Nicholas Smith

Introduction

It’s time to discuss agriculture. This has been one of my hottest macro topics since early 2020 when I became bullish on fertilizers, key crops, and the companies operating in the industry. Since then, a lot has happened. The war in Ukraine disrupted supply chains, high energy prices caused fertilizer prices to soar, and bad weather further reduced food security. In addition to energy, agriculture investments have been the stars of my portfolio. In this article, we’re going to discuss all of this with a focus on new developments. Despite falling crop prices, fundamentals continue to provide fuel for a renewed uptrend. The related energy situation is far from over, as it’s likely to keep demand for both corn and soybeans higher than previously expected.

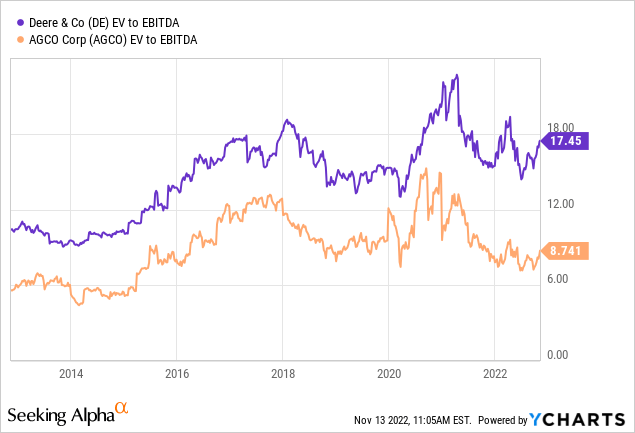

In light of these developments, I will explain why both Deere & Company (NYSE:DE) and its smaller peer AGCO Corp. (NYSE:AGCO) are undervalued. I prefer equipment producers due to fading supply chain problems, the replacement cycle, and related farm income.

I’m prepared to buy more as I believe that both stocks have the potential to accelerate quite significantly the moment general economic demand bottoms.

Now, let’s look at the details!

It’s A Truly Strong Agriculture Bull Case

Where to begin? That’s the question I sometimes ask at the start of complex articles.

It would certainly apply here as agriculture has become an extremely complex topic. What makes agriculture both fascinating and challenging is the fact that it is tied to almost every single macro topic one can think of.

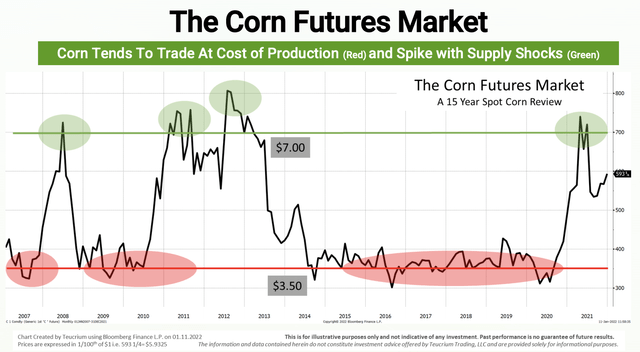

For example, as the (not updated) chart below shows, major crops usually trade slightly above production costs. This makes sense as it’s a market with extremely low entry barriers. Supply and demand are quickly balanced.

It usually takes significant supply shocks to cause major crops to rally. For example, heat waves (droughts), floods, or spikes in energy prices.

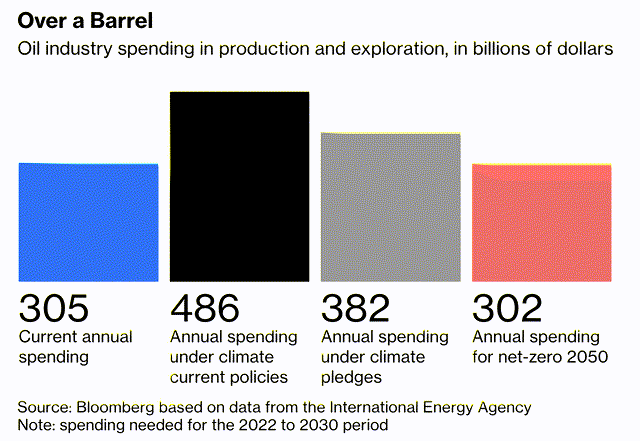

Before we get to the weather aspect, we need to talk about energy. I believe that poorly thought-out government policies regarding energy are a long-term bullish catalyst for agriculture (crop prices and fertilizers).

In an article titled Ridiculous And Dangerous Energy Policies Make Devon Energy A Must-Own Stock (and so many others), I highlighted my expectation that both oil and natural gas prices will remain elevated on a long-term basis as the supply situation is simply horrible.

This matters for at least two reasons. Reason one is that energy costs are a major driver of total farming costs. Elevated energy prices will keep crop prices from falling to pre-crisis levels.

Reason number two is the importance of key crops in the energy process. When I say key crops, I usually mean corn, soybeans, and wheat. Corn and soybeans account for 34.9% of the total planted acres in the United States – each!

In other words, corn and soybeans combined account for roughly 70% of total planted crops.

That matters with regard to energy. Why? As explained by Goehring & Rozencwajg:

[…] global agricultural markets have now become highly integrated into global energy markets. Nothing better demonstrates this phenomenon than the US corn and soybean markets over the last 15 years. Almost 40% of the corn crop is now processed into ethanol and 25% of the soybean crop is now used to make bio-diesel. The worse the global energy crisis becomes the bigger the demand will be for bio-fuel production, resulting in further upward pressure to grain prices.

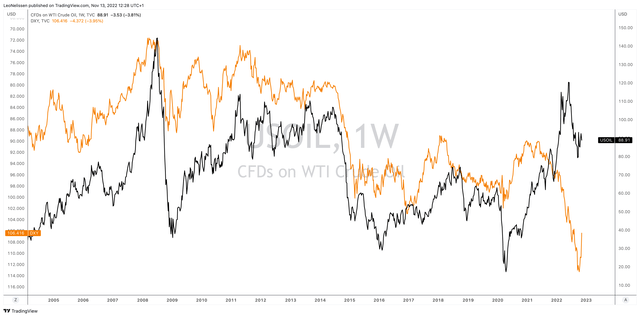

Adding to that, the chart below gives my thesis a bit more support as it shows the long-term correlation between crude oil and corn prices (not updated).

CME Group

Another issue is that crop supply is already very tight. To quote a recent article on Successful Farming:

“Ultimately, ending stocks for U.S. corn, soybeans, and wheat continue to remain historically tight, especially as harvest is just finishing and supplies of grain must again be rationed until the 2023 harvest,” she says. “All eyes are now on global uncertainty with the Black Sea grain corridor agreement expiring on Nov. 19, and upcoming crop weather conditions in South America as their crop is nearly finished being planted.”

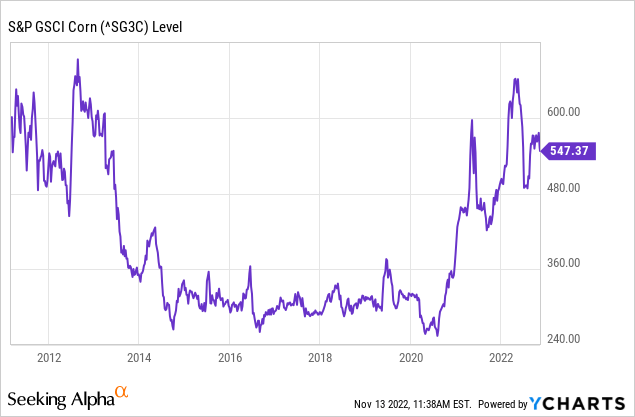

The two charts below visualize this tightness. Corn production is barely matching demand as production growth has significantly slowed in the past 6-8 years.

CME Group

The supply/demand imbalance in wheat is even worse as we’re now looking at three straight years of production not meeting demand. Add to this the geopolitical issues in East Europe, and we have a recipe for disaster.

CME Group

Moreover, the OECD expects long-term food consumption (crop demand) to rise by 1.4% per year. This is mainly driven by population growth.

On the supply side, the OECD expects 1.1% growth per year, which clearly means markets will remain tight.

The Outlook assumes wider access to inputs as well as increased productivity-enhancing investments in technology, infrastructure, and training as critical drivers of agricultural development. However, a prolonged increase in energy and agricultural input prices (e.g. fertilizers) will raise production costs and may constrain productivity and output growth in the coming years.

One of the reasons why OECD comments matter is because one thing has become crystal clear: farming needs to become way more efficient.

Due to supply tightness and a steep decline in arable land, we need to make an increasing amount of food using a declining amount of space – to put it bluntly.

Our World In Data

This is one of the reasons why I am such a big fan of equipment producers in this space as it requires next-gen equipment that most (smaller) peers of Deere and AGCO cannot compete with. But more on that later.

I promised I would elaborate on the weather aspect and what it could mean for supply.

The worst thing about the weather is that it’s even harder to predict than the stock market. However, there are reasons to believe that we’re in for more bad news as the past few years were rather bad for crop supply. Especially in Europe, 2022 did a number on key crops like corn and wheat.

One of the driving forces behind that and floods in Pakistan, wildfires in California, and torrential rains in Australia and Indonesia is La Nina. In September, Bloomberg published a lengthy piece discussing what this means for the world.

Another year of La Nina means the world is hurtling toward $1 trillion in weather-disaster damages by the time 2023 wraps up. The floods, droughts, storms and fires will destroy more homes, ruin more crops, further disrupt shipping, hobble energy supplies and, ultimately, end lives.

Moreover:

The weather cycles that come from La Nina “just exacerbate all the problems that already exist in the big picture, like the war in Ukraine and rising commodity prices,” said Michael Pento, president and founder of Pento Portfolio Strategies. “When you add in the extreme weather, it just creates a scenario for higher energy prices, higher food prices and more inflation. It’s negative for the global economy, and it’s working against the Federal Reserve.”

Additionally, there’s another catalyst I’m watching. If the Federal Reserve is forced to pivot next year (I expect that to happen), we could see significant dollar weakness. Right now, the dollar is strong as the Fed is draining dollars from the system. Once that pressure eases, we will see new tailwinds for commodities. For example, energy. Emerging markets will find it easier to buy dollar-denominated commodities once the Fed eases. It lowers the relative price of commodities and it usually improves structural demand as well.

TradingView (Black = Crude Oil, Orange = DXY (Inverted))

On a side note, a Fed pivot would also improve general economic demand, which helps risk sentiment. After all, both Deere & AGCO are cyclical industrial stocks. For example, Deere has 26% construction and forestry exposure. Even if they benefit from a strong agriculture bull case, it helps when general economic growth is improving as well.

That’s why I’m so bullish.

Why I’m So Bullish On Deere & AGCO

I believe that this may be my most bullish article in a very long time. An alternative article title would have been something like this: Why Deere Is A $600 stock. Yet, that would not have done AGCO any justice.

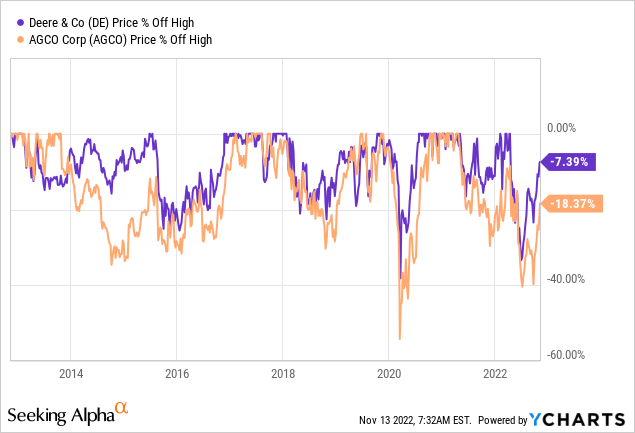

Right now, Deere is trading at $406, which is 18.4% higher since the start of this year. It’s an outperformance of almost 35 points, which is quite remarkable. Especially because Deere is a rather cyclical stock. The same goes for AGCO.

Moreover, it wasn’t easy sailing this year – so far. Both stocks sold off close to 40% this year.

However, both quickly rebounded as this isn’t a common economic downtrend. This downtrend comes with high commodity prices and strong demand for equipment. Even Caterpillar (CAT) is trading close to an all-time high! Just think about that for a second.

I’m not making the case that we won’t encounter more weaknesses, but these developments are important to note and understand.

Caterpillar benefits from strong secular demand, as the energy transition comes with rapidly accelerating demand for commodities – as I discussed in this article.

Deere and AGCO have different tailwinds. They benefit from what looks like a lasting agricultural bull market and the desperate need to innovate to improve automated and precision farming.

I have frequently made the case that both Deere and AGCO are in terrific spots to benefit from these trends. I believe that both companies are leaders in their fields. This is now starting to pay off.

According to AGCO’s third-quarter earnings call:

AGCO’s Precision Ag sales are up over 21% so far this year. We have experienced strong growth for both our Precision Planting business, as well as our Fuse suite of products, as farmers see the benefit of these high-tech solutions.

Precision planting alone saw 24% sales growth year-on-year.

Precision Planting success is generated through their unique retrofit approach, which reduces the farmer’s upfront investment and increases their ROI. By offering solutions through a retrofit approach, we can expand the addressable market beyond AGCO brands to all industry brands. The other way we are addressing the Precision Ag opportunity is Fuse, which provides OEM solutions for our AGCO equipment.

Deere is similar, but it is in an even better spot to benefit from technology. Not only does it have all the tools that AGCO has, but it also looks to incorporate entire farms when it comes to automation processes. The agriculture giant from Moline, Illinois, will be able to provide farmers with fully automated tractors that allow the farmer to become more passive. In other words, monitoring automated equipment will take over from spending a lot of time in tractors and combines. As reported by the Wall Street Journal:

The company this year is rolling out self-driving tractors that can plow fields by themselves, and sprayers that distinguish weeds from crops. Deere, which helped make satellite-guided tractors ubiquitous in the U.S. Farm Belt over the past 20 years, is investing billions of dollars to develop smarter machines that the company said will make farming faster and more efficient than it ever could be with just farmers behind the wheel.

Moreover, when it comes to farms, we witnessed the start of a new replacement cycle in 2020/2021. For the first time in roughly 10 years, crop prices reached favorable levels, that boosted farm income.

AGCO sees rising farmer profitability, even in Europe, where high prices have put some pressure on farmers.

The encouraging news is that despite the global supply bottlenecks and inflationary pressures, farmer economics are very healthy. Global end market demand remains at high level and demand for our products continues to be strong. Our team is working hard to mitigate these challenging conditions to serve our customers and maximize our full year results.

Moreover, this is what Deere commented on this:

[…] our customers will still be profitable, and the environment is supportive of replacement demand, especially when you consider that farmers haven’t been able to replenish their fleets as much as they wanted to this year. The age of the fleet remains above average. Additionally, dealer inventories remain at historic lows since the industry shorted demand the last couple of years due to supply constraints.

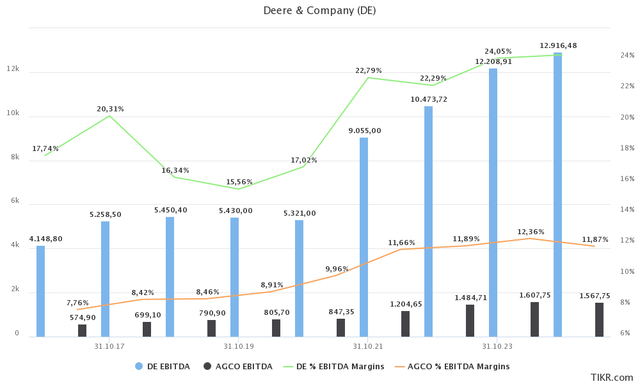

As a result, analysts do not expect that EBITDA will weaken – despite an almost 100% chance of a recession. Deere is expected to boost EBITDA to $12.2 billion in FY2023, with AGCO growing EBITDA to $1.6 billion. Moreover, margins are expected to get a boost in 2023 as supply chain issues are fading.

Both AGCO and Deere have been unable to produce the numbers they wanted. Farmers that did get equipment sometimes got tracers or combines with missing cameras or other minor issues that will be added at a later date.

With that said, there’s a new tailwind: persistent pricing gains and fading supply chain issues. In the third quarter, AGCO was able to more than offset supply chain and pricing issues by being able to hike prices by double-digits. Thanks to high demand and great products, both AGCO and Deere have pricing power.

While supply issues are still a problem, causing companies to keep more inventory than usual, we’re seeing improvements.

Unfortunately, these tailwinds will likely emerge in the first half of 2023, with faster improvements in the second half.

According to AGCO:

Despite the continued strong retail demand, especially for high horsepower equipment, we believe supply chain constraints and the corresponding effects on production will limit demand upside in the fourth quarter.

FMC Corporation (FMC), a pesticide giant I recently covered, mentioned that it expects pricing headwinds to ease significantly in the first half of 2023, followed by inflation becoming a tailwind in the second half of the same year. FMC is obviously different from machinery companies, but I do agree with that assessment as agriculture input price inflation is likely coming down (a lot) in 2023.

Moreover, the recession does offer opportunities as both Deere and AGCO have strong order books – thanks to secular demand growth. If the recession reduces overall economic demand, more key supplies will be available at better prices. I believe that the same applies to defense companies.

As the graph below shows, manufacturing new orders are contracting (below 50). It’s truly a terrible environment to be in. However, both Deere and AGCO are doing well. Hence, by bull case includes a return of economic growth in 2023. At that point, both companies will enjoy agriculture and non-agriculture demand growth, which will have a major impact on the top line.

Wells Fargo

So, what does this mean for the valuation?

Valuation

I’m more bullish than the average analyst. Way more bullish. That started in 2020, and I’m still increasing my targets as the market is truly favorable. Deere is currently trading at a 13.1x 2023E EBITDA multiple. That’s based on its $122.5 billion market cap, $34.5 billion in 2023E net debt, and $2.9 billion in pension liabilities. AGCO is trading at 6.1x 2023E EBITDA based on its $9.5 billion market cap, $100 million in 2023E net debt, and $200 million in current pension liabilities. Deere usually trades at 17-18x EBITDA in good years. AGCO trades roughly at 9-10x EBITDA. That difference is caused by Deere being a strong brand with higher margins.

Deere is trading at a 6.0% 2023E free cash flow yield, which is also great news for dividend investors. AGCO is trading at an implied yield of 8.9%.

Using 2024 numbers, I believe that Deere should be trading at a market cap of $182 billion, implying a 48-55% upside range. AGCO should be trading close to $15 billion, implying at least 55-60% upside.

Again, these are 2024 targets, so roughly 2 years from now.

Takeaway

In this rather lengthy article, we did two important things. First, we discussed why the agriculture bull case is set to last. Supply is tight and I do not expect that to change. Energy is a major driver, geopolitical risks make things worse, and weather-related issues are unlikely to fade. Moreover, this is on top of already very tight supply estimates that put a tremendous focus on precision agriculture.

That’s where AGCO and Deere come in. Both stocks are not getting the love they deserve as ongoing supply chain issues and recession risk keep sentiment somewhat low. Yet, both are doing well this year as their customers are in a good spot. Secular demand is a huge driver of revenue growth and 2023 could see a faster supply chain and inflation easing than expected.

Moreover, both companies offer next-gen farming equipment and both have large backlogs to even withstand weakness in non-farming segments (this mainly goes for Deere).

In 2021 and prior I was more bullish than the average analyst. This time, I’m doing it again. I believe that Deere and AGCO are significantly undervalued and I am a big believer in buying any weakness the market might offer us.

While I do have significant Deere exposure, I’m looking at adding exposure as soon as the market offers a 10-15% discount, which happens rather regularly.

(Dis)agree? Let me know in the comments!

Be the first to comment