martinrlee

Multinational financial services company, The Western Union Company (NYSE:WU) used to be the center of the payments universe. Despite the market growing, the company has witnessed significant revenue decline. This is unlikely to change, with competition in the market growing. However, Western Union has increased its profitability and shown an admirable and disciplined capital allocation, returning significant amounts of capital to shareholders. With an attractive relative valuation, a dividend yield of 6.5%, and an FCF yield of 9.86%, Western Union presents an attractive long-term bet.

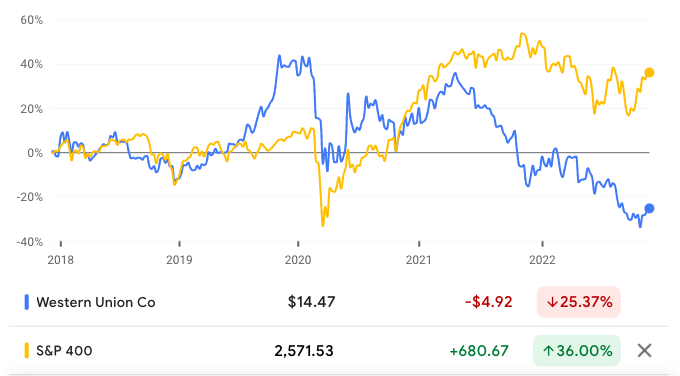

Western Union has not had a great five years, with the share price declining 25.37%, compared to a 36% increase for the S&P 400.

Source: Google Finance

In a time in which many investors have come to learn that, as the demand for a stock increases, and with it, the share price, the supply for future returns declines, it is logical to assume that Western Union would be one of the beneficiaries of the rotation to once-unfashionable stocks. Yet, in the year-to-date, the share price has declined 15.63%, compared to a 6.06% decline for the S&P 400.

Source: Google Finance

Declining Revenues and Rising Profitability

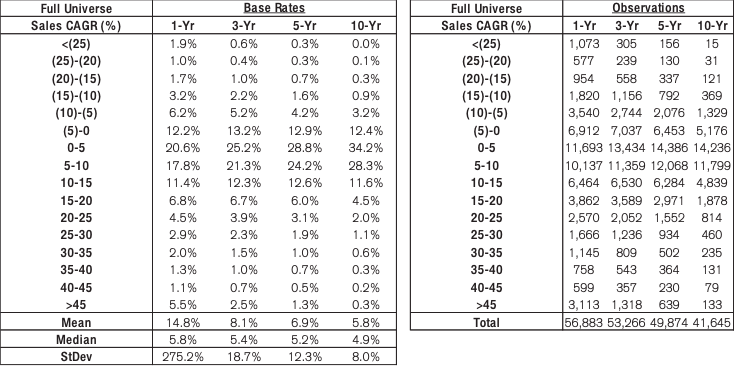

In the last five years, revenue has declined from $5.52 billion in 2017 to just over $5 billion in 2021, at a 5-year revenue compound annual growth rate (CAGR) of -1.7%. According to Credit Suisse’s (CS) The Base Rate Book, 12.9% of firms between 1950 and 2015, had a similar 5-year revenue CAGR.

Source: Credit Suisse

In the first nine months of the year, Western Union earned $3.38 billion in revenue, a decline of 11% compared to the same period last year.

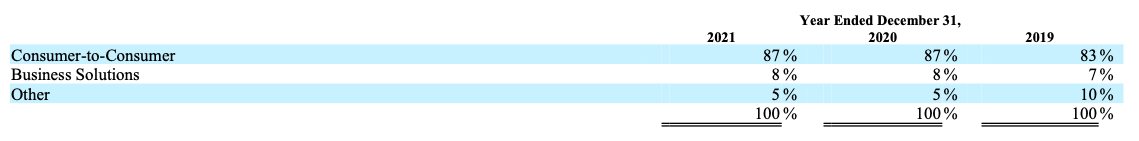

Revenues are earned through three segments: Consumer-to-Consumer, which deals with transfers between consumers; Business Solutions, which facilitates payments, and foreign exchange solutions, mostly for businesses, other organizations and individuals; and Other, which mostly deals with bill payments in Argentina and the United States and money order services. The Consumer-to-Consumer segment accounted for about 87% for revenues in 2021, while Business Solutions accounted for 8%, and Other accounted for 5%.

Source: Credit Suisse

Gross profitability in 2017 was 0.24, rising to 0.25 in 2021. This is short of the 0.33 threshold that Robert Novy-Marx found marked a stock out as attractive.

Western Union’s operating income rose from $473.4 million in 2017 to $1.12 billion in 2021, at a 5-year operating income CAGR of 18.86%. Operating income margin rose from 8.6% in 2017, to 22.1% in 2021. In the first nine months of the year, operating margin was 21.3%.

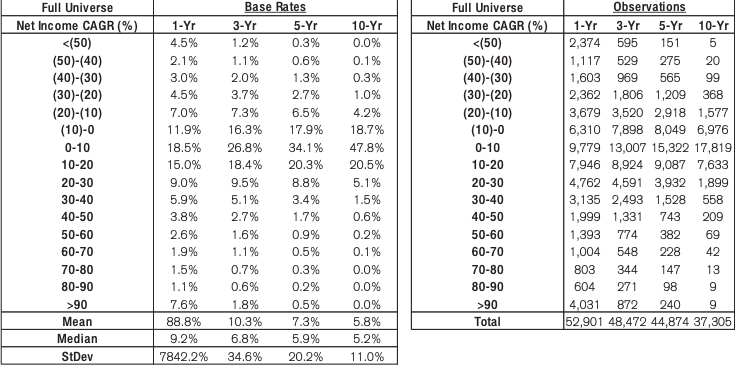

The company made a net loss in 2017, of -$557.1 million, and earned a net income of $805.8 million in 2021. Given the 2017 net loss, we cannot calculate a CAGR, but, we can assign the company a base rate of 0.5% as a crude way of assessing its performance.

Source: Credit Suisse

There is an inverse relationship between asset growth and future returns, a phenomenon known as the asset growth effect. Western Union’s sub-par performance shows how a thesis based on this phenomenon may take years to play out, or, never do so, in the case of “value traps”. Western Union has reduced its total assets from $9.23 billion in 2017 to $8.8 billion at a 5-year total asset CAGR of -0.899%.

Western Union’s free cash flow (FCF) rose from $564.9 million in 2017 to $830.7 million in 2021, at a 5-year FCF CAGR of 8.02%. In the trailing twelve months (TTM), the company has earned $699.8 million.

The company’s growing profitability can be seen from its return on invested capital (ROIC), which has more than doubled in the last five years, from 6% in 2017, to 12.9% in 2021. In the TTM period, ROIC is 13.8%.

A Growing Market

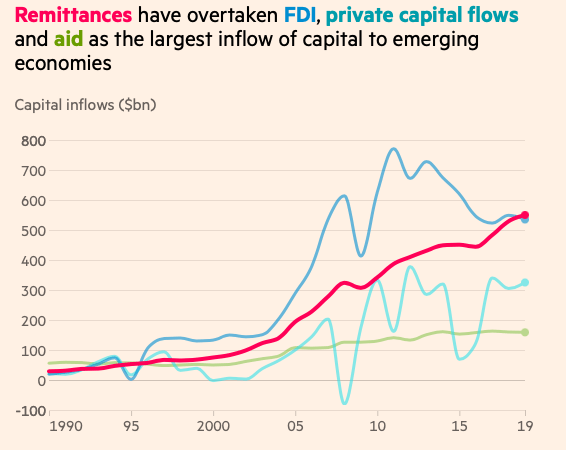

On the face of it, payments are a vital part of the world economy. In decades past, and to an extent, even now, Western Union has been associated with remittances, an area I will use to highlight the growth and importance of Western Union’s market. Indeed, growing the company’s position in remittances was an important part of the discussion in Western Union’s Third Quarter 2022 Earnings Webcast and Conference Call. Remittances is not just a fast-growing market, but a highly resilient one as well. The Financial Times has called remittances the “hidden engine of globalization”. In many small countries, remittances account for more than a quarter of their economic activity as measured by GDP, and in many emerging economies, with China being a notable exception, remittances have overtaken foreign direct investment, private capital flows and official aid as the largest capital inflow.

Source: Financial Times

Remittances are highly resilient, because migrants in the diaspora know that they have to support their families back home, and those ties are not subject to wild economic swings. This was clear in the pandemic where, despite experts forecasting a large decline in remittances, with the World Bank predicting a 20% fall in global remittances to emerging economies, global remittances actually fell by just 1.7% in 2020.

A Declining Company

Yet, despite the company operating in a large, and growing market, the company’s revenues seem to be in secular decline. One reason is that the density of the nodes in the company’s agent network is highly inelastic. The company tends to have agents in large retail spaces, whereas younger peers, such as Intermex in South America for example, operate in smaller retail spaces. Western Union is not capable of the kind of virality the agent network needs in order to grow quickly. This also makes it a less effective option for many customers, who may not want to go to a specific retail operation to get to Western Union, and, instead, want the most accessible option.

Disrupting that agent network in order to make the company a more viral company and a faster growing one, is very difficult. It is likely that it is not even possible. Western Union is locked into a model and it would probably be too costly to change the agent network model to inject growth into the company.

In addition, payments have become so important that competition within the industry has exploded. Every Jack and Jill wants to be in payments. Consider that in a very separate and distinct business, social media, Elon Musk has said he wants to build a payments feature into Twitter. This is not to say that it will happen, or that Twitter will be a serious rival, but to point out that technology has blown open the barriers to entry that once made Western Union such a successful company.

Management is aware of the problems it faces, and has initiatives regarding a “digital first” experience and increasing its visibility in remittances. Western Union’s retail-first strategy is certainly a step in the right direction but comes with the caution that it does not seem to address the growth problem. Certainly the digital money transfer business has grown, and now accounts for 21% of C2C revenue, having been 8% in 2016. Under Devin B. McGranahan, the company has worked hard to innovate, expanding its digital and retail partnerships, creating a multi-currency digital wallet, and digital banking platforms. However, the biggest issue, as I highlighted when discussing Twitter, is that payments has become an almost barrierless market. The shift to digital, while necessary, is also a shift away from where Western Union had enormous competitive advantages, to an area where it does not have such competitive advantages. This is a contradiction that cannot be resolved: it has to happen, and it is unlikely to see any real gains in revenue as a result, at least in the near-term.

It should also be noted that Western Union has high brand visibility, with 90% of customers in major markets being aware of the brand, and with the kind of trust that is the envy of many brands.

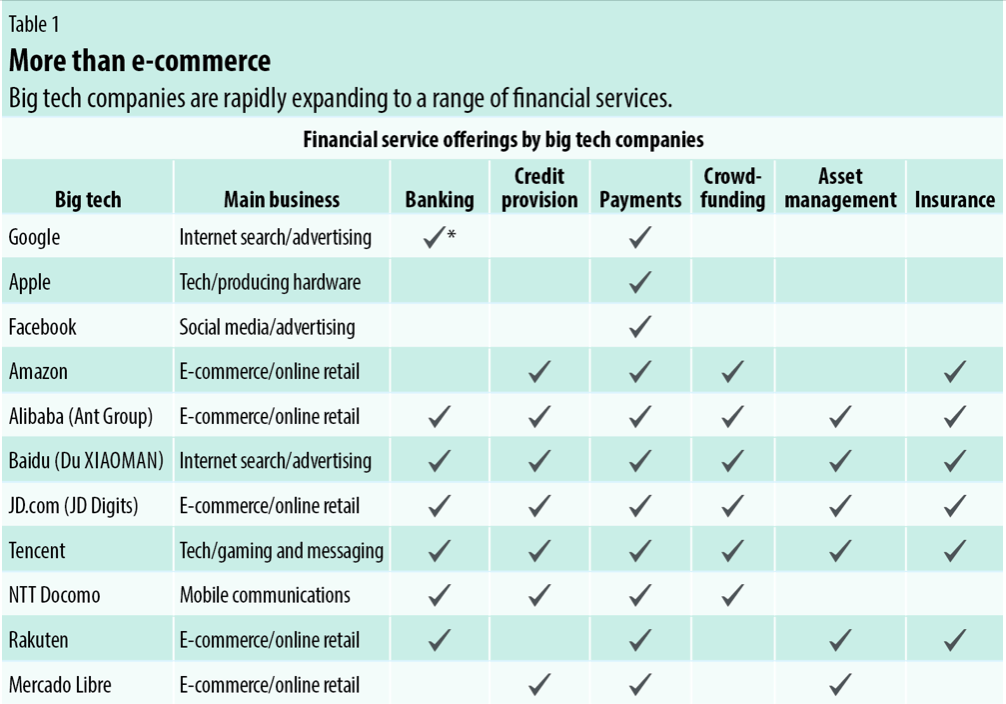

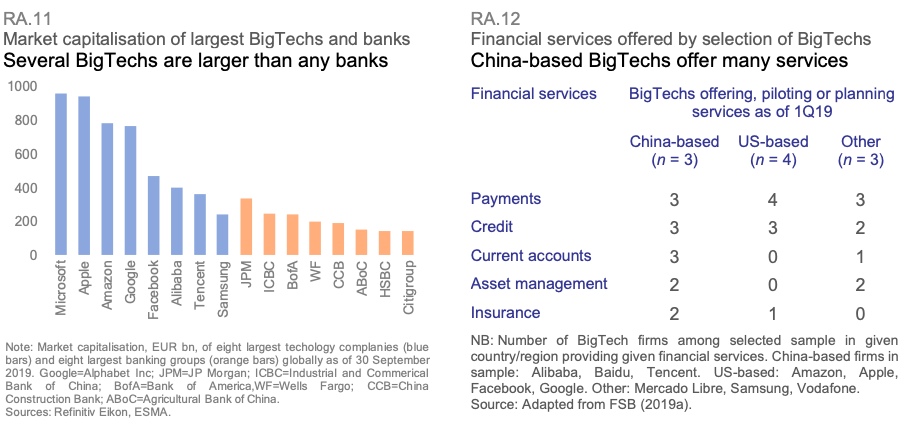

As the International Monetary Fund ((IMF)) noted in a recent report, financial exclusion in emerging markets is driving consumers toward solutions offered by Big Tech, with many Big tech firms already offering payments solutions.

Source: IMF

Big Tech has much larger customer networks than Western Union and of any traditional payments firms, superior data analytics and comparable or even superior brand recognition. While Big Tech has not swept everyone aside in every market, and I am not arguing that Western Union is a dying company, what the entrance of Big Tech means is that Western Union is unlikely to mirror the growth in the payments market, with revenue growth. Western Union’s moat is receding. It faces competition not just from MoneyGram (MGI) and banks, but Big Tech and new banks. When Western Union looks out into the world, their big threats are varied and many. Meta (META), Alphabet (GOOGL) (GOOG) have money transfer solutions, for example. Block’s (SQ) CashApp, PayPal (PYPL) and Xoom, Zelle, OFX, Wise, and retail solutions such as Walmart’s (WMT) Walmart2Walmart, allow money transfer. Alibaba (BABA) offers payment solutions. Banks are a bigger threat now that consolidation in America has made it easier to transfer funds. In the European Union (EU), single euro payments area (SEPA) regulations mean that cross-border payments can be made in under 24 hours.

Source: European Union

Disciplined Capital Allocation

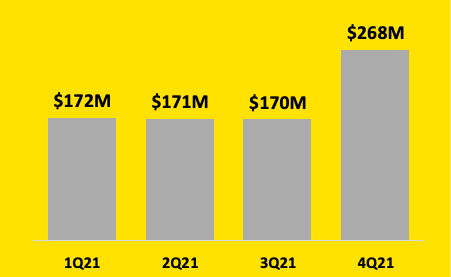

Western Union’s genius has been in sustaining and growing a profitable level of ROIC, and generally, improving profitability, despite essentially being a declining company in a growing market. Faced with incredible competition, management has displayed remarkable capital allocation discipline and wisdom. In doing so, the company has been able to return a significant amount of capital to shareholders, returning $780 million to shareholders in 2021.

Source: Third Quarter 2022 Earnings Webcast and Conference Call

The company has increased dividend payouts from $325.6 million in 2017, to $381.6 million in 2021, at a 5-year dividend CAGR of 3.22%. That in itself is a signal that the company does not believe that it has significant opportunities to grow, and has been wise enough to return cash to shareholders. At present, Western Union has a dividend yield of 6.5%.

Valuation

Western Union has a price-earnings multiple of 6.83, compared to 21.2 for the S&P 500, suggesting an attractive relative valuation. Furthermore, the company has an FCF yield (FCF/enterprise value) of 9.86%, which is much higher than the 1.5% FCF yield of the 2,000 largest companies in the United States, as measured by New Constructs. Given the direction of gross profitability and ROIC, we can form the thesis that the market will reward Western Union in years to come with a higher return.

Conclusion

Western Union is a storied name in payments. Despite declining revenues; a feature which is probably irreversible, the company has found ways to improve its profitability. Intensifying competition in payments, especially with the entrance of Big Tech, suggests that Western Union’s role as the center of the payments universe will never return. However, disciplined capital allocation and some mean reversion suggests that the company will be able to earn attractive ROIC, improve profitability, return rising amounts of cash to investors, and experience enough lean reversion in the price, that the net effect will be a plus for investors. It is unlikely that a significant mean reversion will occur immediately, so investors will need to be patient.

Be the first to comment