Andrii Dodonov

The Congressional Budget Office (CBO) recently reported the US budget deficit for the just completed 2022 fiscal year came in at -$1.4 trillion. This is a significant advancement from last year’s – $2.8 trillion, cutting the 2021 deficit in half.

The improvement came from an increase in revenues, particularly income taxes, and a large drop in pandemic related expenditures, such as stimulus checks and small business loans, which were designed to be temporary.

Nonetheless, this is our third consecutive year of the deficit exceeding $1trillion. With rising interest rates due to 40-year highs in inflation and Fed tightening, this trend will continue in the coming years.

As the Treasury is ramping up to raise new cash to fund the deficit, several of the biggest buyers of US government debt are pulling back from investing in Treasuries.

Federal Reserve

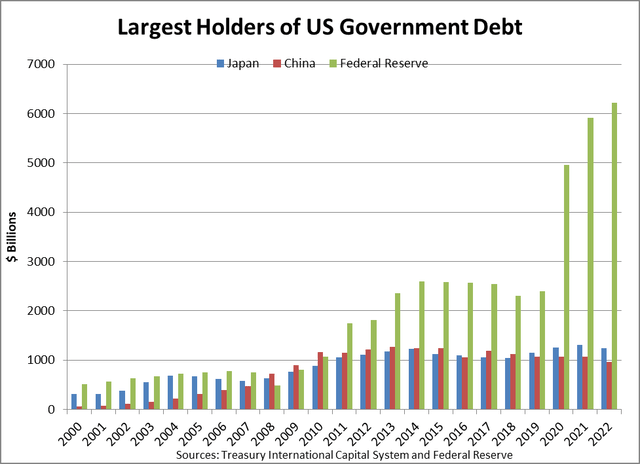

The largest individual owner of Treasuries is the Federal Reserve. As of June 30th, the Fed’s holdings peaked at $6.0 trillion. That same month the Fed began their balance sheet run off with the implementation of Quantitative Tightening (QT) as part of their policy normalization program. Initially they were allowing $30 billion of Treasury securities to roll off each month through maturities. In September, the plan was fully enacted and $60 billion is now being allowed to run off each month.

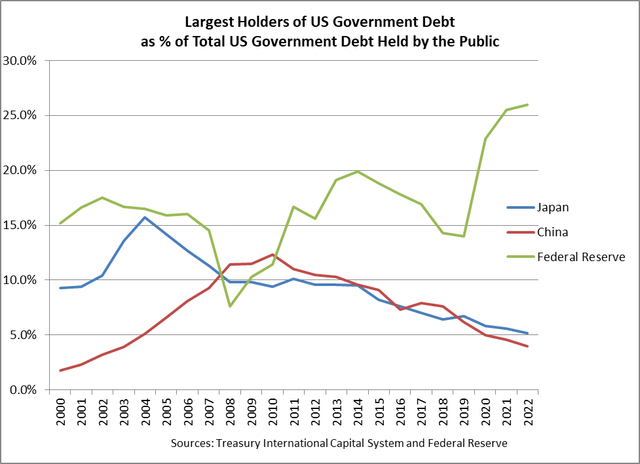

Since 2008 when the Fed began their Quantitative Easing (QE) program, the Fed has gobbled up Treasury securities. Their share of ownership of the US Treasury market has increased from 7.6% in 2008 to the current 26.0%.

Treasury International Capital System and Federal Reserve

Over the past two years, during the pandemic, when the Fed reinstituted QE and doubled the size of their balance sheet, the Fed purchased 57% of all new Treasury issuance (this was done in the secondary market, as the Fed does not buy primary market issues.)

Now however, as the Fed moves into full blown QT, their almost insatiable demand for Treasuries is gone. The impact on Treasury yields has been noticeable.

The decrease in Fed demand for Treasuries actually began with the release of November 2021 FOMC minutes when it was revealed that the Fed would begin tapering their purchases of securities, cutting their appetite by $10 billion per month. The 10-year T-note was yielding 1.55% at the time.

As indicated in yellow in the 10-year T-note chart below, since that date the yield has virtually gone straight up.

Over the past eleven months the Fed has moved from tapering their purchases, to stopping their purchases, to slowly starting their balance sheet reduction, to fully implementing their balance sheet reduction. As of Friday’s close the yield on the 10-year T-note was over 4.0%, the highest level since 2008.

Bloomberg

Foreign Holders

The Fed was not the only large holder of Treasuries to cut their positions. The next two largest owners of Treasury bonds are China and Japan.

China had been the second largest owner of Treasuries, and their holdings peaked at $1.3 trillion in 2013. Since then, their positions have fallen gradually. This year, for the first time since 2009 their position dipped under $1 trillion to $967 billion. China has been dealing with a slowing economy and they have trimmed their Treasury holdings to defend their currency.

Japan moved to the number two spot as their Treasury positions have increased gradually to almost $1.3 trillion.

Treasury International Capital System and Federal Reserve

Although the absolute amounts of both China and Japan’s Treasury holdings have only fluctuated modestly, as a percent of Total US Debt Outstanding, they have haven’t kept pace with the growth of the US Publicly Held Debt.

From highs of owning 12.3% and 15.7% of Total US Debt, China and Japan’s shares have fallen sharply to now owning only 5.2% and 4.0%, respectively.

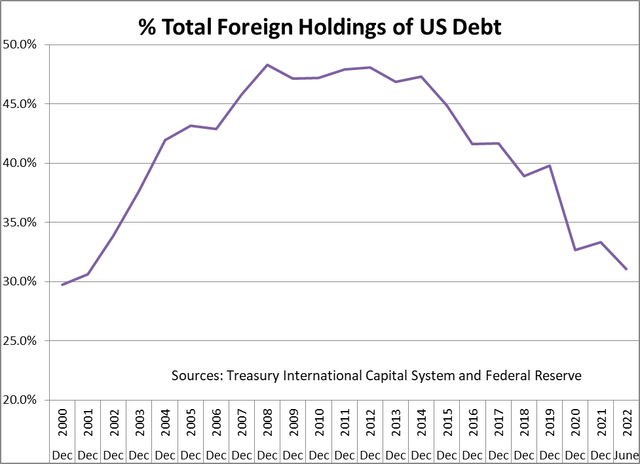

Other foreign holders of Treasury debt have experienced the same relative decline.

Altogether, over 40 countries hold US Treasury securities. From a peak of 48% in 2008, total foreign ownership of US debt has declined to 31%.

Treasury International Capital System and Federal Reserve

US Financial Institutions

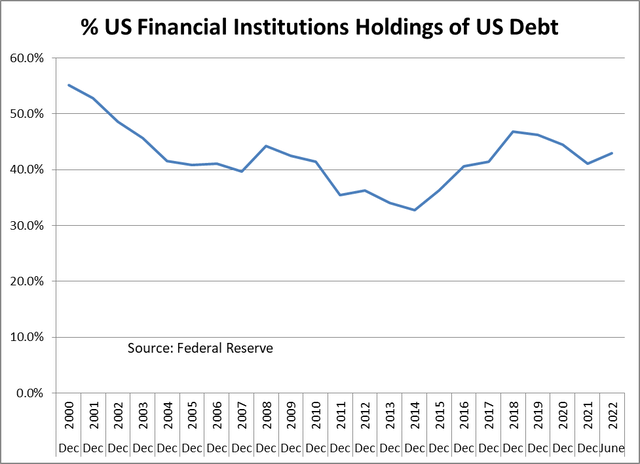

The final major segment of buyers of Treasuries is US financial Institutions. This group is comprised of commercial banks, mutual funds, pension funds, state and local governments, and insurance companies. They typically are more rate sensitive than the Fed and foreign governments.

Collectively US Financial Institutions is the largest of the three groups of buyers of Treasuries. As of June 30, 2022, they owned $10.2 trillion of US Treasuries, a gain from $9.5 trillion at year end 2021. While up in absolute terms, their share of the US Treasury market has remained relatively stable over the past 20 years and has hovered around 40%.

Federal Reserve

With increases in supply and reduced demand for Treasuries, in order for this group to fill the void they may need to see more attractive yields. How high the yields must go is an open question.

Liquidity

As the bond market sells off and the two of the three big players step away from Treasuries, a new problem is emerging. The Treasury market has always been the largest and most liquid segment of the bond market. Large quantities of securities are traded daily. Size trades typically have little impact on the bid /ask spread. This is known as market depth.

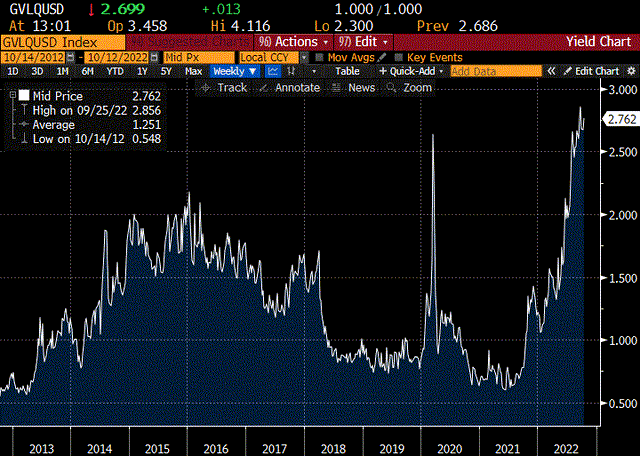

Recent activity, however, has shown a troubling deterioration in market depth. As measured by the Bloomberg US Government Liquidity Index, seen below, liquidity is evaporating. This index measures, on average, how far yields are away from where fair value models suggest they should be. The index just exceeded the pandemic induced spike of March 2020.

Bloomberg

As Treasury bond issuance increases to fund our deficits, a perfect storm is forming through the combination of QT, large players stepping away from the Treasury market, rising yields and reduced liquidity. It will be telling how we navigate through this during the current period of global financial volatility.

The question remains “Who will buy our Treasury debt?”

Be the first to comment