thisnight

This article is part of a series that provides an ongoing analysis of the changes made to Davis Selected Advisers’ 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 11/10/2022. Please visit our Tracking Christopher Davis’ Davis Selected Advisers 13F Portfolio series to get an idea of their investment philosophy and our previous update for the fund’s moves during Q2 2022.

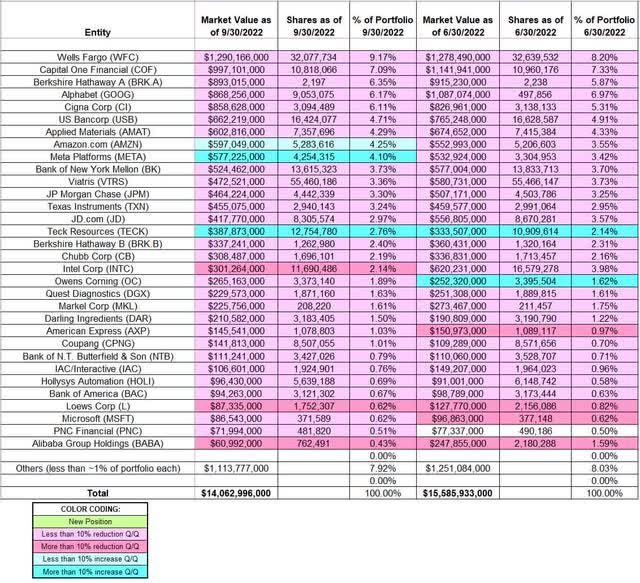

This quarter, Davis Selected Advisers’ 13F portfolio decreased ~10% from $15.59B to $14.06B. The number of holdings remained steady at 114. The top three holdings are at ~23% while the top five holdings are close to ~37% of the 13F assets: Wells Fargo, Berkshire Hathaway, Capital One Financial, Alphabet, and Cigna.

Note: Davis Selected Advisors manage several mutual funds and ETFs. The flagship mutual fund is Davis New York Venture Fund (MUTF:NYVTX) with ~$6B in assets. Since its 1969 inception, the fund has generated significant alpha: 10.77% annualized over 53 years compared to ~10% annualized for the S&P 500 index. Also, they advise the Clipper Fund (MUTF:CFIMX) which was incepted in 1984.

Stake Increases:

Amazon.com Inc. (AMZN): The 4.25% of the portfolio position in AMZN was first purchased in 2006. A very large stake was built next year at prices between ~$2 and ~$5. The position has since been substantially reduced over the years. Recent activity follows. Q3 2021 saw a ~15% selling at prices between ~$160 and ~$187. The stock currently trades at ~$101. Last three quarters had also seen minor trimming while this quarter there was a marginal increase.

Meta Platforms (META) previously Facebook: META is a 4.10% of the portfolio stake first purchased in 2015 at prices between ~$75 and ~$110. The position has wavered. Recent activity follows. There was a ~15% trimming in Q3 2021 at prices between ~$337 and ~$382 while in Q1 2022 there was a ~25% stake increase at prices between ~$187 and ~$339. That was followed with a similar increase this quarter at prices between ~$134 and ~$183. The stock currently trades well below their recent purchase price ranges at ~$113.

Teck Resources (TECK): The 2.76% of the portfolio stake in TECK saw a ~30% increase last quarter at prices between ~$30.50 and ~$45.75. That was followed with a ~17% increase this quarter at prices between ~$26 and ~$37. The stock currently trades at ~$35.

Stake Decreases:

Wells Fargo (WFC): WFC is a very long term stake that has been in the portfolio since their first 13F filing in Q1 1999. At the time, it was already a very large stake at ~28M shares. Recent activity follows. Q3 2020 saw a ~45% stake increase at prices between ~$23.50 and ~$26.50. Since then, the activity had been minor. Last three quarters have seen a ~17% trimming. The stock currently trades at $47.55, and the stake is the largest at 9.17% of the portfolio.

Berkshire Hathaway (BRK.A) (BRK.B): The ~9% of the portfolio Berkshire stake is their second largest position. It has been in the portfolio since their first 13F filing in Q1 1999. Recent activity follows. Last three quarters saw a ~15% trimming at prices between ~$264 and ~$360. It is now at ~$310.

Capital One Financial (COF): The top-three ~7% COF stake was a very small position first purchased in 2014. 2017 saw a substantial ~12M share stake built at prices between ~$78 and ~$100. The 2018-2020 timeframe also saw incremental buying as the stake was increased to ~16.2M shares. Last six quarters have seen a ~35% reduction at prices between ~$99 and ~$178. The stock currently trades at ~$116.

Alphabet Inc. (GOOG) (GOOGL): GOOG is a top-five ~6% of the portfolio position first purchased in 2016 at prices between ~$38 and ~$40. The stake has seen periodic selling since. Recent activity follows. Last six quarters have seen a ~45% selling at prices between ~$87 and ~$150. The stock currently trades at ~$97.

Cigna Corp (CI): The 6.11% of the portfolio CI stake was built in 2020 at prices between ~$142 and ~$220. Next quarter saw a ~50% stake increase at prices between ~$203 and ~$244. That was followed with a ~185% increase in Q3 2021 at prices between ~$218 and ~$246. The stock currently trades at ~$304. Last three quarters have seen minor trimming.

U.S. Bancorp (USB): USB position is a fairly large 4.71% of the portfolio stake. A very small position was first purchased in 2010. A substantial ~9.2M stake was built in 2018 at prices between ~$45 and ~$58. Next year saw a ~10% trimming but 2020 saw a stake doubling at prices between ~$31 and ~$59. The stock currently trades at $44.92. Last five quarters have seen a ~10% trimming.

Applied Materials (AMAT): AMAT is a 4.29% long-term stake first purchased in 2011. The position remained very small until 2018 when a ~13M shares stake was built at prices between ~$30 and ~$62. Next year saw a ~15% stake increase at prices between ~$34 and ~$62. Since then, the position has seen selling. Q1 2021 saw a one-third reduction at prices between ~$85 and ~$140. Last six quarters have also seen minor trimming. The stock is now at ~$111.

Bank of New York Mellon (BK): A huge 110M share stake was built in BK during the 2007-2011 time period at prices between ~$18 and ~$49. The position has since been reduced. The decade through 2020 saw the stake reduced to ~15M shares at prices between ~$21 and ~$58. Last several quarters have also seen minor trimming. The stock currently trades at $44.52, and the stake is at 3.73% of the portfolio.

Viatris Inc. (VTRS): The 3.36% VTRS stake was established in Q1 2021 at prices between ~$14 and ~$19. Next three quarters saw minor increases and that was followed with a ~25% increase last quarter at prices between ~$10 and ~$15.50. The stock currently trades at $11.44. There was a minor ~2% trimming last quarter and a marginal reduction this quarter.

JP Morgan Chase (JPM): A ~43M share stake in JPM was first built in 2004 at an average price in the high-30s. The position size peaked at over 78M shares by 2008. Since then, the stake has wavered. Recent activity follows. Last six quarters had seen a ~35% selling at prices between ~$113 and ~$172. The stock currently trades at ~$135, and the stake is at 3.30% of the portfolio. There was marginal trimming this quarter.

Texas Instruments (TXN): A ~58M share stake in TXN was built in the 2007-08 timeframe at prices between ~$14 and ~$38. The position has since been reduced. Recent activity follows. Last seven quarters have seen a ~15% trimming at prices between ~$149 and ~$201. The stock currently trades at ~$180 and the stake is at 3.24% of the portfolio.

JD.com (JD): The ~3% JD stake was a very small position first purchased in 2014. The position remained small until 2018 when there was a substantial increase from ~2.5M shares to ~7.2M shares at prices between ~$19 and ~$51. Since then, the position has wavered. Recent activity follows. Q3 2021 saw a ~250% stake increase at prices between ~$62 and ~$83 while in the following quarter there was a ~35% selling at prices between ~$66 and ~$92. Q1 2022 saw a ~18% stake increase at prices between ~$43 and ~$78. The stock currently trades at $48.93. There was a ~8% trimming over the last two quarters.

Intel Corporation (INTC): INTC is a ~2% of the portfolio stake built in 2019 at prices between ~$44 and ~$60. Next year saw a ~50% stake increase at prices between ~$44 and ~$69. Last year had also seen a one-third increase at prices between ~$49 and ~$68. The stock currently trades well below the low end of their purchase price ranges at $30.43. There was a ~30% reduction this quarter at prices between ~$26 and ~$41.

Owens Corning (OC): OC is a 1.89% of the portfolio position primarily built last quarter at prices between ~$74 and ~$98 and it is now at ~$92. This quarter saw marginal selling.

Darling Ingredients (DAR): The 1.50% DAR position saw a stake doubling in Q3 2021 at prices between ~$64 and ~$79. Last four quarters have seen only minor adjustments. The stock currently trades at ~$76.

Coupang Inc. (CPNG): CPNG had an IPO in Q1 2021. Shares started trading at ~$49 and currently goes for $19.14. The ~1% of the portfolio stake was established in H1 2021 at prices between ~$36 and ~$49. Q1 2022 saw the position more than doubled at prices between ~$15 and ~$29. There was marginal trimming in the last two quarters.

Alibaba Group Holding (BABA), American Express (AXP), Bank of America (BAC), Bank of N.T. Butterfield & Son (NTB), Chubb Ltd. (CB), Hollysys Automation (HOLI), IAC/Interactive (IAC), Loews Corp (L), Markel Corp (MKL), Microsoft Corp (MSFT), and Quest Diagnostics (DGX): These small (less than ~2.20% of the portfolio each) stakes were decreased this quarter.

Note: They have a ~6.5% ownership stake in NTB and a ~10% ownership stake in HOLI.

The spreadsheet below highlights changes to Davis Selected Advisers’ 13F holdings in Q3 2022:

Christopher Davis – Davis Selected Advisors Q3 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Davis Selected Advisers’ 13F filings for Q2 2022 and Q3 2022.

Be the first to comment