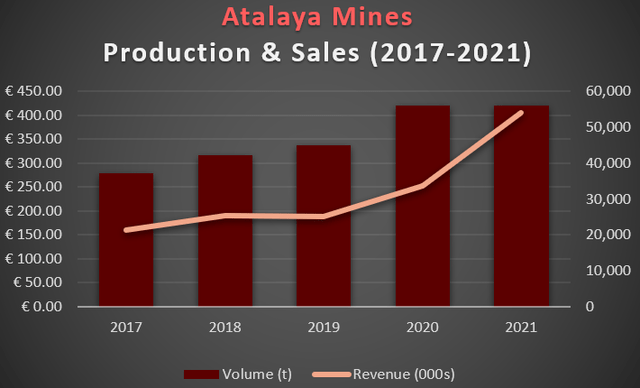

Atalaya’s Riotinto mining operation lies in the Iberian Pyrite Belt in Huelva Province of Spain’s Andalusia Autonomous Region, about 40 miles from Seville. The company ramped up production at Riotinto in early 2016 and from 2017-2021 grew annual sales by over 150% and copper produced by 50%.

Atalaya Annual Sales and Production (Company Financials)

All copper extracted to date came from the Riotinto mining operation’s Cerro Colorado pit, which has reserves of 700,000 tons and a mine life estimated at 12.5 years (per a December 2021 measurement). The company’s latest guidance says production is expected to reach between 52,000-54,000 tons in fiscal year 2022.

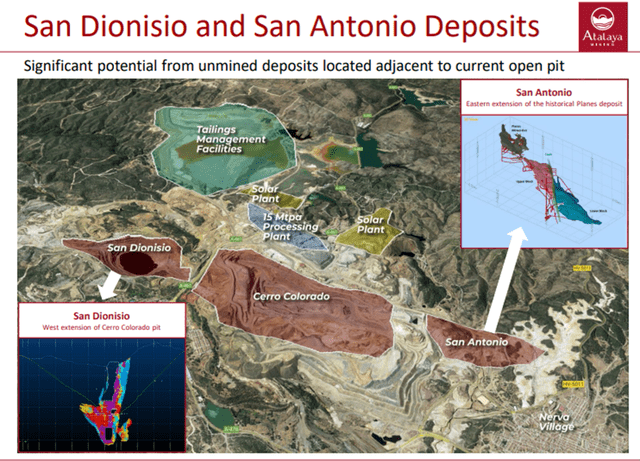

The company in the immediate term is looking to boost production at Riotinto by leveraging the adjacent San Dionisio and San Antonio satellite deposits (see photo below), which contain higher grades of copper, zinc and lead.

Riotinto main mine and adjacent deposits (Atalaya May Investor Presentation)

Notice in the below chart the higher grade ore at Riotinto’s satellite deposits compared to Cerro Colorado.

Riotinto Reserves and Resources (Atalaya Mining Q3 2022 Investor Presentation)

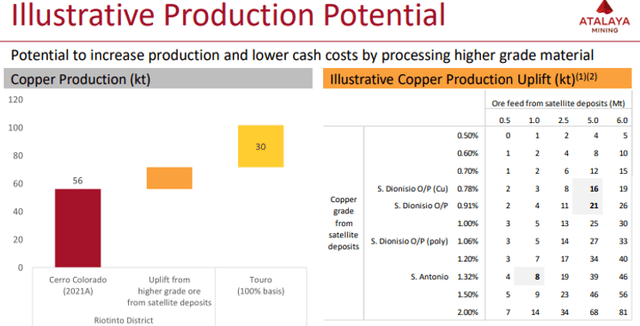

Atalaya Mining CEO Alberto Lavandeira on a November 9 video conference said Riotinto should be producing about 70,000 tons of copper per year by the end of 2024 because of the “uplift” from the satellite deposits’ higher grade ore.

The Touro legacy mine, located in Galicia in northwest Spain, will add another 30,000 tons of copper annually. Atalaya said it will begin construction once permits are approved, which is expected to happen in early 2023.

The Riotinto satellite deposits combined with the Touro project should allow the copper miner to reach 100,000 tons of annual output by the end of 2024 / beginning of 2025.

Atalaya Production Projection (Atalaya Q3 Investor Presentation)

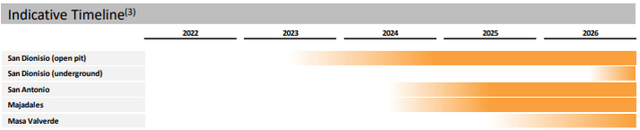

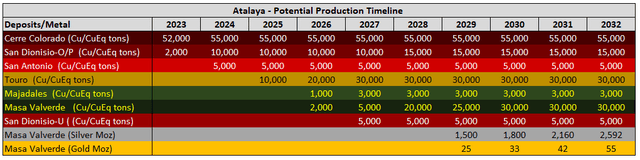

On top of that, the company hopes to bring online product from the Masa Valverde deposit, located less than 20 miles from Riotinto, by 2026. Masa Valverde’s resources include 600,000 tons of copper, 1.2 million tons of zinc, 85 million ounces of silver, and 1.8 million ounces of gold. Next to Masa Valverde is the Majadales deposit which has estimated resources that include 100,000 tons of zinc and 5.3 million ounces of silver. The below timeline gives a rough preliminary sketch of when Atalaya hopes to see these projects ramp up.

Atalaya Production Timeline (Atalaya Q3 Investor Presentation)

Performance & Quant Scores

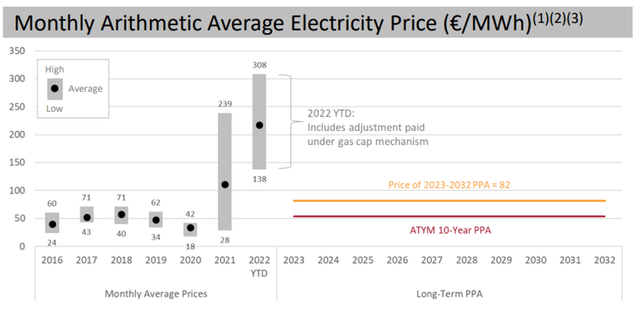

Atalaya’s operating margins took a blow in the third quarter after Spain’s electricity prices climbed to unprecedented heights, surpassing €500/MWh, while natural gas prices also set new record highs, largely due to the conflict in Ukraine and the attack on the Nord Stream pipeline. The company expects costs to moderate in Q4 and says it will benefit from a new long-term power purchase agreement in addition to the start-up of a 50 MW solar plant, which will provide around 50% of the company’s electricity requirements at highly competitive rates. The below graph illustrates the potential cost avoidance from the PPA.

Spain’s Electricity Prices (Atalaya Q3 Investor Presentation)

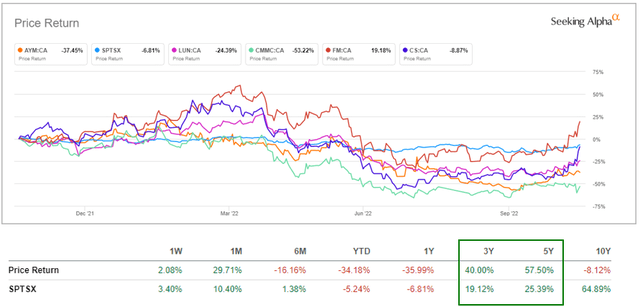

The stock has underperformed the S&P/TSX Composite Index by nearly 30 points in the past year, although it has beat the market in terms of 3-year and 5-year returns. However, Atalaya has also underperformed most direct competitors trading on TSX. The stock has heated up in the past month, however, likely due to signals that China, the world’s largest copper consumer, might ease covid restrictions.

AYM Price Performance (Seeking Alpha Premium)

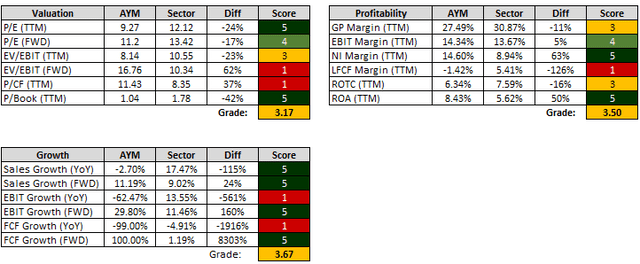

Atalaya Mining has yet to garner Seeking Alpha quant scores, but based on a comparison with the sector, below are what they might look like. The ultimate scores are essentially “C” equivalents. The rough third quarter due to the record high input costs negatively impacted the valuation, profitability, and growth grades significantly.

AYM Possible Quant Scores (Data: SA / Scores: MH Analytics)

The P/E ratio more than tripled since the end of September, with the price shooting up and earnings coming down, a contrarian trend that is hard to see continuing if negative results are posted in Q4.

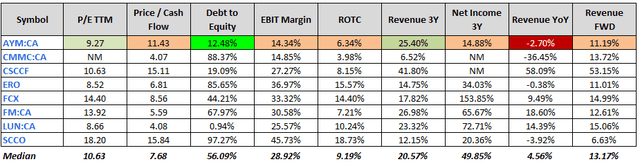

Atalaya – the stock and the company – underperform in key valuation, profit, and growth metrics vs. the median of direct competitors. It outperforms most peers in D/E ratio and revenue and income growth over the past three years.

AYM vs. Peers (Data Source: Seeking Alpha Premium)

Valuation

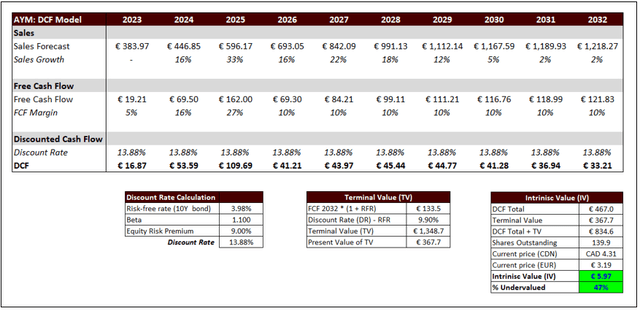

Atalaya’s indicative timeline can provide us with an outline by which to make very preliminary projections. The first few years can be derived from company statements and presentations while beyond 2025 is a matter of educated guesswork based on the resource and life of mine estimates.

Atalaya Potential Production Scenario (MH Analytics)

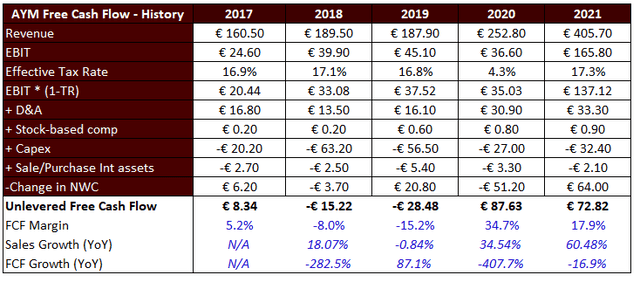

The immediate poor cash flow performance is concerning as we mull what future cash flows might look like. If we assume the input costs stabilize, the long-term view is promising. First, we’ll review recent history before looking at analyst projections.

From 2017-2021 the company saw unlevered free cash flow grow by a compound annual growth rate of some 54%.

The first three years of the model (2023-2025) relies on free cash flow figures provided by analysts covering the company. From that basis we project the remaining seven years FCF based on relatively conservative assumptions about the company’s growth plans.

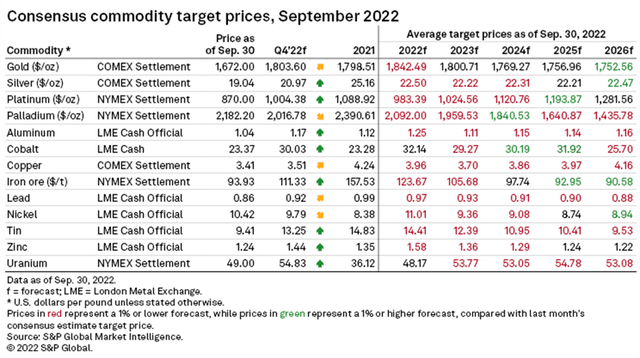

The Atalaya’s FCF margin median over the past 5 years is about 5% and the sector is at roughly 6-7%. The analyst projections for 2023-2025, imply FCF margins of 5%, 16%, and 27% on an incline, and it appears they have more precise insights into the benefits the solar power plant will have on operating margins. Revenue estimates for 2026-2032 are based on conservative metal price assumptions compared to consensus estimates gathered by S&P.

Metal price assumptions used to build the Atalaya revenue forecast beyond 2025:

- Cu and CuEq = $3.50/lb

- Gold = $1,600/oz

- Silver = $19.6/oz

Atalaya DCF Model (MH Analytics)

Based on the current trailing twelve months EPS, this model implies a P/E of 17, which just seems outrageously high for this sector. There seems to be a disconnect between the current state of affairs (negative quarterly EPS) and the optimistic projections. To use a page from the intelligence community’s book, we would say the estimate of the value of the stock based on our model comes with “low confidence.”

The bigger picture problem is being faced with a pair of puzzling antinomies vis-a-vis Europe’s energy crisis (a crisis that makes America’s problem at the gas pump seem quite small. Gas prices were rising before the conflict, by the way). On the one hand, it is good news in a way that the energy crisis is the variable that is driving the negative results. Remove that and we have a no-brainer of a buy. However, on the other hand, reading the minds of world leaders engaged in a war is a precarious business. So good luck trying to project when said variable will be removed from the equation. Pun fully intended.

Conclusion

Atalaya Mining’s stock is undervalued by nearly 50% while the company’s impressive growth plans make it seem like an attractive long-term investment. However, the timing is bad with Europe’s electricity crisis driving up input costs. The war in Ukraine has a direct impact on European companies’ bottom lines, and it is impossible to imagine when the geopolitical environment will stabilize. Although the company expects costs to moderate, it will need to deliver solid results in Q4 to back this up. In addition, it must improve on key quant metrics in order for us to feel more confident in our discounted cash flow projections and issue a buy rating.

Be the first to comment