Alexey Krukovsky/iStock via Getty Images

Investment Thesis

EOG Resources (NYSE:EOG) is one of the biggest oil and natural gas exploration and production companies, benefiting from high oil and natural gas prices.

I run through my reasoning for why high energy prices are going to remain high.

Then, I discuss EOG’s shareholder-friendly dividend allocation program. I put an emphasis on its high annualized dividend, plus its strong balance sheet.

Finally, I assert how even though EOG has seen its share price move higher in 2022, looking out to 2023, it’s still very cheaply priced.

Altogether, there’s a lot to like about EOG. Let’s jump into it.

What’s Happening Right Now?

Oil and gas prices remain high. Despite all the concerns and implications of a potential global recession, with the passage of time, as we are about to enter 2023, oil and gas prices refuse to retrace lower.

Supporting near-term commodity prices are three things.

In the first instance, the US has been releasing a substantial volume of oil from the Strategic Petroleum Reserve (“SPR”). This has succeeded and brought down oil prices throughout the second half of 2022.

However, once the US slows down its release and moves to stop the release of oil reserves, this will stop suppressing oil prices. That’s likely to be fully finished in the coming few months.

In the second instance, China has been in lockdown for most of 2022. And now rumors are circling with increasing vigor that China is about to reopen. That’s going to see China importing substantial oil volumes.

Thirdly, last week, the US inflation data indicated that peak inflation has stopped. The US economy may not have a deep recession as many feared, which would be very positive for oil demand.

Without overcomplicating these dynamics, these 3 elements are bullish and any one of them is likely to lead to oil prices remaining high.

With that in mind, I argue that investors want to be positioned in companies with a clear capital allocation strategy. Companies that are in a position to both benefit from high energy prices and are determined to return capital to shareholders.

Capital Allocation Program, Very Simple

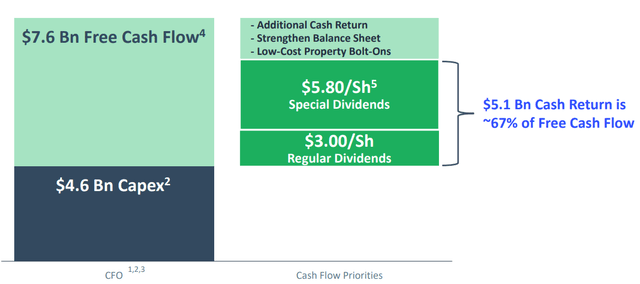

EOG has maintained for some time that its determined to return at least 60% of its free cash flow to shareholders.

And what you see above is a reminder of its imperative.

EOG is now going to return to shareholders its regular dividend which annualizes at $3.30, plus a special dividend of $1.50 to be paid out to stockholders of record as of December 15.

Consequently, for this quarter alone, investors that hold the stock until January 17, they’ll get a combined regular plus special dividend that annualizes at a 10.8% yield.

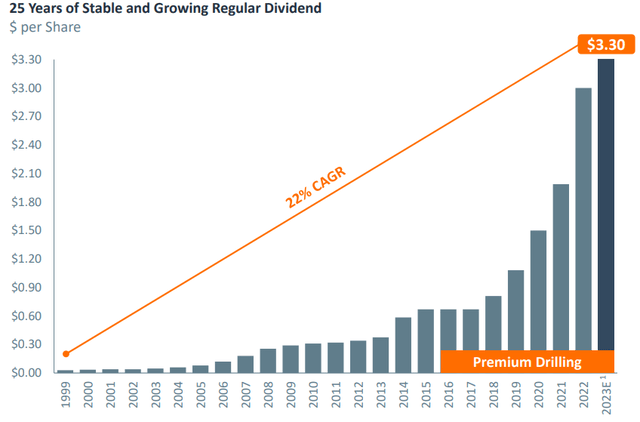

Simply put, investors are getting a dividend that stubbornly moves higher with time.

EOG Stock Valuation – 11x 2023 Free Cash Flow

In my previous article, I estimated that EOG was capable of making $9.5 billion in free cash flow. I now believe that this estimate was wrong. It was too high for 2022.

I now believe that 2022 will see approximately $7.5 billion, an approximate 20% reduction from my previous estimate. And you may ask, given a 20% reduction in free cash flow estimates, how can I still be bullish on EOG?

And the reason is that I’m not bullish on EOG because of what it can make in 2022. But because of what now looks increasingly probable for 2023.

Even if I assume that EOG makes a similar amount of free cash flow next year, that puts the stock prices at approximately 11x next year’s free cash flow. And given what we discussed at the start, I do believe that oil prices will remain elevated in 2023.

That being said, EOG’s multiple is obviously not as cheap as it was earlier in 2022. But at the same time, EOG’s balance sheet is now in a net cash position. And that’s the first time EOG’s balance sheet is this strong, in a long time.

The Bottom Line

Investors are given a choice. They can either opt for the winners of the last decade, namely tech, or they can opt for companies that are going to be winning in the coming year or two.

For now, investors have voted. They still reward tech names with minimal free cash flow growth, with high multiples. And the reason for this is that investors doubt that energy companies could possibly have another year in the sun, like they had in 2022.

And until investors believe that energy prices are going to remain elevated for longer, EOG’s multiple will remain in the bargain basement, at 11x free cash flow. And with a 10.8% annualized yield.

Be the first to comment