CreativaImages/iStock via Getty Images

Overview

It is difficult to describe China’s once prosperous growth engine with superlatives. The darling of international trade, which jumped at WTO membership and export stardom, has since never looked back. Yet, the country now appears a pale figure of its former self.

The past 3 years witnessed a radical economic boom and slow burn bust for the land of the dragon. Political wrangling and abundant finger pointing were a product of the SARS-Cov2 virus which first appeared on the mainland, impeding the industrial powerhouse.

China’s revival efforts kicked into full swing, building hospitals & treatment centers, while reporting rock bottom stats for infection rates & deaths. However, the country to this day continues to shut down large swathes of its population, handicapping GDP growth.

Something simply just does not add up.

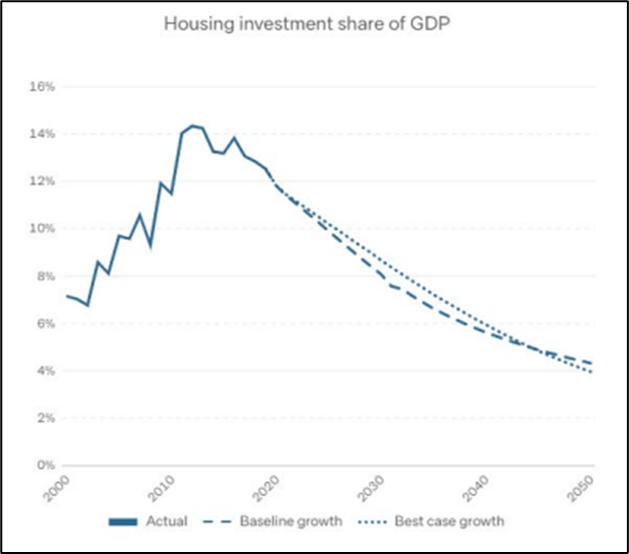

Lowy Institute

China’s once glorified housing boom is slowly receding. Its contribution to Chinese GDP is likely to subside.

And it is not only the Covid stats contrasting so heavily against gargantuan efforts that do not add up. Economic data, info on the shaky Chinese real estate market, and even the demographic print all seem perhaps skewed to paint a rosier picture than present day reality.

Chinese real estate is facing a bust, its tech sector has faced Chinese Communist Party wrath, and US-led semi-conductor export bans are stifling technological advancement. Geo-political tension has come in boat loads, even more so since the Russian invasion of Ukraine.

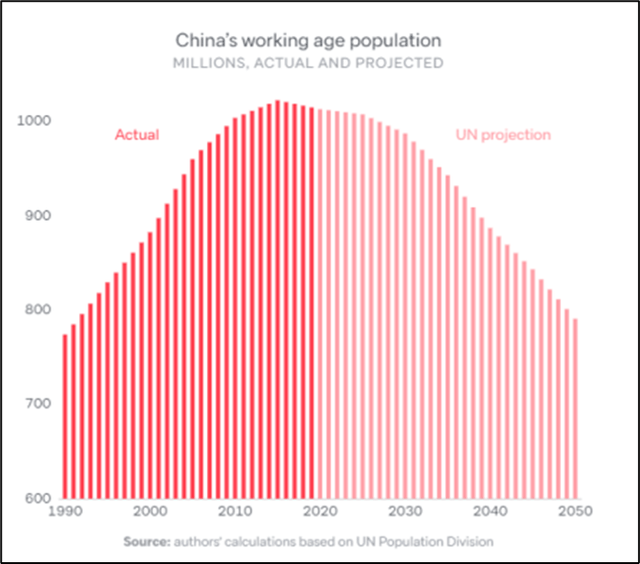

Lowy Institute

China’s demographic pyramid has long-term economic slowdown written all over it.

A skewed demographic pyramid born out of a multi-decade one child policy hints at problems to come. From a largely agrarian economy to the world’s factory fueling global trade, the communist country has been a capital success story, perhaps so much so that it has now firmly popped up on Washington’s radar.

Angst surrounding America’s strategic ambiguity vis-a-vis Taiwan has only grown, particularly with a heavily publicized visit by House Speaker, Nancy Pelosi. Right now, Chinese risk sentiment could perhaps not be possibly higher.

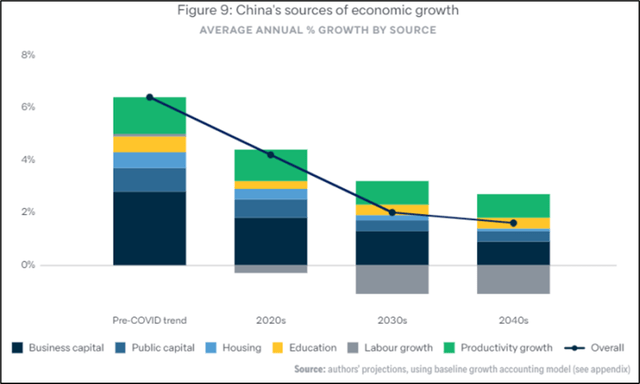

Lowy Institute

Sources of Chinese economic growth is set to shift as demographics change, productivity subsides, the housing market evolves, and business capital reduces.

For punters looking to take a bet on such a cloudy Sino-economic panorama, Direxion Daily FTSE China Bear 3x Shares (NYSEARCA:YANG) may be an attractive option.

The hyper leveraged China bear play provides punctual risk-off exposure to the Chinese markets, making it an appropriate option should risk sentiment dampen. Alternatively for a heavily concentrated portfolio of risky Chinese assets, this may provide a degree of hedging.

Product Synopsis

The fund distinguishes itself by levering up on a handful of Hong Kong listed equities. The 50 or so underlying risky assets are not wholly representative of an “all China” play insofar certain exclusions exist – namely A-shares traded on the Chinese mainland and names solely listed in the United States.

The fund comes with all the trappings of hyper leveraged exotic ETFs – sizable recourse to derivatives for that artificial lift, counterparty risk, path dependency and compounding.

All in, this makes it a punctual play on Chinese downside – not a long-term investment. Hence, the neutral rating. Am I bearish China? Most definitely. But that does not mean I would use this as a long-term play on Chinese downside.

Standard to most leveraged ETFs is daily rebalancing that induces compounding effects on returns. This leads to meaningful differences in expected returns relative to the index further emphasizing its use solely as a tactical trading tool. The funds distant cousin, YINN, which provides leveraged 3x bullish exposure was covered here.

TradingView

YANG has outperformed the broader market (+33.17%) as broader bets came to fruition.

A review of year-to-date price action provides indications of how volatile leveraged ETFs can be. To date the fund has outperformed the broader market logging total returns of +33.17%.

Yet the clear standout on price action over that period was the volatility from the onset on the Russian invasion of Ukraine. This is glaringly evident to the left of the chart, providing traders insight into the risk taken when positioning in the ETF.

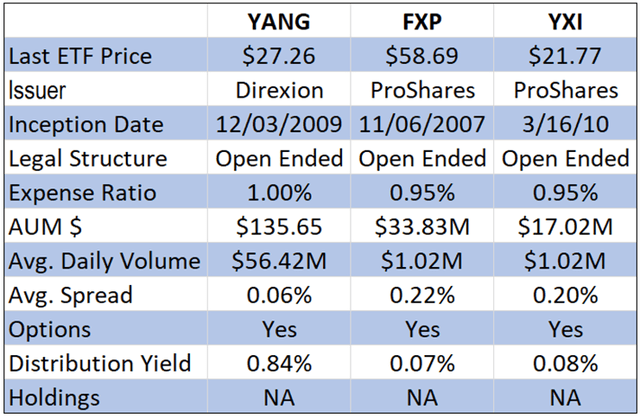

Spreadsheet by author with inputs from ETF.com

Comparative Analysis (YANG) v (FXP) v (YXI)

Benchmarking YANG against its peers underscores its dominance in the field of leveraged bearish bets on China. The fund is ~4x the size of its nearest competitor in terms of assets under management, providing improved daily volumes, reduced spreads, and a more meaningful distribution yield.

Traded average daily volumes provides indications of just how short-term positioning is, with the fund turning over essentially once every two or three days. A handy options market exists to manage risk yet there is not much in terms of expirations or liquidity.

Expense ratios are high which is commonplace in more specialized ETFs containing OTC derivatives and therefore some degree of counterparty risk.

Overall, it appears Direxion Daily has made inroads into capturing this part of the China bear ETF market.

Risk Factors

- Risk factors abound for ETFs using derivatives to pump up returns, namely counterparty risk linked to over-the-counter trading between banks. In times of widespread financial contagion such as those witnessed during Volmaggedon, counterparty risk and illiquidity can completely wipe ETFs out.

- Leverage (the underlying structure of the ETF) coupled with extensive market volatility, as witnessed during the invasion of Ukraine, can rapidly propel underlying ETF values to the upside or downside.

- Any bet on China comes piled with country risk. Macro-economic data providing insights into the country’s financial well-being is often controlled and somewhat difficult to vet.

Key Takeaways

- YANG is Direxion Daily’s 3x packaged bearish bet on Chinese economic downside.

- The fund is a standout in its niche in terms of assets under management and liquidity.

- Derivative contracts are used to provide the 3x leverage – this implies a range of underlying risk factors linked to OTC trading.

- The side effects of leveraged derivative plays (compounding, path dependency) imply short-term holding.

- Mammoth geopolitical volatility as witnessed recently in the Donbas has high level destructive potential for ETFs like this one.

Be the first to comment