Apriori1

Generally speaking, I run a very concentrated portfolio. So it’s not every day that I get to write about one of the companies that I own, let alone one of my favorite holdings. But today is that day. The company in question is none other than automotive retailer Group 1 Automotive (NYSE:GPI). Driven by a mixture of strong demand for vehicles over the past year and by countless acquisitions aimed at increasing its physical footprint, the company has been growing at a rapid pace recently. As a result, the most recent financial performance for the company has allowed it to outperform the broader market. But for investors who are worried about the future, my counterpoint is that shares are still so cheap that they have a high probability of continuing to rise even in the light of uncertain economic data. It’s because of how cheap shares are and because of how well the company’s fundamental performance continues to be that I still have no problem rating it a ‘strong buy’.

A nice ride

About two and a half months ago, in late August, I published my most recent article covering Group 1 Automotive. In that article, I called the company criminally undervalued, basing my assessment on the firm’s robust financial performance through the first half of the 2022 fiscal year. Shares looked incredibly cheap even at a time when sales and profits were climbing. This led me to reiterate my ‘strong buy’ rating for the company, reflecting my belief that it should drastically outperform the broader market for the foreseeable future. While I wouldn’t exactly call the company’s performance since then drastic, it has certainly done well to beat the market, with shares generating upside of 4.5% compared to the 0.2% increase experienced by the S&P 500.

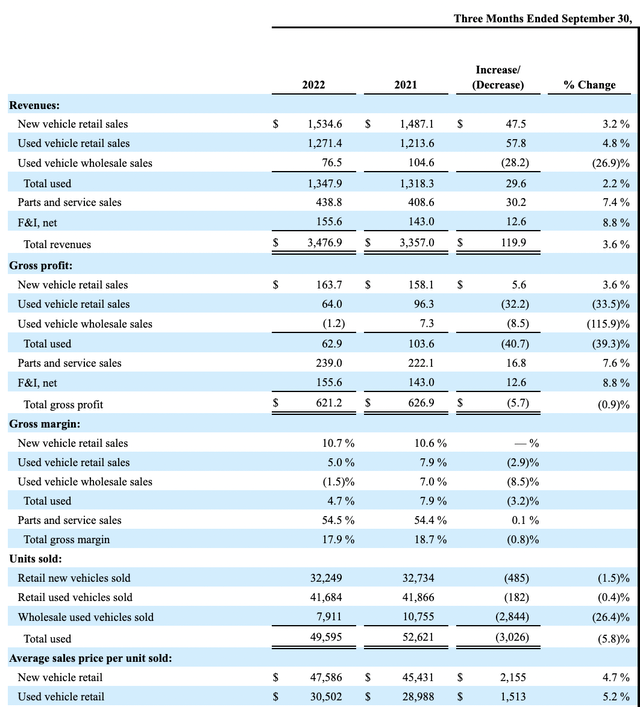

Since only a short amount of time has passed, we only have data covering one additional quarter for the business. That is the third quarter of the 2022 fiscal year. According to management, revenue during that time came in at $4.16 billion. That’s 22% higher than the $3.41 billion the company reported the same time one year earlier. Naturally, there are many working parts to this. The biggest area of growth for the company involved its new vehicle retail sales. Revenue here jumped by 24.4%, rising from $1.51 billion to $1.88 billion. This can be chalked up to a 17.6% rise in the number of new vehicles sold through the company’s retail channels. At the same time, pricing per unit sold increased by 5.8%, climbing from $45,373 to $47,999. During the same window of time, used vehicle retail sales jumped by 21% from $1.23 billion to $1.49 billion. This improvement came from a 13.9% increase in the number of used vehicles sold through its retail channels and by a 6.2% increase in pricing.

There were, of course, other areas of strength for the company. Parts and service sales grew by 23.8% from $416.5 million to $515.6 million. Meanwhile, finance and insurance revenue jumped 27.6% from $146 million to $186.3 million. The only weakness from a sales perspective involved the used vehicles that are sold through the company’s wholesale channels. This number plunged by 15.5%, dropping from $106 million to $89.6 million. Certainly, the strong demand for used vehicles in the company’s retail operations helped to divert activity away from the wholesale operations of the business.

It should be mentioned that not all of the company’s growth is organic in nature. The fact of the matter is that management has been very active in growing the enterprise by means of acquisition. If you look only at same-store locations, sales were up by only 3.6% year over year. Most of the increase for the company, then, came from the company’s acquisition activities. In the first nine months of the firm’s 2022 fiscal year, management made acquisitions that would add $740 million in sales to the company’s top line. From the start of 2021 through today, the company has made acquisitions that collectively should bring on $3.2 billion in revenue. This is not to say that the company is not willing to sell assets when they deem it appropriate. In the third quarter, management sold one dealership that was responsible for generating $65 million in revenue per year. While growing, the company has also been mindful to use the cash it generates to buy back stock. In the first nine months of its 2022 fiscal year, it repurchased about 11.9% of its outstanding shares for $359.5 million. And subsequent to the end of the quarter, they repurchased another $100 million worth of stock.

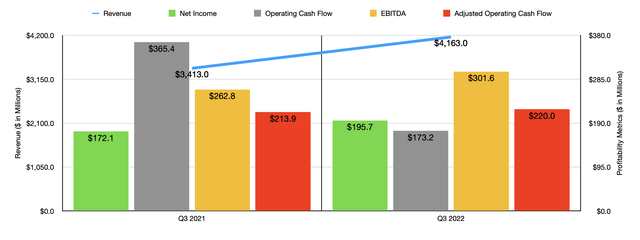

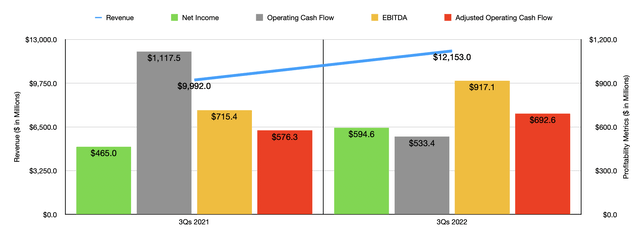

These stock buybacks and acquisitions are only made possible by strong financial results. During the third quarter, the company reported net profits of $195.7 million. This was up from the $172.1 million reported one year earlier. Yes, operating cash flow did worsen year over year, declining from $365.4 million to $173.2 million. But if we adjust for changes in working capital, it would have risen from $213.9 million to $220 million. And over that same window of time, we also would have seen EBITDA improve, rising from $262.8 million to $301.6 million. As you can see in the chart above, financial results for the third quarter were not a one-time event. By almost every metric, the first three quarters of its 2022 fiscal year were far stronger than what they were the same time last year.

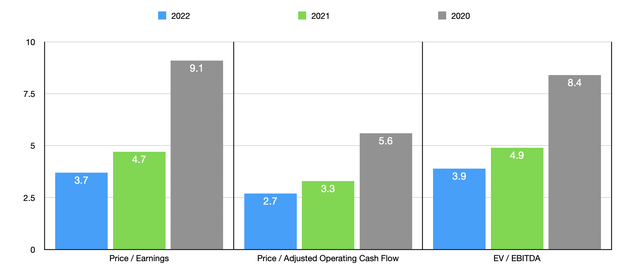

If there’s one complaint that I have about Group 1 Automotive, it’s that management does not really reveal guidance for the current fiscal year. If we were to simply annualize results experienced so far, we would get net income of $706 million, adjusted operating cash flow of $958 million, and EBITDA of $1.37 billion. Taking these figures, we can see that the company is trading at a forward price to earnings multiple of 3.7, at a forward price to adjusted operating cash flow multiple of 2.7, and at a forward EV to EBITDA multiple of 3.9. As the chart above illustrates, even a return to the kind of profitability that the company experienced in 2020 would still see that shares are trading at rather low levels on an absolute basis. But shares are also cheap relative to similar firms. In the table below, you can see how I compared the company to five similar businesses. Using all three valuation metrics, our prospect was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Group 1 Automotive (GPI) | 3.7 | 2.7 | 3.9 |

| Sonic Automotive (SAH) | 5.6 | 3.1 | 6.0 |

| Asbury Automotive Group (ABG) | 5.2 | 4.6 | 5.7 |

| AutoNation (AN) | 4.9 | 4.8 | 4.6 |

| Lithia Motors (LAD) | 5.4 | 24.4 | 6.1 |

| Penske Automotive Group (PAG) | 6.8 | 8.1 | 6.2 |

Takeaway

It’s not every day that you come across an incredibly cheap company that is exhibiting rapid growth, all while buying back stock in order to reward shareholders. I have no doubt that the market for vehicles will eventually worsen, something that will prove to be painful for the firm. But even if you ignore all of the revenue it has acquired over the years and assume that financial performance would tank, it’s difficult to imagine a scenario where shares are overpriced. Not only are shares cheap on an absolute basis, they are also cheap relative to similar firms as well. All of this combined makes for a perfect storm in my book, leading me to feel very comfortable with the ‘strong buy’ rating I have on its stock.

Be the first to comment